Wazua

»

Investor

»

Stocks

»

How to tell NSE has topped/Maxed out.

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@murchr - simple analogy here. China is boosting stocks with an oversize PPT while euroland is also boosting stocks with ECB QE. The KE CB is busying draining liquidity from the system while the 2 above in this example are pumping liquidity. If you were running a hedgefund for hot money where would you place your bet for easy money and meet your target return for the year asap with bonus on top? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

hisah wrote:@murchr - simple analogy here. China is boosting stocks with an oversize PPT while euroland is also boosting stocks with ECB QE. The KE CB is busying draining liquidity from the system while the 2 above in this example are pumping liquidity. If you were running a hedgefund for hot money where would you place your bet for easy money and meet your target return for the year asap with bonus on top? China ofcourse but with caution, Europe has more ghosts that hedge fund investors are reluctant to fight. But my doubt is they'd want to have it all in Chingland rather spread it across with the US being an option. The other BRIC countries are not attractive, that leaves the frontier mkts. CB is only acting on political pressure "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:hisah wrote:@murchr - simple analogy here. China is boosting stocks with an oversize PPT while euroland is also boosting stocks with ECB QE. The KE CB is busying draining liquidity from the system while the 2 above in this example are pumping liquidity. If you were running a hedgefund for hot money where would you place your bet for easy money and meet your target return for the year asap with bonus on top? China ofcourse but with caution, Europe has more ghosts that hedge fund investors are reluctant to fight. But my doubt is they'd want to have it all in Chingland rather spread it across with the US being an option. The other BRIC countries are not attractive, that leaves the frontier mkts. CB is only acting on political pressure. The highlight is what you run away from. Capital is sensitive to politics. Capital got no loyalty for senseless politics. If the CB has no legs out flies capital. Capital follows capital. But KE CB is drying out the liquidity tank. Which financial market runs without liquidity? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Last week the big four(safaricom, kcb, equity and eabl) all did some sizeable volume on the back of the highest weekly foreign outflows in 2015. The bottoms up moment (4400) for the NSE is not that far out. We just ain't dodging a bear run into 2016. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: User Joined: 1/20/2014 Posts: 3,528

|

Where are the half year results to excite the market and bring reversal to this continuous drop of the index!!! Formal education will make you a living. Self-education will make you a fortune - Jim Rohn.

|

|

|

Rank: Member Joined: 7/1/2014 Posts: 895 Location: sky

|

The two pace setters britam and housing finance are setting a very fast pace, by what im seeing in the two, panic is about to visit the market, soon we will start seeing the five top loosers with 9 and 10%, the orders in most counters are dissapearing eg cfc today supply was 30 times demand, centum supply 5 times demand, equity, cfci the same, the market is about to explode downward, unless obama visit,and half year results provides a temporally relief for those held hostage. The market has been going down slowly and undetetable and for sure many are held hostage. I still hold sizeable amount of kenol kobil at an average of 8.63 and i didnt expect it to go below 7.50 but by the look of the market anything is possible There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Othelo wrote:Where are the half year results to excite the market and bring reversal to this continuous drop of the index!!! They'll upset the market instead. Mr Market is moody and bad news, which will be the norm by the way, will make the market dump more points.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

TheGeek on #91 Posted : Tuesday, March 03, 2015 7:48:33 AM wrote:TheGeek wrote:Metasploit wrote:Maybe you can add trendline on the charts;

we have a horizontal trend range on the KCB chart;support at 51-53 from July 2014 and last hit on 18/12/2014 (I bought at 52.50 for shorterm play),and resistance at 60-62 failed to be broken 5 times (Aug,sep,oct,nov 2014)

This implies two things;trend range may continue at least twice with possible lower lows after which we will have a very strong trend change ( a breakout above 62 or a breakdown below 51)

** 52*1.15=60 (15% price difference between support and resistance for the shorterm traders)

CFC stanbic shows the same trend range (support at 118-120,resistance at 127)It has been trying to break above the resistance since June,at the same time support has always been tested (we had price closing at 115 and touching 115 on two occassions).Same script a breakdown or breakout will be strong

** 118*1.12=132 (12% price difference between support and resistance for the shorterm traders)

Equity has been seeing lower lows after hitting the high of 63.

The last low was at 48.50,then 46 and now the price is flirting at 47 and will definately go down.

If the price goes lower than 45,we will set a new support at 50 and this will be a classical head and shoulder pattern

# At this correction cycle,bought centum at 56,KCB at 52.50 and trying KPLC at 13 Price volatility = Traders in the market. I agree on the KPLC also checkout KENGEN. UNGA is also on my radar #67 Posted : Tuesday, December 23, 2014 1:29:48 PM KENGEN @ 9  UNGA @ 35  Also lookout for BAMBURI 135-140(For long term)  #67 Posted : Tuesday, December 23, 2014 1:29:48 PM #91 Posted : Tuesday, March 03, 2015 10:48:33 AM 1. Scangroup  2 KENOLKOBIL  3MPESA BANK  #91 Posted : Tuesday, March 03, 2015 10:48:33 AM @metasploit @mnandii @ hisah @VVS @Philanga what say you ? The reason I like live charts. Some counters are exceeding expectations "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

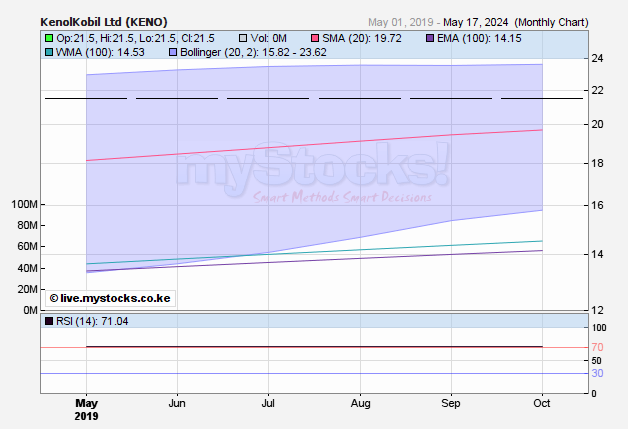

@murchr this is how I see it Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle. Unga - Constructive. Nicely defended. But losing support @40 will turn things south. BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish. SCAN - Neutral, but with a downside hint. KK - Just about to fall off a cliff! Target 5 - 6 zone. Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. Am watching Mpesa Bank this week so far 99% of those buying are foreigners. KENGEN is a longtermer play, those who will buy/bought this one should forget about it till 2018. KK becomes my mistake of 2015, I think i need to set up an 800 number to call whenever am tempted to buy this one. It doesn't excite anymore... "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 7/3/2014 Posts: 245

|

hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. actual Exit positions unga 47. kk 9.5. Mpesa 17. kengen 9.9. Nearly perfect escape from this NSE slow puncture. In the world of securities, courage and patience become the supreme virtues after adequate knowledge and a tested judgment are at hand.

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

@hisah, whats your take on OTC market? SIC, Unitas etc seem almost unaffected?

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,300 Location: kenya

|

hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. @hisa I think the blue chips have spilled with blood or they are just about. What's your recommendation for the chips that could be having high returns if they are picked up right now. Give me the order of your recommendations starting with the most potential to the least if you don't mind please .

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

enyands wrote:hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. @hisa I think the blue chips have spilled with blood or they are just about. What's your recommendation for the chips that could be having high returns if they are picked up right now. Give me the order of your recommendations starting with the most potential to the least if you don't mind please . Na bado. Discounts are coming, better keep your cash in hand and wait for the likes of EABL, Mpesa, KCB, NMG, BAT and Equity. When market starts giving us DY of 5-10% it will be the time to take loans and buy! Life is short. Live passionately.

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

TheGeek wrote:hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. actual Exit positions unga 47. kk 9.5. Mpesa 17. kengen 9.9. Nearly perfect escape from this NSE slow puncture. Kk 10.3 coop 22 Cables 16.3 cic 9.60 . Cash is kinki! (king) Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,176 Location: nairobi

|

I highly doubt Kk can trade at 7bob approaching H1 results leave alone the 5-6 range somebody is quoting "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,300 Location: kenya

|

sparkly wrote:enyands wrote:hisah wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. @hisa I think the blue chips have spilled with blood or they are just about. What's your recommendation for the chips that could be having high returns if they are picked up right now. Give me the order of your recommendations starting with the most potential to the least if you don't mind please . Na bado. Discounts are coming, better keep your cash in hand and wait for the likes of EABL, Mpesa, KCB, NMG, BAT and Equity. When market starts giving us DY of 5-10% it will be the time to take loans and buy! @sparkly would you mind give a brother heads up ,more so do you know probably the approximate exact time so that tuweke loan application for two weeks processing time

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mlennyma wrote:I highly doubt Kk can trade at 7bob approaching H1 results leave alone the 5-6 range somebody is quoting In a bear all bets are off. Logic goes out the window. I expect the market to rise abit before the last ride down. Hopefully that will take the big 5 down with it The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: User Joined: 1/20/2014 Posts: 3,528

|

Targets KCB<48, Mpesa<13 & Coop <18 Formal education will make you a living. Self-education will make you a fortune - Jim Rohn.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,176 Location: nairobi

|

Othelo wrote:Targets KCB<48, Mpesa<13 & Coop <18 I have an appointment with simba below 50 "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has topped/Maxed out.

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|