Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

maka wrote:Turning 40 tomorrow...hush hush...expect random gifts if you are flying or probably an upgrade if you are lucky...sad there is no money for a major celebration. who is turning 40? maka or kq? Towards the goal of financial freedom

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

nzalela wrote:ArrestedDev wrote:obiero wrote:maka wrote:obiero wrote:ArrestedDev wrote:obiero wrote: Sale of the idle planes is a great gift that has been delivered by Ngunze.. The chap just needed 1 more year to be celebrated as a turnaround genius, but fate could not allow.. We now await the replacement for Mr Hondius, the next KQ CEO The current Jambojet CEO will not be the next KQ CEO. I beg to differ. The fleet rationalization was ill informed.The worst thing to summarize the entire exercise was to get rid of the 2 B787s. These jets could have even be retained and the older B737-700 phased out. After Ngunze's exit is when you see the blunders coming out one by one. Look at what Ciano did with the books and procurement in Uchumi, the jury is now out. Every common employee thinks they know better than the CEO, so I understand where you are coming from my friend The B737-700 are the ones going to West Africa they are doing perfectly well...KYM and KYN that were received from KLM were the ones that were phased out...KQ A...KQ B...are leased out to jambo jet...KQ C to KQ H are the work horse (s) of the national carrier.... Excellent breakdown. The Embraer never rests and the 787 has also faired well. Tuwache emotional analysis please @arresteddev The ones with Jambo jet are B737-300 which are very old. I thought it is the 737-800 that goes to Accra as well as Freetown. Is it not only 2 B737-700s which are remaining and 8+ plus years? These 2 has a higher fuel burn rate and the 2 B787s should have been used to replace these. The B787-800 can handle medium to long haul and provide capacity that is much needed to grow revenue. The E190s are now KQ's workhorse but it has worked to the detriment of revenue growth. KQ has never reported a profit since these type were inducted in 2012. The perceived benefits has never been realised. It is leading to capacity constraints and lack of cargo belly. During the high season, it cannot handle the demand and leads to overbooking hence inconveniecing customers. The duty free trolleys cannot fit in the aisle leading to loss of revenue that could have otherwise accrued from the sale of duty free items.This was even acknowledged in the annual report. The biggest loss KQ has suffered from these capacity constraint aircraft type is from Cargo.The technical issues relating to these fleet type has also been spiralling. I beg to differ. I also used to think the embraer was a bad purchase until you look at the numbers. KQ only makes money in routes within 2-3 hours of Nairobi. That is where the embraer flies. It has allowed for razor thin margins and lower break even cabin factors allowing for convenience and more options to the customer. i.e 5 flights a day to Dar, 5 to Entebbe, 3 to Addis, 8 -10 to mombasa...etc. This has been a significant factor that has enabled Kq to maintain market share and fend off regional competition. The fact that connecting passengers have flexiblity in timings. The cargo ofcourse is a pain to deal with but for the most part The embraer has been the saving grace for KQ. You can only differ with facts. Everything you need to know is in the numbers. The increased frequencies have not translated to anything and this is why KQ is in red up to a tune of 25 billion plus as per the 2016 results. The operating costs have not come down as expected since this type was inducted. The same applies to finance costs which have had a very serious impact on the going concern. One need to ask his/herself several questions here. These are the questions that even Ngunze has not been able to provide the answers to and this is the reason why MJ after listening to various people within KQ asked Ngunze to go.The sugar coated words that you quote from him is total hogwash.It is not supported by serious analysis of numbers. Fastjet did not exit the NBO route merely because of competition from KQ but due to the low number of passengers. Who else compete with KQ in the EAC, baby RwandAir and Precision? If that was the case, then RwandAir should have long halted the KGL-NBO service due the high number of daily frequencies by KQ.Sometimes the flight schedule is not about the convenience to a customer but what makes sense commercially for the Airline.It is a very delicate balance of what should take priority for a business to make money. How did KQ find itself at where it is now? The whole strategy adopted earlier own has totally failed and change of tact is required very urgently. It applied when there was less competition in Africa but today the business dynamics has totally changed. Cargo is more profitable to an airline than anything else. Focus need to shift here.KQ left a very big gap when they lost focus on Cargo Ops through a flawed pricing and lack of balance between passenger and cargo operations partly due to the change in the fleet type.ET uploads massive cargo tonnes in Africa. This is where they are making money from. They even leverage this to influence their passenger tickets pricing strategy. They can offer discounted ticket prices in destinations with alot of competition for passengers but less Cargo competition.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ebenyo wrote:maka wrote:Turning 40 tomorrow...hush hush...expect random gifts if you are flying or probably an upgrade if you are lucky...sad there is no money for a major celebration. who is turning 40? maka or kq? LMAO

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Expect a massive leap in share price to mirror the hugely improved business performance. Now all that's left after Ngunzes hard work, is for slight reduction in operation costs accompanied by revenue growth and boom profit sets in H1 this year

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Ebenyo wrote:maka wrote:Turning 40 tomorrow...hush hush...expect random gifts if you are flying or probably an upgrade if you are lucky...sad there is no money for a major celebration. who is turning 40? maka or kq?  possunt quia posse videntur

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote: Expect a massive leap in share price to mirror the hugely improved business performance. Now all that's left after Ngunzes hard work, is for slight reduction in operation costs accompanied by revenue growth and boom profit sets in H1 this year You will be shocked by the loss.The financial year ending March, 2017 has been tough. A series of delays took place.The technical issues directly hits the bottom line. There is no light at the end of the tunnel for now. The other things being done by Mckinsey are just cosmetic changes that will not have any major impact on the direction of the airline in the long term. For instance, redundancies declared recently and suddenly followed by 500+ new hires already undertaking training equates to zero impact on the ever increasing employee costs. Remember the engineers were promised a hike when they went on a go-slow? Please convince me otherwise. Mark my words Wazuans.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

ArrestedDev wrote:obiero wrote: Expect a massive leap in share price to mirror the hugely improved business performance. Now all that's left after Ngunzes hard work, is for slight reduction in operation costs accompanied by revenue growth and boom profit sets in H1 this year You will be shocked by the loss.The financial year ending March, 2017 has been tough. A series of delays took place.The technical issues directly hits the bottom line. There is no light at the end of the tunnel for now. The other things being done by Mckinsey are just cosmetic changes that will not have any major impact on the direction of the airline in the long term. For instance, redundancies declared recently and suddenly followed by 500+ new hires already undertaking training equates to zero impact on the ever increasing employee costs. Remember the engineers were promised a hike when they went on a go-slow? Please convince me otherwise. Mark my words Wazuans. @ArrestedDev care to explain here why the airline made an operating profit in half year results

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

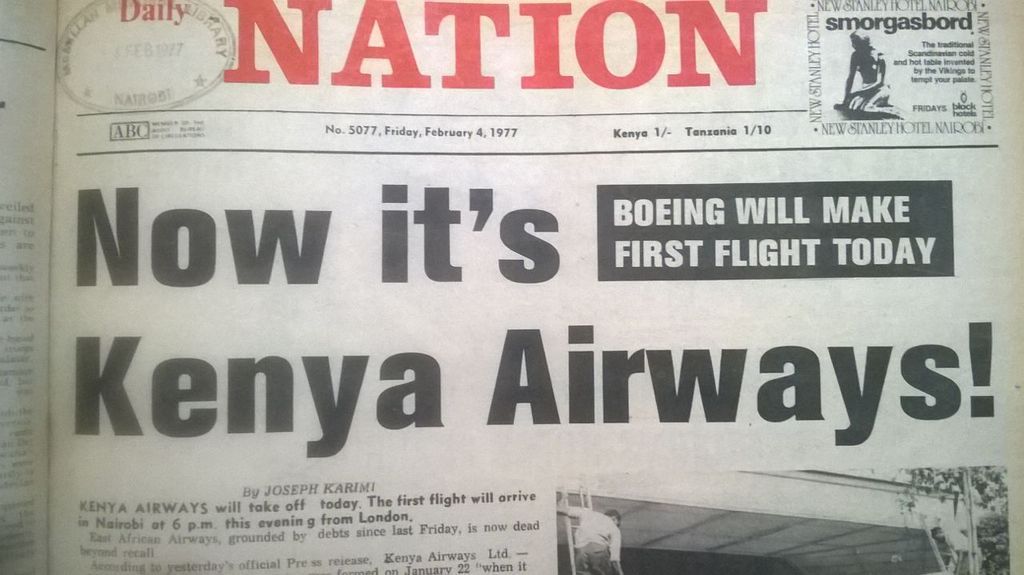

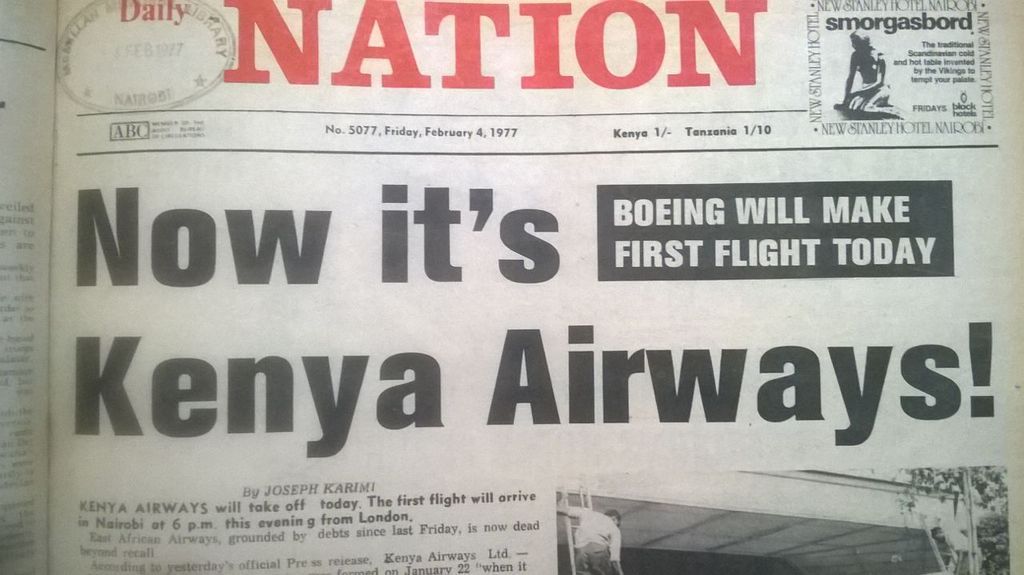

maka wrote:Ebenyo wrote:maka wrote:Turning 40 tomorrow...hush hush...expect random gifts if you are flying or probably an upgrade if you are lucky...sad there is no money for a major celebration. who is turning 40? maka or kq?  40 years as a KQ staff and loving every year of it.. http://www.nation.co.ke/...2064-14iqgilz/index.html

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

aemathenge wrote:Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

aemathenge wrote:Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...782942-m8ypcw/index.html http://www.businessdaily...782942-m8ypcw/index.html

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

sparkly wrote:obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Do you know that GoK has already sunk KES 32B in 2016 into KQ to keep it afloat and has assured further assistance to the tune of KES 60B this year. Anyhow, negative equity is normal in capital intensive business such as airlines, globally

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:sparkly wrote:obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Do you know that GoK has already sunk KES 32B in 2016 into KQ to keep it afloat and has assured further assistance to the tune of KES 60B this year. Anyhow, negative equity is normal in capital intensive business such as airlines, globally Do you realize that being bailed out and having negative equity are not signs of prosperity? Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Do you know that GoK has already sunk KES 32B in 2016 into KQ to keep it afloat and has assured further assistance to the tune of KES 60B this year. Anyhow, negative equity is normal in capital intensive business such as airlines, globally Do you realize that being bailed out and having negative equity are not signs of prosperity? Do you realized that KQ now has an operating profit and leaner fleet hence reduced loss position by over 75%

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Do you know that GoK has already sunk KES 32B in 2016 into KQ to keep it afloat and has assured further assistance to the tune of KES 60B this year. Anyhow, negative equity is normal in capital intensive business such as airlines, globally Do you realize that being bailed out and having negative equity are not signs of prosperity? Do you realized that KQ now has an operating profit and leaner fleet hence reduced loss position by over 75% Do you know that a reduced loss is still a loss? Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:aemathenge wrote:obiero wrote:[quote=aemathenge]Maina and Kîng’ang’î will be singing “Happy Birthday to Kenya Airways” from tomorrow morning while offering a lucky caller 40,000 UhuRuto shillings. KQs biggest year. Life begins at 40  http://www.businessdaily...82942-m8ypcw/index.html[ http://www.businessdaily...82942-m8ypcw/index.html[/quote] Quote:Ancillary services in the airline industry include entertainment, onboard shopping, Internet gaming, car hire, frequent flier programmes, and hotel bookings which eventually offset (and sometimes exceed) the budget ticket costs. Hayia. The Kenya Airways Group also does gambling? Hii pesa lazima tunyonye yote.. Creative juices have started flowing at KQ and now all we get on media are positive reviews.. Ngunze biggest failure was refusal to join social media Do you realize that KQ has a negative equity of KShs 39B? Do you know that GoK has already sunk KES 32B in 2016 into KQ to keep it afloat and has assured further assistance to the tune of KES 60B this year. Anyhow, negative equity is normal in capital intensive business such as airlines, globally Do you realize that being bailed out and having negative equity are not signs of prosperity? Do you realized that KQ now has an operating profit and leaner fleet hence reduced loss position by over 75% Do you know that a reduced loss is still a loss? Do you know that by the business improvement run rate that KQ will make a profit this year?

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

I will buy KQ at sub 4... possunt quia posse videntur

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|