Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

lochaz-index wrote:Aguytrying wrote:sparkly wrote:muandiwambeu wrote:mlennyma wrote:maka wrote:NIC is taking a beating...wololo like a burukenge!!we are past the meltdown infact my exhaust pipe is getting hot Eti nini.    Nikubaya. Afadhali Leo ni Friday. If we start Monday on this mood, hell it shall be. Safcom not done yet. That supply is torrent. Lol just crazy. Smart money has resigned to the fact that we shall breach 3,000. Its a downfall!!! This bear has been relentless. Remember the optimism we had at 5400. Now we're almost half that amount. The thing to remember is that this particular bear has been very deceptive. Most guys were non-believers when it started out and they kept under-estimating its devastation. It has put investors out of their misery in a very surgical manner unlike the high octane types of 2008 & 2011. Look at the commodities bear run since 2011 to date. Oil was the last to tank in 2014 after putting on a very brave fight. I think the NSE will undergo something similar with safcom being the last one to capitulate. NIC appears on Yassers list

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

obiero wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:hisah wrote:lochaz-index wrote:hisah wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:Next support, 3070 low of December 2011,below that opens up to 2360, the March 2009 GFC lows. NSE 20 down 33 points today to close at 3083  With USD Bulls on the driver's seat, Safcom on a downward trend and credit growth at an all time low, NSE 20 would need divine intervention to stay above the 3,000 psychological level. The 3070 support level is now under serious threat! FTSE NSE KE 15 index is oversold on all time frames except the monthly gauge!!! Extremely bearish. Extreme sentiments usually warn of a sharp turn ahead.

Intraday the index is down 1.24% and will likely close this way. NSE20 will likely close down 1% or more which means it will close below 3000 handle  Are we already in sub-3000 territory? That would take the market 7 years back to 2009. The bounce from 3074 was a bit too steep to be sustainable. Some relief rallies before FY results maybe? NSE20 closes at 3047 breaking the 2011 low at 3070 made on Dec 6 2011. This index is also oversold on the daily, weekly and monthly gauges. Divergence noted on the RSI. The low points are not correlating with the RSI which is printing lower highs. Extreme sentiments zone as the bear extends into the third year with fat tails getting fatter.

The ensuing rebound after this overfeeding spree by the bears is going to be awesome. But as usual many will miss this rebound before the extreme negative sentiments can be reset. Then the bull starts a climb of worry then comes the euphoria phase and bang down we go again as the cycle repeats. All this when the Dow is knocking the 20,000 door. We should bottom sometime this quarter.......not very long from now but sub 3,000 is sure to print by week close. Early next week should be considered a good time for partial entry. The amount of capital that has piled into US equities since the November election is on a crazy scale. It has outranked every single asset class/stock market by several multiples. This is happening before both the anticipated tax cuts come on board and the bond rout goes global. A bit surprised that European markets have managed to nearly/entirely erase their earlier 2016 losses considering everything that is going on in their backyard. EM/FM stock market and their respective currencies will have a defensive/nasty 2017 if funds are only itching to have a piece of the American pie via dollar hedging, bonds or stocks etc. Assessed independently, KE's affairs are shambolic and it will take time to undo. My estimate is at least one and a half years. Couple that with the fact that foreign participation @70/80% has been the life blood of the NSE for the last two years or so plus the global preference for dollar assets over a weak(er) KES by same investor class and you can see the difficulty in the market bottoming out so soon. Wanjiku activity has been low in the post GFC period and has declined further since the current bear run began. Cbk turned on the spigots in September and October 2016 for some reason which is still unclear. Banks' skeletons/underbelly will be exposed sooner rather than later, more so if most of them choose not to bite the bullet @FY2016 coz FY 2017 will be devastating if the same economic conditions persist or get worse. Something is rotten in that neck of the woods. Even Q1 2017 shall be robust for tier 1 banks.. Banking is alive and well. It's the small banks that are in shida The issues afflicting the banking sector are many and varied. Some cut across the sector meaning they are systemic in nature, some are specific to certain banks. The main problem however which blows this small bank vs big bank dichotomy out of the water is if confidence in the sector evaporates. That could easily be triggered by a small bank (or a series of them) going belly up. Profits made are not the critical indicator at this point. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

lochaz-index wrote:Aguytrying wrote:sparkly wrote:muandiwambeu wrote:mlennyma wrote:maka wrote:NIC is taking a beating...wololo like a burukenge!!we are past the meltdown infact my exhaust pipe is getting hot Eti nini.    Nikubaya. Afadhali Leo ni Friday. If we start Monday on this mood, hell it shall be. Safcom not done yet. That supply is torrent. Lol just crazy. Smart money has resigned to the fact that we shall breach 3,000. Its a downfall!!! This bear has been relentless. Remember the optimism we had at 5400. Now we're almost half that amount. The thing to remember is that this particular bear has been very deceptive. Most guys were non-believers when it started out and they kept under-estimating its devastation. It has put investors out of their misery in a very surgical manner unlike the high octane types of 2008 & 2011. Look at the commodities bear run since 2011 to date. Oil was the last to tank in 2014 after putting on a very brave fight. I think the NSE will undergo something similar with safcom being the last one to capitulate. Very true @L.Index. The 2009/2011 Bears were high octane partly because we had a manager/economist as President and not a politician like we currently have. Take a look at the slow mo... bear that was in place in the Moi presidency which was characterised by low economic output,profit warnings, low business sentiment etc....like is the case currently............  @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

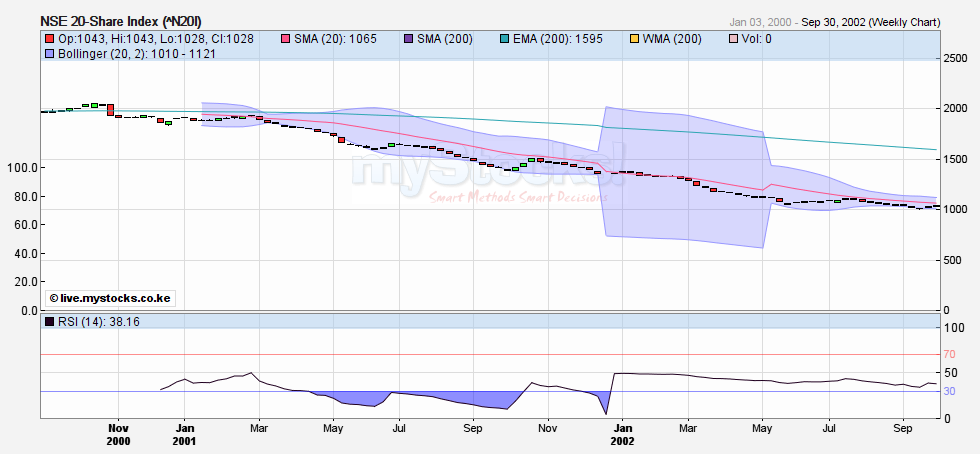

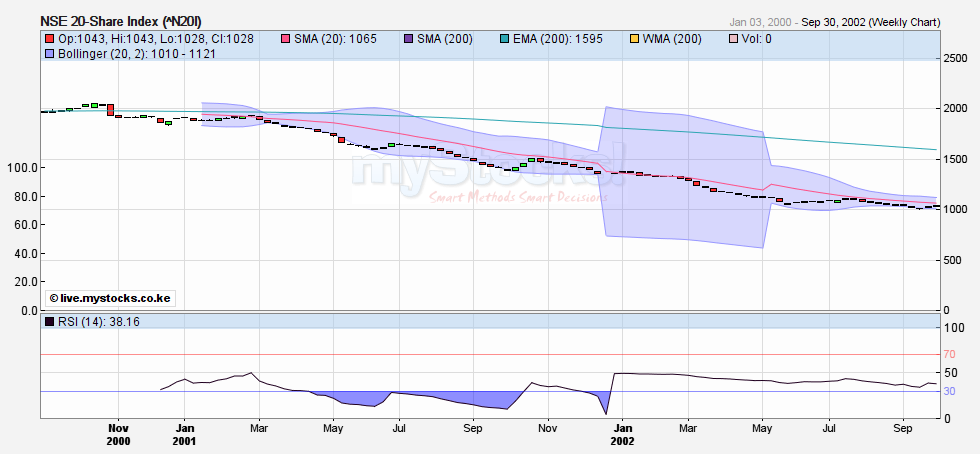

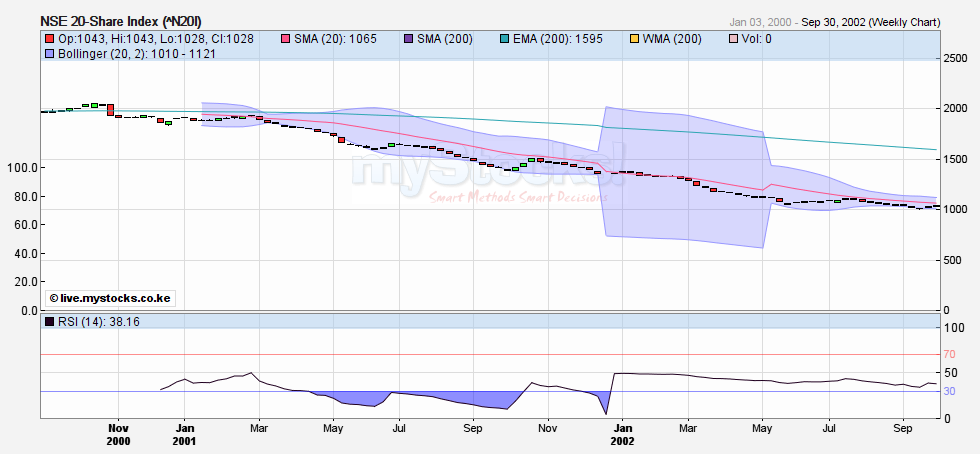

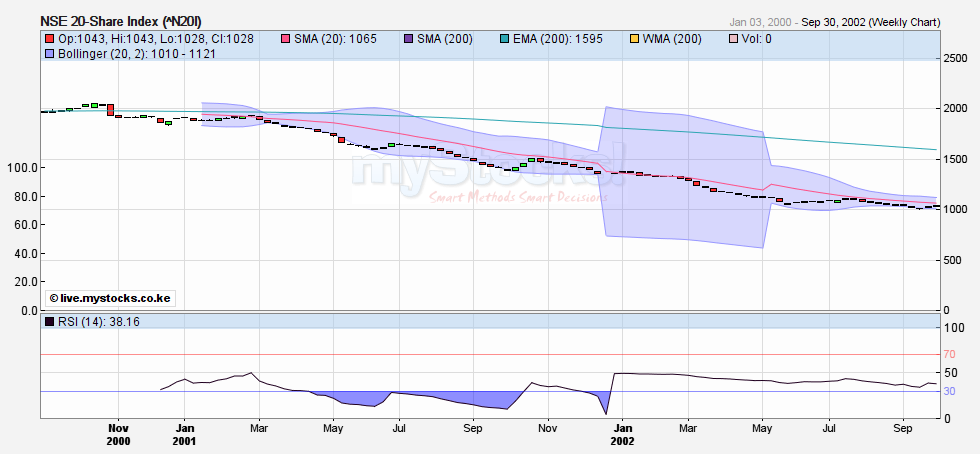

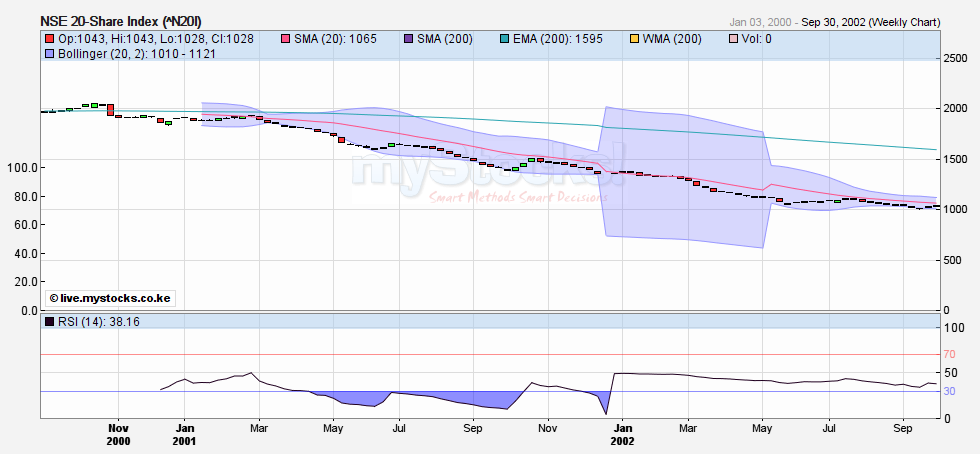

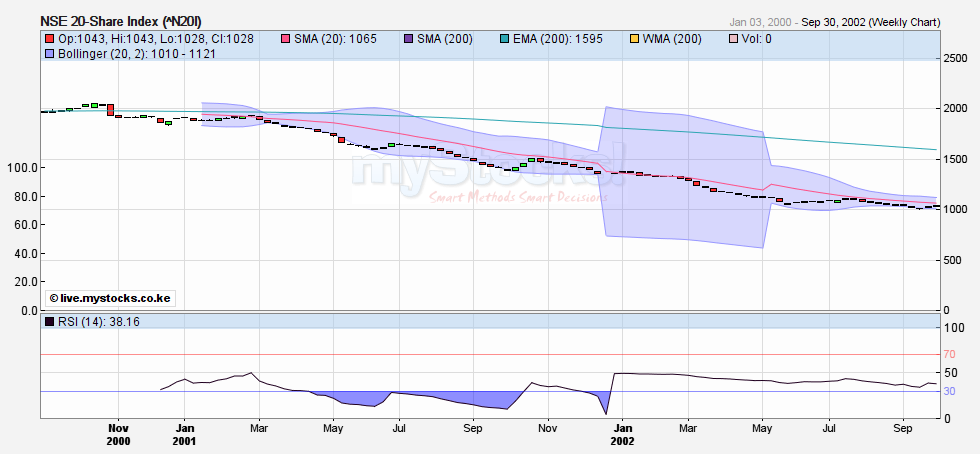

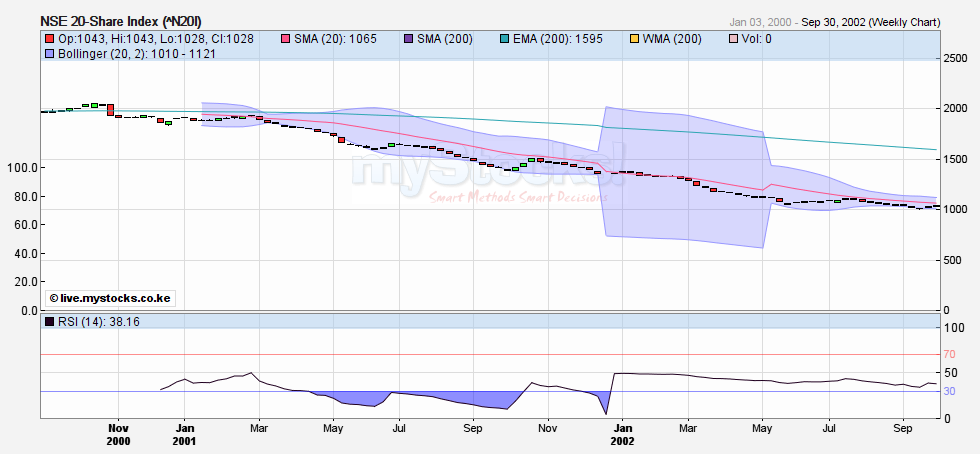

@L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

A much clearer cartoon on the Weekly Time Frame  @SufficientlyP

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote: @L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. Thanks for the charts. I believe that bear run was part of an 8 year downturn (economy, NSE20 etc) where the market in particular tanked from 5000 in 1994 to 1000 in 2002. Interesting similarities to the current situation. I don't expect the bearish momentum to last eight years this time but I think the bear still has some leg room till sub-2000. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote: @L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. Thanks for the charts. I believe that bear run was part of an 8 year downturn (economy, NSE20 etc) where the market in particular tanked from 5000 in 1994 to 1000 in 2002. Interesting similarities to the current situation. I don't expect the bearish momentum to last eight years this time but I think the bear still has some leg room till sub-2000. Some of these predictions here I think are insane and lunatic? Which metrics have aligned between now and then, uhuruto is young, vibrant and going places, moi was retiring. Me needs to see a medic, but they are out farting on nse and complicating my situation inside here. Something must give in. It can not continue like this. Another ten percentiles down and stop loss buttons starts buzzing relentlessly. Daktari tafadhali tokeni NSE and go back to hosi or you will have yourselves to blame for excessively intoxication at NSE without a recourse.      . ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

muandiwambeu wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote: @L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. Thanks for the charts. I believe that bear run was part of an 8 year downturn (economy, NSE20 etc) where the market in particular tanked from 5000 in 1994 to 1000 in 2002. Interesting similarities to the current situation. I don't expect the bearish momentum to last eight years this time but I think the bear still has some leg room till sub-2000. Some of these predictions here I think are insane and lunatic? Which metrics have aligned between now and then, uhuruto is young, vibrant and going places, moi was retiring. Me needs to see a medic, but they are out farting on nse and complicating my situation inside here. Something must give in. It can not continue like this. Another ten percentiles down and stop loss buttons starts buzzing relentlessly. Daktari tafadhali tokeni NSE and go back to hosi or you will have yourselves to blame for excessively intoxication at NSE without a recourse.      . There is bullish sentiment building across the economy. .. Don't rush to stop the loss. . ....Market magicians are out roaring ruthlessly into your holdings. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote: @L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. Thanks for the charts. I believe that bear run was part of an 8 year downturn (economy, NSE20 etc) where the market in particular tanked from 5000 in 1994 to 1000 in 2002. Interesting similarities to the current situation. I don't expect the bearish momentum to last eight years this time but I think the bear still has some leg room till sub-2000. sub 2000 is abit wayyyyyyyyyyy tooooooooo bearish.we arenot in a recession you know ! the current slip in the stock market is because of political tension

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Buyers paradise for the smart investors! Sub 3000 hit on Friday 2971. Unbelievable. Mark my words some stocks will rally 300% in the next bull run! All our current problems are temporary, they can and will be fixed/end. My main worry is the political regime that is killing the economy. But they can change that aspect or be replaced. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Factors contributing to the great NSE bear: famine, reduced liquidity in the economy , slow economic growth, tourism slump, mismanagement and loss of hope in the government - corruption etc. The only thing remaining is very cold weather and it will feel like all hell has broken loose The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Aguytrying wrote:Buyers paradise for the smart investors! Sub 3000 hit on Friday 2971. Unbelievable.

Mark my words some stocks will rally 300% in the next bull run! All our current problems are temporary, they can and will be fixed/end. My main worry is the political regime that is killing the economy. But they can change that aspect or be replaced. On my cross hairs I can not see any stock doing that under this regime. NSE above 3500 without financials/ banking is not possible. Commercials are curtailed seriously to fuel the bulls steroids. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

muandiwambeu wrote:Aguytrying wrote:Buyers paradise for the smart investors! Sub 3000 hit on Friday 2971. Unbelievable.

Mark my words some stocks will rally 300% in the next bull run! All our current problems are temporary, they can and will be fixed/end. My main worry is the political regime that is killing the economy. But they can change that aspect or be replaced. On my cross hairs I can not see any stock doing that under this regime. NSE above 3500 without financials/ banking is not possible. Commercials are curtailed seriously to fuel the bulls steroids. Even 1000% rise is possible but a lot of water must flow below the bridge. ... John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote: @L.Index, this was between 1st Jan 2000(earliest available data) and September 2002 in the moi's sunset years. A similar situation is at play currently. Thanks for the charts. I believe that bear run was part of an 8 year downturn (economy, NSE20 etc) where the market in particular tanked from 5000 in 1994 to 1000 in 2002. Interesting similarities to the current situation. I don't expect the bearish momentum to last eight years this time but I think the bear still has some leg room till sub-2000. We had a double top at 5,400 level on the NSE20 in March 2015. First 5,400 post 2011 bear was in Sept 2004. Only a change of guard at the top from a Politician to a Manager/Economist will take us back there and should this not happen this year, am looking at any meaningful bull in 2022 when wanjiku will be fed up with the status quo and will be pushed into voting with her head. Ans so YES,the 8 year bear run last seen under politician Moi(1994-2002) should play out again if things remain as they are @SufficientlyP

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

Most stocks will be recording 10% dividend yields..I was looking into investing in the Nigeria stock exchange and noted that the difference in exchange rate to the dollar between the black market and the central markets is 150 Naira..a difference of almost 40% KSH is not yet near there..KE is not bearish until the dollar gain soo much against the KSH that black market starts to flourish The current president has mismanaged the economy but the economy is not yet even a thousand miles the recession days before President Mwai Kibaki Unless the elections has violence,a good number of shares are almost at subsidized rates

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Aguytrying wrote:Factors contributing to the great NSE bear: famine, reduced liquidity in the economy , slow economic growth, tourism slump, mismanagement and loss of hope in the government - corruption etc. The only thing remaining is very cold weather and it will feel like all hell has broken loose @aguy you forgot the big one... DEBT. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

THREE YEARS AGO! mnandii wrote:ELLIOTT WAVE ANALYSIS OF THE NSE 20 SHARE INDEXThis is my interpretation of the path of the NSE 20 Share index from the low of Sept. 2002. I've obtained the chart from the FINANCIAL TIMES Website linkElliott wave analysis is mine. Looking at the chart, one can convincingly conclude that it is possible to chart the path of the NSE using Elliott Waves. For those interested in learning the waves you can read ELLIOTT WAVE PRINCIPLE: KEY TO MARKET BEHAVIOUR BY Frost and Prechter. You can get the entire book free and alot more from www.elliottwave.com. It is instructive to note that Prechter and Frost, in the book, predicted the great bull market from 1979 (i.e the DJIA). To date the American market has far exceeded even their own expectations. Prechter won the U.S Trading Championship in 1984 with a record 444% gain. PrechterPrechter is currently researching on social causality via the Socionomics Institute. Now to our analysis:  This chart shows a 5 wave move from the low of Sept. 2002 (1009 points) to the high of Jan 2007 (6026 points). Note the zigzag in wave IV and the triangle in wave four of wave V. This five wave move is called an Impulse Wave. I don't have data from before 1998 so I guess this is a fifth wave move of a much larger impulse wave. A fourth wave usually divides an impulse into a Golden Section. From the low of Sept. 2002 to the high of wave III (at 3176) is a gain of 2167 (i.e. 3176-1009). Wave V has a gain of 3558 points (i.e 6026-2468). Now, wave I through wave III, (i.e 3176-1009=2167) multiplied by 1.618 ( a Fibonacci ratio) gives 3506 points vide: (3176-1009) X 1.618 = 3506 points. Wave V had a gain of 3558 points i.e 6026-2468. The difference btw the two figures (3558 vs 3506) is 52 points which is one and half percentage points from the exact figure! WHY I CONSIDER A HUGE BEAR MARKET FOR NSE1. From the high of 6026, the NSE 20 Share index has fallen in five waves (i.e waves 1, 2, 3, 4 and 5). From the low of March 2009 (at 2576 points), the NSE has moved in 3 waves. Or, at the very least, the move from the part I've labelled A to the part labelled B cannot be considered an impulse wave due to overlap. The Elliott wave pattern that has such characteristics is called a ZIGZAG. A Zigzag is a three wave move that subdivides 5-3-5. So presently we have 5 waves down from the 6026 high, thus forming wave A. Wave B is the three wave move from the low of March 2009 at 2576 to present levels. What remains is another five wave down which is likely to take the 2576 low!!! 2. Also note the DIVERGENCE between the RSI and the highs that the NSE is making presently. 3. From the low of Sept. 2002 to the high of Jan 2007 NSE had a gain of 5017 (i.e 6026-1009) points over a 5 year period. From the low of March 2009 to presently, the NSE has only gained about 2497 points (i.e 5073-2576) over a 5 year period. This is about half the gain of 2002-2007. So we now have a market which shows weakness in breadth apart from not making a new high beyond 6026 points. 4. Economically Kenya has one of the highest taxation levels with little efficiency. Electricity prices are high etc etc. Our debt obligation, though not necessarily un-manageable at this point, has accelerated over the past few years. Alot of grand projects are being announced which appear to be good news. In Elliott analysis complacency usually reigns at the very top of a move. CONCLUSION NSE 20 Share index is over-extended and it is time for a big correction in the market. Regards to all. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

When the CEO of a company appears in the front pages of a magazine celebrating success, consider that a MAJOR TOP in that company's share price. SELL Safaricom and target to buy it at sub-10 bob! BOB COLLYMORE: JOY AND PAIN OF RUNNING SAFARICOMConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

mnandii wrote:When the CEO of a company appears in the front pages of a magazine celebrating success, consider that a MAJOR TOP in that company's share price. SELL Safaricom and target to buy it at sub-10 bob! BOB COLLYMORE: JOY AND PAIN OF RUNNING SAFARICOM We may not get to KES 10 but KES 16 shall print before end of next week

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Member Joined: 1/3/2014 Posts: 257

|

mnandii wrote:When the CEO of a company appears in the front pages of a magazine celebrating success, consider that a MAJOR TOP in that company's share price. SELL Safaricom and target to buy it at sub-10 bob! BOB COLLYMORE: JOY AND PAIN OF RUNNING SAFARICOM May be this will be the trigger http://www.businessdaily.../539550-3516314-11gbxj/

|

|

|

Wazua

»

Investor

»

Stocks

»

Elliott Wave Analysis Of The NSE 20

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|