Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Pesa Nane wrote:Impunity wrote:Pesa Nane wrote:Impunity wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. But CBK is so analogue, I need to go there to apply, they dont have anything online!  You don't need to go anywhere to apply. Download the form, fill and send back electronically. Email, that is. Special email address iko wapi? Apart form the general one on the site. Or we use the general one? comms@centralbank.go.ke Send to National Debt Office @ NDO@centralbank.go.ke Quote:Delivery has failed to these recipients or groups:

Your message can't be delivered because delivery to this address is restricted.    Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Impunity wrote:Pesa Nane wrote:Impunity wrote:Pesa Nane wrote:Impunity wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. But CBK is so analogue, I need to go there to apply, they dont have anything online!  You don't need to go anywhere to apply. Download the form, fill and send back electronically. Email, that is. Special email address iko wapi? Apart form the general one on the site. Or we use the general one? comms@centralbank.go.ke Send to National Debt Office @ NDO@centralbank.go.ke Quote:Delivery has failed to these recipients or groups:

Your message can't be delivered because delivery to this address is restricted.    You should know people  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Angelica _ann wrote:Impunity wrote:Pesa Nane wrote:Impunity wrote:Pesa Nane wrote:Impunity wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. But CBK is so analogue, I need to go there to apply, they dont have anything online!  You don't need to go anywhere to apply. Download the form, fill and send back electronically. Email, that is. Special email address iko wapi? Apart form the general one on the site. Or we use the general one? comms@centralbank.go.ke Send to National Debt Office @ NDO@centralbank.go.ke Quote:Delivery has failed to these recipients or groups:

Your message can't be delivered because delivery to this address is restricted.    You should know people  @maka, which is the correct email address?  Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

Impunity wrote:Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  @liv, yes my perspective as an active market participant...at no point did 12.8 trade on IFB11,if it did show me the NSE price list on that day, and if so it only adds credence to my argument, because today the same paper is trading at 13.05% ... Yes 30b was taken but total bids were 35b so why do a tap for 10b? in the week when KTDA is paying tea bonuses? heloooo!!! @impunity, you will be getting 13.177% how? is that perhaps the coupon on this paper? I thought the coupon was 12%? how do you quantify your profit on a bond? is it on capital gains or interest?

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  My understanding of a bond issue is that either it has a coupon rate or it doesn't(zero coupon) in which case it will then be sold at a lower price than the par value.In this issue is seems both of these are applying?What's the explanation? http://www.investingansw.../bonds/coupon-rate-1323

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

My understanding of a bond issue is that either it has a coupon rate or it doesn't(zero coupon) in which case it will then be sold at a lower price than the par value.In this issue is seems both of these are applying?What's the explanation? http://www.investingansw.../bonds/coupon-rate-1323

maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

kizee1 wrote:Impunity wrote:Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  @liv, yes my perspective as an active market participant...at no point did 12.8 trade on IFB11,if it did show me the NSE price list on that day, and if so it only adds credence to my argument, because today the same paper is trading at 13.05% ... Yes 30b was taken but total bids were 35b so why do a tap for 10b? in the week when KTDA is paying tea bonuses? heloooo!!! @impunity, you will be getting 13.177% how? is that perhaps the coupon on this paper? I thought the coupon was 12%? how do you quantify your profit on a bond? is it on capital gains or interest?

@Kizee1, why should this forum or the CBK consider your perspectives... you don't seem to even understand how the bond yield is computed.... you should be the one explaining to @Impunity how the yield came to 13.177% with a 12% coupon rate.

Can you please check the trades done last Monday in the business daily on tuesday this week

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

kizee1 wrote:Impunity wrote:Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

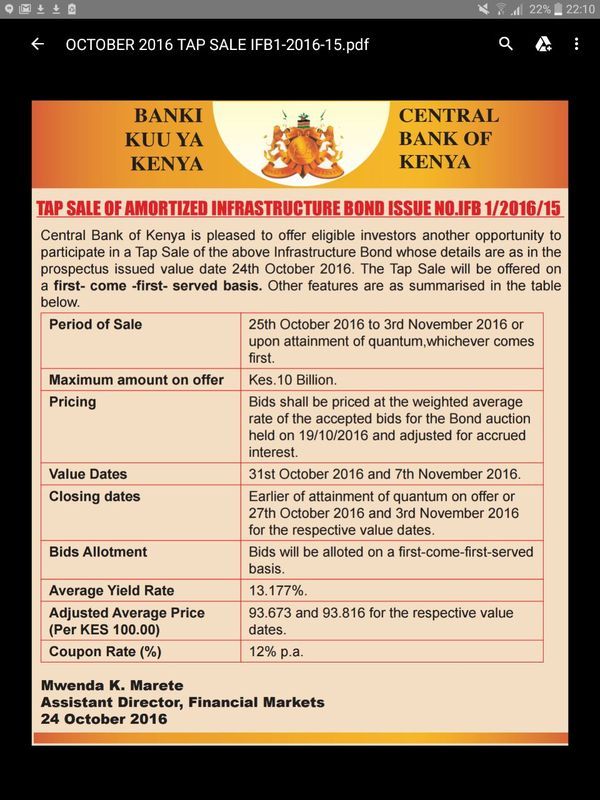

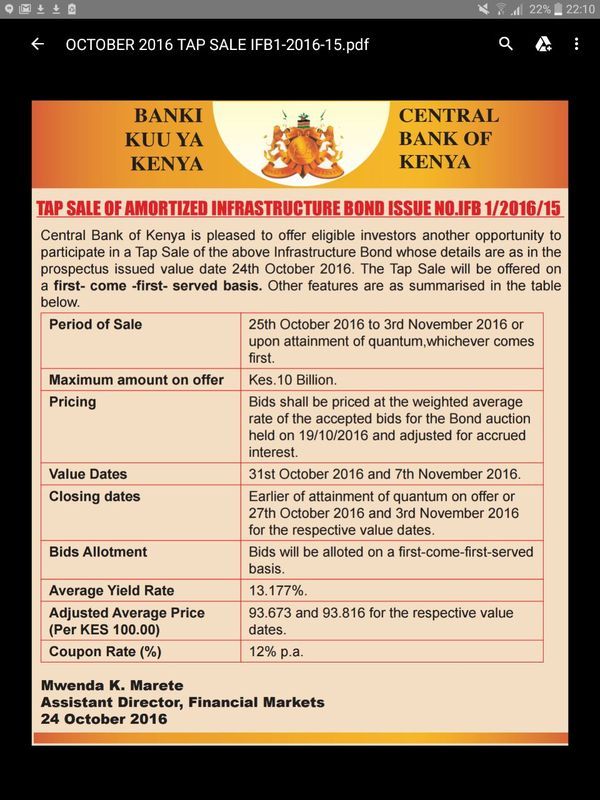

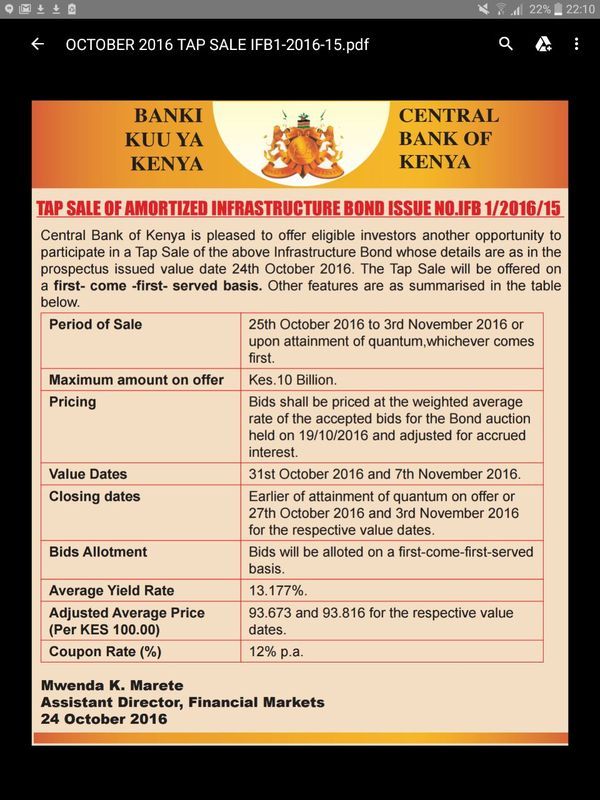

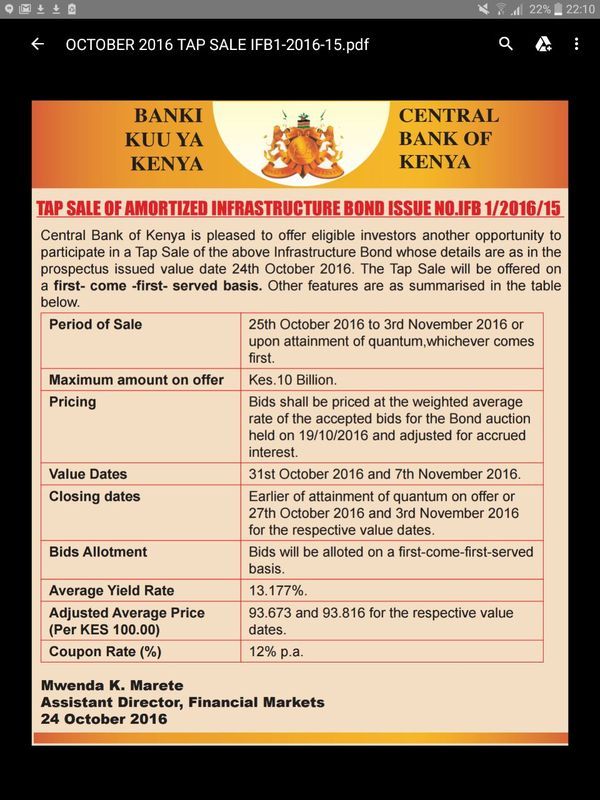

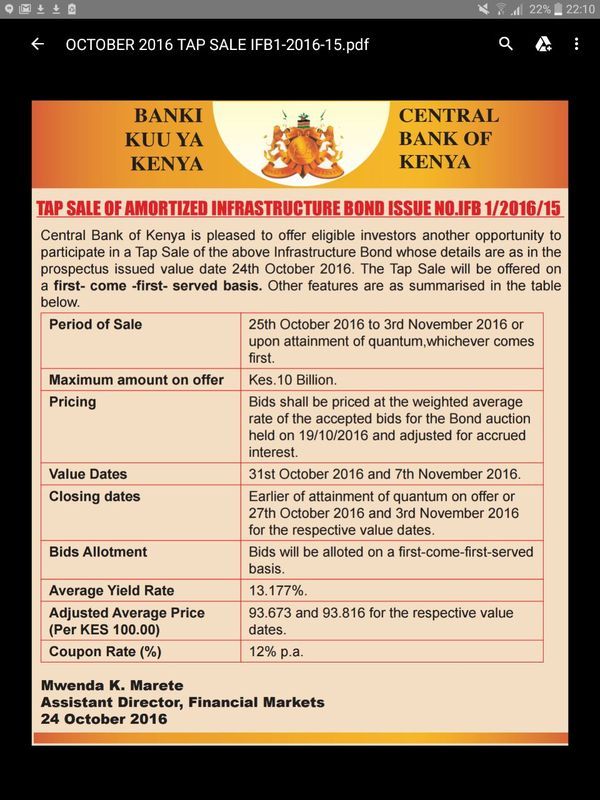

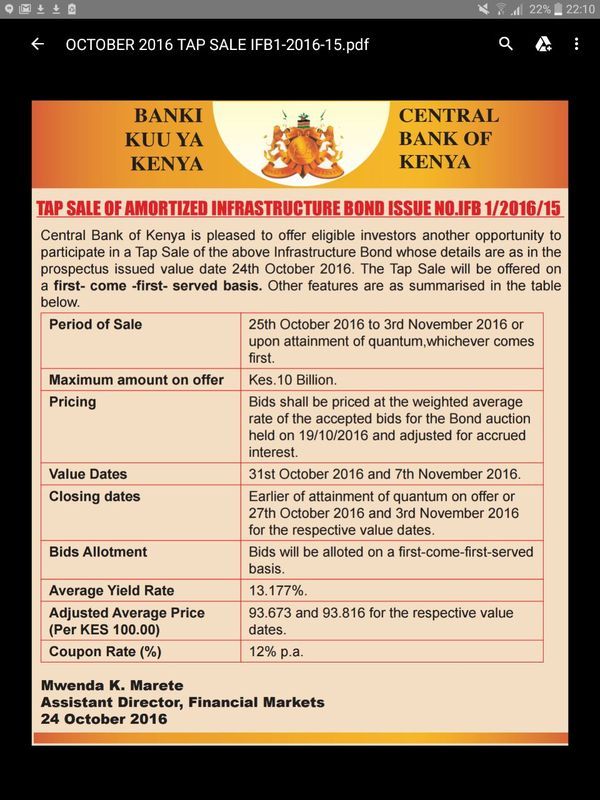

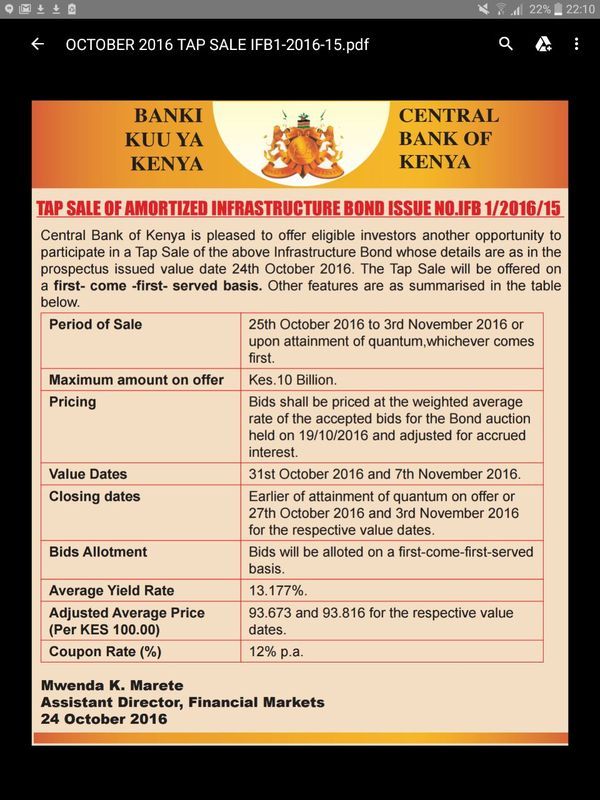

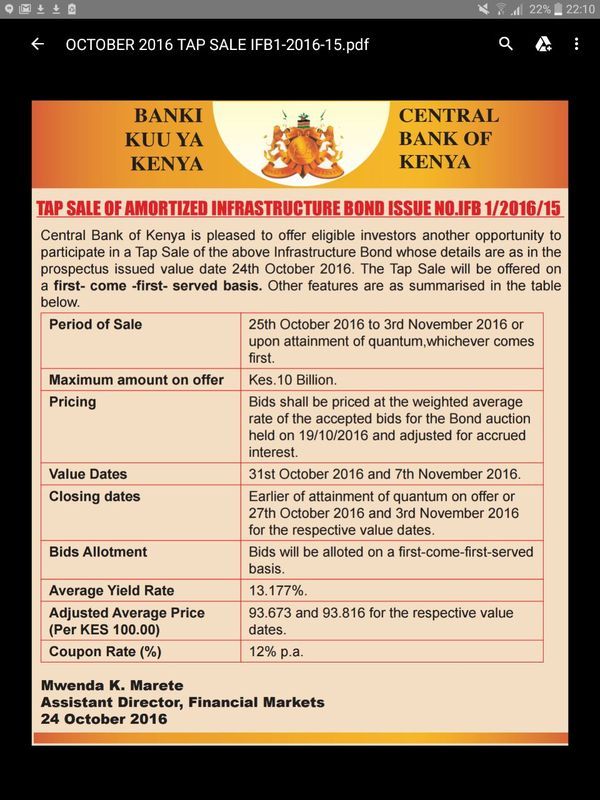

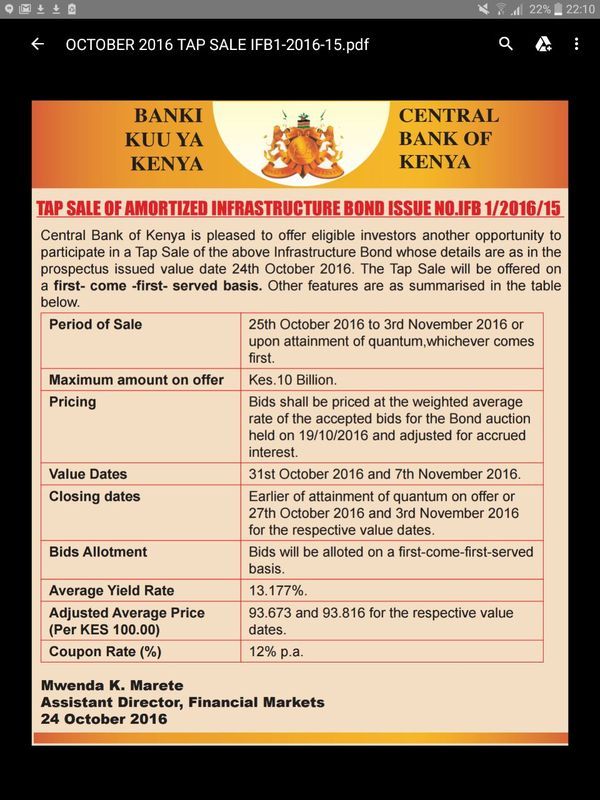

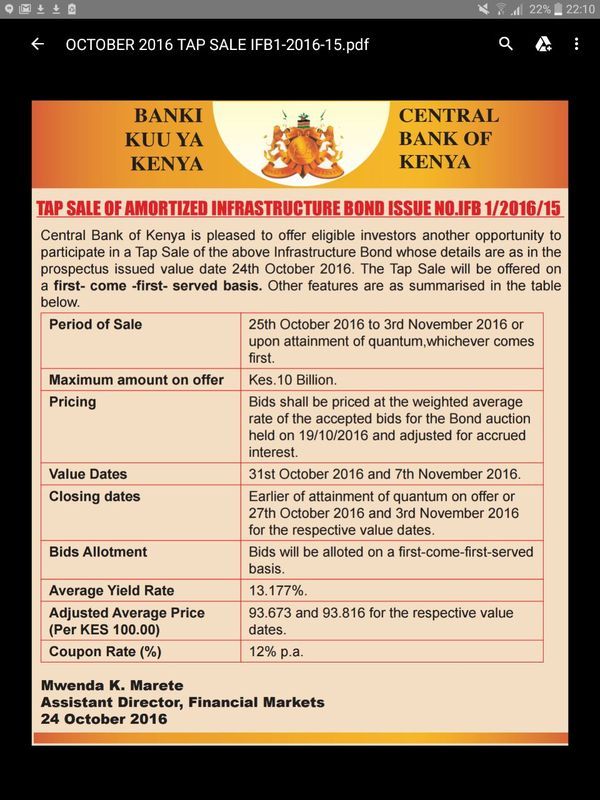

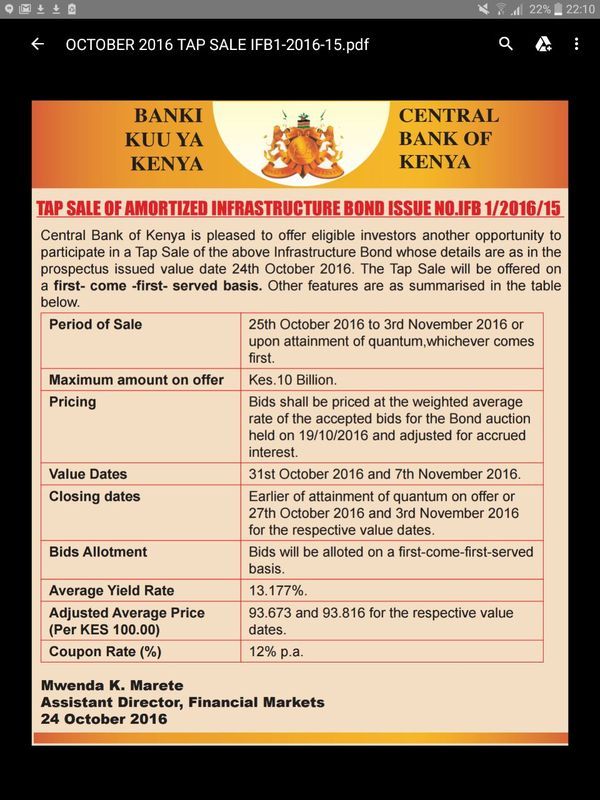

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  @liv, yes my perspective as an active market participant...at no point did 12.8 trade on IFB11,if it did show me the NSE price list on that day, and if so it only adds credence to my argument, because today the same paper is trading at 13.05% ... Yes 30b was taken but total bids were 35b so why do a tap for 10b? in the week when KTDA is paying tea bonuses? heloooo!!! @impunity, you will be getting 13.177% how? is that perhaps the coupon on this paper? I thought the coupon was 12%? how do you quantify your profit on a bond? is it on capital gains or interest? Soma this prospectus and some other post earlier on, a page or two earlier. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

Liv wrote:kizee1 wrote:Impunity wrote:Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  @liv, yes my perspective as an active market participant...at no point did 12.8 trade on IFB11,if it did show me the NSE price list on that day, and if so it only adds credence to my argument, because today the same paper is trading at 13.05% ... Yes 30b was taken but total bids were 35b so why do a tap for 10b? in the week when KTDA is paying tea bonuses? heloooo!!! @impunity, you will be getting 13.177% how? is that perhaps the coupon on this paper? I thought the coupon was 12%? how do you quantify your profit on a bond? is it on capital gains or interest?

@Kizee1, why should this forum or the CBK consider your perspectives... you don't seem to even understand how the bond yield is computed.... you should be the one explaining to @Impunity how the yield came to 13.177% with a 12% coupon rate.

Can you please check the trades done last Monday in the business daily on tuesday this week is it you who wants the explanation or impunity? in any case, the yield is computed as the weighted average of the auction preceding the tap sale, the coupon is fixed(at announcement of the sale, in the prospectus) as opposed to instances when it is market determined..I don't read the business daily but get the NSE daily price list, 12.8 DID NOT TRADE

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

|

|

|

Rank: Member Joined: 9/11/2014 Posts: 228 Location: Nairobi

|

Thanks @P8. Wont these addresses attract spammers tho?

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

iris wrote:Thanks @P8. Wont these addresses attract spammers tho? Positive contribution to enhanced security and systems integrity! Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Now I have missed the deadline for the Value date 3rd Nov. I will now just hope to get the next value date of 7th Nov. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,901

|

Pesa Nane wrote:iris wrote:Thanks @P8. Wont these addresses attract spammers tho? Positive contribution to enhanced security and systems integrity!    In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,325 Location: Masada

|

Impunity wrote:Now I have missed the deadline for the Value date 3rd Nov. I will now just hope to get the next value date of 7th Nov. @Wow! Just checked my email and saw my successful bid. Kumbe CBK can act this fast!    Thank u wazua. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

kizee1 wrote:Liv wrote:kizee1 wrote:Impunity wrote:Liv wrote:kizee1 wrote:Liv wrote:Impunity wrote:maka wrote:Impunity wrote:@when do they close shop for accepting bids for this tap issuance?  Sasa hii first come first served ndio nini sasa? Can they wait till Monday next week? Ama matenderprenuers will take the offer by then?

This is just 10 billion.... One bank or a major foreign investor can just grab it all at once and the tap sale closes. So make haste if you are interested.

The funds are supposed to be transferred to CBK by either Monday 31 Oct or by 7th Nov. so you can apply now and once you get allocation you can plan to send the funds as required. You don't send the funds when you are applying. just 10billion? at the main auction they took 35bn, there's now 45bn of this paper circulating, it was trading at 13.05 before the tap, the tap has now pushed market up to 13.20! that's a 15point jump on a 15yr paper! the market is now in a state of flux awaiting this tap to close, the move was extremely ill advised! Haha.... In whose perspective was the tap sale extremely ill advised? Yours? Tap sale was good for investors who missed in the auction and also good for government in raising more funds. I don't see how it can be extremely ill advised.

Where did you get 13.05? The trades I saw before the tap sale was announced were spread between 12.8 and 13.3 ..... Are you using the average of circa 13.05 to rant here?

And by the way the main auction took 30b and not 35b.... Get your facts right.

Menwhile as he rants nonsense, us will be getting heavy cheques every 6 months for 15 years...while doing nothing really,...13.177% NET Profit for one and half decade.  @liv, yes my perspective as an active market participant...at no point did 12.8 trade on IFB11,if it did show me the NSE price list on that day, and if so it only adds credence to my argument, because today the same paper is trading at 13.05% ... Yes 30b was taken but total bids were 35b so why do a tap for 10b? in the week when KTDA is paying tea bonuses? heloooo!!! @impunity, you will be getting 13.177% how? is that perhaps the coupon on this paper? I thought the coupon was 12%? how do you quantify your profit on a bond? is it on capital gains or interest?

@Kizee1, why should this forum or the CBK consider your perspectives... you don't seem to even understand how the bond yield is computed.... you should be the one explaining to @Impunity how the yield came to 13.177% with a 12% coupon rate.

Can you please check the trades done last Monday in the business daily on tuesday this week is it you who wants the explanation or impunity? in any case, the yield is computed as the weighted average of the auction preceding the tap sale, the coupon is fixed(at announcement of the sale, in the prospectus) as opposed to instances when it is market determined..I don't read the business daily but get the NSE daily price list, 12.8 DID NOT TRADE @kizee1, On Tuesday there were 9 deals on this IFB.... One of them for Kes 150 million had a traded yield of 12.8%. Please have a look at the trades that happened last Tuesday. On Wednesday there was a deal for Kes 100 million and a traded yield of 12.9%. If you were unable to see these then I don't know where you are checking as these were published by NSE and later by the Business daily newspaper.

I will explain the 13.177% yield on this bond in a different post.....and why those who bought it are getting a return of 13.177% and not 12% coupon rate.

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

What is the real return of IFB/1/2016/15 bond?

If you bought Shs 100 face value of this bond, you bought it at a discount of Shs 6.471 and therefore you paid Shs 93.529

In the first 6 months which is equivalent to 182 days, you will be paid Shs 5.983 as interest, computed (100x12%x182/365)

If you were to reinvest Shs 5.983 at the same rate 12% for another 6 months, you would earn interest income of Shs 6.341, computed (105.983x12%x182/365) .

Total interest earned in 12 months is 5.983+6.341 = 12.324

Actual funds invested = 93.529

Return = 12.324/93.529 = 13.177%

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

Liv wrote:What is the real return of IFB/1/2016/15 bond?

If you bought Shs 100 face value of this bond, you bought it at a discount of Shs 6.471 and therefore you paid Shs 93.529

In the first 6 months which is equivalent to 182 days, you will be paid Shs 5.983 as interest, computed (100x12%x182/365)

If you were to reinvest Shs 5.983 at the same rate 12% for another 6 months, you would earn interest income of Shs 6.341, computed (105.983x12%x182/365) .

Total interest earned in 12 months is 5.983+6.341 = 12.324

Actual funds invested = 93.529

Return = 12.324/93.529 = 13.177%

I thought there is a payment schedule for the interest after every six months?i,e the issue of re-investing the Shs 5.983 is not there because you have to redeem it?

|

|

|

Rank: Member Joined: 10/26/2015 Posts: 151

|

Liv wrote:What is the real return of IFB/1/2016/15 bond?

If you bought Shs 100 face value of this bond, you bought it at a discount of Shs 6.471 and therefore you paid Shs 93.529

In the first 6 months which is equivalent to 182 days, you will be paid Shs 5.983 as interest, computed (100x12%x182/365)

If you were to reinvest Shs 5.983 at the same rate 12% for another 6 months, you would earn interest income of Shs 6.341, computed (105.983x12%x182/365) .

Total interest earned in 12 months is 5.983+6.341 = 12.324

Actual funds invested = 93.529

Return = 12.324/93.529 = 13.177%

Highly appreciate the explanation

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|