Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

Chaka wrote:Tall Order wrote:Currently the Money Market Funds offer better returns than the T-Bills. Bonds require long term investment, which is money you don't need in the medium term.

Top MMFs are Amana Capital, Zimele, CIC, Madison Asset, Britam & GenCap.

Where do the MMF's invest these funds? I suppose bonds za mayuu like the Eurobond etal! Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Member Joined: 1/3/2014 Posts: 257

|

Anyone know the process of buying bonds on secondary market?

|

|

|

Rank: Hello Joined: 5/30/2014 Posts: 1

|

Where can I get the listing of the available Company Bonds?

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

NSE daily bond price list Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 6/17/2009 Posts: 1,625

|

http://af.reuters.com/ar...AFJ8N0O100Y20140724...a sharp drop in the 91 day T-bill rate.But of interest is the subscription,only 753 million shillings for 3 billion shillings worth of bills on offer.

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

snipermnoma wrote:Anyone know the process of buying bonds on secondary market? go through a broker,expect disappointment if your lot sizes are tiny

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

Jarida wrote:Tell him to get the Jamii Bora Bonds. Returns are at 13% per annum better than the TBills. Tall Order wrote:Currently the Money Market Funds offer better returns than the T-Bills. Bonds require long term investment, which is money you don't need in the medium term.

Top MMFs are Amana Capital, Zimele, CIC, Madison Asset, Britam & GenCap.

Does this still hold true? And where would I get info on returns, for all available instruments, for comparison purposes?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. possunt quia posse videntur

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

maka wrote:snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. well that someone could be me and you ;-)

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

kizee1 wrote:maka wrote:snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. well that someone could be me and you ;-) Commissions are too low for bonds. Not worth the effort. And the paperwork is more than trading equities. @SufficientlyP

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Sufficiently Philanga....thropic wrote:kizee1 wrote:maka wrote:snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. well that someone could be me and you ;-) Commissions are too low for bonds. Not worth the effort. And the paperwork is more than trading equities. For 100m the commission is 24k on one side of the transaction (0.024%) if am still in the know,when the market is dry some firms can go a whole month without trading a single bond,our traded volumes are still low...the other problem is with settlement confirming the deals takes a lifetime,we should get an efficient system for settlement and things will be easier....ION kumbe Kabando thinks like me... I support this 100%.  possunt quia posse videntur

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

maka wrote:Sufficiently Philanga....thropic wrote:kizee1 wrote:maka wrote:snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. well that someone could be me and you ;-) Commissions are too low for bonds. Not worth the effort. And the paperwork is more than trading equities. For 100m the commission is 24k on one side of the transaction (0.024%) if am still in the know,when the market is dry some firms can go a whole month without trading a single bond,our traded volumes are still low...the other problem is with settlement confirming the deals takes a lifetime,we should get an efficient system for settlement and things will be easier....ION kumbe Kabando thinks like me... I support this 100%.  Forgive me. For a moment there, I thought you were referring to the cartoon

|

|

|

Rank: New-farer Joined: 1/16/2014 Posts: 25

|

According to the CBK website, there are two 5-year bonds expected to mature in Sep 2014 and a 2-yr bond due in Oct 2014. I will try my hand for the 2-yr one since my lot is abt 300k. Never done it b4 so just testing it to find out how it really works. The coupon rate for that is 12%, but no guarantee that the subsequent one they will float will also be at the same rate.

|

|

|

Rank: Member Joined: 8/16/2012 Posts: 661

|

c&p NSE Launches New Bond SystemHighlights- on-line trading of debt securities

-report both over the counter and on exchange transactions through a centralized reporting system

-It will be much easier for the investor to compare the pricing of debt securities

-ability to integrate with regulators’ surveillance systems and ability to report transactions that are concluded over the counter for purposes of settlementQuote:" On the first full day of using the system, the value of bonds traded on the NSE was Kshs.... This is a significant step towards the Exchange’s resolve of ensuring that the secondary market becomes more transparent and the price discovery mechanism is beyond reproach. The multicurrency trading functionality of the new system means that foreign denominated bonds can be traded. With this development, we look forward to the listing of the Government of Kenya Sovereign Bond at the Exchange and the trading of new products such as Derivatives.” Mr. Peter Mwangi, Chief Executive of the Nairobi Securities Exchange Live and learn; and don’t forget, nothing ventured, nothing gained.

|

|

|

Rank: Member Joined: 1/3/2014 Posts: 257

|

Museveni wrote:c&p NSE Launches New Bond SystemHighlights- on-line trading of debt securities

-report both over the counter and on exchange transactions through a centralized reporting system

-It will be much easier for the investor to compare the pricing of debt securities

-ability to integrate with regulators’ surveillance systems and ability to report transactions that are concluded over the counter for purposes of settlementQuote:" On the first full day of using the system, the value of bonds traded on the NSE was Kshs.... This is a significant step towards the Exchange’s resolve of ensuring that the secondary market becomes more transparent and the price discovery mechanism is beyond reproach. The multicurrency trading functionality of the new system means that foreign denominated bonds can be traded. With this development, we look forward to the listing of the Government of Kenya Sovereign Bond at the Exchange and the trading of new products such as Derivatives.” Mr. Peter Mwangi, Chief Executive of the Nairobi Securities Exchange @maka @kizee1 @Sufficiently Philanga....thropic so does this improve things? Time to start that trading desk?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

snipermnoma wrote:Museveni wrote:c&p NSE Launches New Bond SystemHighlights- on-line trading of debt securities

-report both over the counter and on exchange transactions through a centralized reporting system

-It will be much easier for the investor to compare the pricing of debt securities

-ability to integrate with regulators’ surveillance systems and ability to report transactions that are concluded over the counter for purposes of settlementQuote:" On the first full day of using the system, the value of bonds traded on the NSE was Kshs.... This is a significant step towards the Exchange’s resolve of ensuring that the secondary market becomes more transparent and the price discovery mechanism is beyond reproach. The multicurrency trading functionality of the new system means that foreign denominated bonds can be traded. With this development, we look forward to the listing of the Government of Kenya Sovereign Bond at the Exchange and the trading of new products such as Derivatives.” Mr. Peter Mwangi, Chief Executive of the Nairobi Securities Exchange @maka @kizee1 @Sufficiently Philanga....thropic so does this improve things? Time to start that trading desk? Working on it good progress...We are going places.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

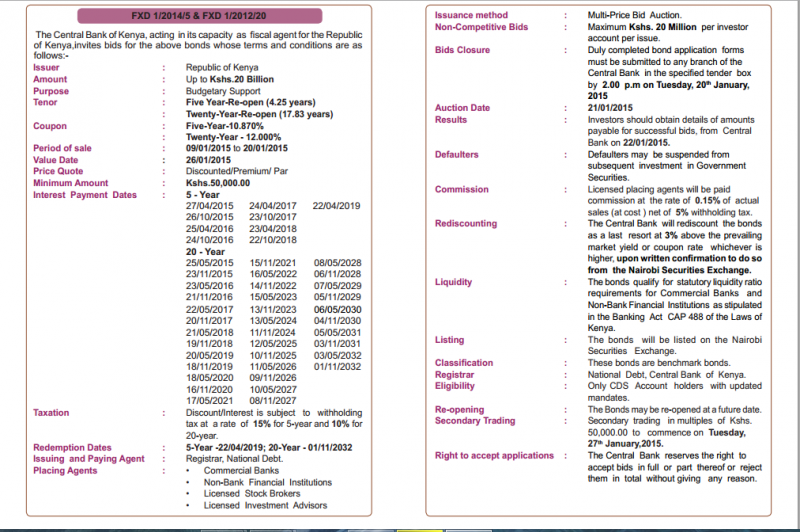

possunt quia posse videntur

|

|

|

Rank: Member Joined: 6/14/2010 Posts: 521 Location: Nairobi

|

National Housing Corporation is planning to float a 5Bn bond at the NSE in the second half of 2015.proceeds to be used to build more than 3000 residential units in Nairobi, Mombasa and Kisumu. [ Read more: Business Daily]

|

|

|

Rank: Veteran Joined: 2/2/2012 Posts: 1,134 Location: Nairobi

|

maka wrote:Sufficiently Philanga....thropic wrote:kizee1 wrote:maka wrote:snipermnoma wrote:Anyone know the process of buying bonds on secondary market? If you go through the daily/weekly bond price list you will notice that most trades are in lots of 100m,anything below this figure is normally traded as an odd lot,buying a bond for let's say 50k or 100k is almost close to impossible as most people who buy such small lots at the primary tend to hold to maturity...I think it's high time someone started a trading desk for small lots...upto maybe 10m. well that someone could be me and you ;-) Commissions are too low for bonds. Not worth the effort. And the paperwork is more than trading equities. For 100m the commission is 24k on one side of the transaction (0.024%) if am still in the know,when the market is dry some firms can go a whole month without trading a single bond,our traded volumes are still low...the other problem is with settlement confirming the deals takes a lifetime,we should get an efficient system for settlement and things will be easier....ION kumbe Kabando thinks like me... I support this 100%.  Kabando and Jaindi simply don't get it! The reason many "small investors" don't put money in T-Bills is NOT because they can't raise sh100k. It's because they don't know how to buy t-bills. In addition, the media [including the likes of Jaindi] have created the false impression that only banks with hundreds of millions of shillings can invest in t-bills. Secondly, the Jaindi-Kabando types have also created the false impression that t-bills are the highest interest earning deposits available. Again that is so untrue! If you ask me, if you don't have enough money to make a competitive t-bill bid, just put you money in an MMF. You'll get higher interest and you have access to your money withing 72hrs. With t-bills, you have to wait 12 weeks for the damn thing to mature!

|

|

|

Rank: Member Joined: 9/26/2006 Posts: 462 Location: CENTRAL PROVINCE

|

The 20 year bond was auctioned last week at a weighted average of 13.624%. After 10% tax, thats a net of 12.2616% (or 6.1308% every six months)........is there any money market fund giving such a return in Kenya? Happy Hunting. x handle: @stocksmaster79

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|