Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Member Joined: 7/1/2014 Posts: 895 Location: sky

|

rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

banks were up because of rate cap hope which MPs have voted to retain today, so another round of tanking by banks There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

littledove wrote:rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

banks were up because of rate cap hope which MPs have voted to retain today, so another round of tanking by banks The exchange bar warned all and sundry.. This thing being implemented of deposit cap removal will be the immediate death of all small banks. None shall remain

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 7/3/2007 Posts: 1,634

|

obiero wrote:littledove wrote:rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

banks were up because of rate cap hope which MPs have voted to retain today, so another round of tanking by banks The exchange bar warned all and sundry.. This thing being implemented of deposit cap removal will be the immediate death of all small banks. None shall remain Where banks are concerned, I don't invest in Companies. I invest in people. I follow Buffets principle 'not to invest in any business that he does not understand.' For me I understand NONE. So, essentially I will put my money in any Bank (regardless of size) led by Mwangi, Oigara (and Oduor before him) and Muriuki. They are the best money makers around. Mworia used to be in this short list but his association with the DJ (who has a money losing streak stretching for years) scared me away. "The opposite of a correct statement is a false statement. But the opposite of a profound truth may well be another profound truth." (Niels Bohr)

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Wakanyugi wrote:obiero wrote:littledove wrote:rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

banks were up because of rate cap hope which MPs have voted to retain today, so another round of tanking by banks The exchange bar warned all and sundry.. This thing being implemented of deposit cap removal will be the immediate death of all small banks. None shall remain Where banks are concerned, I don't invest in Companies. I invest in people. I follow Buffets principle 'not to invest in any business that he does not understand.' For me I understand NONE. So, essentially I will put my money in any Bank (regardless of size) led by Mwangi, Oigara (and Oduor before him) and Muriuki. They are the best money makers around. Mworia used to be in this short list but his association with the DJ (who has a money losing streak stretching for years) scared me away. Mworia has always been with DJ CK apart from the short stint at TCL. Life is short. Live passionately.

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

Please share a list of the undervalued firms @rewrite Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Fyatu wrote:rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

Please share a list of the undervalued firms @rewrite Well for those I've been keeping an eye on, and some I hold... • DTB - Really mean with dividend payouts • Britam - Bear effects. Pensive investors. • Co-op - Bonus shares every other year (a plus for those already in, but price remains at same levels) • Kenya Re - Has stagnated in a thin price range for so long High dividend yields compared to the rest of the market peers (above 7%): • Barclays/ABSA eg. DY here is 8% compared to Equity's 4% or KCB's 5% • NMG - market hasn't been very kind to this one. But at Sh 85 a share, the DY is 11% going by last years DPS of 10. Factoring in a reduction to DPS to 7, the yield will be 8%. • Fahari I-Reit. DY 7%

|

|

|

Rank: New-farer Joined: 2/27/2018 Posts: 56 Location: Cambrian Dc

|

rwitre wrote:Fyatu wrote:rwitre wrote:Blood....blood everywhere. Heavyweights falling. Undervalued firms not attracting interest. Penny stocks just trapping people's capital. And the occasional sudden suspensions by CMA. Only cash rich blue chips seem to be weathering the storm. Those betting that post-2017 elections would be a good time to be on NSE were wrong.

Please share a list of the undervalued firms @rewrite Well for those I've been keeping an eye on, and some I hold... • DTB - Really mean with dividend payouts • Britam - Bear effects. Pensive investors. • Co-op - Bonus shares every other year (a plus for those already in, but price remains at same levels) • Kenya Re - Has stagnated in a thin price range for so long High dividend yields compared to the rest of the market peers (above 7%): • Barclays/ABSA eg. DY here is 8% compared to Equity's 4% or KCB's 5% • NMG - market hasn't been very kind to this one. But at Sh 85 a share, the DY is 11% going by last years DPS of 10. Factoring in a reduction to DPS to 7, the yield will be 8%. • Fahari I-Reit. DY 7% If you are looking for another great buy I'd recommend Williamson tea. Even during lean years you'll always get something for your investment and when times are good they'll feed you very well. As the market seems to be quite uncertain for the foreseeable future, this is a safe place to park your cash. If the radiance of a thousand suns were to burst at once into the sky that would be like the splendour of the mighty one.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Blood on the streets and my own is all over. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

sparkly wrote:Blood on the streets and my own is all over. NIC bank share price goes below 30. Next will be Centum,real blood on the streets Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,569

|

sparkly wrote:Blood on the streets and my own is all over. Expect more blood there are no savings Quote:Capital Markets Authority has expressed concern about the poor saving culture that Kenyans have developed over the last decade. Chairman James Ndegwa said the poor saving culture has led to fewer companies being listed in the Nairobi Stock Exchange. A study conducted by the regulator in June indicates Kenya’s gross savings rate has dropped by almost half in 10 years. In 2007, the savings rate was 11.7 per cent but this has dropped to 6.2 per cent at the end of 2017. Link

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

wukan wrote:sparkly wrote:Blood on the streets and my own is all over. Expect more blood there are no savings Quote:Capital Markets Authority has expressed concern about the poor saving culture that Kenyans have developed over the last decade. Chairman James Ndegwa said the poor saving culture has led to fewer companies being listed in the Nairobi Stock Exchange. A study conducted by the regulator in June indicates Kenya’s gross savings rate has dropped by almost half in 10 years. In 2007, the savings rate was 11.7 per cent but this has dropped to 6.2 per cent at the end of 2017. Link With which money does he want people to save? The savings rate has dropped due to deterioration of the state of the economy Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Hello Joined: 8/22/2017 Posts: 6 Location: nrb

|

Ericsson wrote:wukan wrote:sparkly wrote:Blood on the streets and my own is all over. Expect more blood there are no savings Quote:Capital Markets Authority has expressed concern about the poor saving culture that Kenyans have developed over the last decade. Chairman James Ndegwa said the poor saving culture has led to fewer companies being listed in the Nairobi Stock Exchange. A study conducted by the regulator in June indicates Kenya’s gross savings rate has dropped by almost half in 10 years. In 2007, the savings rate was 11.7 per cent but this has dropped to 6.2 per cent at the end of 2017. Link With which money does he want people to save? The savings rate has dropped due to deterioration of the state of the economy How can one save when meeting daily basic needs is a struggle?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,475 Location: nairobi

|

Natim wrote:Ericsson wrote:wukan wrote:sparkly wrote:Blood on the streets and my own is all over. Expect more blood there are no savings Quote:Capital Markets Authority has expressed concern about the poor saving culture that Kenyans have developed over the last decade. Chairman James Ndegwa said the poor saving culture has led to fewer companies being listed in the Nairobi Stock Exchange. A study conducted by the regulator in June indicates Kenya’s gross savings rate has dropped by almost half in 10 years. In 2007, the savings rate was 11.7 per cent but this has dropped to 6.2 per cent at the end of 2017. Link With which money does he want people to save? The savings rate has dropped due to deterioration of the state of the economy How can one save when meeting daily basic needs is a struggle? I talked early about the two men but no one was ready to listen

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 15,750 ABP 6.45

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

wukan wrote:sparkly wrote:Blood on the streets and my own is all over. Expect more blood there are no savings Quote:Capital Markets Authority has expressed concern about the poor saving culture that Kenyans have developed over the last decade. Chairman James Ndegwa said the poor saving culture has led to fewer companies being listed in the Nairobi Stock Exchange. A study conducted by the regulator in June indicates Kenya’s gross savings rate has dropped by almost half in 10 years. In 2007, the savings rate was 11.7 per cent but this has dropped to 6.2 per cent at the end of 2017. Link Ouch! Lower savings, lower investments, more GoK borrowing, credit freeze, higher taxes...some vicious cycle this is. It is going to be be a journey of gradual lower lows(like the pre 2002 trend) for the NSE then the final rout to occur possibly when KES gives way. A shock therapy of sorts is needed to rejig the fundies and general psyche of the average citizen. It is however very tough to try and hazard where such will emanate from and the likelihood of such a path being taken. All indications are that GoK is averse to biting the bullet in any way. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

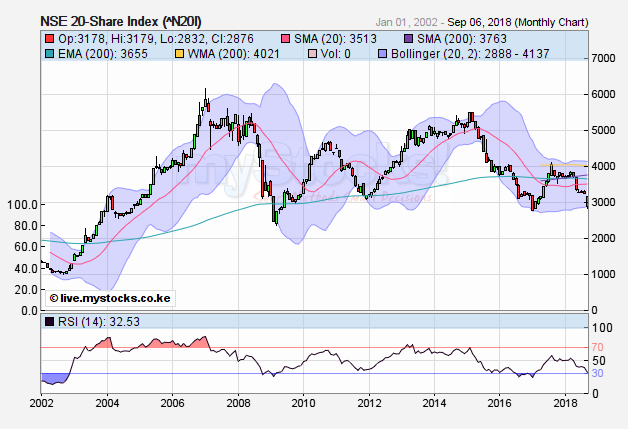

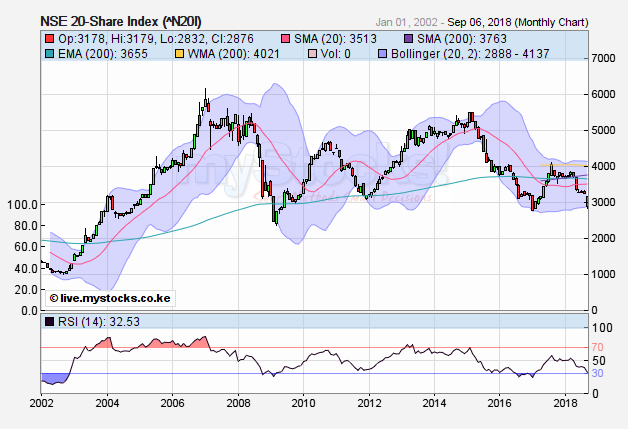

Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   @SufficientlyP

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

|

|

|

Rank: Member Joined: 6/15/2013 Posts: 301

|

I don't know where I will get the money, but I will. I will not miss that party of sub3000

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Meanwhile, today we are on our way to breach the Dec 2011 low of 3070 on the NSE 20. Next stop will be the Jan 2017 low of 2790. If this too is taken out, we shall be staring at the March 2009 lows of 2360. If Uhuru refuses to bite the bullet at this level and tame his huge appetite for loans, then we can look at more rout targeting the September 2002 low of 1005   I think anything below 3000 will translate into a long winter. From the reaction of KE eurobond yields I would say it is almost a certainty. Of critical importance right now despite the irksome nature of their involvement, is for KE to remain in the good graces of the IMF. Yank that support out and it becomes a very steep and nasty decline across all asset classes. That implies the VAT on petroleum stays and the rate cap goes. Note that yield on the 10yr note has been declining (about a 100bps) since the advent of the caps against a tide of rising global interest rates. The more the cap remains the more destructive the snap will be when it is finally lifted. This is coz it will have to rise that much faster to catch up with the global average for EM/FM. The rate cap has worked in similar fashion to a currency peg and this is a bad environment for the cbk to try and defend it. All things held constant, how KE will navigate next year will be the deciding factor when principal bullet payments on debt come due. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

mulla wrote:I don't know where I will get the money, but I will. I will not miss that party of sub3000 Buying will be the easy part. Staying put - awaiting the uptick - in spite of falling or stagnant prices will be the hard part. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

lochaz-index wrote:mulla wrote:I don't know where I will get the money, but I will. I will not miss that party of sub3000 Buying will be the easy part. Staying put - awaiting the uptick - in spite of falling or stagnant prices will be the hard part. To be honest at the moment Id rather buy fixed income... Then with the coupon payments buy stocks... Equities will be down for a while... possunt quia posse videntur

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|