Wazua

»

Investor

»

Economy

»

Ksh at its weakest since it floated in 1994

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Kenya to issue $1 bln debut Eurobond after peaceful vote - http://www.reuters.com/a...d-idUSL6N0C35QS20130311

This will pour very cold water to the USD vs KES trade. Those insisting on holding the USD, goodluck. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Inflation for the month of March will likely spike above 5% $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

hisah wrote:

Inflation for the month of March will likely spike above 5%

91,182 and 364 t-bill rates have been gradually rising...and subscription for the last couple of auctions has been dismal where is the money? possunt quia posse videntur

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

maka wrote:hisah wrote:

Inflation for the month of March will likely spike above 5%

91,182 and 364 t-bill rates have been gradually rising...and subscription for the last couple of auctions has been dismal where is the money? repos?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

USDKES fight is still a bore between 85 - 88. Break of 88 targets 90 and break of 85 targets 83. KES strength towards 83 means equities rally hard. The opposite applies. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

hisah wrote:USDKES fight is still a bore between 85 - 88. Break of 88 targets 90 and break of 85 targets 83. KES strength towards 83 means equities rally hard. The opposite applies. Forgive my ignorance, kind Sir, but could you be so kind and translate the above into English, please. My interest is premised on the fact that I am a freelancer writer paid in dollars and currently holding cash in paypal and therefore following this thread with interest.

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

Since I'm bored I will be so kind Mathenge, he means that there is not much action between the USD & KES fight between the 85-88 exchange rate. If the rate goes to 88 then 90 will be achieved, or if rate goes to 85 then 83 will print. If rate goes towards 83, then the stock market will rally but if it goes towards 90 then the market will slump.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

aemathenge wrote:hisah wrote:USDKES fight is still a bore between 85 - 88. Break of 88 targets 90 and break of 85 targets 83. KES strength towards 83 means equities rally hard. The opposite applies. Forgive my ignorance, kind Sir, but could you be so kind and translate the above into English, please. My interest is premised on the fact that I am a freelancer writer paid in dollars and currently holding cash in paypal and therefore following this thread with interest. @nabwire has given the explanation. Above 88 your USD will be worth more and below 85 they'll be worth less KES. If gok is able to float the eurobond this year then expect USD rate to slide. You'll have to work more to get more USD to keep up with the KES strength.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:kizee1 wrote:hisah

very boring market, in 2008 during PEV time the action was amazing, this time price action is boring or maybe ive been in this business for too long.. Yep. In 2008 it was action packed compared to know. Wow! Very very boring. Watching paint dry is more exciting. Maybe the excitement will come in once we see the Uhuruto Fin Min.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

The zero sum game called hoarding USD. This is a monthly chart and USD is still facing headwinds from the KES rebound assisted by a desperate CB that is still hosing USD speculators. USD longs are a tough call at the moment unless inflation spikes above tbill rates as well as CBR.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

doubt cbk allow 82 to give, irony of our times they wont let it go below 82 or above 87.50, last week they bought a whopping $100mio from the market and the KES still rallied, if not for this fly in the ointment(read cbk) yes 82 would yield...i could be wrong tho

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

@Chief Hisah, kindly direct me to a site that teaches how to read this type of chart. Thank you in advance.

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

kizee1 wrote:if not for this fly in the ointment(read cbk) yes 82 would yield I read the above to mean that you would profit from below Kshs. 82 to the dollar "yield". Why, in your opinion, would the Central Bank of Kenya hold the ceiling at 82? Personally, the lower it fell the better.

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

aemathenge wrote:kizee1 wrote:if not for this fly in the ointment(read cbk) yes 82 would yield I read the above to mean that you would profit from below Kshs. 82 to the dollar "yield". Why, in your opinion, would the Central Bank of Kenya hold the ceiling at 82? Personally, the lower it fell the better. ....happened before especially last year the term export competitiveness comes to mind. .

|

|

|

Rank: Veteran Joined: 2/3/2012 Posts: 1,317

|

Why then is the price of fuel going up?

|

|

|

Rank: Member Joined: 8/16/2012 Posts: 661

|

kollabo wrote:Why then is the price of fuel going up? Because it is tied to previous rates. Now you can be sure the next update on oil prices will be a drop. Live and learn; and don’t forget, nothing ventured, nothing gained.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@aemathenge - http://www.babypips.com/school/ from pre-school to graduation. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

kizee1 wrote:doubt cbk allow 82 to give, irony of our times they wont let it go below 82 or above 87.50, last week they bought a whopping $100mio from the market and the KES still rallied, if not for this fly in the ointment(read cbk) yes 82 would yield...i could be wrong tho So we have silent DNT (do not touch) bounds between 82 - 87 levels. Definitely below 80 makes KES strong and bad for exports in EA as it appreciates too much vs TZS, RWF and UGX.

Waiting to see the effects when eurobond is finally floated.

Btw USDKES broke below 84 level today. Getting muscular.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

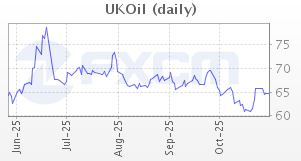

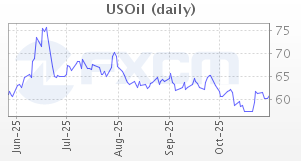

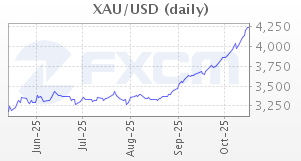

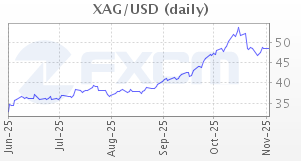

Pleased at how recent USD/KES & Crude trends will merge  #PerfectStorm

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@chief cde - This april has seen commodos take it in the chin blow by blow without a breather and the ref aint stopping the match! Look at the charts below. The only solice the commodos have is at least they haven't tanked like bitcoin, which is down 70% in two days after a parabolic rally of 3 months since Jan 2013! That is what you call a nuclear blood-bath... Brent  Crude  Gold  Silver  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Ksh at its weakest since it floated in 1994

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|