Wazua

»

Investor

»

Bonds

»

Kenya Debt Watch

Rank: Member Joined: 8/17/2011 Posts: 207 Location: humu humu

|

One would think the falling inflation determines the direction of tbills. However I still feel the inflation rate in the neighbourhood of 5% is high. Last year rates were very high and looking at how inflation is arrived at I would be carefull. I hope the inflation rate stabilises in the coming year and beyond.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Moody’s sees investor boost in Kenya sovereign bond plan http://www.businessdailyafrica....4/-/15ijp0a/-/index.htmlsovereign bond would be used to retire the syndicated loan, as the former is expected to be cheaper.

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

GoK domestic debt just inches away from the Ksh1 trillion mark wooow http://www.centralbank.g...flation20-october205.pdf

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

hisah wrote:Btw now that Le prof has signalled the debt distress, how will tbill yields remain sub 10%... Will yields go back to 20%? A nightmare that would be... apparently the governor said that article was rubbish and he didn't say anything of the sort. I think in this case we have poor journalism. “We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

[quote=the deal]GoK domestic debt just inches away from the Ksh1 trillion mark wooow http://www.centralbank.g...lation20-october205.pdf[/quote] What's more amazing is that the average maturity of Kenyan debt rose from 4 years 9 months to 5 years 2 months in a week due to the issue of a 15yr bond. Goes to show how much of an effect borrowing on the long end of the curve has on the maturity profile of national debt - we've got a 3 month extension. We can't ignore that we have downward trending inflation and increased liquidity, which ordinary should make it cheaper for Treasury to borrow. But the fundamental don't make sense here. Bond yields are rising purely because of demand for borrowing to finance our huge public sector. This is just to finance the wage bill, which should lead to greater inflation during an election year (we'd hope no money printing or devaluation of shilling compounds the situation). I shudder to think the effect on interest rates when we fully implement all the devolution structures, when taxes are insufficient to fund the new infrastructure. The CBK O/D is already maxed out, they can't print. “We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Scubidu wrote:hisah wrote:Btw now that Le prof has signalled the debt distress, how will tbill yields remain sub 10%... Will yields go back to 20%? A nightmare that would be... apparently the governor said that article was rubbish and he didn't say anything of the sort. I think in this case we have poor journalism. Poor journalism has been cited too many a times...

Anyway, I can see tbills are getting undersubscribed and rates edged up above 10% for 182 day bill. Yields are quietly reversing the slide... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

hisah wrote:Scubidu wrote:hisah wrote:Btw now that Le prof has signalled the debt distress, how will tbill yields remain sub 10%... Will yields go back to 20%? A nightmare that would be... apparently the governor said that article was rubbish and he didn't say anything of the sort. I think in this case we have poor journalism. Poor journalism has been cited too many a times...

Anyway, I can see tbills are getting undersubscribed and rates edged up above 10% for 182 day bill. Yields are quietly reversing the slide... @hisah. Off course Prof justifies his statements with debt to GDP. Unfortunately it looks like keeping a balanced budget is close to impossible this year which means that they have raise the yield curve to fund fiscal spending. You can see the momentum in Tbill rates is reflected in the repo rate as well, particularly with the term action deposit facility. Over the last 2 weeks they've risen 150-190bps to 9.8%-10% levels. But what happens between December 2012 to April 2013 when 110 billion worth of bonds mature he's going to have to jack up bond yields. So it's likely we're not going to see any major cut in the CBR going forward, becoz he can't afford to do so. If his hands aren't tied by the budget stress (Teachers payments) then it's by liquidity management (repo) and debt repayments (bond redemptions). Not a good position to be in as governor. “We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Scubidu wrote:hisah wrote:Scubidu wrote:hisah wrote:Btw now that Le prof has signalled the debt distress, how will tbill yields remain sub 10%... Will yields go back to 20%? A nightmare that would be... apparently the governor said that article was rubbish and he didn't say anything of the sort. I think in this case we have poor journalism. Poor journalism has been cited too many a times...

Anyway, I can see tbills are getting undersubscribed and rates edged up above 10% for 182 day bill. Yields are quietly reversing the slide... @hisah. Off course Prof justifies his statements with debt to GDP. Unfortunately it looks like keeping a balanced budget is close to impossible this year which means that they have raise the yield curve to fund fiscal spending. You can see the momentum in Tbill rates is reflected in the repo rate as well, particularly with the term action deposit facility. Over the last 2 weeks they've risen 150-190bps to 9.8%-10% levels. But what happens between December 2012 to April 2013 when 110 billion worth of bonds mature he's going to have to jack up bond yields. So it's likely we're not going to see any major cut in the CBR going forward, becoz he can't afford to do so. If his hands aren't tied by the budget stress (Teachers payments) then it's by liquidity management (repo) and debt repayments (bond redemptions). Not a good position to be in as governor. Dilemma here for Le prof. Tough call this especially when those bonds mature and at the height of the election campaigns... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Tbill yield still edging up while undersubscription still persists... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

hisah wrote:Tbill yield still edging up while undersubscription still persists... @hisah. There's about 43 billion in repo maturities this week versus Tbill auction of 8 billion and repo yielding higher. 7-day up today from 9.30% to 9.68%, so what else can we expect when CB mops up all the liquidity on OMO. They give the impression that there's demand for borrowing so the cost of borrowing must follow. Interference by CB affecting fiscal policy in order to keep the shilling protected. So now we have over 43 billion outstanding in repos. That's a lot of KES so CB can't leave the repo market just yet either. “We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

Analysts at Capital Economics reckon that if Kenya was to issue a 10yr Eurobond in 2014 we'd have to pay at least 7.50%. This is based on the impressive issue in Zambia, where they raised $750 million yielding 5.60%. The study by the firm compares the macro indicators in both countries and adds a premium to the rate paid by the Zambians. What was the criteria used? Potential growth (10yr) in kenya = 6.0% (Zambia; 7.0%), C/A Balance in Kenya = -11.2% (Zambia; 0.4%), Fiscal Balance in Kenya = -4.3% (Zambia; -3.0%) and Government Debt to GDP in Kenya = 49.0% (Zambia; 26.0%). The analysts concluded that based on the Zambian case subsequent Sub-Saharan countries would have to pay the following for 10yr tenor Eurobonds: Kenya (7.50%), Mozambique (7.0%), Rwanda (6.0%), Tanzania (8.0%) and Uganda (7.0%). Read more: http://www.capitaleconom...who-is-next-in-line.html“We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Scubidu wrote:hisah wrote:Tbill yield still edging up while undersubscription still persists... @hisah. There's about 43 billion in repo maturities this week versus Tbill auction of 8 billion and repo yielding higher. 7-day up today from 9.30% to 9.68%, so what else can we expect when CB mops up all the liquidity on OMO. They give the impression that there's demand for borrowing so the cost of borrowing must follow. Interference by CB affecting fiscal policy in order to keep the shilling protected. So now we have over 43 billion outstanding in repos. That's a lot of KES so CB can't leave the repo market just yet either. At some point CBK will be forced to let the KES to weaken since the gimmicks employed are unsustainable in the long run. That will mess the current account...

I've also noticed horizontal repo yield is at 13%. With repo offering juicy apples, banks will overlook tbills. Effect, tbill yields continue climbing. Govt debt with treasury forking out salary hikes with a squeaking economy...

Were it not for foreigners, NSE would still be below 3500pts. I dread if those foreigners get spooked, the NSE nosedive will be crashing

For now I can't tell what is what. Treasury is sending to many mixed signals. Can hardly wait for a new admin post elections, which I hope will be peaceful for fresh ideas esp with the huge counties budget burden.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Scubidu wrote:Analysts at Capital Economics reckon that if Kenya was to issue a 10yr Eurobond in 2014 we'd have to pay at least 7.50%. This is based on the impressive issue in Zambia, where they raised $750 million yielding 5.60%. The study by the firm compares the macro indicators in both countries and adds a premium to the rate paid by the Zambians. What was the criteria used? Potential growth (10yr) in kenya = 6.0% (Zambia; 7.0%), C/A Balance in Kenya = -11.2% (Zambia; 0.4%), Fiscal Balance in Kenya = -4.3% (Zambia; -3.0%) and Government Debt to GDP in Kenya = 49.0% (Zambia; 26.0%). The analysts concluded that based on the Zambian case subsequent Sub-Saharan countries would have to pay the following for 10yr tenor Eurobonds: Kenya (7.50%), Mozambique (7.0%), Rwanda (6.0%), Tanzania (8.0%) and Uganda (7.0%). Read more: http://www.capitaleconom...ho-is-next-in-line.html BD has published it today.

http://www.businessdaily...4/-/hexvr5/-/index.html

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

IMF pushes for wider VAT net to boost tax revenue - http://www.businessdaily...-/127lpckz/-/index.html

I really hope VAT on essential foods is scrapped off. Bad idea since it'll squeeze very many households especially the low income bracket, which will be hardest hit. It is no secret that IMF advice must always be taken with a pitch of salt. If IMF expects KE's GDP to grow by 5% in 2012, yet the econ is on a slowdown as per KNBS @ 3.3%. If IMF says KE's debt to GDP ratio above 50% is sustainable yet gok is sweating to balance the budget and facing constant labour protests. IMF advised that EA changes the inflation model in 2010 to be more accurate and inflation suddenly spiked with EA currencies taking a good beating. Would you really take advice from a stranger on how to run your house yet they dont live in that house? Personally I want those negative elements in that Finance bill to be totally eliminated or the bill crashes. Amen. If anyone can point to me a single proposal that IMF/WB has recommended and helped a nation to be prosperous, then and only then can I stop my biased critism on them. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:... Were it not for foreigners, NSE would still be below 3500pts. I dread if those foreigners get spooked, the NSE nosedive will be crashing

Dread is on the foreigners’ dominated/driven large cap counters. However, in the absence of 2013 politics misbehaviour, foreigners won’t get spooked. The country is working all ways to lift our econ growth which will reflect well on NSE

|

|

|

Rank: Veteran Joined: 11/11/2006 Posts: 971 Location: Home

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

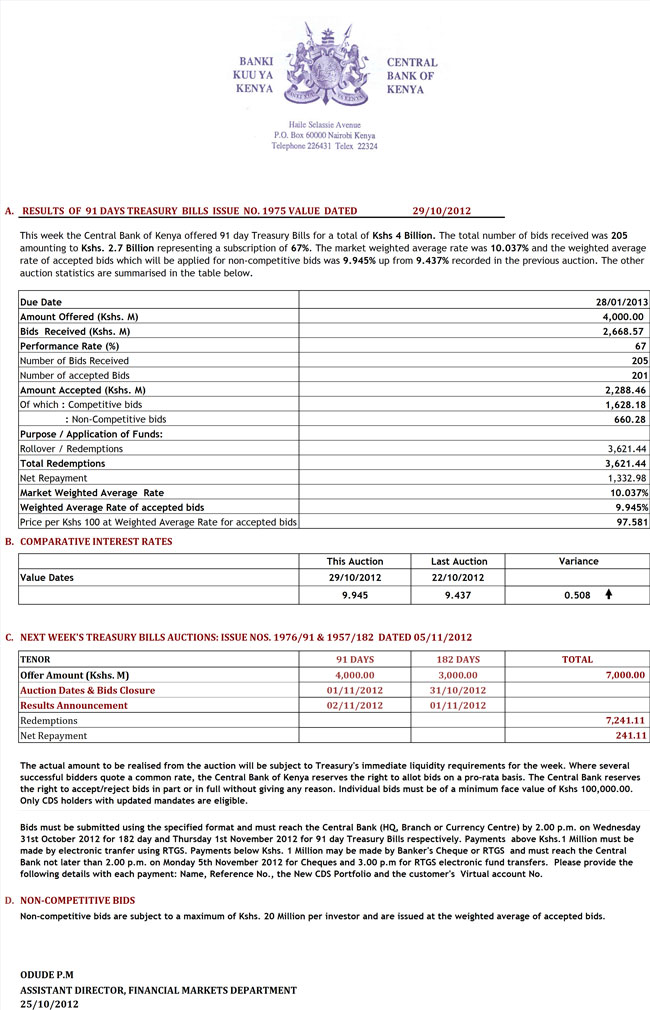

Tbill yields zaendelea kupaa...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

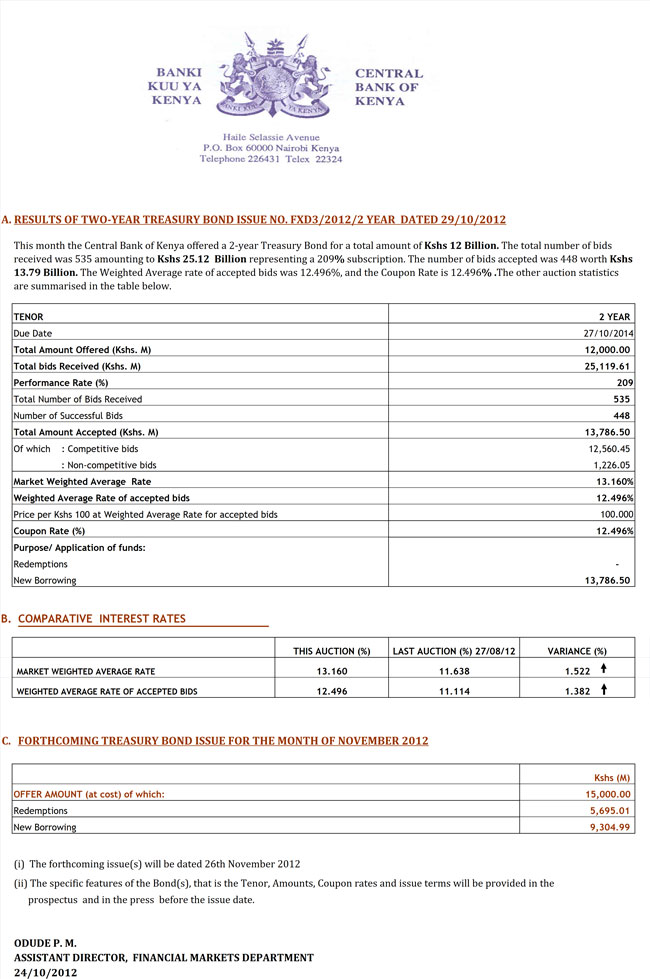

2yr bond yield also spiking higher...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

So we have NSE rallying above 4000 since Jan 2012, bond yields are up for a while now, tbills same as bonds, USDKES ranging btwn 82 - 88, inflation crashed from 19% - 5%, CBR cut from 18% - 13%, lending rates avg still above 20% (CBK stats), GDP Q2 2012 at 3.3% What a conundrum of mixed signal. Monetary fiasco!? At some point, the reality will have to catch up and we'll have a winner either being equities or money market. When that train comes rushing in, don't stand infront of it! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

hisah wrote:So we have NSE rallying above 4000 since Jan 2012, bond yields are up for a while now, tbills same as bonds, USDKES ranging btwn 82 - 88, inflation crashed from 19% - 5%, CBR cut from 18% - 13%, lending rates avg still above 20% (CBK stats), GDP Q2 2012 at 3.3%

What a conundrum of mixed signal. Monetary fiasco!? At some point, the reality will have to catch up and we'll have a winner either being equities or money market. When that train comes rushing in, don't stand infront of it! Certainly a very confusing scenario when fundamentals say that interest rates should remain low, but with IMF pushing for consumption tax increases and high bank liquidity, can we really afford to lower the CBR any further? Tbills edging up, repo rates up and the 2yr bond issue took a beating... up 152bps in 2 months... and the results only show the 'weighted average rate of accepted bids' and the 'market weighted average rate', but no one knows the cut-off yield (which remains undisclosed by CBK) where some folks believe it rose by 168bps from 11.51% to 13.19% (that means the highest yield CBK was willing to pay investors rose faster than what the market was willing to bid - says a lot about how much gava really needs to borrow). But it seems as Treasury front-loads borrowing we'll have an interesting scenario next year, where bank liquidity is high, shilling legs still wobbling, inflation leveling out, and bond rates remaining high. This means no cut in the CBR next month. The winner theoretically should be money markets as analyst factor in the interest rate and potential inflation spikes into their WACC (though probably depends on ur sector). But i'm hopeful something can be done about GDP growth and the shakey housing market... some upmarket areas will not be affected, but i'm sure some folk are feeling the financing cost. The equity rally goes on despite elections, but do you blame the foreigners driving the NSE, they probably don't have anywhere else to put their money but in frontiers. “We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Wazua

»

Investor

»

Bonds

»

Kenya Debt Watch

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|