Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

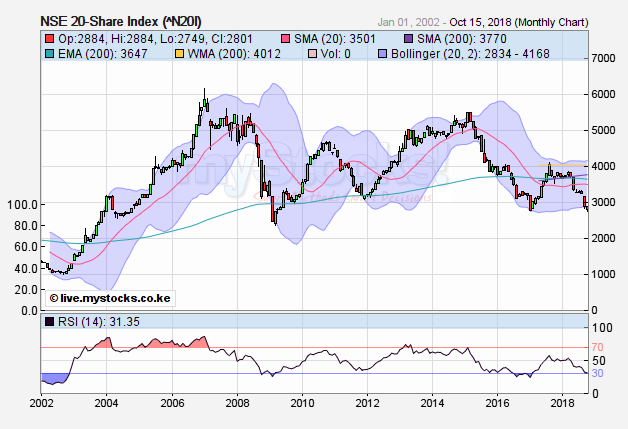

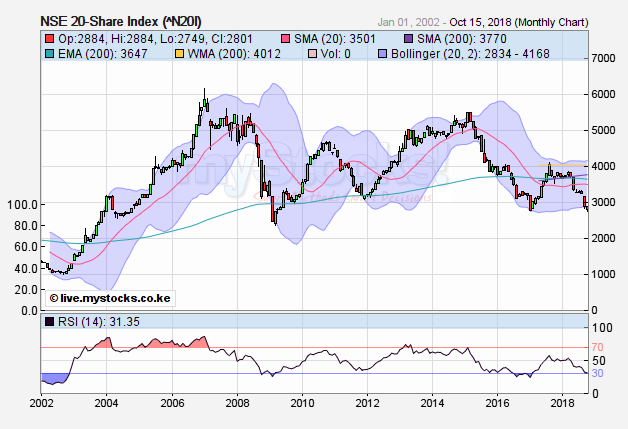

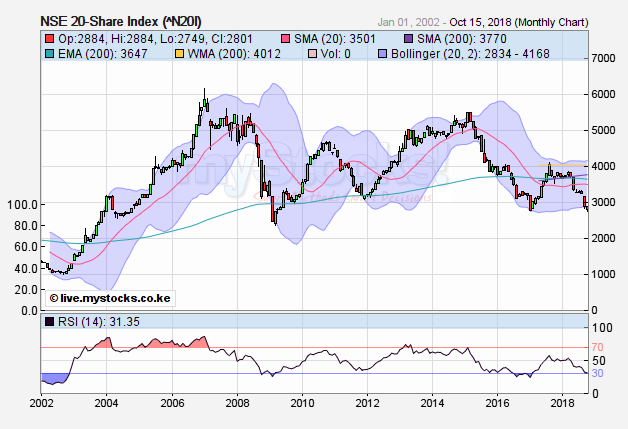

rwitre wrote:obiero wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   Time to buy. Blood on the street    Things are elephant Thus momentumless plateau phenomenon. Rarely occurring in traders charts. Minus momentum, plus acoustically dampening noise, the only way to go is down..... But how far.... ,Behold, a sower went forth to sow;....

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   Ouch! 9 years undone...bitter pill to swallow. Interesting that safcom is losing ground much faster than the overall market...this is in stark contrast to earlier correlations where safcom wasn't losing much despite a steep tanking of the indices. Markets seem a bit jittery with sell-offs in one being replicated and even exceeded in another. The shanghai composite in particular has had it rough in the past two weeks. As interest rates continue their upward trajectory, the weaklings will find the going very tough. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

What is happening to stocks is very sad,we are almost 10yrs backwards. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. What of the Kenyan economy? 15 years Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ericsson wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. What of the Kenyan economy? 15 years I said it here about the two men

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

obiero wrote:Ericsson wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. What of the Kenyan economy? 15 years I said it here about the two men economy is GDP of plus 5% what is? Guys are not using factors of production but cutting corners to get rich (&wealthy) what do you expect? In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Angelica _ann wrote:obiero wrote:Ericsson wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. What of the Kenyan economy? 15 years I said it here about the two men economy is GDP of plus 5% what is? Guys are not using factors of production but cutting corners to get rich (&wealthy) what do you expect? Watching Mr market race safcom, the prodigal son, down, just like it did chase up. What a pivotal stock. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

cnn wrote:Sufficiently Philanga....thropic wrote:Finally the Jan 2017 low has been smashed and we are at levels never seen in this decade. NSE 20 currently at 2783. We were last here twice last decade, in October 2004, when Kibaki was still new in the Presidency, and April 2009 during the GFC. Yes 9 years of gains wiped out of the NSE. What separates us now from the Sept 2002 lows of 1005 is the 2360 GFC low of March 2009......more popcorns please   The GFC lows were a great buying time for some good dividend paying stocks .I have kept BAT since then . Another 15 to 20 percent fall in the indices and some great long term buys should present themselves . Indeed.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. Life is short. Live passionately.

|

|

|

Rank: Veteran Joined: 9/21/2011 Posts: 2,032

|

Is it true foreign investors are shunning emerging markets and rushing to the US o A? Has this contributed to state of affairs at NSE? And why is govt quiet? If you have prolonged bear market at NSE, slump in real estate, yet these are the traditional areas that have been giving high returns, which are the newfound areas the financial experts are advising people to invest?

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,175 Location: nairobi

|

sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

mlennyma wrote:sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. Stocks require much patience.Mambo ya haraka haraka hapa sioni. Towards the goal of financial freedom

|

|

|

Rank: Member Joined: 2/20/2007 Posts: 359

|

limanika wrote:Is it true foreign investors are shunning emerging markets and rushing to the US o A? Has this contributed to state of affairs at NSE? And why is govt quiet? If you have prolonged bear market at NSE, slump in real estate, yet these are the traditional areas that have been giving high returns, which are the newfound areas the financial experts are advising people to invest? Yes it is true. Interest rates are rising in Europe and USA creating btter opportunities in even safer currencies.

|

|

|

Rank: Member Joined: 1/3/2011 Posts: 264 Location: Nairobi

|

limanika wrote:Is it true foreign investors are shunning emerging markets and rushing to the US o A? Has this contributed to state of affairs at NSE? And why is govt quiet? If you have prolonged bear market at NSE, slump in real estate, yet these are the traditional areas that have been giving high returns, which are the newfound areas the financial experts are advising people to invest? uuuum actual businesses?

|

|

|

Rank: Member Joined: 1/3/2011 Posts: 264 Location: Nairobi

|

Ebenyo wrote:mlennyma wrote:sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. Stocks require much patience.Mambo ya haraka haraka hapa sioni. But the dividend yields?? The yields are heaven sent.

|

|

|

Rank: Veteran Joined: 9/21/2011 Posts: 2,032

|

Muthawamunene wrote:limanika wrote:Is it true foreign investors are shunning emerging markets and rushing to the US o A? Has this contributed to state of affairs at NSE? And why is govt quiet? If you have prolonged bear market at NSE, slump in real estate, yet these are the traditional areas that have been giving high returns, which are the newfound areas the financial experts are advising people to invest? uuuum actual businesses? Like the mutual funds...where do they invest nowadays other than govt security? those mutual funds who invested in real estate and at NSE over last 10yrs are we staring at depressed yields?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Ebenyo wrote:mlennyma wrote:sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. Stocks require much patience.Mambo ya haraka haraka hapa sioni. Mmmmmmh... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

maka wrote:Ebenyo wrote:mlennyma wrote:sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. Stocks require much patience.Mambo ya haraka haraka hapa sioni. Mmmmmmh... NSE stock values are diving south so better watch out. My fren the signs are all there to see. Jubilee mambo baaad, good i moved out. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Member Joined: 2/20/2015 Posts: 465 Location: Nairobi

|

Angelica _ann wrote:maka wrote:Ebenyo wrote:mlennyma wrote:sparkly wrote:mlennyma wrote:What is happening to stocks is very sad,we are almost 10yrs backwards. Wanjiku lost complete trust in Stocks since the 2004-2006 Bull. The stock market has never been the same since the Safaricom IPO and the Nyaga, Discount Brokers collapse. I might also throw in the towel during the next recovery. Stocks require much patience.Mambo ya haraka haraka hapa sioni. Mmmmmmh... NSE stock values are diving south so better watch out. My fren the signs are all there to see. Jubilee mambo baaad, good i moved out. Last 3 years i threw in the towel with NSE. Planting trees & mangoes and hopefully in the next 10 years will beat NSE returns.

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|