Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

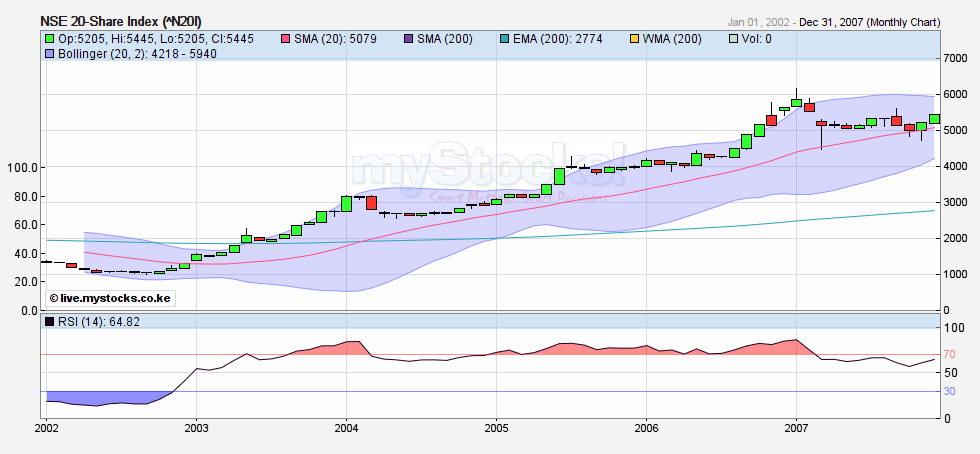

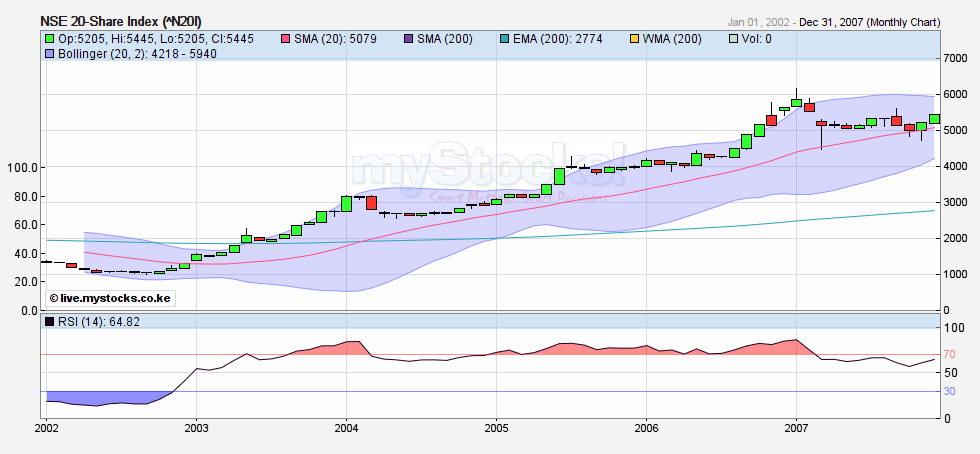

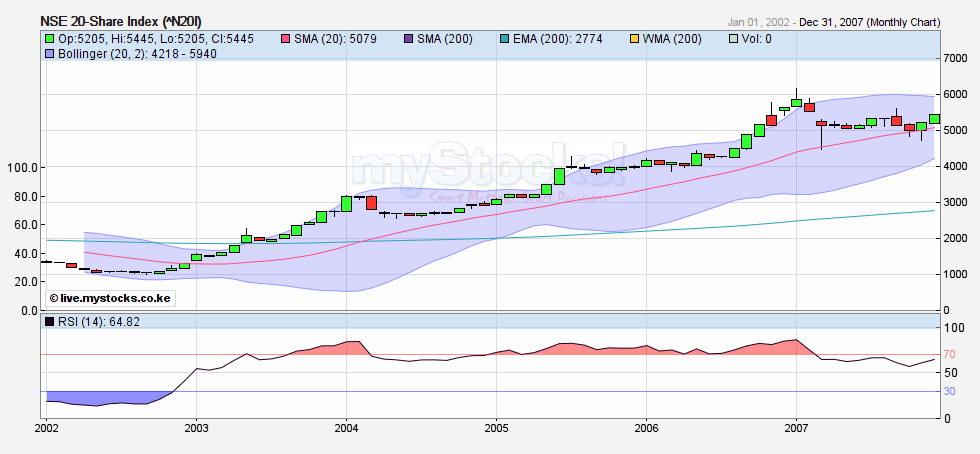

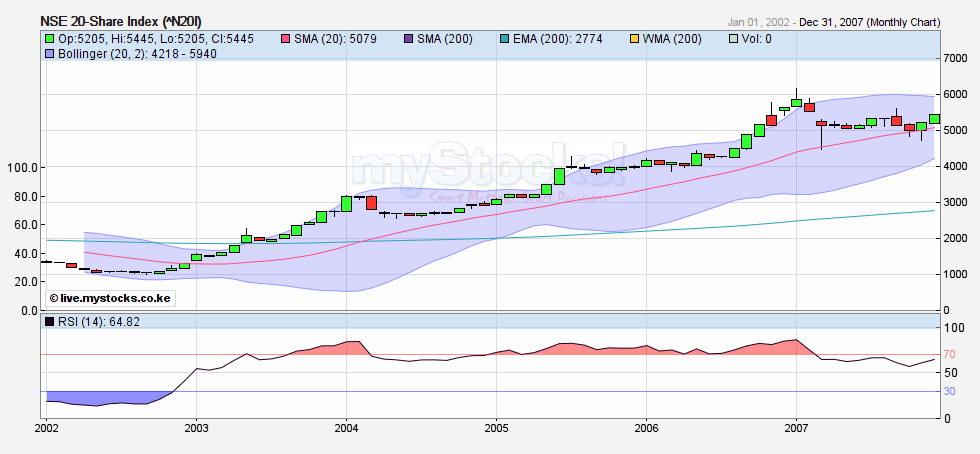

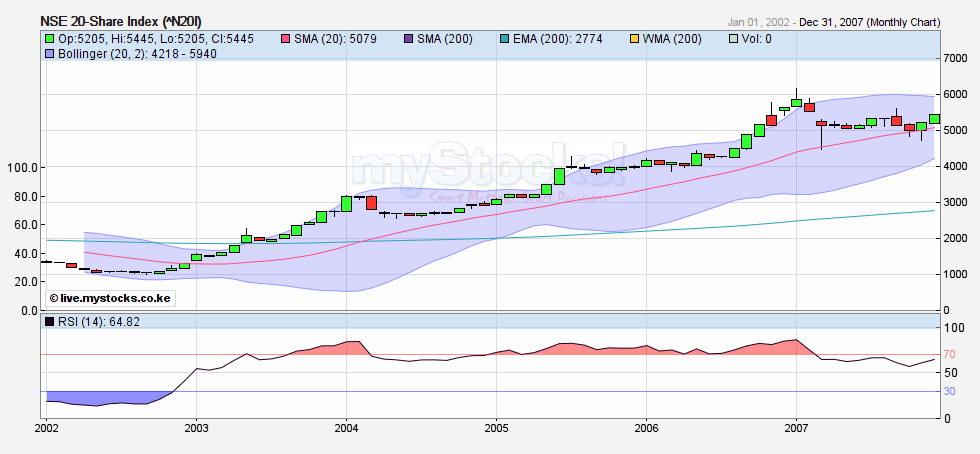

Emilio's 1st term in office.....  Took over power when NSE20 was at 1357. It closed 2007 at 5445. @SufficientlyP

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:September 2019 low of 2420 taken out. NSE20 prints 2410..... 50 points shy of March 2009 GFC low of 2360  Indeed. The GFC low is now the line in the sand. Supply was heavy for most of the big counters especially KCB. Only safcom looks likely to stabilize. After staging a decent recovery yesterday, Dow has dumped another 400 points at the open today...PPT and dip buyers are being bulldozed out of the way. If it closes today heavily in the red, that GFC low of 2360 on the NSE20 will be challenged tomorrow. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Extraterrestrial wrote:RENEWED BEAR. WE WILL BREAK 18 YEAR LOW AGAIN ON NSE20 IT SEEMS. THIS IS UNPRECEDENTED IN MODERN TIMES. 18 year low on the NSE20 is 1000 points in 2002. We are yet to break the 11 year GFC low of 2360 in 2009. Then there is the small matter of the September 2019 low of 2419.  The current driver aka CEO Kenya, seems hellbent on getting us here, although the current rout has nothing to do with him. Shall we forgive him in future when the history books are written? Could the Corona virus sweep Trump into the dustbin together with the Kenyan CEO? Only time will tell. I don't think NSE20 will tank as far as 1000 points but that would be a sight to behold. The sort of ridiculous prices that would print...penny stock flood gates. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Sufficiently Philanga....thropic wrote:Emilio's 1st term in office.....  Took over power when NSE20 was at 1357. It closed 2007 at 5445. The money we made in this Era, whah God bless Kibaki. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Member Joined: 6/1/2017 Posts: 288

|

Angelica _ann wrote:Sufficiently Philanga....thropic wrote:Emilio's 1st term in office.....  Took over power when NSE20 was at 1357. It closed 2007 at 5445. The money we made in this Era, whah God bless Kibaki. One can argue that Emilio benefited from the US housing bubble that played out in the early 2000s.The Greenspan Fed had lowered Fed funds rate to 1% expanding the dollar money supply that found itself into real estate and US stocks.It was "happy bubble" times in the West and considering Westerners constitute the majority of the investors in our bourse,they also came to scoop up our local shares in the feel good happy times.Global stock and real estate markets rose in tandem as the West easy money policies were fueling global rise in asset prices then in 2006 cracks started appearing in the US housing bubble and Western investors started pulling back from frontier markets like Kenya thus our indices stalled.Then as we all know 2008 happened and with the GFC global stock and real estate markets imploded and Westerners were forced to liquidate our stocks in droves to meet margin calls in their tumbling markets thus our NSE20 fell 50% just like the S&P 500. Then Western central banks went nuts with lowering rates to zero and engaging in massive QE money printing of several trillions of dollars re-inflating their stocks and thus their investors came back to Kenya and NSE20 rose in tandem. The period 2011-2012 saw the European sovereign debt crisis and the Westerners pulled back from our markets again thus our indices fell.Massive QE stimulus by Western central banks "saved" the European debt fiaso and the Caucasians came back to our market hence our equities rose. From 2015,the Fed signaled intention to raise rates and this strengthened the USD considerably and instilled confidence in the US thus global capital was once again attracted to the US dollar and US asset classes making the wazungus pull back from our bourse thus the decline during that period Late 2016 saw the Trump victory that promised tax cuts,reduced regulation and massive QE stimulus from the European and Japanese central banks and 2017 ushered a year of massive near parabolic gains in global markets which also pushed up our stock market.The peak in global market came in January 2018 but markets started to unravel in late January of 2018 as all the Western central banks money printing resulted in inflation fears creating a steep sell off in global markets.Its at this point that the US markets diverged with global markets that never recovered from their January 2018 highs which includes the NSE20.US markets continued to surge higher to all time highs while other global indices lagged as Fed rate hikes were sucking ever more global capital and Westerners felt it better to invest in the US and pulled back from our equity market Also now foreign investors are pulling out of our market to meet margin calls in their faltering markets due to coronavirus fears. Thus the Kenyan bourse is simply a reflection of global macro-economic and market trends and what happens in the developed world has a direct co-relation with the performance of our stock market. Contrarian Investor and Trader.Advocate of free markets,limited government interference in the economy and sound money

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,056 Location: Nairobi

|

xtina wrote:xtina wrote:lochaz-index wrote:xtina wrote:lochaz-index wrote:xtina wrote:I must admit I like seeing the green in banking stocks, feel like offloading a few and re-enter later coz I am not sure this green is gonna last long. Then I buy Centum, Unga and BAT. Is this wise? I do not know     . The past one year has been absolutely dreadful so it is good to see some positive change. Anyway, I have bitten the bullet and will sell a few, let me enjoy while it lasts since I am not sure we will see this green again, at least in the near future and early 2020. Ride the wave first then sell once the excitement is fizzling out towards the end of November. Nimetoka, wale wamebaki all the best and see you end of year/early 2020. That was a sweet journey and reward for being patient for the last one year. Kesho I am also offloading some Safaricom as it seems the results will be good It seems I did make good decision after all, offloaded 90% of my shares at peak price then and buy early 2020. Glad to see shares retracting and looking very attractive. Shida ni sina pesa   . Very good prices now 27th Feb: 1. Centum 25.55 2. Safcom 28.10 (but should really go lower) 3. Equity 48 4 KCB 46.5 (I can't believe it's even lower than Equity  but I won't buy KCB) 5. NCBA 35.00 6. I$M 50 7 BAT 490 (I hope it goes lower). I have to say that was an excellent call!  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,056 Location: Nairobi

|

Ericsson wrote:Norway’s sovereign wealth fund returns a record $180 billion thanks to a rally in stock markets They should bring some of that cash to Kenya! Just $10bn can make a huge difference! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,056 Location: Nairobi

|

Sufficiently Philanga....thropic wrote:September 2019 low of 2420 taken out. NSE20 prints 2410..... 50 points shy of March 2009 GFC low of 2360  The Lost Decade for the NSE. Without Safaricom, would we be looking at 2,000 or lower? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:September 2019 low of 2420 taken out. NSE20 prints 2410..... 50 points shy of March 2009 GFC low of 2360  Indeed. The GFC low is now the line in the sand. Supply was heavy for most of the big counters especially KCB. Only safcom looks likely to stabilize. After staging a decent recovery yesterday, Dow has dumped another 400 points at the open today...PPT and dip buyers are being bulldozed out of the way. If it closes today heavily in the red, that GFC low of 2360 on the NSE20 will be challenged tomorrow. Dow shed 1190 points by close of session! European markets also ended up heavily in the red. Will be very interesting to see whether the NSE20 holds on to the GFC low in light of the brutal sell-off. If the markets are pricing in a global recession for 2020 this will be very painful and steep downtrend. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

VituVingiSana wrote:Sufficiently Philanga....thropic wrote:September 2019 low of 2420 taken out. NSE20 prints 2410..... 50 points shy of March 2009 GFC low of 2360  The Lost Decade for the NSE. Without Safaricom, would we be looking at 2,000 or lower? Sure. That said, any meaningful correction on Safaricom (20%+) coupled with losses of more or less the same degree on other counters constituting would likely get the market to sub 2000. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 6/1/2017 Posts: 288

|

lochaz-index wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:September 2019 low of 2420 taken out. NSE20 prints 2410..... 50 points shy of March 2009 GFC low of 2360  Indeed. The GFC low is now the line in the sand. Supply was heavy for most of the big counters especially KCB. Only safcom looks likely to stabilize. After staging a decent recovery yesterday, Dow has dumped another 400 points at the open today...PPT and dip buyers are being bulldozed out of the way. If it closes today heavily in the red, that GFC low of 2360 on the NSE20 will be challenged tomorrow. Dow shed 1190 points by close of session! European markets also ended up heavily in the red. Will be very interesting to see whether the NSE20 holds on to the GFC low in light of the brutal sell-off. If the markets are pricing in a global recession for 2020 this will be very painful and steep downtrend. Yes,the Dow records its greatest one day point drop in history.Interesting price action today.S&P had its 200 SMA at 3050 and when the index hit this critical technical level,the Plunge Protection Team (PPT) pulled all the stops with new Fed repo liquidity and tried to buy back the market which almost went positive but it was a bull trap as the markets seriously flashed out and algos just went nuts and sold in huge volumes in the last 3 hours of trading.Bond yields hit a historical low yesterday. Now the Fed is under IMMENSE PRESSURE to cut rates and pump even more liquidity.Trump bullying the Fed to pump even more money but unlike prior market corrections caused by financial distress that was "resolved" by more money printing,the coronavirus is a black swan that cannot be mitigated by money printing.The only hope for this bubble market is that a vaccine or antivirus drug is found or as scientists hope the summer months in the Northern Hemisphere may subdue the virus. For those of us shorting this market its serious $$$$$$    everyday Contrarian Investor and Trader.Advocate of free markets,limited government interference in the economy and sound money

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,639 Location: NAIROBI

|

Angelica _ann wrote:Sufficiently Philanga....thropic wrote:Emilio's 1st term in office.....  Took over power when NSE20 was at 1357. It closed 2007 at 5445. The money we made in this Era, whah God bless Kibaki. It was superb, you buy a share today and in less than 2 years money has doubled. Those days we were comparing real estate prices vs stock price appreciation Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,056 Location: Nairobi

|

Ericsson wrote:Angelica _ann wrote:Sufficiently Philanga....thropic wrote:Emilio's 1st term in office.....  Took over power when NSE20 was at 1357. It closed 2007 at 5445. The money we made in this Era, whah God bless Kibaki. It was superb, you buy a share today and in less than 2 years money has doubled. Those days we were comparing real estate prices vs stock price appreciation Both have tanked under Tano Tena! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Another heavy down day for the Dow. It has shed 1900 points in two days. Heavy PPT action at the open which was quickly overwhelmed by sellers. 10 yr UST touched a record low which doesn't portend well for the global economy in 2020. In view of the fact that trade fell in 2019 first time since 2009, could be pricing in recessions in most countries. What a rout!!!6% shave. Seems the PPT ran out of cash along the way  Dow futures have shed an extra 500 points so far. Extremely oversold territory. Presidential jawboning, the likelihood of a 75 bps cut, subsequent DXY weakness, Fed's repo action, promise of fiscal stimulus haven't stopped or slowed down this knife fall. Euro of all currencies has been on a monster rally for the past few days in most crosses. Asia showing signs of recovery after getting battered for two weeks. The whipsaw action is unreal. Will be fading my US shorts and turn my focus to Europe for the coming week. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Another heavy down day for the Dow. It has shed 1900 points in two days. Heavy PPT action at the open which was quickly overwhelmed by sellers. 10 yr UST touched a record low which doesn't portend well for the global economy in 2020. In view of the fact that trade fell in 2019 first time since 2009, could be pricing in recessions in most countries. What a rout!!!6% shave. Seems the PPT ran out of cash along the way  Dow futures have shed an extra 500 points so far. Extremely oversold territory. Presidential jawboning, the likelihood of a 75 bps cut, subsequent DXY weakness, Fed's repo action, promise of fiscal stimulus haven't stopped or slowed down this knife fall. Euro of all currencies has been on a monster rally for the past few days in most crosses. Asia showing signs of recovery after getting battered for two weeks. The whipsaw action is unreal. Will be fading my US shorts and turn my focus to Europe for the coming week. Tonnes of cash made here by those who went in early for the shorts! @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

As we watch our gains being swept away....well....those on the Longs.....how about some spiritual encouragement from The Old Rock... Hebrews 12:27: "This expression, Yet once more," denotes the removing of those things which can be shaken, as of created things, so that those things which cannot be shaken may remain." Lots of shaking going on ATM ... where is YOUR foundation ??? @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

We are waiting for The Donald to wake up.....in store for us, after that huge 4 digit figure sell off on the Dow.......is a plethora of Tweets..This should keep us going through the fire. Closer home, today, we slide below 2360 at the NSE20  .........in the absence of any positive news on the Corona virus. @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,218 Location: Sundowner,Amboseli

|

Sufficiently Philanga....thropic wrote:Very interesting discussion going on here.

Other factors held constant(coronavirus impact and the US elections), the get out of jail meal will be served from early next month when Banks start reporting FY19.

Safcom, the bellwether stock has hit a dead end for now at the 33 levels, twice in a month, while member and simba have faced strong headwinds at the 55 level.

On the international scene, the 2020 US elections shall see the mother of all battles, battle royale, with china fielding its candidate, Mike Bloomberg to face off with Russia's 2016 candidate Donald Trump.

Remember the Dems played the Stock Market card in 2008 to get into power. Will they use Mike this time? Let's see how the Dow performs as we head into the elections.

The dollar has been gaining vs other currencies in the wake of this coranavirus threat and this, coupled with our weak economy saddled with huge debts and a possible referendum around the corner will have an adverse effect on the NSE.

Investor should consider selective entry in the many dips that will show up this year at the NSE.

This was Feb 21st. The Dow had closed at 29219 the day before. Didn't think it would be the last day post 29000 for the Dow  @SufficientlyP

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:lochaz-index wrote:Another heavy down day for the Dow. It has shed 1900 points in two days. Heavy PPT action at the open which was quickly overwhelmed by sellers. 10 yr UST touched a record low which doesn't portend well for the global economy in 2020. In view of the fact that trade fell in 2019 first time since 2009, could be pricing in recessions in most countries. What a rout!!!6% shave. Seems the PPT ran out of cash along the way  Dow futures have shed an extra 500 points so far. Extremely oversold territory. Presidential jawboning, the likelihood of a 75 bps cut, subsequent DXY weakness, Fed's repo action, promise of fiscal stimulus haven't stopped or slowed down this knife fall. Euro of all currencies has been on a monster rally for the past few days in most crosses. Asia showing signs of recovery after getting battered for two weeks. The whipsaw action is unreal. Will be fading my US shorts and turn my focus to Europe for the coming week. Tonnes of cash made here by those who went in early for the shorts! I thought this would be a constructive correction over several weeks/months. It turned out to be a crashing freight train. After the epic short squeeze on Tesla and the market in general this sell-off is most certainly welcome relief for short sellers. The weekly crash of circa 4000 points is the steepest since GFC. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|