Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

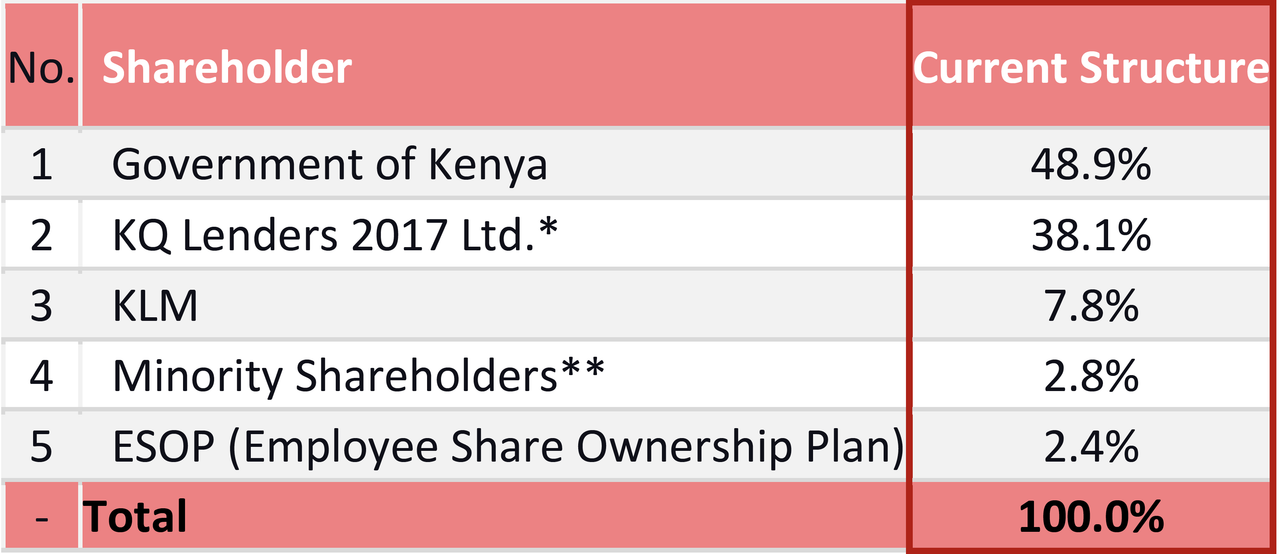

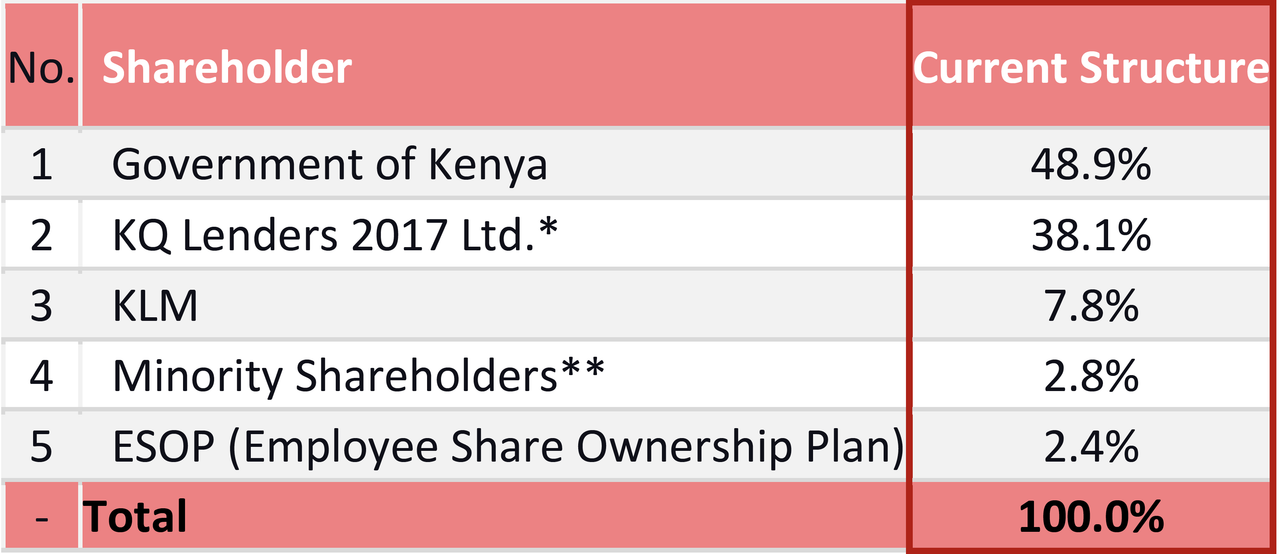

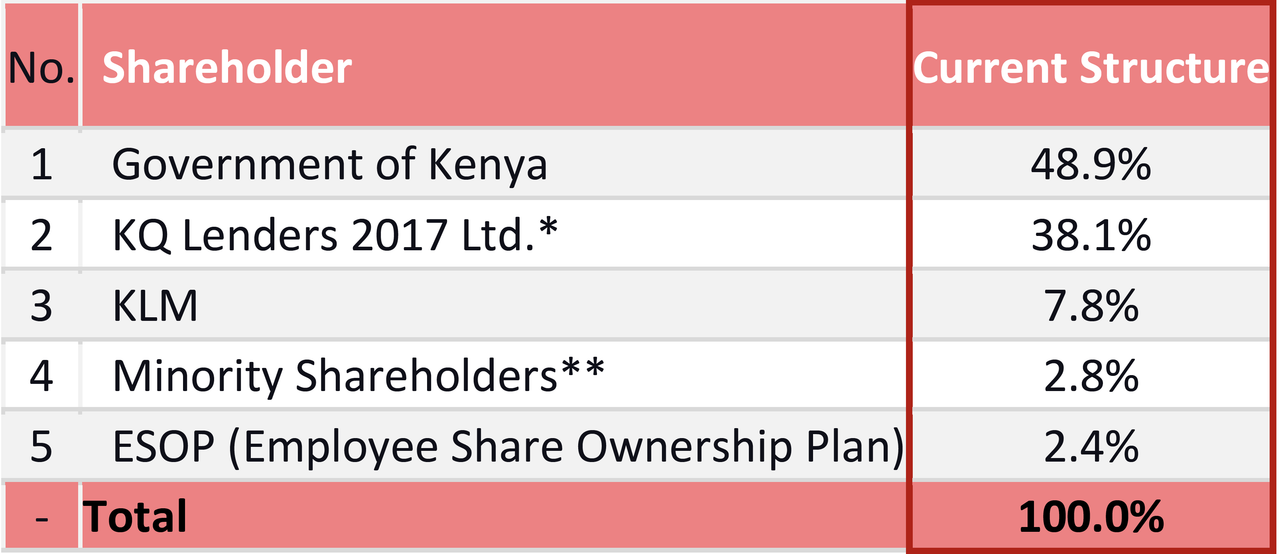

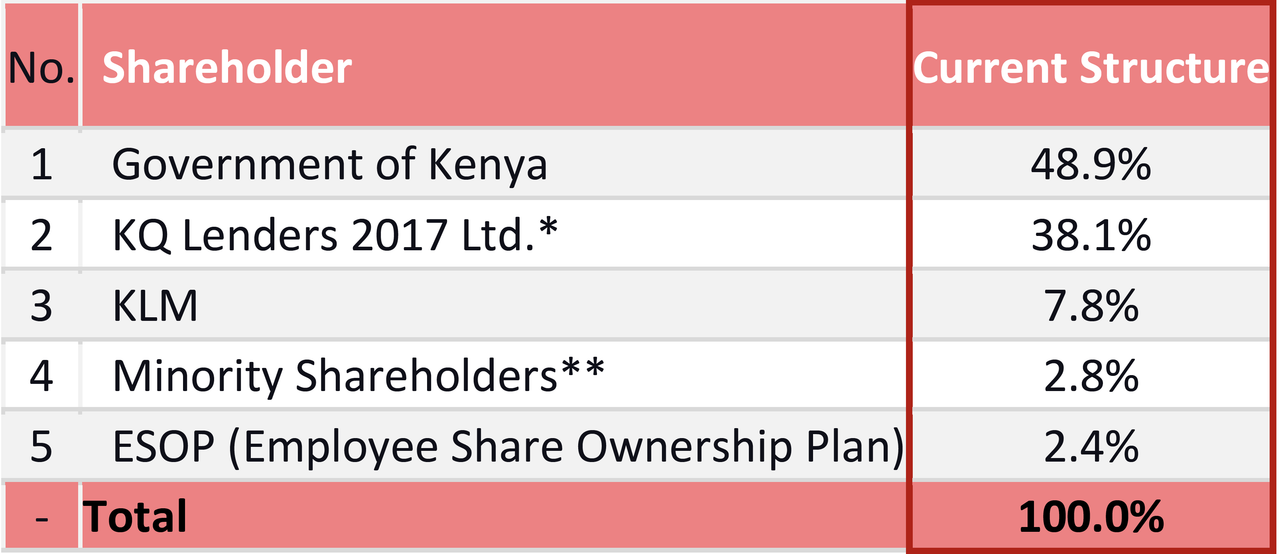

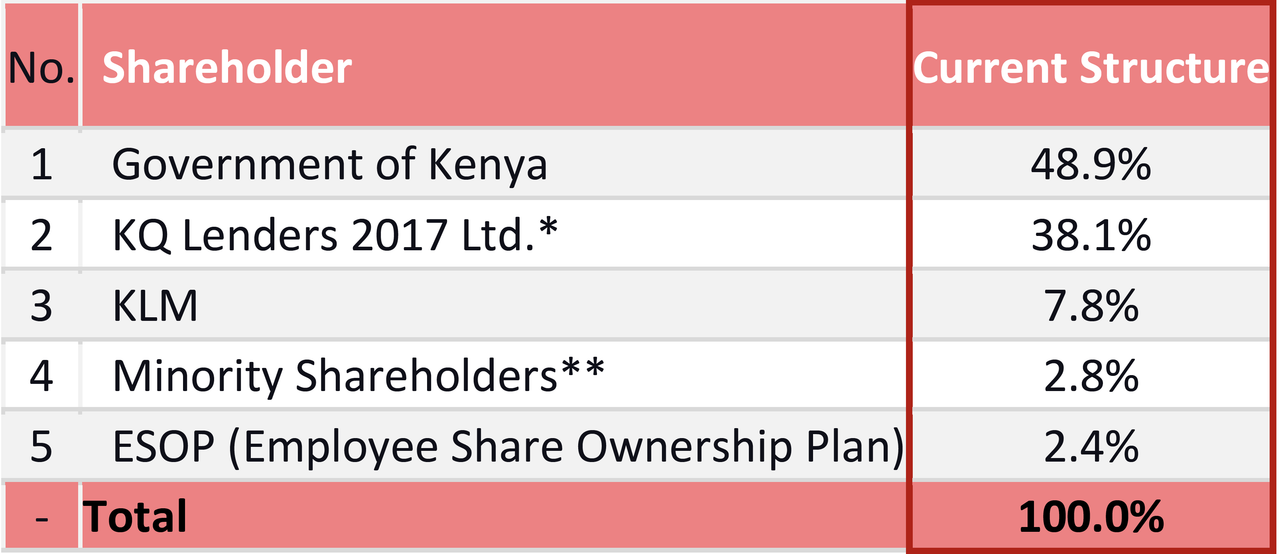

obiero wrote:obiero wrote:mufasa wrote:MaichBlack wrote:The sad thing is people are losing big time money here. That is not funny. These are real people losing real money. I hate that!!! With only 5% listed for public trading. I doubt the share price will change much. This one will bleed for a long time. A seasoned investor has spoken. It helps to remember that there are KQ shareholders who bought at KES 111 per share GoK to give up some space to allow entry of the strategic investment. KQLC are immovable since their shareholding was a debt conversion  The strategic investor should buy KLM and KQLC stake. Those ones the shareholding is not in their strategic plans and is of no use. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

Ericsson wrote:obiero wrote:obiero wrote:mufasa wrote:MaichBlack wrote:The sad thing is people are losing big time money here. That is not funny. These are real people losing real money. I hate that!!! With only 5% listed for public trading. I doubt the share price will change much. This one will bleed for a long time. A seasoned investor has spoken. It helps to remember that there are KQ shareholders who bought at KES 111 per share GoK to give up some space to allow entry of the strategic investment. KQLC are immovable since their shareholding was a debt conversion  The strategic investor should buy KLM and KQLC stake. Those ones the shareholding is not in their strategic plans and is of no use. The thing is, this strategic investor is likely to be GoK. They are not saying it, but it will be. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,808

|

obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:mufasa wrote:MaichBlack wrote:The sad thing is people are losing big time money here. That is not funny. These are real people losing real money. I hate that!!! With only 5% listed for public trading. I doubt the share price will change much. This one will bleed for a long time. A seasoned investor has spoken. It helps to remember that there are KQ shareholders who bought at KES 111 per share GoK to give up some space to allow entry of the strategic investment. KQLC are immovable since their shareholding was a debt conversion  The strategic investor should buy KLM and KQLC stake. Those ones the shareholding is not in their strategic plans and is of no use. The thing is, this strategic investor is likely to be GoK. They are not saying it, but it will be. Watch and learn What value will GoK add??? And I am not talking money coz that we (tax payers) have poured in billions upon billions and things still fall apartNever count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,808

|

Warren Buffet's Capital Allocation Doctrine!Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

MaichBlack wrote:obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:mufasa wrote:MaichBlack wrote:The sad thing is people are losing big time money here. That is not funny. These are real people losing real money. I hate that!!! With only 5% listed for public trading. I doubt the share price will change much. This one will bleed for a long time. A seasoned investor has spoken. It helps to remember that there are KQ shareholders who bought at KES 111 per share GoK to give up some space to allow entry of the strategic investment. KQLC are immovable since their shareholding was a debt conversion  The strategic investor should buy KLM and KQLC stake. Those ones the shareholding is not in their strategic plans and is of no use. The thing is, this strategic investor is likely to be GoK. They are not saying it, but it will be. Watch and learn What value will GoK add??? And I am not talking money coz that we (tax payers) have poured in billions upon billions and things still fall apart Refer to ET set up

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,808

|

obiero wrote:MaichBlack wrote:obiero wrote:Ericsson wrote:obiero wrote:obiero wrote:mufasa wrote:MaichBlack wrote:The sad thing is people are losing big time money here. That is not funny. These are real people losing real money. I hate that!!! With only 5% listed for public trading. I doubt the share price will change much. This one will bleed for a long time. A seasoned investor has spoken. It helps to remember that there are KQ shareholders who bought at KES 111 per share GoK to give up some space to allow entry of the strategic investment. KQLC are immovable since their shareholding was a debt conversion  The strategic investor should buy KLM and KQLC stake. Those ones the shareholding is not in their strategic plans and is of no use. The thing is, this strategic investor is likely to be GoK. They are not saying it, but it will be. Watch and learn What value will GoK add??? And I am not talking money coz that we (tax payers) have poured in billions upon billions and things still fall apart Refer to ET set up Just reapond directly and clearly for once @Obiero. What value will GoK add??? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

If you have time watch this whole mind shifting session. If you are short on time, spare 5 mins to view from timestamp 1:16:00 noting to thank me later https://youtu.be/Ff_97c6CEBM?si=mdyn8ZVl1cEUswyF

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,808

|

I am not taking 5 minutes to watch something you can answer in one or two simple straightforward sentences. Sitaki mambo ya wild goose chase!! Make a habit of giving straight definitive answers @Obiero. That's the only helpful thing in this community. Code, watch and learn, writing on walls etc. are not actionable. And that is why we are all here. To act and make money or avoid losing money!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

MaichBlack wrote:I am not taking 5 minutes to watch something you can answer in one or two simple straightforward sentences. Sitaki mambo ya wild goose chase!! Make a habit of giving straight definitive answers @Obiero. That's the only helpful thing in this community. Code, watch and learn, writing on walls etc. are not actionable. And that is why we are all here. To act and make money or avoid losing money!!! Luckily there are other people in this world. Mwenye ako na muda atatumia vile anataka. This is not a forced action

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

Second Dreamliner is scheduled to be back in the skies by September 25, 2025, with the final grounded one expected to resume operations by December 19, 2025. Ceteris paribus.

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

https://www.businessdailyafrica.com/bd/opinion-analysis/columnists/real-price-of-keeping-kenya-in-the-skies-5179406There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

Government support is assured

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

obiero wrote:Second Dreamliner is scheduled to be back in the skies by September 25, 2025, with the final grounded one expected to resume operations by December 19, 2025. Ceteris paribus.

Primary play revolves around the KES 66B capital injection. Return of the two grounded aircraft will be awesome but it is not enough to rescue the Pride of Africa

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

obiero wrote:obiero wrote:Second Dreamliner is scheduled to be back in the skies by September 25, 2025, with the final grounded one expected to resume operations by December 19, 2025. Ceteris paribus.

Primary play revolves around the KES 66B capital injection. Return of the two grounded aircraft will be awesome but it is not enough to rescue the Pride of Africa  Near-zero supply below KES 5.00. Fair value remains KES 8.52. Thank me later

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

obiero wrote:VituVingiSana wrote:jawgey wrote:MaichBlack wrote:Kufa dereva, kufa makanga, kufa mechanic, kufa mwenye gari!!! A good thing he referred to 'kamikaze'- kill or be killed! Best bid at 9.58am is 1.80 Some poor suckers bought at 3.90 @Obiero Splash out the 500k! I have placed the low bid that you have sighted. Averaging down. So help me God 😁 Gained +30% ROI on COOP and I have sold it at prevailing rate, with awareness it could trace higher to KES 26. Full sale proceeds applied to KQ. Insanity? Maybe! Watch and learn

KQ ABP 4.26

|

|

|

Rank: New-farer Joined: 2/27/2018 Posts: 59 Location: Cambrian Dc

|

That 'surprise' loss really did a mental number on you,sir. It was like walking in on your wife, that you've never even suspected of being unfaithful,engaging in a bukake in your living room. I hope it works out for you. But 5bob sio mbali to get out. May the almighty grant you peace and strength. Best of luck! If the radiance of a thousand suns were to burst at once into the sky that would be like the splendour of the mighty one.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

VyaBureSiachi wrote:That 'surprise' loss really did a mental number on you,sir. It was like walking in on your wife, that you've never even suspected of being unfaithful,engaging in a bukake in your living room.

I hope it works out for you. But 5bob sio mbali to get out. May the almighty grant you peace and strength. Best of luck! Hehe. Let me Google bukake. I will be back

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

obiero wrote:VyaBureSiachi wrote:That 'surprise' loss really did a mental number on you,sir. It was like walking in on your wife, that you've never even suspected of being unfaithful,engaging in a bukake in your living room.

I hope it works out for you. But 5bob sio mbali to get out. May the almighty grant you peace and strength. Best of luck! Hehe. Let me Google bukake. I will be back Very vivid imagery on the bukake. God forbid. Now, back to KQ, my aim is not KES 5 which would present a 3% ROI. Even KES 7 will not suffice. Fair value KES 8.52 remains the minimum, but KES 10 is not far fetched if the KES 69B capital injection is secured

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

One of the 75K minority shareholders in KQ. Apply italics, underline and bold, the key word undervalued. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,188 Location: nairobi

|

Sadly Waweru passed on last year, before realizing a return on his wager. But luckily his estate has held fort https://www.businessdail...-1-1m-share-deal-2108994

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|