Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

the deal wrote:obiero wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share Imagine!!!! Unfortunately not buying KQ anymore.. That price is tempting Best decision to make    Too many mixed signals from management.. Better stay safe

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

VituVingiSana wrote:lochaz-index wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share One of the brokers had a sell recommendation with a target price of KES 0.8...even that is pricey for a firm that is in negative equity and sinking further. A simple solution. Another Reverse Split    This process can continue until there are just 100 shares left  All those shares trading at sub-5 should be forced to have reverse splits to get them trading at a minimum of 10/- until they crater again! Anything that has a value of Bob and below can acquire any value when speculators meets the liquidators. This said and done, reverse split will not improve market price of such a share since it has been denoted with Bob for convenience only. To improve on this, the firm has to create countable value that can be allocated to each share and certainly. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

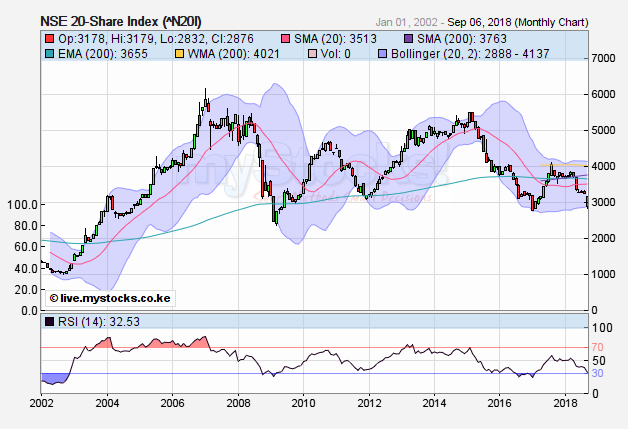

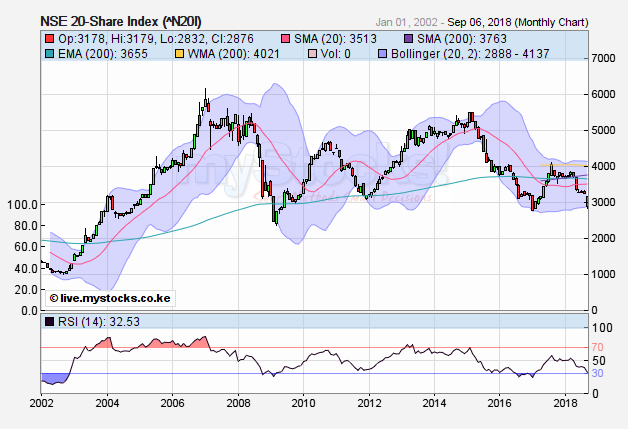

lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  @SufficientlyP

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,177 Location: nairobi

|

In some counters Iam bleeding profusely,who scared the bull in our nse? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? When monkies lead a pride, profuse blood letting is the only thing to expect. A small trumplet went into NSE. The logic of Kenyan concept in trial here. Time horizons, till black Gold comes mainstream full throttle. Hiyo ingine imefail @mugundaman. Look at where the error cropped and know how to tame the 😈. Gava was too optimistic to count chicks before they had hatched. Desperate times call for desperate measures. Hapa sio kujikaza pekee, sackers ✂️✂️✂️✂️ sinatolewa waziwazi, peupepeupe. This is a true, systemic, induced 🐻 in town. No knejerk reaction. All is playing before your open eyes and all you have to do is see the unraveling cirucs. If you make it through this one and be the same then u are doing exactly the same thing ur used too doing all along and definitely you will always be there every time. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,641 Location: NAIROBI

|

Neveready touches ksh.1 per share and Home Afrika touches 60 cents Kenya power goes below ksh.5 per share Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: New-farer Joined: 2/27/2018 Posts: 56 Location: Cambrian Dc

|

mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. If the radiance of a thousand suns were to burst at once into the sky that would be like the splendour of the mighty one.

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. To Each His Own

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment".

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

rwitre wrote:kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment". Remember the most recent monkey named ARM went into a coma.. I would urge you to dissuade

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Member Joined: 12/22/2015 Posts: 224 Location: Mombasa, Kenya

|

rwitre wrote:kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment". Careful! Its diving season at the NSE. Better to accumulate cash and watch from the sidelines. The monkeys running this country have doomed us! Start!

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Metch wrote:rwitre wrote:kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment". Careful! Its diving season at the NSE. Better to accumulate cash and watch from the sidelines. The monkeys running this country have doomed us! Very courageous of you, the route is yet to be routed. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

obiero wrote:rwitre wrote:kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment". Remember the most recent monkey named ARM went into a coma.. I would urge you to desist, I would dissuade/discourage from attempting that, t ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,641 Location: NAIROBI

|

And there we have it Neveready goes below ksh.1 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

Mpesa too feeling the heat.Looking set to test 25 by close of day or early morning tomorrow! @SufficientlyP

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. That's right. Like NMG which had a GFC low of 84 now stranded at the lower 70s  Ditto for KPLC. I am still of the opinion that the bear season will be over once the heavyweights do the dance aka tanking. Safcom, Jubilee, BAT, Eabl, bamburi etc are still in trading in premium zone. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

VituVingiSana wrote:lochaz-index wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share One of the brokers had a sell recommendation with a target price of KES 0.8...even that is pricey for a firm that is in negative equity and sinking further. A simple solution. Another Reverse Split    This process can continue until there are just 100 shares left  All those shares trading at sub-5 should be forced to have reverse splits to get them trading at a minimum of 10/- until they crater again! Interesting proposition more so with shorting. Some stocks would be shorted into becoming illiquid counters. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Ericsson wrote:And there we have it Neveready goes below ksh.1 Got this right  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,060 Location: Nairobi

|

13 September 2018 at 11.20am Shares I do not own KPLC 4.95 Saf 26.00 KCB 40.75 Neveready 0.95 KQ 9.00 MSC 0.60 NBK 5.60 NMG 72.00 Shares I own that are hitting recent lows. A good buying opportunity but I have no cash! Equity 42.75  CFC 96.00  ICDC 28.00  NIC 29.00  TPSEA 23.50  Unga, KK, KenRe and I&M are holding steady but not much higher than their recent lows. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,060 Location: Nairobi

|

Metch wrote:rwitre wrote:kayhara wrote:VyaBureSiachi wrote:mlennyma wrote:In some counters Iam bleeding profusely,who scared the bull in our nse? Probably the Republican tax cuts plus the fuel tax. The sell off for 'greener pastures' coincided with books closure declines and they created a wave of panic selling as no one knows where the bottom is with all the negative sentiments about the economy and our sovereign debt. Most people I think are selling off to stem their own capital hemorrhage. That's my theory. I could be wrong. malicious word on the street about possible CMA action on NSE monkeys has some people panic selling, I will be brave and average out on my three monkeys , I am about 16% into the red. Looking for a monkey that can jump and offset paper losses from my blue chips. Speculative "investment". Careful! Its diving season at the NSE. Better to accumulate cash and watch from the sidelines. The monkeys running this country have doomed us! Deportation pap! China or Canada? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|