Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

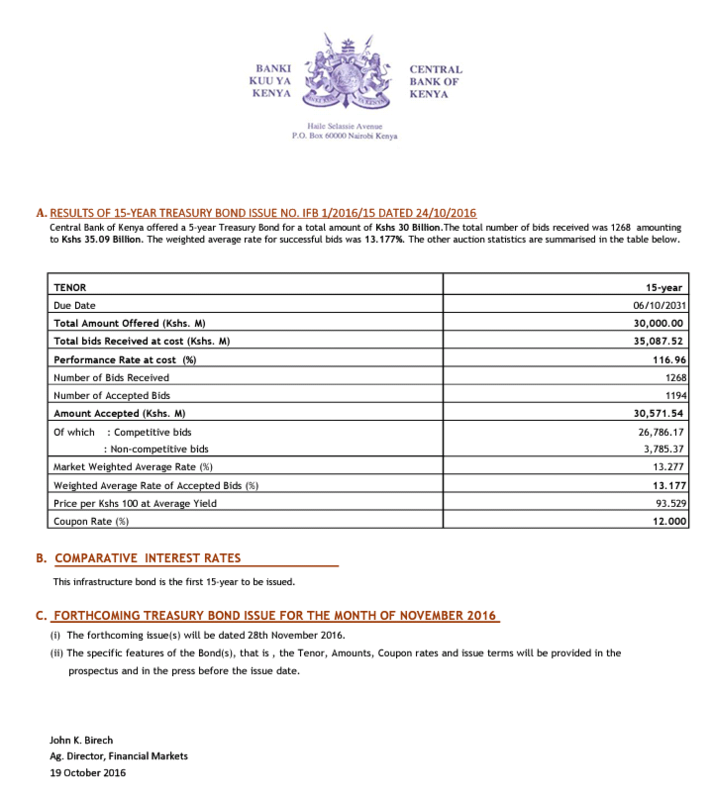

Expected to come in at 13.20 -13.50....IFB 11 possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

maka wrote:Expected to come in at 13.20 -13.50....IFB 11

My goodness.....why would you expect it to be that high?

I would expect to be 12.25-12.50 quoted yield..... Why do you think the market will be that aggressive?

|

|

|

Rank: Member Joined: 11/17/2009 Posts: 399 Location: Where everyone knows you

|

maka wrote:Expected to come in at 13.20 -13.50....IFB 11 @Maka, What is IFB 11. The one on offer at the moment is IFB/1/2016/15 with a coupon of 12%. I don't like anything over 5 years and prefer 2 year bonds. I might go for 1 million, as this will be fully redeemed in 5 years. I wonder when the next 2 year bond will be offered. Maybe next month or December. The last ones were in January and May. About time I think Regards

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

Liv wrote:maka wrote:Expected to come in at 13.20 -13.50....IFB 11

My goodness.....why would you expect it to be that high?

I would expect to be 12.25-12.50 quoted yield..... Why do you think the market will be that aggressive? Si I thought it was fixed at 12%? Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

Impunity wrote:Liv wrote:maka wrote:Expected to come in at 13.20 -13.50....IFB 11

My goodness.....why would you expect it to be that high?

I would expect to be 12.25-12.50 quoted yield..... Why do you think the market will be that aggressive? Si I thought it was fixed at 12%?

The coupon rate is fixed at 12%. But depending on how the market players will bid, there will be a derived quoted yield .... If the average bid accepted by CBK will be at discount the quoted yield will be higher than the coupon rate. E.g. If CBK asks you to pay Shs 99,500 for a Shs 100,000 bond amount, the quoted yield will be 12.06% after a discount of Shs 500 or 0.5%.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,929

|

Liv wrote:Impunity wrote:Liv wrote:maka wrote:Expected to come in at 13.20 -13.50....IFB 11

My goodness.....why would you expect it to be that high?

I would expect to be 12.25-12.50 quoted yield..... Why do you think the market will be that aggressive? Si I thought it was fixed at 12%?

The coupon rate is fixed at 12%. But depending on how the market players will bid, there will be a derived quoted yield .... If the average bid accepted by CBK will be at discount the quoted yield will be higher than the coupon rate. E.g. If CBK asks you to pay Shs 99,500 for a Shs 100,000 bond amount, the quoted yield will be 12.06% Avogadro  In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Angelica _ann wrote:Liv wrote:Impunity wrote:Liv wrote:maka wrote:Expected to come in at 13.20 -13.50....IFB 11

My goodness.....why would you expect it to be that high?

I would expect to be 12.25-12.50 quoted yield..... Why do you think the market will be that aggressive? Si I thought it was fixed at 12%?

The coupon rate is fixed at 12%. But depending on how the market players will bid, there will be a derived quoted yield .... If the average bid accepted by CBK will be at discount the quoted yield will be higher than the coupon rate. E.g. If CBK asks you to pay Shs 99,500 for a Shs 100,000 bond amount, the quoted yield will be 12.06% Avogadro  @Impuntiy unaniangusha its an auction guys throw in bids you can even quote 20% and miss properly thats why you should have a general idea where current rates are with that you tend to have a rough idea where the bids will fall...@I hereby revise my earlier prediction to 12.70 -13.20.  possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 11/14/2006 Posts: 1,311

|

@Maka,

On what basis 12.70 - 13.20?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Liv wrote:@Maka,

On what basis 12.70 - 13.20?

Market Intel... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 10/1/2009 Posts: 2,436

|

@Maka, I thought this was a fixed coupon, no bidding?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Intelligentsia wrote:@Maka, I thought this was a fixed coupon, no bidding? Even if the coupon is fixed guys still bid. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

maka wrote:Intelligentsia wrote:@Maka, I thought this was a fixed coupon, no bidding? Even if the coupon is fixed guys still bid. I too thought that when the gaamnent says "fixed coupon" then no haggling allowed. I was wrong and seemingly tuko wengi. @maka,are guys placing less than 1M allowed to bid ama if they do that they will automatically disquolified? Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Impunity wrote:maka wrote:Intelligentsia wrote:@Maka, I thought this was a fixed coupon, no bidding? Even if the coupon is fixed guys still bid. I too thought that when the gaamnent says "fixed coupon" then no haggling allowed. I was wrong and seemingly tuko wengi. @maka,are guys placing less than 1M allowed to bid ama if they do that they will automatically disquolified? Above 20mio you have to bid....below 20mio it's not a must you can apply at average....but to answer you yes you can put in a competitive bid even at 100k. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

What sort of commission do brokers charge when selling a bond?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

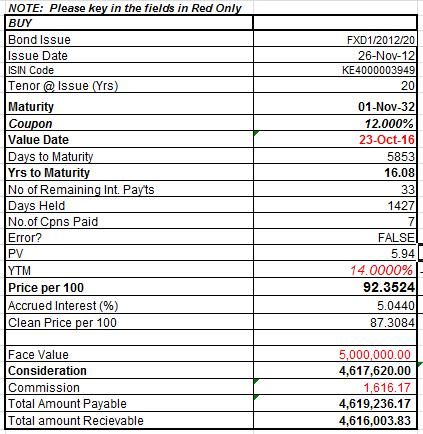

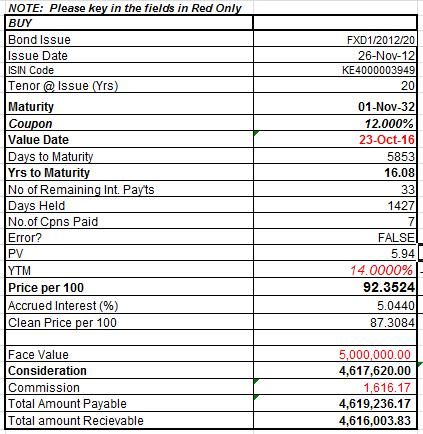

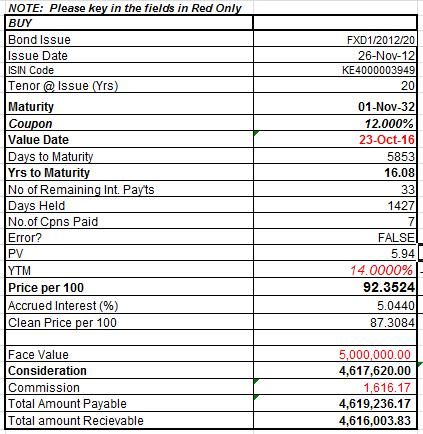

Chaka wrote:What sort of commission do brokers charge when selling a bond? 0.00024% lets just say its negligible. possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/16/2007 Posts: 2,114

|

maka wrote:Chaka wrote:What sort of commission do brokers charge when selling a bond? 0.00024% lets just say its negligible. Ok,then they may not be keen to sell small lots?

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

maka wrote:Chaka wrote:What sort of commission do brokers charge when selling a bond? 0.00024% lets just say its negligible.  Check out the comms for 5 mio...but most brokers they have set the minimum as 500 bob...so if you transact 100,000...you will be charged 500 bob possunt quia posse videntur

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

maka wrote:maka wrote:Chaka wrote:What sort of commission do brokers charge when selling a bond? 0.00024% lets just say its negligible.  Check out the comms for 5 mio...but most brokers they have set the minimum as 500 bob...so if you transact 100,000...you will be charged 500 bob How do Bond brokers make money then if the commision is so tiny hivi? Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Impunity wrote:maka wrote:maka wrote:Chaka wrote:What sort of commission do brokers charge when selling a bond? 0.00024% lets just say its negligible.  Check out the comms for 5 mio...but most brokers they have set the minimum as 500 bob...so if you transact 100,000...you will be charged 500 bob How do Bond brokers make money then if the commision is so tiny hivi? Arbitrage.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

maka wrote:Liv wrote:@Maka,

On what basis 12.70 - 13.20?

Market Intel... Like I said...  possunt quia posse videntur

|

|

|

Wazua

»

Investor

»

Bonds

»

Treasury Bills and Bonds

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|