Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 9/15/2006 Posts: 3,905

|

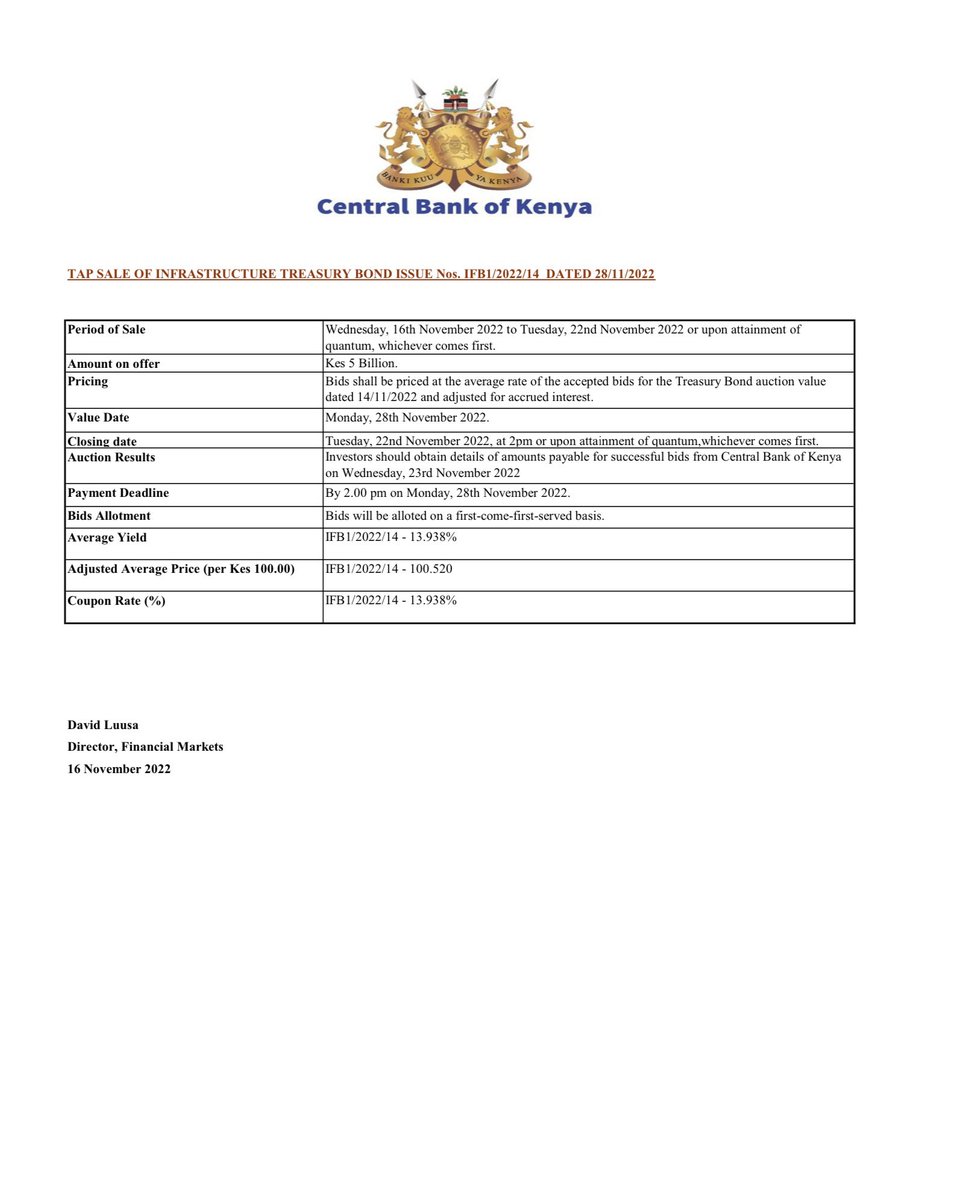

Talk is cheap; the cost of money is real. Tap Sale is here at 13.938%.

|

|

|

Rank: New-farer Joined: 4/4/2011 Posts: 94 Location: Nairobi

|

muganda wrote:Talk is cheap; the cost of money is real. Tap Sale is here at 13.938%.  Government looking for another 5B! I thought CBK accepted the last IFB1 2022/14 Bond by an additional over 15B? Looks like the thirst is real...

|

|

|

Rank: New-farer Joined: 4/4/2011 Posts: 94 Location: Nairobi

|

mchawi wrote:muganda wrote:Talk is cheap; the cost of money is real. Tap Sale is here at 13.938%.  Government looking for another 5B! I thought CBK accepted the last IFB1 2022/14 Bond by an additional over 15B? Looks like the thirst is real... CBK accepted 19B! Also seeking to roll over another 87.8B of T-Bills and FXD Bonds as a 6-year Infrastructure Bond. What could this imply?

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,059

|

mchawi wrote:mchawi wrote:muganda wrote:Talk is cheap; the cost of money is real. Tap Sale is here at 13.938%.  Government looking for another 5B! I thought CBK accepted the last IFB1 2022/14 Bond by an additional over 15B? Looks like the thirst is real... CBK accepted 19B! Also seeking to roll over another 87.8B of T-Bills and FXD Bonds as a 6-year Infrastructure Bond. What could this imply? What else other than the GoK is broke! Get ready for massive tax hikes.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Anyone so far? Yesterday was 12th, a public holiday. Waiting! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

It came,thanks mates! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Member Joined: 11/17/2009 Posts: 397 Location: Where everyone knows you

|

Impunity wrote:It came,thanks mates! What came???

|

|

|

Rank: Member Joined: 6/26/2008 Posts: 384

|

MatataMingi wrote:Impunity wrote:It came,thanks mates! What came???  Probably a coupon payment

|

|

|

Rank: Member Joined: 11/17/2009 Posts: 397 Location: Where everyone knows you

|

|

|

|

Rank: Member Joined: 1/15/2015 Posts: 681 Location: Kenya

|

What is the chance of government restructuring domestic debt at the moment guys? I see interest of domestic papers is almost 3/4 yet debt itself is less than half. Also noted that Ghana was in the same situation and has begun restructuring domestic debt..... ...then sometime last year we almost defaulted on a due Chinese loan interest 0payment?

60% Learning, 30% synthesizing, 10% Debating

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Thitifini wrote:What is the chance of government restructuring domestic debt at the moment guys?

I see interest of domestic papers is almost 3/4 yet debt itself is less than half. Also noted that Ghana was in the same situation and has begun restructuring domestic debt.....

...then sometime last year we almost defaulted on a due Chinese loan interest 0payment? GOK has been beseeching TB holders to convert to longer term Bonds Life is short. Live passionately.

|

|

|

Rank: Member Joined: 1/15/2015 Posts: 681 Location: Kenya

|

sparkly wrote:Thitifini wrote:What is the chance of government restructuring domestic debt at the moment guys?

I see interest of domestic papers is almost 3/4 yet debt itself is less than half. Also noted that Ghana was in the same situation and has begun restructuring domestic debt.....

...then sometime last year we almost defaulted on a due Chinese loan interest 0payment? GOK has been beseeching TB holders to convert to longer term Bonds Conversion of debt to long term is not a big problem for me. Restructuring debt is what I'm worried about. Imagine holding a bond of 12% then the government doesn't pay up or reduces the interest on rolled over interest to zero!

60% Learning, 30% synthesizing, 10% Debating

|

|

|

Rank: Member Joined: 11/17/2009 Posts: 397 Location: Where everyone knows you

|

I don't think that the Government can refuse to pay, or reduce interest on rolled over bids to zero.

Too many funds and banks are holding investments.

They could, I suppose not redeem the investments on the due dates, and keep paying the coupon.

Or they could, as they recently did, offer attractive switch bonds for upcoming redemptions.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,068 Location: Nairobi

|

MatataMingi wrote:I don't think that the Government can refuse to pay, or reduce interest on rolled over bids to zero.

Too many funds and banks are holding investments.

They could, I suppose not redeem the investments on the due dates, and keep paying the coupon.

Or they could, as they recently did, offer attractive switch bonds for upcoming redemptions. Ghana Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 834 Location: nairobi

|

MatataMingi wrote:I don't think that the Government can refuse to pay, or reduce interest on rolled over bids to zero.

Too many funds and banks are holding investments.

They could, I suppose not redeem the investments on the due dates, and keep paying the coupon.

Or they could, as they recently did, offer attractive switch bonds for upcoming redemptions. Unless things change, the path we are on as a country will most likely lead us to Ghana situation. I saw that even Counties have not been receiving funds

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,650 Location: NAIROBI

|

heri wrote:MatataMingi wrote:I don't think that the Government can refuse to pay, or reduce interest on rolled over bids to zero.

Too many funds and banks are holding investments.

They could, I suppose not redeem the investments on the due dates, and keep paying the coupon.

Or they could, as they recently did, offer attractive switch bonds for upcoming redemptions. Unless things change, the path we are on as a country will most likely lead us to Ghana situation. I saw that even Counties have not been receiving funds Start with Sri Lanka before heading to Ghana Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

The recent Tap Sale for IFB1/2023/17 attracted kshs12B only from the 20B on offer signalling tight liquidity in the market given that the coupon rate was quite attractive at 14.399% p.a.

|

|

|

Rank: Member Joined: 8/25/2015 Posts: 839 Location: Kite

|

Anyone received bond payment this week?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 13,478 Location: nairobi

|

Taurrus wrote:Anyone received bond payment this week? Following this post closely

HF 30,000 ABP 3.49; KQ 414,100 ABP 7.92; MTN 23,800 ABP 6.45

|

|

|

Rank: Member Joined: 8/25/2015 Posts: 839 Location: Kite

|

obiero wrote:Taurrus wrote:Anyone received bond payment this week? Following this post closely Imefika. Walituzoesha vibaya!

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|