Wazua

»

Investor

»

Stocks

»

KCB FY 2016 earnings flat +1%

Rank: Elder Joined: 9/15/2006 Posts: 3,901

|

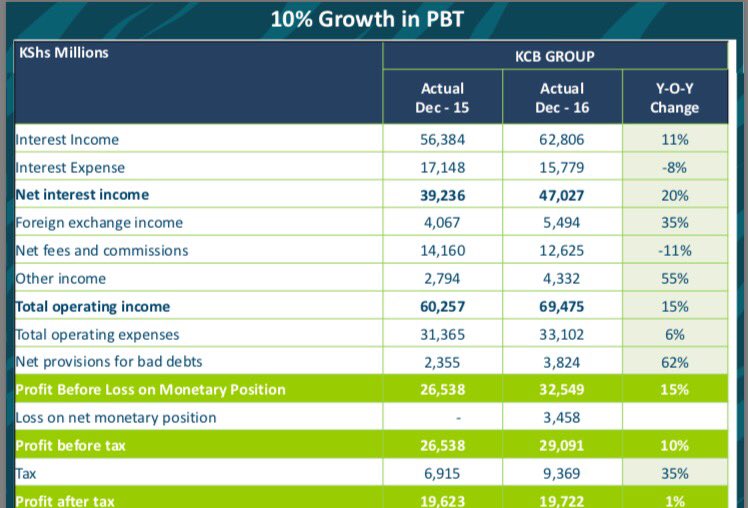

These results show the clear culprit is loan loss provisions. Seems the boom years resulted in largesse (in ageing branches) which was covered up by exorbitant loans.

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,901

|

But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5%

|

|

|

Rank: Veteran Joined: 11/2/2006 Posts: 1,206 Location: Nairobi

|

muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Is this confirmed?? Formally employed people often live their employers' dream & forget about their own.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 955 Location: Kenya

|

I thought KCB had thinning core capital....dividend rise was not expected

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

bird_man wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Is this confirmed?? Confirmed "The KCB Group AGM will be held on 21st April 2017. The Proposed final dividend will be Sh3 per share" Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: New-farer Joined: 10/14/2016 Posts: 25 Location: Nairobi

|

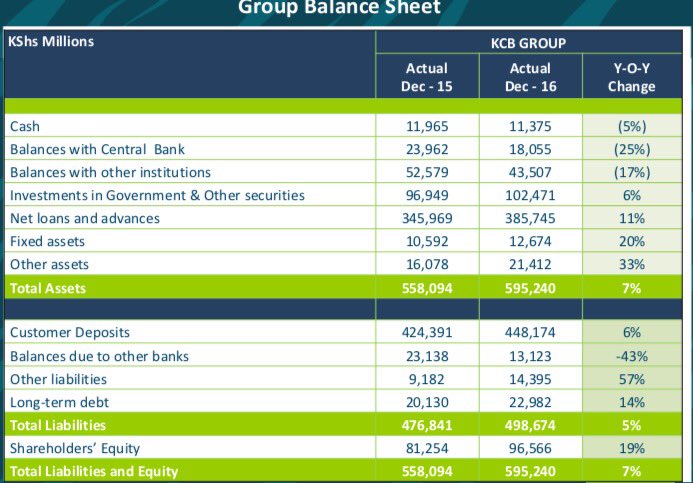

These results are interesting. On the balance sheet, customer deposits growth of only 6% against public notion that with the rate caps and tier three banks struggling, funds would have naturally gone to the big banks. Balances to other banks down 43% (who are funding the small banks since also their deposits have also stagnated?), growth in deposits in 2014/2015 was only 13%.

When you look at lending, higher by 11%, in 2014/2015 was 22% which is obvious from the capping law.

In terms of cash, there are questions not answered. @muganda, any chance we can see the cash flow statement.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Spikes wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. Hakuna rights issue Wewe meza mate watu wakila nyama Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

watesh wrote:I thought KCB had thinning core capital....dividend rise was not expected 2017 is a killer year for banks, the only hope is lifting the rate cap "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Ericsson wrote:Spikes wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. Hakuna rights issue Wewe meza mate watu wakila nyama Good lucky. I know the market is hyped it can rise as high as 40/- John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Questionable, very suspicious. Muganda some people here may not understand that what pay out ratio is. Please do mind to explain, elaborate compare and contrast with the sectors average. I suspect fattening for slaughter   ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

muandiwambeu wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Questionable, very suspicious. Muganda some people here may not understand that what pay out ratio is. Please do mind to explain, elaborate compare and contrast with the sectors average. I suspect fattening for slaughter   Payout ratio is 47% of after tax profit Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 217 Location: Talai

|

muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% EXTREMELY! This is what will save an entire generation of wasuans.. Watch and Listen and Live

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 955 Location: Kenya

|

My analysis on interest income KCB Bank (assuming its the Kenyan unit from the statements provided)

Q1 2016 - 14.39

Q2 2016 - 14.43

Q3 2016 - 14.86

Q4 2016 - 12.5

As compared to 2015

Q1 2015 - 10.63

Q2 2015 - 11.89

Q3 2015 - 11.99

Q4 2015 - 14.2

Interest rate cap had an impact....a couple of billions gone. Through increased volumes kind of compensated. From this i can say Q1 2017 will be stagnant or drop....

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

Spikes wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. Bring it on! Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Spikes wrote:Ericsson wrote:Spikes wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. Hakuna rights issue Wewe meza mate watu wakila nyama Good lucky. I know the market is hyped it can rise as high as 40/- 40 ni ndoto za mchana.. Lakini 30 is reality

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

bird_man wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Is this confirmed?? yes its confirmed. Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

obiero wrote:Spikes wrote:Ericsson wrote:Spikes wrote:muganda wrote:But a proposed final dividend of 3/= per share is a lucrative pay-out of 11.5% Nothing lucrative there.Just preparing you for rights issue.This is purely a bait. Hakuna rights issue Wewe meza mate watu wakila nyama Good lucky. I know the market is hyped it can rise as high as 40/- 40 ni ndoto za mchana.. Lakini 30 is reality Kwa hivyo sahii ni kubaya? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Member Joined: 6/15/2013 Posts: 301

|

watesh wrote:My analysis on interest income KCB Bank (assuming its the Kenyan unit from the statements provided)

Q1 2016 - 14.39

Q2 2016 - 14.43

Q3 2016 - 14.86

Q4 2016 - 12.5

As compared to 2015

Q1 2015 - 10.63

Q2 2015 - 11.89

Q3 2015 - 11.99

Q4 2015 - 14.2

Interest rate cap had an impact....a couple of billions gone. Through increased volumes kind of compensated. From this i can say Q1 2017 will be stagnant or drop.... Wah didn't think interest rate caps law would affect the banks so soon in Q4. Does KCB issue interim ama 3/= is first and final DVD?

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

The dividends are also been paid earlier this year (May 26) compared to previous period when they have been paying in July and late June Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Wazua

»

Investor

»

Stocks

»

KCB FY 2016 earnings flat +1%

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|