Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Chief Joined: 1/3/2007 Posts: 18,323 Location: Nairobi

|

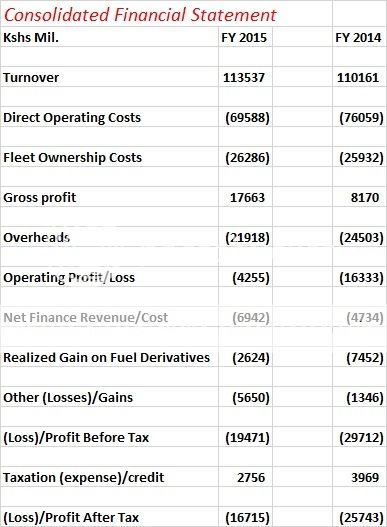

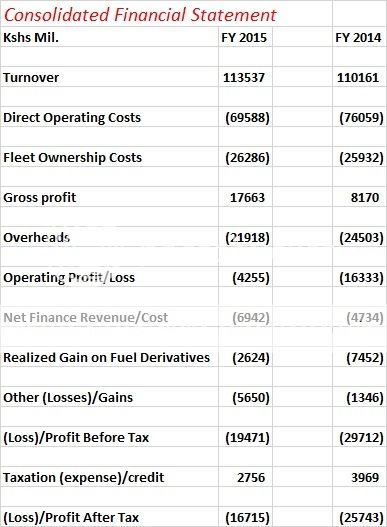

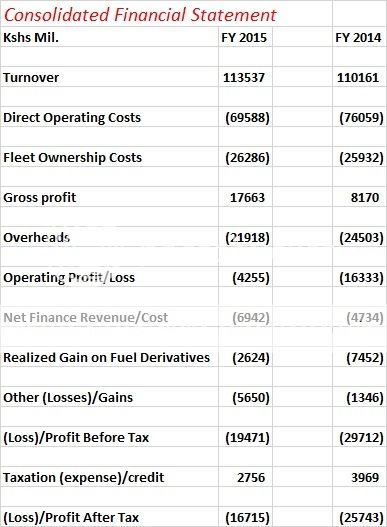

Negative Shareholders Equity of 33bn. Let's put that into perspective. KQ needs to make PAT of 3.3bn/year for 10 years before it gets to positive territory. 10 years. What was the PAT for the BEST year that KQ had? If you invest 5/- in KQ by buying shares of KQ vs 5/- in 13% (net of tax) IFB ... the IFB interest for 10 years = 7.50 (compounded interest) + 5/- principal = 12.50 Anyway, off to KK & KenRe I go. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

qw25041985 wrote:Thanx God not all of us are maths genius. Coz if every kenya airways shareholder knew that operatin margin is massively down like this then the share wld be tradin at ksh 1.00. I side with @proverb. And i willnt get suprised if this share breaks its downward support level of ksh 50.00. Trappin those who bought at ksh 54.00 in losses. This is the time most of u will regret the herd mentallity at wazua. blast from the past

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,323 Location: Nairobi

|

obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Boris Boyka wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! @HAFR is trading at KES 1.30 headed lower.. It will be the first share to trade at less than a shilling at the NSE.. On KQ, @VVS was right to a given extent. It must not be assumed that I was not aware that my share had slide from an average buy price of KES 8.76. I was aware I was running a loss position and the portfolio was held constant at 63,800 shares since the full year results despite myself having copious amounts of cash.. Cowards live longer.. Tafakari hayo

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

obiero wrote:Boris Boyka wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! @HAFR is trading at KES 1.30 headed lower.. It will be the first share to trade at less than a shilling at the NSE.. On KQ, @VVS was right to a given extent. It must not be assumed that I was not aware that my share had slide from an average buy price of KES 8.76. I was aware I was running a loss position and the portfolio was held constant at 63,800 shares since the full year results despite myself having copious amounts of cash.. Cowards live longer.. Tafakari hayo Bravery is not a wise thing. I vividly recall the day you openly asked for advice on KQ, I told you I have bailed out at a loss but redirected the cash in other stocks which successfully covered for the loss. All wazuans advised quitting honourably but You stayed put; signs of a gambler. Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Boris Boyka wrote:obiero wrote:Boris Boyka wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! @HAFR is trading at KES 1.30 headed lower.. It will be the first share to trade at less than a shilling at the NSE.. On KQ, @VVS was right to a given extent. It must not be assumed that I was not aware that my share had slide from an average buy price of KES 8.76. I was aware I was running a loss position and the portfolio was held constant at 63,800 shares since the full year results despite myself having copious amounts of cash.. Cowards live longer.. Tafakari hayo Bravery is not a wise thing. I vividly recall the day you openly asked for advice on KQ, I told you I have bailed out at a loss but redirected the cash in other stocks which successfully covered for the loss. All wazuans advised quitting honourably but You stayed put; signs of a gambler. @Boris. Gambler is exactly the wrong word. Long term investor is preferable.. :) I didnt load up more. Otherwise, I woild be having a loss in excess of half a million. My portfolio in investment includes properties which are fairing well. I sold KQ in a bear hence making the loss look larger than necessary, but trust me I shall be back in this share.. Also remember, that inorder to make a gain in stock trading, someone else make make a loss. This time around, I am that someone :(

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

VituVingiSana wrote:Negative Shareholders Equity of 33bn. Let's put that into perspective. KQ needs to make PAT of 3.3bn/year for 10 years before it gets to positive territory. 10 years.

What was the PAT for the BEST year that KQ had?

If you invest 5/- in KQ by buying shares of KQ vs 5/- in 13% (net of tax) IFB ... the IFB interest for 10 years = 7.50 (compounded interest) + 5/- principal = 12.50

Anyway, off to KK & KenRe I go.  No. 1 fan. Shore up yourself and tell the children the Truth. As you are a holder of KK, how long did KK take to get out of doldrums? What did KK do as well? You make winning sweet..!

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

VituVingiSana wrote:Negative Shareholders Equity of 33bn. Let's put that into perspective. KQ needs to make PAT of 3.3bn/year for 10 years before it gets to positive territory. 10 years.

What was the PAT for the BEST year that KQ had?

If you invest 5/- in KQ by buying shares of KQ vs 5/- in 13% (net of tax) IFB ... the IFB interest for 10 years = 7.50 (compounded interest) + 5/- principal = 12.50

Anyway, off to KK & KenRe I go. @vvs am done with my weeks confessions but I must confess I have  and may you chew it down. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

Just surprised lenders especially local ones have not moved to recall their debt. -33B equity suggests they are tottering on collapse. They will very soon be unable to meet basic obligations like salaries.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Kausha wrote:Just surprised lenders especially local ones have not moved to recall their debt. -33B equity suggests they are tottering on collapse. They will very soon be unable to meet basic obligations like salaries. going by current trend. ceteris paribus, the full year should bring up the following:

KQ ABP 4.26

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

Very interesting that the shrank capacity across all markets and called it tactical. Could it be the competition is beginning to strangle them.

Reduction in oil prices and the nice dollar rate helped their top line.

A company that borrows to service debt is something an equity investor should exit asap. I don't see KQ repaying Kshs 167B. Something will have to give. The lenders who lent them $200m have the appetite of equity investors. This KQ will require some serious work to return to normalcy which looks extremely remote at this point.

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

Very interesting that the shrank capacity across all markets and called it tactical. Could it be the competition is beginning to strangle them.

Reduction in oil prices and the nice dollar rate helped their top line.

A company that borrows to service debt is something an equity investor should exit asap. I don't see KQ repaying Kshs 167B. Something will have to give. The lenders who lent them $200m have the appetite of equity investors. This KQ will require some serious work to return to normalcy which looks extremely remote at this point.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

obiero wrote:Kausha wrote:Just surprised lenders especially local ones have not moved to recall their debt. -33B equity suggests they are tottering on collapse. They will very soon be unable to meet basic obligations like salaries. going by current trend. ceteris paribus, the full year should bring up the following:  The capacity have been reduced and yet you see an improved annual revenue...how now? Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Impunity wrote:obiero wrote:Kausha wrote:Just surprised lenders especially local ones have not moved to recall their debt. -33B equity suggests they are tottering on collapse. They will very soon be unable to meet basic obligations like salaries. going by current trend. ceteris paribus, the full year should bring up the following:  The capacity have been reduced and yet you see an improved annual revenue...how now? Most of the forecast figures are direct mutiplication of the just released H1.. i.e 56,720 * 2 = KES 113,440 adjusted with margin of error +-4%.. Obviously some of the gains and costs reported in H1 such as the fuel derivatives and FX losses were one offs, thus heavier positive bias when forecasting.. Financials sector analysis is more accurate using models since there is less turbulance in that sector, but generally speaking for KQ, shit has hit the fan..

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

obiero wrote:Boris Boyka wrote:obiero wrote:Boris Boyka wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! @HAFR is trading at KES 1.30 headed lower.. It will be the first share to trade at less than a shilling at the NSE.. On KQ, @VVS was right to a given extent. It must not be assumed that I was not aware that my share had slide from an average buy price of KES 8.76. I was aware I was running a loss position and the portfolio was held constant at 63,800 shares since the full year results despite myself having copious amounts of cash.. Cowards live longer.. Tafakari hayo Bravery is not a wise thing. I vividly recall the day you openly asked for advice on KQ, I told you I have bailed out at a loss but redirected the cash in other stocks which successfully covered for the loss. All wazuans advised quitting honourably but You stayed put; signs of a gambler. @Boris. Gambler is exactly the wrong word. Long term investor is preferable.. :) I didnt load up more. Otherwise, I woild be having a loss in excess of half a million. My portfolio in investment includes properties which are fairing well. I sold KQ in a bear hence making the loss look larger than necessary, but trust me I shall be back in this share.. Also remember, that inorder to make a gain in stock trading, someone else make make a loss. This time around, I am that someone :( Fine. I know where the money went to  . Soiling hands of ppl approving mjengo. Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Boris Boyka wrote:obiero wrote:Boris Boyka wrote:obiero wrote:Boris Boyka wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:No more 20/-... already trading steady to up today with plenty of buyers ready at 50/-... @vvs could you be related to @kalonzo.. you were ready to buy at 50/-.. but now you pillory your ex I chose to leave the abusive relationship. Not even Friends with benefits!    Heck, even Warren Buffett chose to dump his airline holdings... And warned others not to enter into financial arrangements with gold diggers. This is an enjoyable battle after the @obiero vs @WAI 254Guru battle stopped prematurely! @HAFR is trading at KES 1.30 headed lower.. It will be the first share to trade at less than a shilling at the NSE.. On KQ, @VVS was right to a given extent. It must not be assumed that I was not aware that my share had slide from an average buy price of KES 8.76. I was aware I was running a loss position and the portfolio was held constant at 63,800 shares since the full year results despite myself having copious amounts of cash.. Cowards live longer.. Tafakari hayo Bravery is not a wise thing. I vividly recall the day you openly asked for advice on KQ, I told you I have bailed out at a loss but redirected the cash in other stocks which successfully covered for the loss. All wazuans advised quitting honourably but You stayed put; signs of a gambler. @Boris. Gambler is exactly the wrong word. Long term investor is preferable.. :) I didnt load up more. Otherwise, I woild be having a loss in excess of half a million. My portfolio in investment includes properties which are fairing well. I sold KQ in a bear hence making the loss look larger than necessary, but trust me I shall be back in this share.. Also remember, that inorder to make a gain in stock trading, someone else make make a loss. This time around, I am that someone :( Fine. I know where the money went to  . Soiling hands of ppl approving mjengo. Usicheke kaka.. Building has stress

KQ ABP 4.26

|

|

|

Rank: Hello Joined: 11/15/2015 Posts: 1 Location: Canada

|

Thank you so much for the high quality post. I have been following the comments. <a href="http://www.cutewriters.com">I shall create an essay out of the comments</a>

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|