Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Ericsson wrote:HFCK example of a company moving from blue chip to junk.

There is a crisis in the NSE When did this junk become a blue chipsh, or it's blue being in blue session.    ,Behold, a sower went forth to sow;....

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

Core Holdings KK will likely touch 16.00 (a recent low) Unga has no buyers at 40.00 (despite the Seaboard buyout offer) KenRe is struggling at 16.30 (almost as low as when Mwarania was "fired") I&M at 101.00 (low of 100) All the above firms are PROFITABLE with decent 1H earnings. All pay dividends and are expected to have a profitable FY 2018. Unga has to release FY2017-2018 results by 30th Oct. Tough times! In a weird way, I am not overly concerned since all of them are expected to be profitable this year. Unga is a wild card given the recent volatility in flour prices and the economic malaise of the urban consumers. Tier 2 includes Centum which should turn a profit but will struggle, Stanbic which has a great 1H, Equity and NIC will do reasonably OK, C&G expects a profit but will struggle given the economic situation. Kapchorua is paying a 10/- dividend but every year is different! Tier 3 includes ARM which is dead and a NPA in my books. So it's a combination of              Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

VituVingiSana wrote:Core Holdings KK will likely touch 16.00 (a recent low) Unga has no buyers at 40.00 (despite the Seaboard buyout offer) KenRe is struggling at 16.30 (almost as low as when Mwarania was "fired") I&M at 101.00 (low of 100) All the above firms are PROFITABLE with decent 1H earnings. All pay dividends and are expected to have a profitable FY 2018. Unga has to release FY2017-2018 results by 30th Oct. Tough times! In a weird way, I am not overly concerned since all of them are expected to be profitable this year. Unga is a wild card given the recent volatility in flour prices and the economic malaise of the urban consumers. Tier 2 includes Centum which should turn a profit but will struggle, Stanbic which has a great 1H, Equity and NIC will do reasonably OK, C&G expects a profit but will struggle given the economic situation. Kapchorua is paying a 10/- dividend but every year is different! Tier 3 includes ARM which is dead and a NPA in my books. So it's a combination of              Here is free advise on UNGA. The Seaboard guys were not daft in giving an offer at KES 40.. Now the guys inside are trapped as no one is willing to buy above the initial KES 40 and Seaboard are holding back ready to pull the trigger at a lower price which will happen to the weak hands.. You should have sold to Seaboard

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,055 Location: Nairobi

|

obiero wrote:VituVingiSana wrote:Core Holdings KK will likely touch 16.00 (a recent low) Unga has no buyers at 40.00 (despite the Seaboard buyout offer) KenRe is struggling at 16.30 (almost as low as when Mwarania was "fired") I&M at 101.00 (low of 100) All the above firms are PROFITABLE with decent 1H earnings. All pay dividends and are expected to have a profitable FY 2018. Unga has to release FY2017-2018 results by 30th Oct. Tough times! In a weird way, I am not overly concerned since all of them are expected to be profitable this year. Unga is a wild card given the recent volatility in flour prices and the economic malaise of the urban consumers. Tier 2 includes Centum which should turn a profit but will struggle, Stanbic which has a great 1H, Equity and NIC will do reasonably OK, C&G expects a profit but will struggle given the economic situation. Kapchorua is paying a 10/- dividend but every year is different! Tier 3 includes ARM which is dead and a NPA in my books. So it's a combination of              Here is free advise on UNGA. The Seaboard guys were not daft in giving an offer at KES 40.. Now the guys inside are trapped as no one is willing to buy above the initial KES 40 and Seaboard are holding back ready to pull the trigger at a lower price which will happen to the weak hands.. You should have sold to Seaboard It's all good. We will be OK. It's profitable and 30% haven't sold out. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

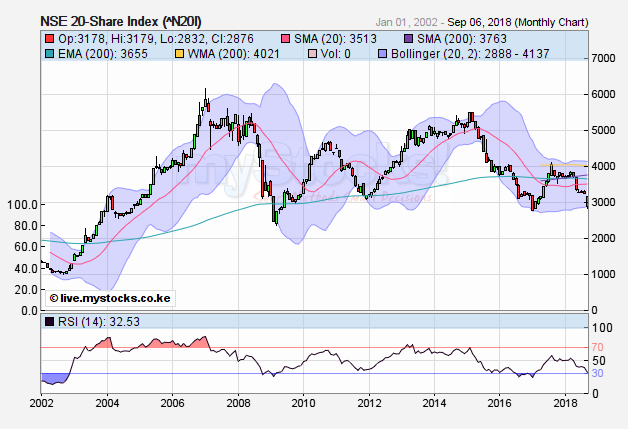

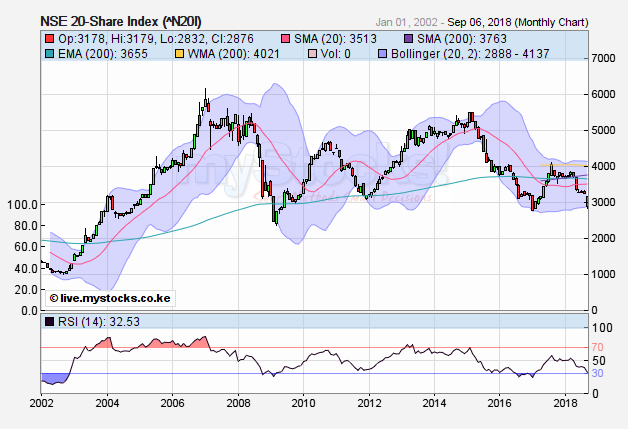

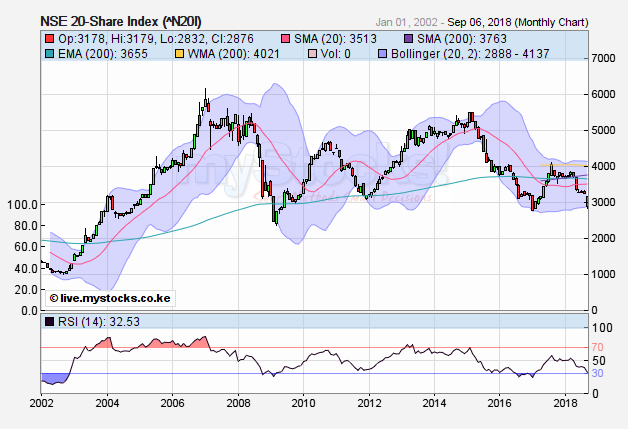

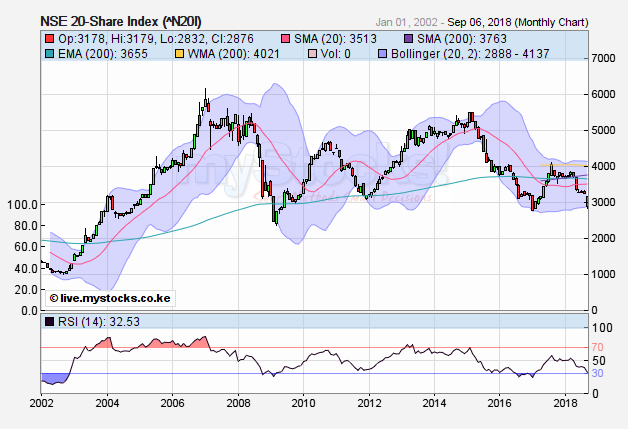

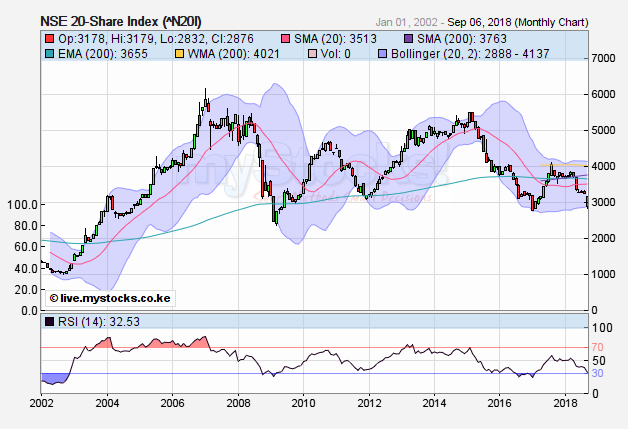

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  NSE 20 firmly in sub 3000 territory having closed at 2969.EM stocks will be greatly hit by rising yields on the 10 year UST, currently at 3%. We are not even talking the US, China trade wars. Long winter here at the NSE. @SufficientlyP

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  NSE 20 firmly in sub 3000 territory having closed at 2969.EM stocks will be greatly hit by rising yields on the 10 year UST, currently at 3%. We are not even talking the US, China trade wars. Long winter here at the NSE. @SPT I had missed you..

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  NSE 20 firmly in sub 3000 territory having closed at 2969.EM stocks will be greatly hit by rising yields on the 10 year UST, currently at 3%. We are not even talking the US, China trade wars. Long winter here at the NSE. On a YTD basis the NSE20 is now in bear territory having lost 20%. The other NSE (Nigeria) - which has a tight correlation to the Kenyan one - is leading the way in terms of losses. Even the shanghai composite hasn't been spared the EM/FM contagion and is still trending south from the 2015 high. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

obiero wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  NSE 20 firmly in sub 3000 territory having closed at 2969.EM stocks will be greatly hit by rising yields on the 10 year UST, currently at 3%. We are not even talking the US, China trade wars. Long winter here at the NSE. @SPT I had missed you..  Had taken a sabbatical. @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  NSE 20 firmly in sub 3000 territory having closed at 2969.EM stocks will be greatly hit by rising yields on the 10 year UST, currently at 3%. We are not even talking the US, China trade wars. Long winter here at the NSE. On a YTD basis the NSE20 is now in bear territory having lost 20%. The other NSE (Nigeria) - which has a tight correlation to the Kenyan one - is leading the way in terms of losses. Even the shanghai composite hasn't been spared the EM/FM contagion and is still trending south from the 2015 high. Correct. Even The Handshake on 9th March this year only offered a temporary reprieve. A strong USD is a nightmare to both EM and FM. @SufficientlyP

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

What is madness at NSE like,a kind asks, K-ochardsplaining, a sad parent answers. 😂😂😂😂 82/= damn to 14/=, rocket science to me. That pumps safety valve just went MIA. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

muandiwambeu wrote:What is madness at NSE like,a kind asks, K-ochardsplaining, a sad parent answers. 😂😂😂😂

82/= damn to 14/=, rocket science to me.

That pumps safety valve just went MIA. The maximum daily changes in price is 10%............ Towards the goal of financial freedom

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Ebenyo wrote:muandiwambeu wrote:What is madness at NSE like,a kind asks, K-ochardsplaining, a sad parent answers. 😂😂😂😂

82/= damn to 14/=, rocket science to me.

That pumps safety valve just went MIA. The maximum daily changes in price is 10%............ 1000 shares traded today at 14.   NSE iko na maneno

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

600 billion lost in the last 5 months https://www.businessdail...765070-dou0c0/index.html

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

[quote=obiero]600 billion lost in the last 5 months https://www.businessdail...65070-dou0c0/index.html[/quote] Soon it will be sh.1 trillion Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

It's unlikely.. The lows around seem low enough

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

If and when Safaricom gives in, it will be beyond 1T. Of course the direction Rotich and co are taking, things will only get murkier. Funny they have a GDP growth rate of 5.8% for this year. They will fix the number, but reality will be different. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Angelica _ann wrote:If and when Safaricom gives in, it will be beyond 1T. Of course the direction Rotich and co are taking, things will only get murkier. Funny they have a GDP growth rate of 5.8% for this year. They will fix the number, but reality will be different. You still believe in GDP figures quoted by Rotich Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

This bear is brutal... Even my ka Fahari I-Reit... I'm bleeding... Ama will Uhuru demolish Greenspan?

|

|

|

Rank: Member Joined: 5/2/2018 Posts: 267

|

the deal wrote:This bear is brutal... Even my ka Fahari I-Reit... I'm bleeding... Ama will Uhuru demolish Greenspan? @thedeal Shouldn't you be adding more at these attractive prices?

|

|

|

Rank: Elder Joined: 12/9/2009 Posts: 6,592 Location: Nairobi

|

Wa! Is that NMG I'm seeing below my knees?

BBI will solve it :)

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|