Wazua

»

Investor

»

Stocks

»

The KenolKobil 2015 pendulum

Rank: Elder Joined: 8/16/2011 Posts: 2,369

|

Hey Gentle Biz people. Ouko is right s govt Auditor doing it on a corporation owned by Govt. Both KPC and KK owe each other large sums. KK claims more for business loss where it missed bizz when KPC delayed or refused to store/process its fuel after arrival at port KPRL by then. KPC want KK pay for already processed and transported fuels already done by then. So the Court need to make decision on how much each has to pay each other. KK claims 7.6 Billion while KPC claims 4 Billion. Ouko is just sfeguarding and keeping us aware that the govt is making a case to recover Govt or Public (Not private - KK) Money.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

I still can't believe this is your post. It's so intelligent and coherent. Realtreaty wrote:Hey Gentle Biz people. Ouko is right s govt Auditor doing it on a corporation owned by Govt. Both KPC and KK owe each other large sums. KK claims more for business loss where it missed bizz when KPC delayed or refused to store/process its fuel after arrival at port KPRL by then. KPC want KK pay for already processed and transported fuels already done by then. So the Court need to make decision on how much each has to pay each other. KK claims 7.6 Billion while KPC claims 4 Billion. Ouko is just sfeguarding and keeping us aware that the govt is making a case to recover Govt or Public (Not private - KK) Money.

Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Realtreaty wrote:Hey Gentle Biz people. Ouko is right s govt Auditor doing it on a corporation owned by Govt. Both KPC and KK owe each other large sums. KK claims more for business loss where it missed bizz when KPC delayed or refused to store/process its fuel after arrival at port KPRL by then. KPC want KK pay for already processed and transported fuels already done by then. So the Court need to make decision on how much each has to pay each other. KK claims 7.6 Billion while KPC claims 4 Billion. Ouko is just sfeguarding and keeping us aware that the govt is making a case to recover Govt or Public (Not private - KK) Money.

when did this creation of free transport done to Kk happen and how is it possible in a private company? "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

When all seems quiet big men snatch big volumes unseen "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: New-farer Joined: 5/21/2013 Posts: 72 Location: KENYA

|

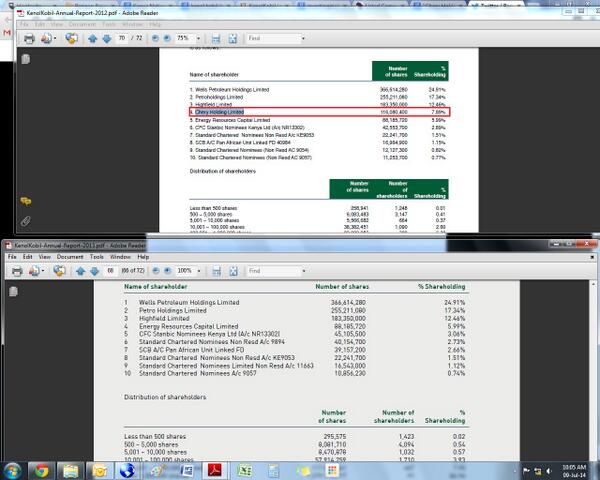

Having a look a t KK's top 10 shareholders since 2013; the change is massive! You can guess where those massive volume spikes have been coming from. “The market can remain irrational longer than you can remain solvent.” - John Maynard Keynes

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

shiznit wrote:Having a look a t KK's top 10 shareholders since 2013; the change is massive!

You can guess where those massive volume spikes have been coming from. Source please "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Top 10 Shareholders (end Jan 2016) 1. Wells Petroleum Holdings Limited – 20.56% 2. Petro Holdings Limited – 17.34% 3. Standard Chartered Nominees A/C KE14861 – 8.64% 4. Energy Resources Capital Limited – 5.99% 5. SCB A/C Pan African Unit Linked FD – 3.65% 6. CFC STANBIC Nominees Limited – 3.21% 7. Standard Chartered Nominees ltd A/c KE002105 – 2.88% 8. CFC STANBIC Nominees Limited 1873738 – 2.03% 9. CFC STANBIC Nominees Limited 1031144 – 1.33% 10. SCB A/C Pan African deposit admin FD – 1.12% "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: New-farer Joined: 5/21/2013 Posts: 72 Location: KENYA

|

mlennyma wrote:Top 10 Shareholders (end Jan 2016)

1. Wells Petroleum Holdings Limited – 20.56%

2. Petro Holdings Limited – 17.34%

3. Standard Chartered Nominees A/C KE14861 – 8.64%

4. Energy Resources Capital Limited – 5.99%

5. SCB A/C Pan African Unit Linked FD – 3.65%

6. CFC STANBIC Nominees Limited – 3.21%

7. Standard Chartered Nominees ltd A/c KE002105 – 2.88%

8. CFC STANBIC Nominees Limited 1873738 – 2.03%

9. CFC STANBIC Nominees Limited 1031144 – 1.33%

10. SCB A/C Pan African deposit admin FD – 1.12% Top 10 shareholders for FY2015  Top 10 shareholders for 2012 and 2013  “The market can remain irrational longer than you can remain solvent.” - John Maynard Keynes

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Only one serious mover, kenol kobil cares for you,thankyou and come again "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

@Aguy I expect you to brush your shoes tomorrow and attend the AGM,try to ask questions on wazuas behalf including the first quarter snapshot and debt level progress. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

mlennyma wrote:@Aguy I expect you to brush your shoes tomorrow and attend the AGM,try to ask questions on wazuas behalf including the first quarter snapshot and debt level progress. He he. Unfortunately I can't, I would have loved to attend. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Kenol Kobil 2016 AGM KenolKobil had its annual shareholders meeting on May 12, at the Hilton Hotel in Nairobi. The board chairman spoke of the company’s performance in the three years since they had lost Kshs 6.2 billion. They had thereafter embarked on a turnaround that involved reducing costs, divesting from non-performing territories, focusing on profitable business rather than growing their market share, paying down debt, and corporate governance moves (separating the role of Chairman & CEO role) . Highlights Regional Business: Tanzania: The company would up their short foray in Tanzania where they were losing $2 million a year. They had a depot that was part of their venture was an expensive lease, and while fuel prices in Tanzania are set by the government, many companies sell below that price as they don’t pay taxes. The directors said that Kenol was a responsible company that could not and decided to close shop. DRC: They invested here, but did not ship product there as they were not happy. with the business climate and decided to sell out. Burundi is doing well despite the political turmoil there. Dividends: One shareholder said the dividend was too low, but the chairman said they have a consistent policy of paying 25% of net profit as dividend, while the Group MD (GMD) said they still had to pay down a lot of debt. O ne long-term shareholder told the meeting, that it was better for the company to be conservative with dividends, rather than aggressive, like other companies, and come back in a few years to ask shareholders to invest more money in a right issues Property: They have decided not to put up an office building in Haile Selassie street in downtown Nairobi for now as the office property market is saturated. Goodies: Lunch box (which Hilton guards would not allow to be eaten on site), and tote bag. Some shareholders pleaded for the company to provide them with caps and umbrellas to promote the brand. Odd Point: One shareholder asked why the AGM had not started with prayers. The Chairman said it would not be productive, as they would have to have prayers for Christian, Muslim, Jewish, and traditional African religions to be fair to all shareholders present. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Great update! mlennyma wrote:Kenol Kobil 2016 AGM

KenolKobil had its annual shareholders meeting on May 12, at the Hilton Hotel in Nairobi. The board chairman spoke of the

company’s performance in the three years since they had lost Kshs 6.2 billion. They had thereafter embarked on

a turnaround that involved reducing costs, divesting from non-performing territories, focusing on profitable business rather than

growing their market share, paying down debt, and corporate governance moves (separating the role of Chairman & CEO role) .

Highlights

Regional Business:

Tanzania:

The company would up their short foray in Tanzania where they were losing $2 million a year. They had a

depot that was part of their venture was an expensive lease, and while fuel prices in Tanzania are set by the government,

many companies sell below that price as they don’t pay taxes. The directors said that Kenol was a responsible company

that could not and decided to close shop.

DRC:

They invested here, but did not ship product there as they were not happy. with the business climate and decided to

sell out.

Burundi is doing well despite the political turmoil there.

Dividends:

One shareholder said the dividend was too low, but the chairman said they have a consistent policy of paying 25% of

net profit as dividend, while the Group MD (GMD) said they still had to pay down a lot of debt. O ne long-term shareholder told

the meeting, that it was better for the company to be conservative with dividends, rather than aggressive, like other companies,

and come back in a few years to ask shareholders to invest more money in a right issues

Property: They have decided not to put up an office building in Haile Selassie street in downtown Nairobi for now as

the office property market is saturated.

Goodies:

Lunch box (which Hilton guards would not allow to be eaten on site), and tote bag. Some shareholders pleaded for the

company to provide them with caps and umbrellas to promote the brand.

Odd Point:

One shareholder asked why the AGM had not started with prayers. The Chairman said it would not be productive, as

they would have to have prayers for Christian, Muslim, Jewish, and traditional African religions to be fair to all shareholders

present. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mlennyma wrote:Kenol Kobil 2016 AGM

KenolKobil had its annual shareholders meeting on May 12, at the Hilton Hotel in Nairobi. The board chairman spoke of the

company’s performance in the three years since they had lost Kshs 6.2 billion. They had thereafter embarked on

a turnaround that involved reducing costs, divesting from non-performing territories, focusing on profitable business rather than

growing their market share, paying down debt, and corporate governance moves (separating the role of Chairman & CEO role) .

Highlights

Regional Business:

Tanzania:

The company would up their short foray in Tanzania where they were losing $2 million a year. They had a

depot that was part of their venture was an expensive lease, and while fuel prices in Tanzania are set by the government,

many companies sell below that price as they don’t pay taxes. The directors said that Kenol was a responsible company

that could not and decided to close shop.

DRC:

They invested here, but did not ship product there as they were not happy. with the business climate and decided to

sell out.

Burundi is doing well despite the political turmoil there.

Dividends:

One shareholder said the dividend was too low, but the chairman said they have a consistent policy of paying 25% of

net profit as dividend, while the Group MD (GMD) said they still had to pay down a lot of debt. O ne long-term shareholder told

the meeting, that it was better for the company to be conservative with dividends, rather than aggressive, like other companies,

and come back in a few years to ask shareholders to invest more money in a right issues

Property: They have decided not to put up an office building in Haile Selassie street in downtown Nairobi for now as

the office property market is saturated.

Goodies:

Lunch box (which Hilton guards would not allow to be eaten on site), and tote bag. Some shareholders pleaded for the

company to provide them with caps and umbrellas to promote the brand.

Odd Point:

One shareholder asked why the AGM had not started with prayers. The Chairman said it would not be productive, as

they would have to have prayers for Christian, Muslim, Jewish, and traditional African religions to be fair to all shareholders

present. Thanks "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

murchr wrote:mlennyma wrote:Kenol Kobil 2016 AGM

KenolKobil had its annual shareholders meeting on May 12, at the Hilton Hotel in Nairobi. The board chairman spoke of the

company’s performance in the three years since they had lost Kshs 6.2 billion. They had thereafter embarked on

a turnaround that involved reducing costs, divesting from non-performing territories, focusing on profitable business rather than

growing their market share, paying down debt, and corporate governance moves (separating the role of Chairman & CEO role) .

Highlights

Regional Business:

Tanzania:

The company would up their short foray in Tanzania where they were losing $2 million a year. They had a

depot that was part of their venture was an expensive lease, and while fuel prices in Tanzania are set by the government,

many companies sell below that price as they don’t pay taxes. The directors said that Kenol was a responsible company

that could not and decided to close shop.

DRC:

They invested here, but did not ship product there as they were not happy. with the business climate and decided to

sell out.

Burundi is doing well despite the political turmoil there.

Dividends:

One shareholder said the dividend was too low, but the chairman said they have a consistent policy of paying 25% of

net profit as dividend, while the Group MD (GMD) said they still had to pay down a lot of debt. O ne long-term shareholder told

the meeting, that it was better for the company to be conservative with dividends, rather than aggressive, like other companies,

and come back in a few years to ask shareholders to invest more money in a right issues

Property: They have decided not to put up an office building in Haile Selassie street in downtown Nairobi for now as

the office property market is saturated.

Goodies:

Lunch box (which Hilton guards would not allow to be eaten on site), and tote bag. Some shareholders pleaded for the

company to provide them with caps and umbrellas to promote the brand.

Odd Point:

One shareholder asked why the AGM had not started with prayers. The Chairman said it would not be productive, as

they would have to have prayers for Christian, Muslim, Jewish, and traditional African religions to be fair to all shareholders

present. Thanks Thanks. Nice summary The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,369

|

Yes, we had the debt to pay and we are almost settling it, but how much is remaining? When are we going to be debt free and have more profits hence more dividends from 25% total?

Further more the argument not to build a Tower may not be so good as later date cost to have one will be more. What I could suggest is to build a mixed Hotel-office building tower as more space for hotel rooms is required at City Center for major MICE and citizens. This is how Dubai does it and hotels line up maintaining a 80% occupancy. Kenol could invite Hyatt Hotels for lease.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Realtreaty wrote:Yes, we had the debt to pay and we are almost settling it, but how much is remaining? When are we going to be debt free and have more profits hence more dividends from 25% total?

Further more the argument not to build a Tower may not be so good as later date cost to have one will be more. What I could suggest is to build a mixed Hotel-office building tower at more space for hotel rooms is required at City Center for major MICE. Wewe @RealTreaty you mean to refer high-net-worth individuals 'major MICE'? You are a confirmed comedian brother. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,369

|

|

|

|

Rank: Elder Joined: 8/16/2011 Posts: 2,369

|

KK closes their books. Time to look for more. Next year results scheduled to come early March and decision to build the tower will rise again after August General Elections.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Realtreaty wrote:KK closes their books. Time to look for more. Next year results scheduled to come early March and decision to build the tower will rise again after August General Elections. let's see whether this books have any effect tomorrow .spikes dreams of 8bob "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

The KenolKobil 2015 pendulum

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|