Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

maka wrote:lochaz-index wrote:mulla wrote:I don't know where I will get the money, but I will. I will not miss that party of sub3000 Buying will be the easy part. Staying put - awaiting the uptick - in spite of falling or stagnant prices will be the hard part. To be honest at the moment Id rather buy fixed income... Then with the coupon payments buy stocks... Equities will be down for a while... I'm glad that I was out while the tide turned.. Market is still expensive..

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Deacons at 70 cents Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Ericsson wrote:Deacons at 70 cents some you just have to    In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

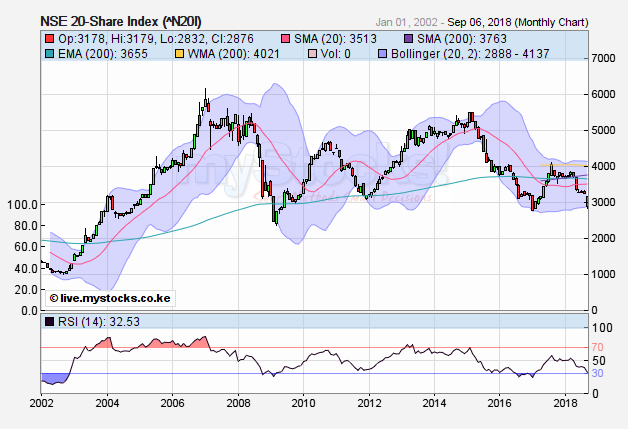

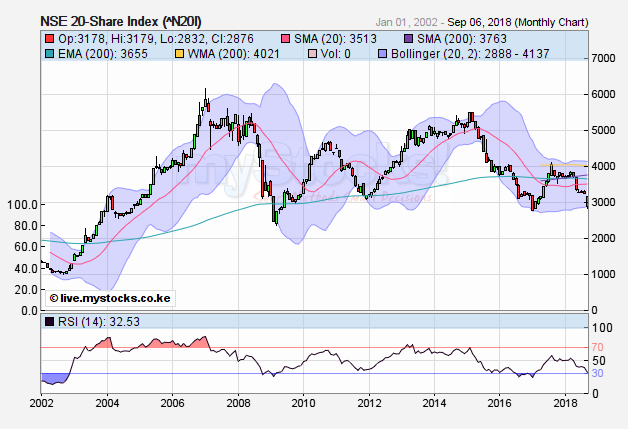

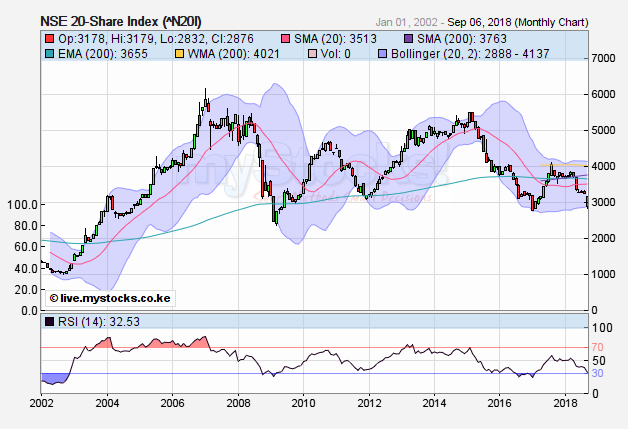

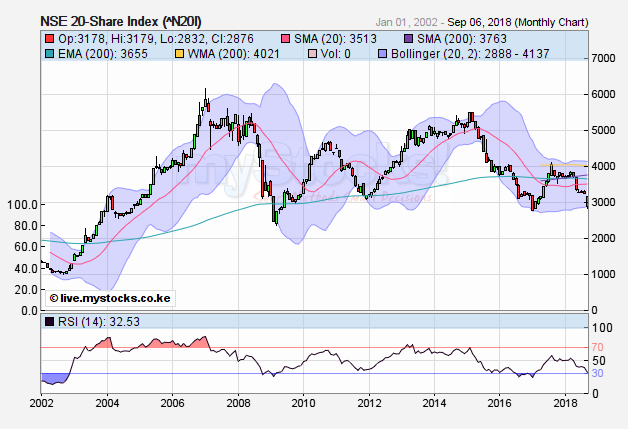

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. @SufficientlyP

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. NMG @75 per share Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ericsson wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. NMG @75 per share Crazy!

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

obiero wrote:Ericsson wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. This will be quite interesting. On the NSE, a long winter is here with us and salvation will only come after financial discipline in the public sector is attained, a tall order by all means and might require a change of guard at the top. NMG @75 per share Crazy! Crazy times ahead. Ask me what am I waiting for. For my concrete work to be finished I leverage on it because I am confident:- Britam will trade sub 9/= when the happy hearts know tharat is not a loser 2. Kq will trade sub 6/= when NY dust blows 3. NMG chini ya mbei ya DN 3. EABl chini ya mbei ya tusker, nitabandirishanga bottle kwa hisa moja na change napata 4. BAT sub 450/ 5. CFC sub 60 6. Kplc, sub token ya 4/= 7. K_gin. Kubole. Hi, men. I will be robbing every bank with my fattened titledeeds. Foreman hebu harakisha hapo, naona mawingu gathering to the east at a distance. Hiyo maneno ya bengi, hebu tuachie J.m ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets And there we are sub-30 clocked. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets Next is Eveready going below ksh.1 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets Next is Eveready going below ksh.1 There was a guy who was really into Neveready where did he disappear to  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Angelica _ann wrote:Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets Next is Eveready going below ksh.1 There was a guy who was really into Neveready where did he disappear to  Undoubtedly moving to sumuni territory by next week Wednesday

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets And there we are sub-30 clocked. NSE 2018 is Ulcers Central

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

rwitre wrote:Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets And there we are sub-30 clocked. NSE 2018 is Ulcers Central  Tragic

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Member Joined: 5/31/2011 Posts: 247

|

rwitre wrote:Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets And there we are sub-30 clocked. NSE 2018 is Ulcers Central  Depending on where you are standing. Some of us are waiting to load up more on Simba, Carbacid, na Mpesa bank, tho it's really resilient - Imekaa ngumu. You lose money chasing women, but you never lose women chasing money - NAS

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Kenyan Oracle wrote:rwitre wrote:Ericsson wrote:Ericsson wrote:sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets And there we are sub-30 clocked. NSE 2018 is Ulcers Central  Depending on where you are standing. Some of us are waiting to load up more on Simba, Carbacid, na Mpesa bank, tho it's really resilient - Imekaa ngumu. True dat

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Another company joins the 70 cents a share club; Deacons Home Afrika Mumias Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

obiero wrote:Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week Uchumi & Neveready will be competing on who will be the 1st to join. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Angelica _ann wrote:obiero wrote:Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week Uchumi & Neveready will be competing on who will be the 1st to join. Uchumi 1.30 Neveready 1.20 Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Ericsson wrote:Angelica _ann wrote:obiero wrote:Ericsson wrote:Another company joins the 70 cents a share club;

Deacons

Home Afrika

Mumias Uchumi likely to join the party before end of this week Uchumi & Neveready will be competing on who will be the 1st to join. Uchumi 1.30 Neveready 1.20 Other candidates are Olympia, Express. KQ were sly to consolidate. Life is short. Live passionately.

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|