Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Horton wrote:Skin in the game ..... overrated?

So the last couple of firms to go down the dark road ARM & DEACONS CEOs both had skin in the game. Is this trait overrated? Firms will fail. It has happened for as long as there were firms and farms. I feel sorry for both of them given they had real money at stake and didn't sell like some could have done. I feel better in firms where the management has skin in the game. James Mwangi, BC Patel (as a director), James Mworia, etc. [Building value] On the other hand, the former CEO of the largest destroyer of wealth in KE, had zero shares. Some are crooks e.g. Matu who eats from the other 95%, Merali whose insider dealings eats most of the profits, Ndegwas with their conflicts (selling Ennsvalley to Unga), etc Dande, Arora, etc have "skin in the game" too    Let's see where they end up! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

VituVingiSana wrote:Horton wrote:Skin in the game ..... overrated?

So the last couple of firms to go down the dark road ARM & DEACONS CEOs both had skin in the game. Is this trait overrated? Firms will fail. It has happened for as long as there were firms and farms. I feel sorry for both of them given they had real money at stake and didn't sell like some could have done. I feel better in firms where the management has skin in the game. James Mwangi, BC Patel (as a director), James Mworia, etc. [Building value] On the other hand, the former CEO of the largest destroyer of wealth in KE, had zero shares. Some are crooks e.g. Matu who eats from the other 95%, Merali whose insider dealings eats most of the profits, Ndegwas with their conflicts (selling Ennsvalley to Unga), etc Dande, Arora, etc have "skin in the game" too    Let's see where they end up! Exactly my point 😆😆. I try not to make this a must have requirement ie “don’t buy shares unless CEO has skin in the game ”

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Horton wrote:VituVingiSana wrote:Horton wrote:Skin in the game ..... overrated?

So the last couple of firms to go down the dark road ARM & DEACONS CEOs both had skin in the game. Is this trait overrated? Firms will fail. It has happened for as long as there were firms and farms. I feel sorry for both of them given they had real money at stake and didn't sell like some could have done. I feel better in firms where the management has skin in the game. James Mwangi, BC Patel (as a director), James Mworia, etc. [Building value] On the other hand, the former CEO of the largest destroyer of wealth in KE, had zero shares. Some are crooks e.g. Matu who eats from the other 95%, Merali whose insider dealings eats most of the profits, Ndegwas with their conflicts (selling Ennsvalley to Unga), etc Dande, Arora, etc have "skin in the game" too    Let's see where they end up! Exactly my point 😆😆. I try not to make this a must have requirement ie “don’t buy shares unless CEO has skin in the game ” WB and CM are NDANI  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

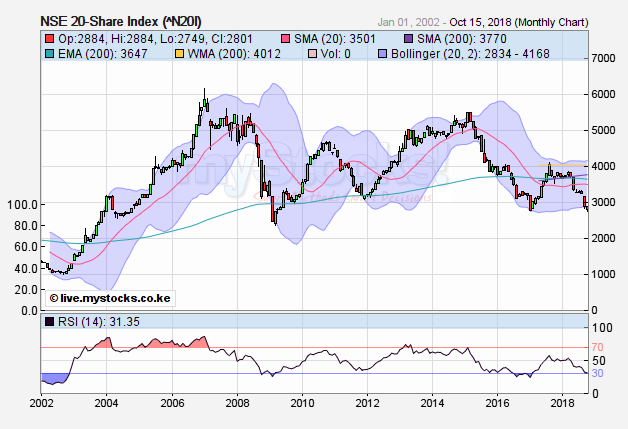

Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   Closed at 2769 yesterday. Rough couple of weeks in most markets with few and far in between pockets of resilience. NSE's ambivalence was quite surprising. Let's see how much of that carnage is priced in. Watch out for cracks in the credit market, things should get more interesting as another fed hike draws closer. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

20% uptick on key counters as we head towards end of the year Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Why you need a vulture’s patience at Nairobi bourse https://www.businessdail...E&tg=1102&pt=63

“Our stay-put behaviour reflects our view that the stock market serves as a relocation centre at which money is moved from the active to the patient,”—Warren Buffett. Remember this is from a man who by the time he turned 50, he only held one percent of his current holdings (estimated at Sh8.6 trillion). He turned 88 this year. “The world is full of foolish gamblers and they will not do as well as the patient investors.” —Charles Munger. Charles is Mr Buffett’s billionaire second-in-command at Berkshire Hathaway. “It is possible to make money – and a great deal of money – in the stock market. But it can be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator.” —J Paul Getty (Patriarch of the Getty Family) “Patience is essential.”— Howard Marks. Marks is known for his prescient investment memos, which warned about the 2008 financial crisis and the dot-com bubble. He manages Oaktree, which oversees over Sh10 trillion of assets. “One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do.”— James Rogers. James is the co-founder of the Quantum Fund and Soros Fund management “Throughout all my years of investing I’ve found that the big money was never made in the buying or the selling. The big money was made in the waiting.”— Jessie Livermore. Boy! plunger knew the usefulness of staying patient. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Ericsson wrote:20% uptick on key counters as we head towards end of the year Slide resumes. The bear is not done yet

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

VituVingiSana wrote:Why you need a vulture’s patience at Nairobi bourse https://www.businessdail...E&tg=1102&pt=63

“Our stay-put behaviour reflects our view that the stock market serves as a relocation centre at which money is moved from the active to the patient,”—Warren Buffett. Remember this is from a man who by the time he turned 50, he only held one percent of his current holdings (estimated at Sh8.6 trillion). He turned 88 this year. “The world is full of foolish gamblers and they will not do as well as the patient investors.” —Charles Munger. Charles is Mr Buffett’s billionaire second-in-command at Berkshire Hathaway. “It is possible to make money – and a great deal of money – in the stock market. But it can be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator.” —J Paul Getty (Patriarch of the Getty Family) “Patience is essential.”— Howard Marks. Marks is known for his prescient investment memos, which warned about the 2008 financial crisis and the dot-com bubble. He manages Oaktree, which oversees over Sh10 trillion of assets. “One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do.”— James Rogers. James is the co-founder of the Quantum Fund and Soros Fund management “Throughout all my years of investing I’ve found that the big money was never made in the buying or the selling. The big money was made in the waiting.”— Jessie Livermore. Boy! plunger knew the usefulness of staying patient. i fully agree.Patience is the best skill to succeed in the stock market.Being in a hurry here,will be doomed. Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ebenyo wrote:VituVingiSana wrote:Why you need a vulture’s patience at Nairobi bourse https://www.businessdail...E&tg=1102&pt=63

“Our stay-put behaviour reflects our view that the stock market serves as a relocation centre at which money is moved from the active to the patient,”—Warren Buffett. Remember this is from a man who by the time he turned 50, he only held one percent of his current holdings (estimated at Sh8.6 trillion). He turned 88 this year. “The world is full of foolish gamblers and they will not do as well as the patient investors.” —Charles Munger. Charles is Mr Buffett’s billionaire second-in-command at Berkshire Hathaway. “It is possible to make money – and a great deal of money – in the stock market. But it can be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator.” —J Paul Getty (Patriarch of the Getty Family) “Patience is essential.”— Howard Marks. Marks is known for his prescient investment memos, which warned about the 2008 financial crisis and the dot-com bubble. He manages Oaktree, which oversees over Sh10 trillion of assets. “One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do.”— James Rogers. James is the co-founder of the Quantum Fund and Soros Fund management “Throughout all my years of investing I’ve found that the big money was never made in the buying or the selling. The big money was made in the waiting.”— Jessie Livermore. Boy! plunger knew the usefulness of staying patient. i fully agree.Patience is the best skill to succeed in the stock market.Being in a hurry here,will be doomed. Calculated patience otherwise you may not enjoy the fruits of your labor

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Has @ericsson become my good luck charm? Any holding of mine he has dissed of late has done well    Unga KK NIC ARM (Maybe. Anything over zero is good given it "died" on me) Now I await his dissing of KenRe and I&M. Among the others that I hold but in smaller value. Please don't diss Centum since I am a buyer so I don't want a jump in the price  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

This will be the worst year for stock investors in a decade,since the 2008 financial crisis. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/9/2009 Posts: 6,592 Location: Nairobi

|

"Winter is here". The global bear officially begins. Or so I think. I wonder how this will affect our already battered market. Question is, will these investors hold their cash after exiting counters in the west or will they put it in markets such as ours?

BBI will solve it :)

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

|

|

|

Rank: Member Joined: 7/1/2014 Posts: 895 Location: sky

|

2012 wrote:"Winter is here". The global bear officially begins. Or so I think.

I wonder how this will affect our already battered market. Question is, will these investors hold their cash after exiting counters in the west or will they put it in markets such as ours? demand is slowly fading , equity supply of 2million against demand of 50k There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

VituVingiSana wrote:Has @ericsson become my good luck charm? Any holding of mine he has dissed of late has done well    Unga KK NIC ARM (Maybe. Anything over zero is good given it "died" on me) Now I await his dissing of KenRe and I&M. Among the others that I hold but in smaller value. Please don't diss Centum since I am a buyer so I don't want a jump in the price  Vvs, where will u keep ur golden eggs, now that u sold ur vault too ,Behold, a sower went forth to sow;....

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

muandiwambeu wrote:VituVingiSana wrote:Has @ericsson become my good luck charm? Any holding of mine he has dissed of late has done well    Unga KK NIC ARM (Maybe. Anything over zero is good given it "died" on me) Now I await his dissing of KenRe and I&M. Among the others that I hold but in smaller value. Please don't diss Centum since I am a buyer so I don't want a jump in the price  Vvs, where will u keep ur golden eggs, now that u sold ur vault too My friend, they have not been laid! Or the Golden Goose may be stolen like the computer from NLC!  for me  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Stock prices hit their peak in 2014. Since that time it has been a downward trend,even the bull run of 2017 wasn't able to lift prices above the 2014 highs. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: New-farer Joined: 5/19/2014 Posts: 68 Location: Migori

|

September 13, 2002 in the months leading up to the yote yawezekana bila Moi the NSE 20 was at 1008.79 points. Guys haven't seen nothing yet. Learning to sit on my hands

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Where is @Sparkly? Despite losing my bet, I am glad I stayed put in KK. Great return vs KenGen It took a year longer than expected!  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

ombaalbt wrote:September 13, 2002 in the months leading up to the yote yawezekana bila Moi the NSE 20 was at 1008.79 points. Guys haven't seen nothing yet. What do you mean. Yote yawezekana deja Vu or what!🤕👶🙃 No, no, no, thunderstorm to strike nse is busy doing pressure ups. Bulls aren't born cowards, and they are strategic. Here all I see is shenanigansm only. Pandemonium and quarndaryness is yet to cause a thriller show here. Watch how gava handles it's debts and you will know how to strategize yourself on this. Wakikata corner, tunakata, wakiruka, Mimi ndiye huyo. ,Behold, a sower went forth to sow;....

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|