Wazua

»

Investor

»

Stocks

»

Safaricom FY2018

Rank: Elder Joined: 9/15/2006 Posts: 3,901

|

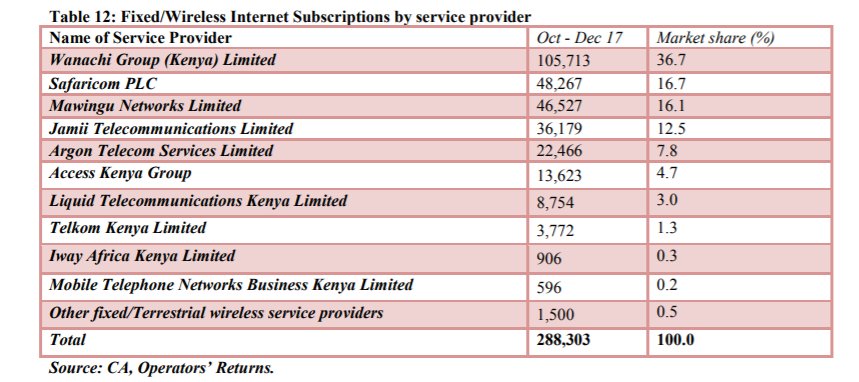

Metch wrote:Fastest growing is actually Safaricom. in 4th place the year before and in 2nd place today overtaking JTL and Mawingu. First place will be grabbed in a number of months. By this time next year we'll begin talking about dominance in this arena as well What are you talking about @Metch? Just in Sep 2017, Mawingu was in 5th place while Safaricom was still in 2nd place then. Since then, Mawingu has added +16,622 subscriptions to Safaricom's +8,252. VituVingiSana wrote:Is it a for-profit venture?

What's the ARPU for Mawingu?

Folks like fast speeds...

Zuku is the loser after blowing their advantage. A new (TZ) owner is buying 51% and perhaps the new leadership will flight back. @VVS appears to be commercial in nature with a digital inclusion agenda, perhaps at early funding stage. But heck, Equity Bank could have been described with similar terms at its inception. http://www.mawingunetworks.com/faq.html

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

muganda wrote:Metch wrote:Fastest growing is actually Safaricom. in 4th place the year before and in 2nd place today overtaking JTL and Mawingu. First place will be grabbed in a number of months. By this time next year we'll begin talking about dominance in this arena as well What are you talking about @Metch? Just in Sep 2017, Mawingu was in 5th place while Safaricom was still in 2nd place then. Since then, Mawingu has added +16,622 subscriptions to Safaricom's +8,252. VituVingiSana wrote:Is it a for-profit venture?

What's the ARPU for Mawingu?

Folks like fast speeds...

Zuku is the loser after blowing their advantage. A new (TZ) owner is buying 51% and perhaps the new leadership will flight back. @VVS appears to be commercial in nature with a digital inclusion agenda, perhaps at early funding stage. But heck, Equity Bank could have been described with similar terms at its inception. http://www.mawingunetworks.com/faq.html   "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,260

|

|

|

|

Rank: Member Joined: 12/22/2015 Posts: 224 Location: Mombasa, Kenya

|

Kama vile Baba husema, "kelele ya chura haimzuii tembo kunywa maji" Start!

|

|

|

Rank: Veteran Joined: 4/23/2014 Posts: 903

|

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

I expected a mad rally but it seems investors are cautious "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

mlennyma wrote:I expected a mad rally but it seems investors are cautious The rally that was there from the beginning of the year factored the results. The current P/E at 28.50 is about 20. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: New-farer Joined: 2/27/2018 Posts: 56 Location: Cambrian Dc

|

mlennyma wrote:I expected a mad rally but it seems investors are cautious The rally will come, just give it a week or two. Most of the cash from dividend chasers and profit takers from the bank stocks will need to find a place to relax and safcom will be a top choice. If the radiance of a thousand suns were to burst at once into the sky that would be like the splendour of the mighty one.

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 7/10/2014 Posts: 145 Location: Nairobi

|

mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii Honestly the super 55B profits are out of their exploitative charges. I use ZUKU at my work place over 20 comps with Hispeed cable internet wifi in the entire compound ZUKU TV and a zuku telephone which we dont use charges Ksh 6,000. I doubt if Safaricom can match that price "Blowing out someone else candle won't make yours shine brighter"-Anonymous

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii #TukoPamoja I like my Faiba 4G modem and 25Gbs for 1,000/-! Though the irony is I have to pay by M-Pesa! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

VituVingiSana wrote:mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii #TukoPamoja I like my Faiba 4G modem and 25Gbs for 1,000/-! Though the irony is I have to pay by M-Pesa! Banks are heavily targeting the mobile settlements space via own paybills and soon your bank shall have direct bill settlement straight to the Faiba bank account hence bypassing mpesa altogether. Equitel is already on this, but Safaricom presence is simply too wide for any company to overhaul in a huff. Not even Telkom will challenge the market share percentages, but days of astronomical P&L growth are coming to a halt for Safaricom

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

obiero wrote:VituVingiSana wrote:mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii #TukoPamoja I like my Faiba 4G modem and 25Gbs for 1,000/-! Though the irony is I have to pay by M-Pesa! Banks are heavily targeting the mobile settlements space via own paybills and soon your bank shall have direct bill settlement straight to the Faiba bank account hence bypassing mpesa altogether. Equitel is already on this, but Safaricom presence is simply too wide for any company to overhaul in a huff. Not even Telkom will challenge the market share percentages, but days of astronomical P&L growth are coming to a halt for Safaricom No company is too big to fall if they ignore the customers concerns "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii Ati only mpesa what?  come on obiero. By the way the days safcom used to have mad rallies are gone. By this time next year the new normal will be about 40/- Those mentioning Equitel and faiba need to look at the numbers posted by the communication authority. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

murchr wrote:mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii Ati only mpesa what?  come on obiero. By the way the days safcom used to have mad rallies are gone. By this time next year the new normal will be about 40/- Those mentioning Equitel and faiba need to look at the numbers posted by the communication authority. @murchr we are in 2022, not today's numbers. Safaricom has to fight off Telkom or else it wont end well. Mpesa is still big for Safaricom along with data which combined are more than voice revenue i.e 99.27B vs 95.6B. Voice is dead! And data is under heavy attack from multiple 'enemies'

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 12/4/2009 Posts: 1,982 Location: matano manne

|

Me thinks Mpesa settlements and payment modes and visa/mastercard like convenience is the key here. Not mere payments to and from account to account. This area is where the game is and here Safaricom is way ahead of even Equitel. Look at their attempt at ecommerce payment via ebay, Amazon, playstore......

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

obiero wrote:murchr wrote:mlennyma wrote:obiero wrote:Cornelius Vanderbilt wrote:mlennyma wrote:I expected a mad rally but it seems investors are cautious why do you expect a rally in a downtrend market , though ? Very odd expectation from @mlennyma.. Only mpesa floats the Safaricom boat in terms of percentage increase y-on-y, and with recent happenings in the industry, if their voice and data lines are heavily attritioned, Safaricom may start to loose the spring in its step, albeit slowly I think so too because I have already jumped out of their expensive data.iam paying only 1000 monthly for 23gb data which is enough for my needs at jamii Ati only mpesa what?  come on obiero. By the way the days safcom used to have mad rallies are gone. By this time next year the new normal will be about 40/- Those mentioning Equitel and faiba need to look at the numbers posted by the communication authority. @murchr we are in 2022, not today's numbers. Safaricom has to fight off Telkom or else it wont end well. Mpesa is still big for Safaricom along with data which combined are more than voice revenue i.e 99.27B vs 95.6B. Voice is dead! And data is under heavy attack from multiple 'enemies'   We had this conversation about Equitel Airtel etc. In 2022, data will not just be "come use us to browse" it will be " What can we do with the information we have about you" Listen to Sateesh's interview with AlyKhan. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Wazua

»

Investor

»

Stocks

»

Safaricom FY2018

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|