Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Liv wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can.

I thought you said you expect the bear to continue even after the elections.... Now you are advising people to buy stocks now and continue accumulating? What has changed? I still do, I think the bear has at the very least another year baked in it. That however is not a reason not to buy...the only difference is one's risk appetite. Right now, stocks are the ugly ducklings of the investing world in KE when juxtaposed with real estate or bonds. For the long game, you buy (at rock bottom prices) when no one is interested in stocks and sit tight...when everyone else comes rushing in you sell to them. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 10/26/2015 Posts: 151

|

maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... possunt quia posse videntur

|

|

|

Rank: Member Joined: 12/21/2009 Posts: 602

|

maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge...

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Dahatre wrote:maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge... working on that makes a lot of sense with this depressed prices...btw CBA offers a facility on bonds...up to a max of 80% of holdings...72month payment period. possunt quia posse videntur

|

|

|

Rank: Member Joined: 12/21/2009 Posts: 602

|

maka wrote:Dahatre wrote:maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge... working on that makes a lot of sense with this depressed prices...btw CBA offers a facility on bonds...up to a max of 80% of holdings...72month payment period. More details on the CBA deal please?

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,569

|

MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit I would be careful about owning public assets when sovereign debt bubble starts deflating you will notice you were swimming naked. Already shareholders in public equities KQ, Uchum, NBK, Kenya Power, Kengen having the consequences. Public sector is usually the last to get hit in recessions. Hedge with private assets

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Dahatre wrote:maka wrote:Dahatre wrote:maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge... working on that makes a lot of sense with this depressed prices...btw CBA offers a facility on bonds...up to a max of 80% of holdings...72month payment period. More details on the CBA deal please? Whats your email I forward it to you.... possunt quia posse videntur

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. My point is how many have the patience to hold out till maturity? Funds are scarce and most would hold the bonds for trade.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Dahatre wrote:maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge... Equity is high return but verrrry risky. Imagine if you edged KQ and Mumias shares in 2002 for a 30 year window viz someone who bought IFB at 15% at the time. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

maka wrote:Dahatre wrote:maka wrote:Dahatre wrote:maka wrote:MadDoc wrote:maka wrote:hisah wrote:maka wrote:lochaz-index wrote:hisah wrote:Angelica _ann wrote:Ericsson wrote:maka wrote:https://www.centralbank.go.ke/uploads/treasury_bonds_prospectuses/1995993595_March%202017%20-%20TREASURY%20BOND%20PROSPECTUS.pdf Under subscription very fast That Interest rate is more like testing the waters  Some dividend yields are almost paying similar rates!!!

The headlines are now spotting that fund managers have moved into the treasuries market as equities are RIP. Do you know what happens when a trade/market becomes crowded...?

Stick with the hated equities... There is a lot of interest from newbies in the Tbill/bond market too. Another stock rout will kill all bulls and send them scampering to Tbills/bonds then the NSE20 bottoms out and the crowd is trapped in govt paper. Buying stocks now affords you a nice window where you won't chase prices and you are able to accumulate as much as you possibly can. Isnt getting trapped based on your investment strategy? If I can comfortably hold a 15-20 or 30 year bond I guess one is fine... A fund can hold out for that long, but not wanjiku! Boss I hold...1.11.20...1.12.20...1.11.30...good amounts.I am holding them till maturity. If you're getting a return of >13% on an IB, doesn't that qualify as a sound investment? But let's see how he responds to your Wanjiku bit Personally it is...its obvious in the long run equities outperform bonds but you have to have your eye on the market at all times (on equities i.e)... If I had @Maka's money I would use my bond proceeds to buy equities as a hedge... working on that makes a lot of sense with this depressed prices...btw CBA offers a facility on bonds...up to a max of 80% of holdings...72month payment period. More details on the CBA deal please? Whats your email I forward it to you.... 2008impunity (at) gmail(dot)com Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

M-Akiba to be launched tommorrow. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Gatheuzi wrote:M-Akiba to be launched tommorrow.

Its a good thing hope it works...Imagine in 3 years you will be up 30%. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

Can someone explain about what happens should the T-Bill/Bond investor die before maturity of the investment?

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Chaka wrote:Can someone explain about what happens should the T-Bill/Bond investor die before maturity of the investment? Next of kin takes over. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

Ok,the problem is that I saw a bond application form which only requires the name of next of kin,no contact details required?Would be tricky should the next of kin not even be aware about the investment. Spikes wrote:Chaka wrote:Can someone explain about what happens should the T-Bill/Bond investor die before maturity of the investment? Next of kin takes over.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Spikes wrote:Chaka wrote:Can someone explain about what happens should the T-Bill/Bond investor die before maturity of the investment? Next of kin takes over. If you hide the details from spouse/next of kin, then they are taken to unclaimed items after some period ..... i think 3 years for the Gava (read Jubilee) to use in 'developing' the economy on your behalf to better the life/lives of your next of kin. You know where your money will go!!!! In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 1,996 Location: Kitale

|

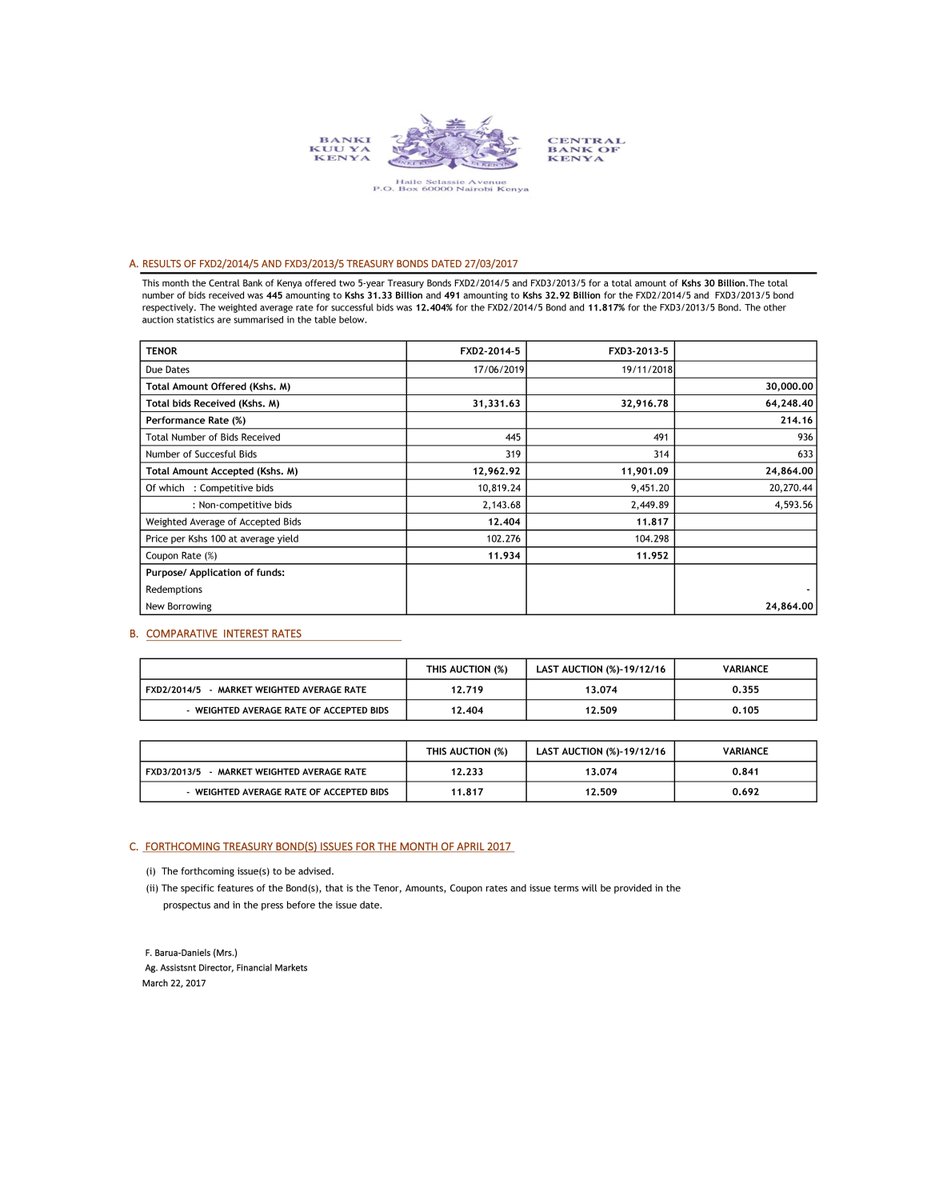

anyone with insider knowledge to post today t.bond auction results? Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Ebenyo wrote:anyone with insider knowledge to post today t.bond auction results?  Pesa Nane plans to be shilingi when he grows up.

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|