Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

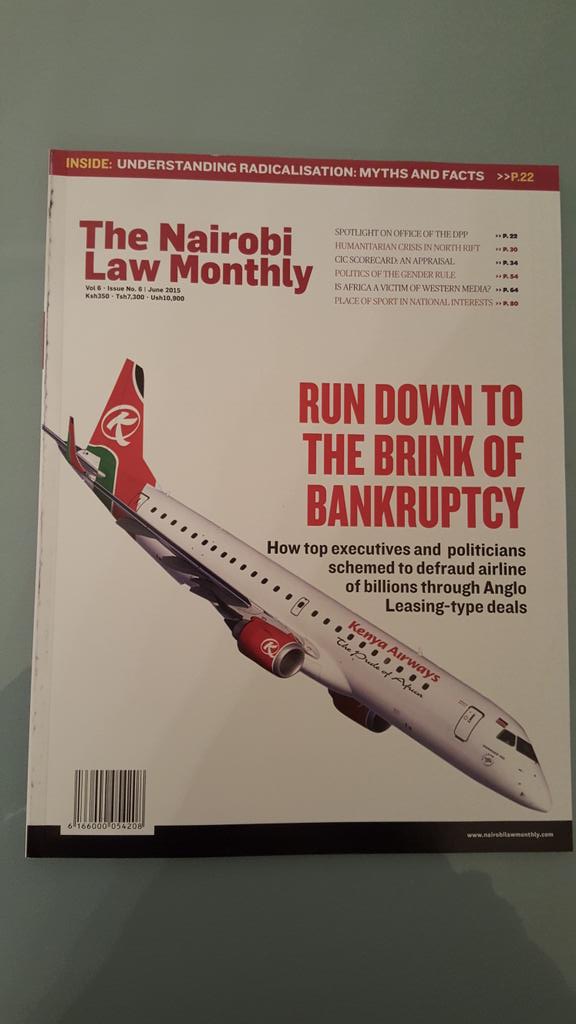

kollabo wrote:moneydust wrote:Kausha wrote:Haya 25 billion net loss pap! Surely something must be done to the perpetrators of this wealth genocide... Kenya is some sort of a safe haven..nay hotbed for plunderers. Doubt anything will happen to ero! possunt quia posse videntur

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

obiero wrote:Aguytrying wrote:newfarer wrote:obiero wrote:newfarer wrote:obiero wrote:Aguytrying wrote:Im sorry to say this, but I firm consistently making billions of shilling losses doesn't deserve to be yeven trading. Profits (EBT) (KSh m) From 2003 to 2015 ascending: 547 2,075 5,520 6,960 5,975 6,526 −5,664 2,671 5,002 2,146 −10,826 −4,861 -29,710 Kindly point out the consistency in loss making for Kenya Airways.. One must remember that even KCB was once loss making, in the year 2003-2004 You cannot see consistency show us any cent left as profit in the last 6year cumulative Was KQ established in 2009? The firm is old and beautiful.. Its just experiencing a rough patch. Respect your elders :) Much respects elder, enjoy your deadhorse ride. @Obiero. If you add this years loss. That's 3 years in row. Question. Will KQ make a profit in fy 2015? Are you sure??? KQ must make a profit in 2015. Its not a matter of choice, and Ngunze & Co are well aware.. Therein lies the gamble. Im not sure, but highly optimistic Indeed this is consistent loss making.. Had not imagined it would be that huge. Going through the statemnt of comprehensive income and I realise that management has lost the battle against cost

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Paper thin demand. By 3pm it is likely the 5 handle or lower will be tested. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: New-farer Joined: 1/23/2015 Posts: 15 Location: mtandao

|

total equity (5.963)B    CFC,ICDC

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

Never mind KQ still charges 86k to Jozi when ET is charging 36K on the same route.

This company overcharges customers and still can't make money.

Obiero, you had promised us loads of profits this year after management had fixed the problems. What went wrong?

Technically KQ is insolvent and lenders may just be knocking on them KQ doors very soon.

|

|

|

Rank: New-farer Joined: 1/23/2015 Posts: 15 Location: mtandao

|

|

|

|

Rank: Elder Joined: 6/8/2013 Posts: 2,517

|

"😖😡KQ makes money for everyone except the shareholder 😏😏 " overheard in Wazua

|

|

|

Rank: Veteran Joined: 2/3/2012 Posts: 1,317

|

Ati what? Is this a going concern anymore? What did auditors say?

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

The concern went away a while back it would appear.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Kausha wrote:Never mind KQ still charges 86k to Jozi when ET is charging 36K on the same route.

This company overcharges customers and still can't make money.

Obiero, you had promised us loads of profits this year after management had fixed the problems. What went wrong?

Technically KQ is insolvent and lenders may just be knocking on them KQ doors very soon. @kausha.. next year is when I said the tide may turn. had very early on declared a projected loss of 9.5B for FY 2014/2015.

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

I will be candid with my brother. That P&L suggests to a company in comatose and just about to turn the lights out. This has nothing to do with the tide. The gross profit alone can support the HQ costs nor repay annual loan obligations. Their only route would be to raise fares which they did a few years back.

The company has wrong assets for their commercial pursuits or wrong commercial activities for the type of assets they have. If all the planes can not fly profitably and service their debt, right there you have a primary problem you must solve before attempting something else.

This is when you stop the entire set up and go draw up a new script else you will still be making losses by March 2016.

|

|

|

Rank: Member Joined: 7/1/2014 Posts: 895 Location: sky

|

obiero wrote:Kausha wrote:Never mind KQ still charges 86k to Jozi when ET is charging 36K on the same route.

This company overcharges customers and still can't make money.

Obiero, you had promised us loads of profits this year after management had fixed the problems. What went wrong?

Technically KQ is insolvent and lenders may just be knocking on them KQ doors very soon. @kausha.. next year is when I said the tide may turn. had very early on declared a projected loss of 9.5B for FY 2014/2015. http://www.bloomberg.com/news/articles/2015-07-30/kenya-airways-will-raise-loan-sell-aircraft-after-record-loss?utm_source=dlvr.it&utm_medium=twitteris this strategy spelling doom even for next year?, selling aircraft will be at a loss most likely and worse if buying price was inflated There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

in September 2014....What about now? http://aviationblog.dall...ofitable-airlines.html/

possunt quia posse videntur

|

|

|

Rank: Member Joined: 1/21/2013 Posts: 427

|

kollabo wrote:Ati what? Is this a going concern anymore? What did auditors say? I don't think it is. There is also a question of whether the financial statements should be prepared on a going concern basis. Where are accounting experts of Wazua?

|

|

|

Rank: Elder Joined: 3/19/2010 Posts: 3,504 Location: Uganda

|

obiero wrote:obiero wrote:Aguytrying wrote:newfarer wrote:obiero wrote:newfarer wrote:obiero wrote:Aguytrying wrote:Im sorry to say this, but I firm consistently making billions of shilling losses doesn't deserve to be yeven trading. Profits (EBT) (KSh m) From 2003 to 2015 ascending: 547 2,075 5,520 6,960 5,975 6,526 −5,664 2,671 5,002 2,146 −10,826 −4,861 -29,710 Kindly point out the consistency in loss making for Kenya Airways.. One must remember that even KCB was once loss making, in the year 2003-2004 You cannot see consistency show us any cent left as profit in the last 6year cumulative Was KQ established in 2009? The firm is old and beautiful.. Its just experiencing a rough patch. Respect your elders :) Much respects elder, enjoy your deadhorse ride. @Obiero. If you add this years loss. That's 3 years in row. Question. Will KQ make a profit in fy 2015? Are you sure??? KQ must make a profit in 2015. Its not a matter of choice, and Ngunze & Co are well aware.. Therein lies the gamble. Im not sure, but highly optimistic Indeed this is consistent loss making.. Had not imagined it would be that huge. Going through the statemnt of comprehensive income and I realise that management has lost the battle against cost Buried horse punda amecheka

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

Turn around 2015? Not until they learn to bring down their operation costs....as well as match their competitors prices. They will keep disappointing their shareholders for a while. Declare bankruptcy, and quit advertising on CNN and the likes, use the internet...cheaper and more effective. No traveler will flip tv channels looking for the best rates. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 12/9/2009 Posts: 6,592 Location: Nairobi

|

How has this counter not hit -30%? Who is buying even for 1/-?

BBI will solve it :)

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

2012 wrote:How has this counter not hit -30%? Who is buying even for 1/-? Me I would buy @ 1...   possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

2012 wrote:How has this counter not hit -30%? Who is buying even for 1/-? -30% ni hesabu ya wapi? Anyway the price will hover around there because those who hold big chuncks here are GOK and KLM "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

This is a crime scene Sehemu ndio nyumba

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|