Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:hisah wrote:streetwise wrote:Now you know our NSE ndio baba yao. let them that pulled their money out to invest in those market come back to NSE we may be willing to offer them a few shares. KES assets vs USD assets. No contest there. Capital is flying into USD and it doesn't care about anything else! It'll be very hard to compete with the ensuing USD stampede. So imagine the upcoming momentum spike when Fed hikes again and maybe another time before year end...  What is likely to happen to the NSE and the KES in particular Unless gok can device creative ways to attract capital the bear pressure will sustain. The bond market is already sending bad signals. Undersubscribed tax free bonds since Dec 2015  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

hisah wrote:Aguytrying wrote:hisah wrote:streetwise wrote:Now you know our NSE ndio baba yao. let them that pulled their money out to invest in those market come back to NSE we may be willing to offer them a few shares. KES assets vs USD assets. No contest there. Capital is flying into USD and it doesn't care about anything else! It'll be very hard to compete with the ensuing USD stampede. So imagine the upcoming momentum spike when Fed hikes again and maybe another time before year end...  What is likely to happen to the NSE and the KES in particular Unless gok can device creative ways to attract capital the bear pressure will sustain. The bond market is already sending bad signals. Undersubscribed tax free bonds since Dec 2015  the economic mis management is likely to continue until 2022,Kenya's magufuli is nowhere in sight "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:hisah wrote:The Yuan is already warning to get ready for a strong dollar. Chingland will struggle keeping capital in China. This will test to the limit the chingland miracle economy! Capital controls will get ugly there, which will worsen the capital flight! Commodities are indeed on course for a big crash! Get ready! Image courtesy of XE.com - USD-CNY 10yr chart.  Target is GFC peg fix at 6.83. Break above will mean the USD will be racing back to the 2006 level around 8.0. Look at the Russian Ruble against the Emerging Markets. Zuma has no idea what hit him The rand is definitely headed past the 20 handle vs $. Meltdown mode! The SA civil fabric will crack under this stress. This year's local government elections will test ANC's popularity to the core. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Cde Monomotapa wrote:hisah wrote:The Yuan is already warning to get ready for a strong dollar. Chingland will struggle keeping capital in China. This will test to the limit the chingland miracle economy! Capital controls will get ugly there, which will worsen the capital flight! Commodities are indeed on course for a big crash! Get ready! Image courtesy of XE.com - USD-CNY 10yr chart.  Target is GFC peg fix at 6.83. Break above will mean the USD will be racing back to the 2006 level around 8.0. Good one @lochaz and @hisah how about finding the inflection of USD deficit draw down supply while RMB demand escalates to reflect SDR quotas in run up to Oct. 2016. The easier to monitor is PBOC devaluations in that time. Could be a good punt? http://www.cnbc.com/2016...e-as-japanese-sell.html & R+G=Y

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Cde Monomotapa wrote:Cde Monomotapa wrote:hisah wrote:The Yuan is already warning to get ready for a strong dollar. Chingland will struggle keeping capital in China. This will test to the limit the chingland miracle economy! Capital controls will get ugly there, which will worsen the capital flight! Commodities are indeed on course for a big crash! Get ready! Image courtesy of XE.com - USD-CNY 10yr chart.  Target is GFC peg fix at 6.83. Break above will mean the USD will be racing back to the 2006 level around 8.0. Good one @lochaz and @hisah how about finding the inflection of USD deficit draw down supply while RMB demand escalates to reflect SDR quotas in run up to Oct. 2016. The easier to monitor is PBOC devaluations in that time. Could be a good punt? http://www.cnbc.com/2016...e-as-japanese-sell.html & R+G=Y PBOC looking disorderly policy wise. They had better pull a fast one on their currency or the market will force their hand one way or another. The latter will not be a happy ending since you can't strong arm the market. In other news, how the yen is still regarded as a safe haven beats me... It has performed remarkably well against the USD in this chaotic chapter. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 6/4/2015 Posts: 604

|

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

http://www.marketwatch.c...-big-problem-2016-01-12

A sneak preview of the real problems facing China. The stock market crash is a mere appetizer for the real showdowns aka real estate collapse, enterprise/industrial overcapacity and the knock on effect they will both have on its financial sector. Couple that with the fact that the central government has been bailing debt ridden municipals and at the same time trying to stabilize the yuan then you realise that it could get ugly very fast. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

I don't like this bear chorus being bleated this loud. Isn't it a bit odd that the same people telling investors to sell were the same ones publishing bullish stock estimates for 2016 at the end of 2015. A week of stock market sell-offs causes seismic shifts in perceptions/forecasts... Recency bias. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:murchr wrote:Crude going down down....causing panic Throwback Dec 17 2014 Bloomberg  Article Article : Crude was $60 then. A year later $36 If crude closes below 35 this year that will signal a shift from high prices to lower prices for a long time! The strong USD will continue frying the commodity market. Hisah translate this in laymans language "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:hisah wrote:murchr wrote:Crude going down down....causing panic Throwback Dec 17 2014 Bloomberg  Article Article : Crude was $60 then. A year later $36 If crude closes below 35 this year that will signal a shift from high prices to lower prices for a long time! The strong USD will continue frying the commodity market. Hisah translate this in laymans language Oil closed the year below $35. The high to low price shift has been triggered!

In short, global economy will go in winter as deflation spreads across the globe.

Effects:

- Strong USD/ rocket $ (capital flight into $)

- Commodities crash (deflation triggered)

- Shipping activity crash (deflation triggered)

- High yield credit market crash (debt unwind coz of rocket $ - sovereign debt crisis/junk bond collapse)

- alternate currencies (e.g. Cyptocurrencies/bitcoin etc) will sprout as fiat currencies devalue rapidly. At this point gold will become inverse to the weak commodities trend and start rallying.

I've had the $15 oil target for a long period... Unless a miracle or war happens I dont see this trend changing for quite some years.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:murchr wrote:hisah wrote:murchr wrote:Crude going down down....causing panic Throwback Dec 17 2014 Bloomberg  Article Article : Crude was $60 then. A year later $36 If crude closes below 35 this year that will signal a shift from high prices to lower prices for a long time! The strong USD will continue frying the commodity market. Hisah translate this in laymans language Oil closed the year below $35. The high to low price shift has been triggered!

In short, global economy will go in winter as deflation spreads across the globe.

Effects:

- Strong USD/ rocket $ (capital flight into $)

- Commodities crash (deflation triggered)

- Shipping activity crash (deflation triggered)

- High yield credit market crash (debt unwind coz of rocket $ - sovereign debt crisis/junk bond collapse)

- alternate currencies (e.g. Cyptocurrencies/bitcoin etc) will sprout as fiat currencies devalue rapidly. At this point gold will become inverse to the weak commodities trend and start rallying.

I've had the $15 oil target for a long period... Unless a miracle or war happens I dont see this trend changing for quite some years.

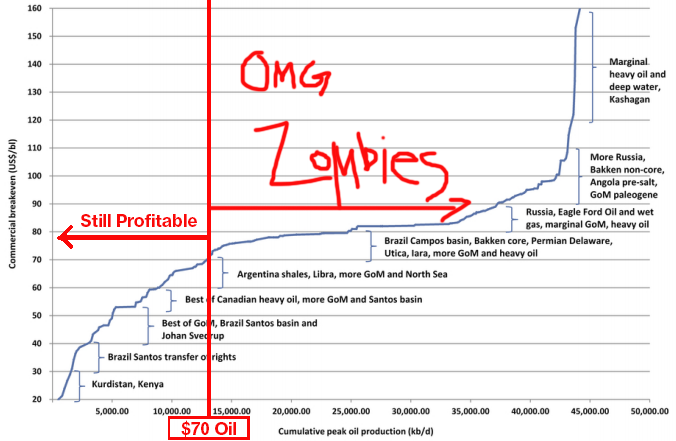

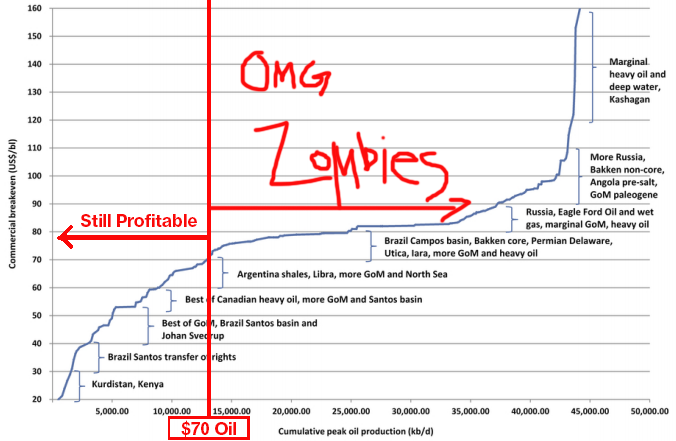

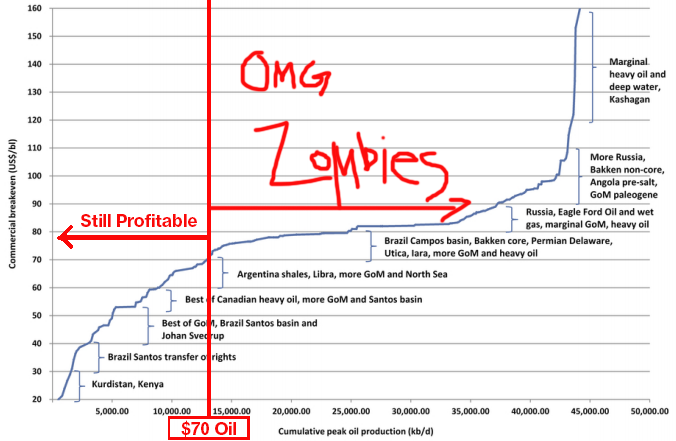

$15 means only Iran, Iraq and Saudis will be on the money the rest = losses. Wao! I didn't know the ching economy carried so much weight "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@murchr, $/yuan has to remain sub 7 if the markets are to remain sane! Keep an eye on that flood gate. But there is little chance the chingman will be able to hold back the expected flood gate breakdown! The US markets are now testing critical support levels. It'll get ugly when the floors start breaking down in US. If the rebound fails to rallly past the year open get ready for a huge selloff across board! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: New-farer Joined: 1/12/2016 Posts: 19

|

I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: New-farer Joined: 1/12/2016 Posts: 19

|

Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

joga bonito wrote:Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

@Joga,

Don't allow yourself to be guided by ignorant people. You will soon be like them....

A barrel of crude oil will need to be refined before the refined products are shipped to Kenya. Out of it the following are generated

LPG

Premium fuel,

Regular fuel

Jet oil

Kerosine

Diesel

Fuel oil

Bitumen for making roads.

All the above are produced in certain proportions and the price of the Barrel must be allocated accordingly. High value products like LPG and premium fuel are allocated higher cost than bitumen and fuel oil per litre.

On top of that the cost of shipping and hauling, import / custom duties, VAT taxes and other related charges like clearing and forwarding are loaded to the base price. The companies that have invested in the import, shipping and stocking of the products must get some return on their investments. The Retailer / dealers must pay salaries and get a return on their investments and so the mark ups are added there too.

All those are added up to get to your price of Shs 90-100 per litre for premium super gas.

If you want to know whether the consumers are overcharged in Kenya, you should compare the prices per litre in USD with other countries. Our prices in Kenya are lower than many other oil importing countries.

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

Liv wrote:joga bonito wrote:Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

@Joga,

Don't allow yourself to be guided by ignorant people. You will soon be like them....

A barrel of crude oil will need to be refined before the refined products are shipped to Kenya. Out of it the following are generated

LPG

Premium fuel,

Regular fuel

Jet oil

Kerosine

Diesel

Fuel oil

Bitumen for making roads.

All the above are produced in certain proportions and the price of the Barrel must be allocated accordingly. High value products like LPG and premium fuel are allocated higher cost than bitumen and fuel oil per litre.

On top of that the cost of shipping and hauling, import / custom duties, VAT taxes and other related charges like clearing and forwarding are loaded to the base price. The companies that have invested in the import, shipping and stocking of the products must get some return on their investments. The Retailer / dealers must pay salaries and get a return on their investments and so the mark ups are added there too.

All those are added up to get to your price of Shs 90-100 per litre for premium super gas.

If you want to know whether the consumers are overcharged in Kenya, you should compare the prices per litre in USD with other countries. Our prices in Kenya are lower than many other oil importing countries. And I know you (@Liv) are not on Gok payroll. Are the rates for Jan/Feb out? The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

jerry wrote:Liv wrote:joga bonito wrote:Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

@Joga,

Don't allow yourself to be guided by ignorant people. You will soon be like them....

A barrel of crude oil will need to be refined before the refined products are shipped to Kenya. Out of it the following are generated

LPG

Premium fuel,

Regular fuel

Jet oil

Kerosine

Diesel

Fuel oil

Bitumen for making roads.

All the above are produced in certain proportions and the price of the Barrel must be allocated accordingly. High value products like LPG and premium fuel are allocated higher cost than bitumen and fuel oil per litre.

On top of that the cost of shipping and hauling, import / custom duties, VAT taxes and other related charges like clearing and forwarding are loaded to the base price. The companies that have invested in the import, shipping and stocking of the products must get some return on their investments. The Retailer / dealers must pay salaries and get a return on their investments and so the mark ups are added there too.

All those are added up to get to your price of Shs 90-100 per litre for premium super gas.

If you want to know whether the consumers are overcharged in Kenya, you should compare the prices per litre in USD with other countries. Our prices in Kenya are lower than many other oil importing countries. And I know you (@Liv) are not on Gok payroll. Are the rates for Jan/Feb out? @Jerry what is your take on Kenyan corporate greed? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: New-farer Joined: 1/12/2016 Posts: 19

|

Spikes wrote:jerry wrote:Liv wrote:joga bonito wrote:Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

@Joga,

Don't allow yourself to be guided by ignorant people. You will soon be like them....

A barrel of crude oil will need to be refined before the refined products are shipped to Kenya. Out of it the following are generated

LPG

Premium fuel,

Regular fuel

Jet oil

Kerosine

Diesel

Fuel oil

Bitumen for making roads.

All the above are produced in certain proportions and the price of the Barrel must be allocated accordingly. High value products like LPG and premium fuel are allocated higher cost than bitumen and fuel oil per litre.

On top of that the cost of shipping and hauling, import / custom duties, VAT taxes and other related charges like clearing and forwarding are loaded to the base price. The companies that have invested in the import, shipping and stocking of the products must get some return on their investments. The Retailer / dealers must pay salaries and get a return on their investments and so the mark ups are added there too.

All those are added up to get to your price of Shs 90-100 per litre for premium super gas.

If you want to know whether the consumers are overcharged in Kenya, you should compare the prices per litre in USD with other countries. Our prices in Kenya are lower than many other oil importing countries. And I know you (@Liv) are not on Gok payroll. Are the rates for Jan/Feb out? @Jerry what is your take on Kenyan corporate greed? @Liv well put, but you still agree that more than 50% of the 90-100 price is govt tax

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

joga bonito wrote:Spikes wrote:jerry wrote:Liv wrote:joga bonito wrote:Spikes wrote:joga bonito wrote:I wonder whats the formula used by ERC, 1 barrel= 159 liters, 1 litre of petrol= 90 kes while 1 barrel= 30USD meaning 1 liter should be 19 kes. You have forgotten the fact that your government is a den of thieves. what will happen when there will be nothing left to be stolen?

@Joga,

Don't allow yourself to be guided by ignorant people. You will soon be like them....

A barrel of crude oil will need to be refined before the refined products are shipped to Kenya. Out of it the following are generated

LPG

Premium fuel,

Regular fuel

Jet oil

Kerosine

Diesel

Fuel oil

Bitumen for making roads.

All the above are produced in certain proportions and the price of the Barrel must be allocated accordingly. High value products like LPG and premium fuel are allocated higher cost than bitumen and fuel oil per litre.

On top of that the cost of shipping and hauling, import / custom duties, VAT taxes and other related charges like clearing and forwarding are loaded to the base price. The companies that have invested in the import, shipping and stocking of the products must get some return on their investments. The Retailer / dealers must pay salaries and get a return on their investments and so the mark ups are added there too.

All those are added up to get to your price of Shs 90-100 per litre for premium super gas.

If you want to know whether the consumers are overcharged in Kenya, you should compare the prices per litre in USD with other countries. Our prices in Kenya are lower than many other oil importing countries. And I know you (@Liv) are not on Gok payroll. Are the rates for Jan/Feb out? @Liv what is your take on Kenyan corporate greed? @Liv well put, but you still agree that more than 50% of the 90-100 price is govt tax John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|