Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

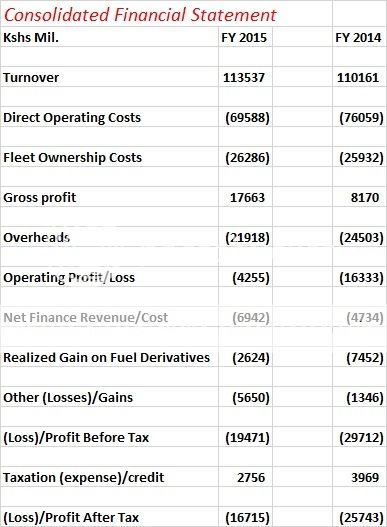

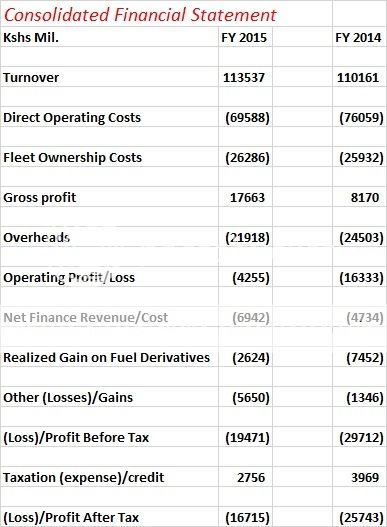

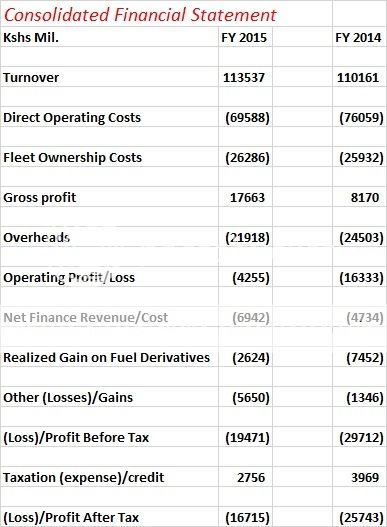

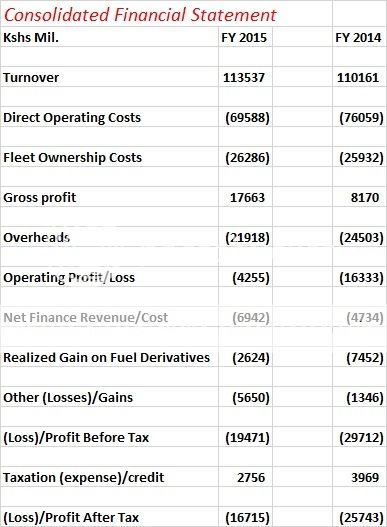

sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. The figures tell a story. The story that KQ will be in trouble for a long long time. Let us review in exactly five months, I have reason to believe the worst is behind us. Todays top gainer?? Problem with KQ is a very weak topline. The company needs to double the topline just to break even. I doubt if they are covering their fixed costs. The topline was impacted by some of the reasons offered by management in previous announcements. However, I see an active management ready to steady the sinking ship/plunging plane which was abused by Naikuni's impropriety.. Based on the macro environment and steps taken to right the operating measures at KQ, its unlikely neigh improbable that the firm shall remain in losses upto their next H1

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Ericsson wrote:@Obiero

VituVingiSana is right

At one point Sunil Shah owned 10% of KCB shares split amongst the following;

Him himself;shares held under his name

Through a nominee account for United Millers that he used to invest in KCB.

But he has been gradually reducing his stake and investing the money in putting up commercial complexes like United Mall in Kisumu Oh. Consolidated holding of related entities.. That I agree :)

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. The figures tell a story. The story that KQ will be in trouble for a long long time. Let us review in exactly five months, I have reason to believe the worst is behind us. Todays top gainer?? Problem with KQ is a very weak topline. The company needs to double the topline just to break even. I doubt if they are covering their fixed costs. The topline was impacted by some of the reasons offered by management in previous announcements. However, I see an active management ready to steady the sinking ship/plunging plane which was abused by Naikuni's impropriety.. Based on the macro environment and steps taken to right the operating measures at KQ, its unlikely neigh improbable that the firm shall remain in losses upto their next H1 Obiero why did u sell your KQ. U r campaigning so hard for its like you still have your 90k shares still yet last time I checked it was 500  ama uliongeza? I'm starting to believe the guy you once reffered to as a new clown (@spikes )

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. The figures tell a story. The story that KQ will be in trouble for a long long time. Let us review in exactly five months, I have reason to believe the worst is behind us. Todays top gainer?? Problem with KQ is a very weak topline. The company needs to double the topline just to break even. I doubt if they are covering their fixed costs. The topline was impacted by some of the reasons offered by management in previous announcements. However, I see an active management ready to steady the sinking ship/plunging plane which was abused by Naikuni's impropriety.. Based on the macro environment and steps taken to right the operating measures at KQ, its unlikely neigh improbable that the firm shall remain in losses upto their next H1 Obiero why did u sell your KQ. U r campaigning so hard for its like you still have your 90k shares still yet last time I checked it was 500  ama uliongeza? I'm starting to believe the guy you once reffered to as a new clown (@spikes )

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. The figures tell a story. The story that KQ will be in trouble for a long long time. Let us review in exactly five months, I have reason to believe the worst is behind us. Todays top gainer?? Problem with KQ is a very weak topline. The company needs to double the topline just to break even. I doubt if they are covering their fixed costs. The topline was impacted by some of the reasons offered by management in previous announcements. However, I see an active management ready to steady the sinking ship/plunging plane which was abused by Naikuni's impropriety.. Based on the macro environment and steps taken to right the operating measures at KQ, its unlikely neigh improbable that the firm shall remain in losses upto their next H1 Obiero why did u sell your KQ. U r campaigning so hard for its like you still have your 90k shares still yet last time I checked it was 500  ama uliongeza? I'm starting to believe the guy you once refered to as a new clown in town (@spikes )

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

@enyands personal reasons.. the new clown said we shall touch KES 2, that made me laugh..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

obiero wrote:@enyands personal reasons.. the new clown said we shall touch KES 2, that made me laugh..

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

If next losses-announcement-fatten and negative equity sinks deeper @obiero you will turn a pure parody dancing the tunes of 2bob per piece amid clad in new black suits for KQ's 2016 demise! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Spikes wrote:If next losses-announcement-fatten and negative equity sinks deeper @obiero you will turn a pure parody dancing the tunes of 2bob per piece amid clad in new black suits for KQ's 2016 demise! Surely with reinstatement of western africa routes, lifting of travel bans, reduction in fuel price, sale of old planes, use of efficient new craft and disposal of land, can KQ really have a wider loss.. If that happens then surely it will delist, but based on slim operating loss in H1, do not be suprised if an operating profit is posted

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:Spikes wrote:If next losses-announcement-fatten and negative equity sinks deeper @obiero you will turn a pure parody dancing the tunes of 2bob per piece amid clad in new black suits for KQ's 2016 demise! Surely with reinstatement of western africa routes, lifting of travel bans, reduction in fuel price, sale of old planes, use of efficient new craft and disposal of land, can KQ really have a wider loss.. If that happens then surely it will delist, but based on slim operating loss in H1, do not be suprised if an operating profit is posted Then why are you not buying KQ by the bucket loads? Put you money where your mouth is or just shush. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

@obiero you want to emphasis that I am likely to miss the flight when KQ takes off? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Whats the worst that can happen? possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? To Each His Own

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

kayhara wrote:Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? 4k for one-way on KQ or JJ? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

kayhara wrote:Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? Yes it makes sense but the guys doing the pricing are shitty characters to say the least,oblivious of reality. possunt quia posse videntur

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

maka wrote:kayhara wrote:Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? Yes it makes sense but the guys doing the pricing are shitty characters to say the least,oblivious of reality. KQ is trying to maximize on the last-minute flyers. Is it 16k one-way in economy? The idea is that whoever needs to fly will fly and pay 16k. My view is that you can do so when enough seats are sold out & the flight is breakeven so any 'new' passengers are 90% profit. The problem is that flying breakeven flights is not profitable but flying profitable is profitable. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 5/5/2011 Posts: 1,059

|

VituVingiSana wrote:maka wrote:kayhara wrote:Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? Yes it makes sense but the guys doing the pricing are shitty characters to say the least,oblivious of reality. KQ is trying to maximize on the last-minute flyers. Is it 16k one-way in economy? The idea is that whoever needs to fly will fly and pay 16k. My view is that you can do so when enough seats are sold out & the flight is breakeven so any 'new' passengers are 90% profit. The problem is that flying breakeven flights is not profitable but flying profitable is profitable. That's economy funnier still I tried buying a ticket online for a friend and the same flight was now full, the friend drove, I get on the plane and it's not even half full plus is was the big Boeing not the usual Embraer SMH, someone kick sense into Ngunze or is gunze To Each His Own

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

"Profits always take care of themselves but losses never do." Jesse L. Livermore Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

The shareholders of KQ need to fire the current board and management and hire Delta by selling them a significant stake in the business and run KQ. http://www.bloomberg.com...lta-really-run-try-five

Check this out re: Oil prices http://www.cnbc.com/2015...24-years-time-opec.html

And how Delta bought cheap planes for cash instead of expensive new planes using debt. http://www.bloomberg.com...d-out-boeing-stock-gain

And this. http://www.wsj.com/artic...06404578072960852910072

Delta's shares are +400% since 2011 ($13 in Jan 2011 & now $49) vs KQ which was 40-ish in Jan 2011 & now at 5/-. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 5/28/2014 Posts: 149 Location: Nairobi

|

kayhara wrote:VituVingiSana wrote:maka wrote:kayhara wrote:Someone please educate me on KQ pricing formula I am taking a flight from Mombasa to Nairobi, the plane is about half full and tickets going from 16k, I paid early at 4k wouldn't it make more sense to lower prices to get more passengers? Yes it makes sense but the guys doing the pricing are shitty characters to say the least,oblivious of reality. KQ is trying to maximize on the last-minute flyers. Is it 16k one-way in economy? The idea is that whoever needs to fly will fly and pay 16k. My view is that you can do so when enough seats are sold out & the flight is breakeven so any 'new' passengers are 90% profit. The problem is that flying breakeven flights is not profitable but flying profitable is profitable. That's economy funnier still I tried buying a ticket online for a friend and the same flight was now full, the friend drove, I get on the plane and it's not even half full plus is was the big Boeing not the usual Embraer SMH, someone kick sense into Ngunze or is gunze I never understand that...Booking a ticket last week I got the message that there are only 2 seats left. In choosing a seat this weekend, there were only 3 seats to choose from. When I got to the airport I asked if I could get one further ahead. They said, yes of course. I got the first row after business class. The seat next to me was empty, and so were many others. When you live for others' opinions, you are dead.

- Carlos Slim Helu

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|