Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

sparkly wrote:Ericsson wrote:Angelica _ann wrote:obiero wrote:Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week Uchumi & Neveready will be competing on who will be the 1st to join. Uchumi 1.30 Neveready 1.20 Other candidates are Olympia, Express. KQ slyqueen consolidated. Waiting for right of rebuttable   In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Angelica _ann wrote:sparkly wrote:Ericsson wrote:Angelica _ann wrote:obiero wrote:Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week Uchumi & Neveready will be competing on who will be the 1st to join. Uchumi 1.30 Neveready 1.20 Other candidates are Olympia, Express. KQ slyqueen consolidated. Waiting for right of rebuttable   Lol

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

2 pm 11/09/18 Mumias sugar at 0.65 Hafri at 0.6 Uchumi at 1.30 and going down Nice buy opportunity or get in line an get slaughtered? nikubaya To Each His Own

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? A number of these shares will be suspended soon. Seeing NBV also headed sub bob. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,641 Location: NAIROBI

|

Angelica _ann wrote:sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? A number of these shares will be suspended soon. Seeing NBV also headed sub bob. Suspension is a pipe dream Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,641 Location: NAIROBI

|

Even KQ not immune to madness as it goes below ksh.10 per share Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ericsson wrote:Angelica _ann wrote:sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? A number of these shares will be suspended soon. Seeing NBV also headed sub bob. Suspension is a pipe dream HAFR is likely to be done away with..

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share Imagine!!!! Unfortunately not buying KQ anymore.. That price is tempting

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

obiero wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share Imagine!!!! Unfortunately not buying KQ anymore.. That price is tempting Best decision to make

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,060 Location: Nairobi

|

sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? KES 0.05? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,060 Location: Nairobi

|

obiero wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share Imagine!!!! Unfortunately not buying KQ anymore.. That price is tempting Don't listen to pessimists! BUY, BUY, BUY...    Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? 0.50 since that will allow the 0.05/= denomination and 10% rule to apply. Apply that with caution. At 0.495/= u r in the imaginary world. Ie 10% of 0.5/= is equal to 0.05/= roundindi down, but of 0.495/= is equal to zero damn. 💩. How low do u wish you averaging down should go 😂 ,Behold, a sower went forth to sow;....

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share One of the brokers had a sell recommendation with a target price of KES 0.8...even that is pricey for a firm that is in negative equity and sinking further. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 5/30/2016 Posts: 217 Location: Talai

|

THIS IS PURE WORLD MADNESS IN CAPITAL LETTERS.. what is happpening... Watch and Listen and Live

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

muandiwambeu wrote:sparkly wrote:kayhara wrote:2 pm 11/09/18

Mumias sugar at 0.65

Hafri at 0.6

Uchumi at 1.30

and going down

Nice buy opportunity or get in line an get slaughtered? nikubaya What's the lowest a share can trade at? 0.50 since that will allow the 0.05/= denomination and 10% rule to apply. Apply that with caution. At 0.495/= u r in the imaginary world. Ie 10% of 0.5/= is equal to 0.05/= roundindi down, but of 0.495/= is equal to zero damn. 💩. How low do u wish you averaging down should go 😂 My question is who is selling t this prices? could the guys who bought at 21 be getting out? would it not make sense to just hold out the winter, I think CMA can not just suspend a share because it's trading at rock bottom prices, but then I might be wrong. To Each His Own

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

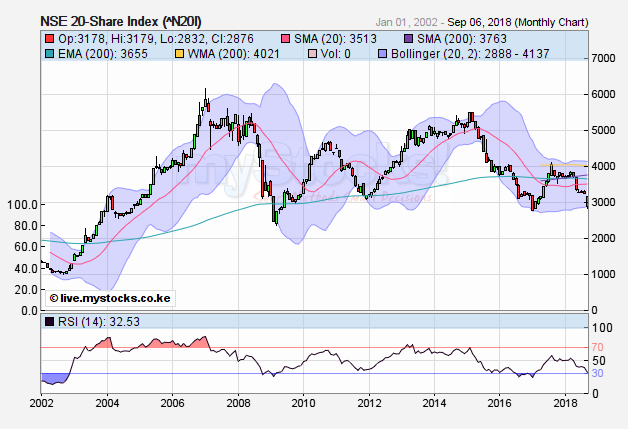

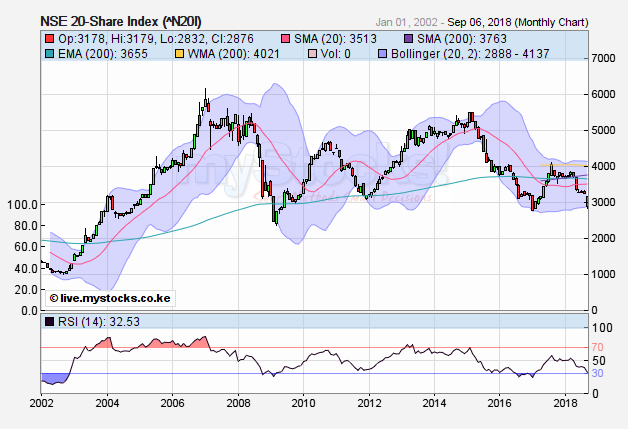

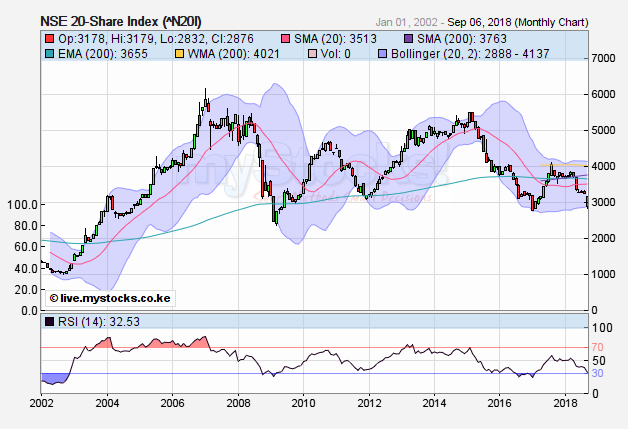

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. The way things are going, we are headed there  TANO TENA    . In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Angelica _ann wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. Closed at 3045 headed to sub 3000. Only the Feb 2017 lows now stand between the market at its current position and the GFC low of 2360. Some stocks have already surpassed those lows and are now aiming at the 2002 levels...interesting. The way things are going, we are headed there  TANO TENA    . Kumiria kumiria🐒 🐒 🐒🐒🐒 🐒🐒 🐒🐒 🐒🐒 🐒🐒 🐒 tooo many to make a business snse anyway. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,060 Location: Nairobi

|

lochaz-index wrote:Ericsson wrote:Even KQ not immune to madness as it goes below ksh.10 per share One of the brokers had a sell recommendation with a target price of KES 0.8...even that is pricey for a firm that is in negative equity and sinking further. A simple solution. Another Reverse Split    This process can continue until there are just 100 shares left  All those shares trading at sub-5 should be forced to have reverse splits to get them trading at a minimum of 10/- until they crater again! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|