Wazua

»

Investor

»

Stocks

»

How to tell NSE has topped/Maxed out.

Rank: User Joined: 1/20/2014 Posts: 3,528

|

mulla wrote:heri wrote:sparkly wrote:heri wrote:I have nobody to blame but my greed . How could i not have sold CFC at 140. most of my gains have been wiped out

i thought the double digits profit growths would last longer What was your purchase price? I bought at 66 two years ago Pole sana bro....its a learning experience...You have got to be disciplined enough when making a sale too...once you reach your target start preparing yourself for exit and fight emotions of greed. At over 100% capital gain that counter should have been long sold. once i make 100% plus on a share, generally i recover my initial investment and treat the remaining shares at zero value & manage it for there on long term basis (though i still watch the portfolio). Learnt the hard way from firestone and cables  Formal education will make you a living. Self-education will make you a fortune - Jim Rohn.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

heri wrote:sparkly wrote:heri wrote:I have nobody to blame but my greed . How could i not have sold CFC at 140. most of my gains have been wiped out

i thought the double digits profit growths would last longer What was your purchase price? I bought at 66 two years ago Its now at 101 so you can still sell at a profit. watch out for support on the way down at 85-90, 65-70 and if things go baaad at 45! Life is short. Live passionately.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,056 Location: Nairobi

|

mlennyma wrote:I highly doubt Kk can trade at 7bob approaching H1 results leave alone the 5-6 range somebody is quoting Never say never. It will be a great point to buy more by the spadeful. These chances do not come along often. If I controlled KK, I would start selling off any station that does not make (or potential) enough to cover 15% ROA. I would use the cash to pay down debt. Then shop around for a buyer/suitor. If there are no suitors, then just sell off the stations to the highest bidder [not a fire sale but a coordinated sale] as I find buyers for the depots, etc. My gut feeling is that the assets [land and buildings] are worth more than the Book Value. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

When market varies its trading hours "due to President Barack Obama's visit" Buy or Sell early. Market closes at 1200 HRS  Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

friends, it is not funny out there. Britam can be had for 14.00, hfck for 20.50( though i expected this this is pretty shocking how quickly it has materialised). Cic heading to 5 bob!! centum at 48- That one made me smile its coming back to earthly valuations soon. There are shocking prices out there. There are 3 stocks still holding the NSE at respectable levels. Safcom, kcb, Equity. KCB and equity seem to be succumbing to the bear but not completely. Safcom is the hardest nut to crack, after the bounce that has been talked of, if safcom breaches below 15 and lower, that's when the real party will start, and all other stocks should sink properly after that. Happy hunting, bargain hunters. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

Aguytrying wrote:friends, it is not funny out there. Britam can be had for 14.00, hfck for 20.50( though i expected this this is pretty shocking how quickly it has materialised). Cic heading to 5 bob!! centum at 48- That one made me smile its coming back to earthly valuations soon. There are shocking prices out there.

There are 3 stocks still holding the NSE at respectable levels. Safcom, kcb, Equity. KCB and equity seem to be succumbing to the bear but not completely. Safcom is the hardest nut to crack, after the bounce that has been talked of, if safcom breaches below 15 and lower, that's when the real party will start, and all other stocks should sink properly after that.

Happy hunting, bargain hunters. Equity is losing ground soo fast.Touched a low of 40 HFCK RSI is worse than 2009.Its on a 5 year low (5 year chart RSI at around 10) with sellers still active.It is breaching the 2013 support of 21-22 which means the next low is the 2012 support of 13-15.I thought the guy would bottom in 2016 but seems bottom is in 2015 with sideway plays in 2016. EQUITY 156M traded volume (30th June 2015) and other volumes (between 18th June to 15th JUly 2015) were distribution volumes!! Guys has breached the 45 support and now the 40 support.NEXT SUPPORT IS 35. CFC is already flirting with sub 100 I Think for now its better to flee the market..dont even hunt for bargains till the 2016 sideway plays is almost done towards Q3 2016. Or plays defensive with agrics like EAAGADS et all

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Member Joined: 3/26/2012 Posts: 830

|

Stock market is 90% psychology and 10% genius/luck. If you can watch your portfolio shrink 60% without selling,you are made for the market. Someone once told me that's why only dead people make serious cash in stocks over the long term. A successful man is not he who gets the best, it is he who makes the best from what he gets.

|

|

|

Rank: Member Joined: 2/1/2010 Posts: 272 Location: Nairobi

|

Metasploit wrote:Aguytrying wrote:friends, it is not funny out there. Britam can be had for 14.00, hfck for 20.50( though i expected this this is pretty shocking how quickly it has materialised). Cic heading to 5 bob!! centum at 48- That one made me smile its coming back to earthly valuations soon. There are shocking prices out there.

There are 3 stocks still holding the NSE at respectable levels. Safcom, kcb, Equity. KCB and equity seem to be succumbing to the bear but not completely. Safcom is the hardest nut to crack, after the bounce that has been talked of, if safcom breaches below 15 and lower, that's when the real party will start, and all other stocks should sink properly after that.

Happy hunting, bargain hunters. Equity is losing ground soo fast.Touched a low of 40 HFCK RSI is worse than 2009.Its on a 5 year low (5 year chart RSI at around 10) with sellers still active.It is breaching the 2013 support of 21-22 which means the next low is the 2012 support of 13-15.I thought the guy would bottom in 2016 but seems bottom is in 2015 with sideway plays in 2016. EQUITY 156M traded volume (30th June 2015) and other volumes (between 18th June to 15th JUly 2015) were distribution volumes!! Guys has breached the 45 support and now the 40 support.NEXT SUPPORT IS 35. CFC is already flirting with sub 100 I Think for now its better to flee the market..dont even hunt for bargains till the 2016 sideway plays is almost done towards Q3 2016. Or plays defensive with agrics like EAAGADS et all What is potential support for CFC, in your analysis? Thanks for the insights by the way, highly appreciated. The harder you work, the luckier you get

|

|

|

Rank: Member Joined: 6/15/2013 Posts: 301

|

kryptonite wrote:Metasploit wrote:Aguytrying wrote:friends, it is not funny out there. Britam can be had for 14.00, hfck for 20.50( though i expected this this is pretty shocking how quickly it has materialised). Cic heading to 5 bob!! centum at 48- That one made me smile its coming back to earthly valuations soon. There are shocking prices out there.

There are 3 stocks still holding the NSE at respectable levels. Safcom, kcb, Equity. KCB and equity seem to be succumbing to the bear but not completely. Safcom is the hardest nut to crack, after the bounce that has been talked of, if safcom breaches below 15 and lower, that's when the real party will start, and all other stocks should sink properly after that.

Happy hunting, bargain hunters. Equity is losing ground soo fast.Touched a low of 40 HFCK RSI is worse than 2009.Its on a 5 year low (5 year chart RSI at around 10) with sellers still active.It is breaching the 2013 support of 21-22 which means the next low is the 2012 support of 13-15.I thought the guy would bottom in 2016 but seems bottom is in 2015 with sideway plays in 2016. EQUITY 156M traded volume (30th June 2015) and other volumes (between 18th June to 15th JUly 2015) were distribution volumes!! Guys has breached the 45 support and now the 40 support.NEXT SUPPORT IS 35. CFC is already flirting with sub 100 I Think for now its better to flee the market..dont even hunt for bargains till the 2016 sideway plays is almost done towards Q3 2016. Or plays defensive with agrics like EAAGADS et all What is potential support for CFC, in your analysis? Thanks for the insights by the way, highly appreciated. Now if the real bear is supposed to awaken in 2016, with the elections coming in 2017 theoretically the market may not pick up until after the elections when things settle down.....

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@mulla. That is exactly what we thought before the 2013 elections. The bear was in 2011. Do you remember how that turned out? The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Asante POTUS. Safari njema na karibu tena! Aje abambue retire huku @254. #MagicalKenya A East Africa Single Visa too - tour the region...

OK.

Granted the 'necessary bureaucracies' of the Katiba, I'd make firm calls on the market's direction after the simplified tax is implemented. That road/fuel levy was rather fast?!? Hey.

As @hisah, stock picking this year will be selective.

|

|

|

Rank: User Joined: 1/20/2014 Posts: 3,528

|

Prices at close of trading on Monday, July 27, 2015 NSE Index: 4,467.36 (down by 33.07 points) Formal education will make you a living. Self-education will make you a fortune - Jim Rohn.

|

|

|

Rank: New-farer Joined: 10/16/2014 Posts: 33

|

Bargain hunters...

"Be greedy when others are fearful..."

Looking to cherry pick a few stocks from the bear.. any recommendations?

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

Othelo wrote:Prices at close of trading on Monday, July 27, 2015

NSE Index: 4,467.36 (down by 33.07 points) the Obama market comeback  "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,979

|

murchr wrote:TheGeek on #91 Posted : Tuesday, March 03, 2015 7:48:33 AM wrote:TheGeek wrote:Metasploit wrote:Maybe you can add trendline on the charts;

we have a horizontal trend range on the KCB chart;support at 51-53 from July 2014 and last hit on 18/12/2014 (I bought at 52.50 for shorterm play),and resistance at 60-62 failed to be broken 5 times (Aug,sep,oct,nov 2014)

This implies two things;trend range may continue at least twice with possible lower lows after which we will have a very strong trend change ( a breakout above 62 or a breakdown below 51)

** 52*1.15=60 (15% price difference between support and resistance for the shorterm traders)

CFC stanbic shows the same trend range (support at 118-120,resistance at 127)It has been trying to break above the resistance since June,at the same time support has always been tested (we had price closing at 115 and touching 115 on two occassions).Same script a breakdown or breakout will be strong

** 118*1.12=132 (12% price difference between support and resistance for the shorterm traders)

Equity has been seeing lower lows after hitting the high of 63.

The last low was at 48.50,then 46 and now the price is flirting at 47 and will definately go down.

If the price goes lower than 45,we will set a new support at 50 and this will be a classical head and shoulder pattern

# At this correction cycle,bought centum at 56,KCB at 52.50 and trying KPLC at 13 Price volatility = Traders in the market. I agree on the KPLC also checkout KENGEN. UNGA is also on my radar #67 Posted : Tuesday, December 23, 2014 1:29:48 PM KENGEN @ 9  UNGA @ 35  Also lookout for BAMBURI 135-140(For long term)  #67 Posted : Tuesday, December 23, 2014 1:29:48 PM #91 Posted : Tuesday, March 03, 2015 10:48:33 AM 1. Scangroup  2 KENOLKOBIL  3MPESA BANK  #91 Posted : Tuesday, March 03, 2015 10:48:33 AM @metasploit @mnandii @ hisah @VVS @Philanga what say you ? The reason I like live charts. Some counters are exceeding expectations Hisah July 21, 2015 wrote:@murchr this is how I see it

Kengen - Oh my! That vol spike in Mar 2015 has cratered this thing. Bearish and likely to slide towards 7 handle.

Unga - Constructive. Nicely defended. But losing support @40 will turn things south.

BAMB - vol spike towards end of 2014 was supportive. Trend shift turning bullish.

SCAN - Neutral, but with a downside hint.

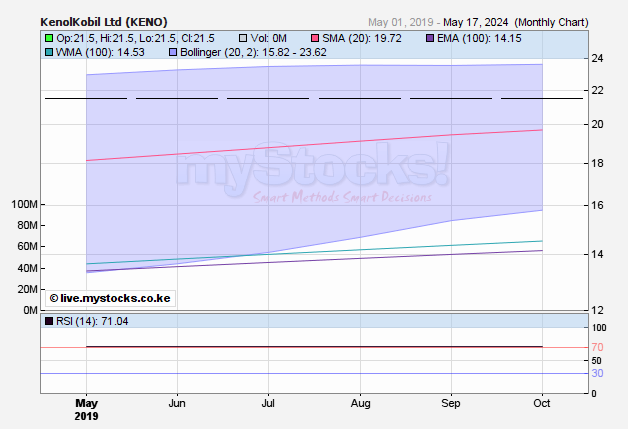

KK - Just about to fall off a cliff! Target 5 - 6 zone.

Mpesa bank - forming a mushroom top. Target still remains 13 - 14 zone. the Geek July 21 2015 wrote:actual Exit positions unga 47. kk 9.5. Mpesa 17. kengen 9.9.

Nearly perfect escape from this NSE slow puncture. KK very flat will not get to 5 - 6 but seems to oscillate on 8 - 9. Mpesa bank, no letting go. Cash is King, we should now revive the bottomed out thread. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:Britam - 2yr chart shows strong rejection from the 40/- zone level. Chartists will tell that the coming correction will not be gentle...  Equity - 2yr chart says thin sim or no thin sim, upside is very limited!  Centum - 2yr chart. This is my favourite coz it's such a nice selloff bazooka cocktail which will leave serious hangover side-effects for late the party-goers. Best bull trap setup at the NSE so far!  I will be waiting for those lessons learnt tales. And they'll be plenty as the trapped realize the pretty shiny golden handcuffs just work like the normal handcuffs.  @murchr, I never thought this would last this long! It's almost 2 years since 26/9/2014... The overall market party mood has shuttered as the nasty hangover resets the wild party. Mr market has now overextended the lessons

As a reminder markets always go against the crowd.

The extreme sentiments being generated by this rate cap bill, is the energy springboard needed to flip things over against the crowd... Stay focussed as the market magicians start staging a new show, whether the bill is signed or not!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

hisah wrote:hisah wrote:Britam - 2yr chart shows strong rejection from the 40/- zone level. Chartists will tell that the coming correction will not be gentle...  Equity - 2yr chart says thin sim or no thin sim, upside is very limited!  Centum - 2yr chart. This is my favourite coz it's such a nice selloff bazooka cocktail which will leave serious hangover side-effects for late the party-goers. Best bull trap setup at the NSE so far!  I will be waiting for those lessons learnt tales. And they'll be plenty as the trapped realize the pretty shiny golden handcuffs just work like the normal handcuffs.  @murchr, I never thought this would last this long! It's almost 2 years since 26/9/2014... The overall market party mood has shuttered as the nasty hangover resets the wild party. Mr market has now overextended the lessons

As a reminder markets always go against the crowd.

The extreme sentiments being generated by this rate cap bill, is the energy springboard needed to flip things over against the crowd... Stay focussed as the market magicians start staging a new show, whether the bill is signed or not! Who are these market magicians you have been trumpeting about all along? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,300 Location: kenya

|

Spikes wrote:hisah wrote:hisah wrote:Britam - 2yr chart shows strong rejection from the 40/- zone level. Chartists will tell that the coming correction will not be gentle...  Equity - 2yr chart says thin sim or no thin sim, upside is very limited!  Centum - 2yr chart. This is my favourite coz it's such a nice selloff bazooka cocktail which will leave serious hangover side-effects for late the party-goers. Best bull trap setup at the NSE so far!  I will be waiting for those lessons learnt tales. And they'll be plenty as the trapped realize the pretty shiny golden handcuffs just work like the normal handcuffs.  @murchr, I never thought this would last this long! It's almost 2 years since 26/9/2014... The overall market party mood has shuttered as the nasty hangover resets the wild party. Mr market has now overextended the lessons

As a reminder markets always go against the crowd.

The extreme sentiments being generated by this rate cap bill, is the energy springboard needed to flip things over against the crowd... Stay focussed as the market magicians start staging a new show, whether the bill is signed or not! Who are these market magicians you have been trumpeting about all along? @Spikes hisah is one of most respectable wazuan.we owe him respect alot. Address him with caution since he won't engage in muddling habits of fight back but will tell you the do's and donts for your success. I never heed his advise of cash is king instead I'm burning with 500k loss in bear. But I'm wiser now because of people like him

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

hisah wrote:hisah wrote:Britam - 2yr chart shows strong rejection from the 40/- zone level. Chartists will tell that the coming correction will not be gentle...  Equity - 2yr chart says thin sim or no thin sim, upside is very limited!  Centum - 2yr chart. This is my favourite coz it's such a nice selloff bazooka cocktail which will leave serious hangover side-effects for late the party-goers. Best bull trap setup at the NSE so far!  I will be waiting for those lessons learnt tales. And they'll be plenty as the trapped realize the pretty shiny golden handcuffs just work like the normal handcuffs.  @murchr, I never thought this would last this long! It's almost 2 years since 26/9/2014... The overall market party mood has shuttered as the nasty hangover resets the wild party. Mr market has now overextended the lessons

As a reminder markets always go against the crowd.

The extreme sentiments being generated by this rate cap bill, is the energy springboard needed to flip things over against the crowd... Stay focussed as the market magicians start staging a new show, whether the bill is signed or not! On point.    indeed the bull will return like a thief, at a time we all least expect. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Buy now in manageable pieces, better than chasing a share! In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has topped/Maxed out.

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|