Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

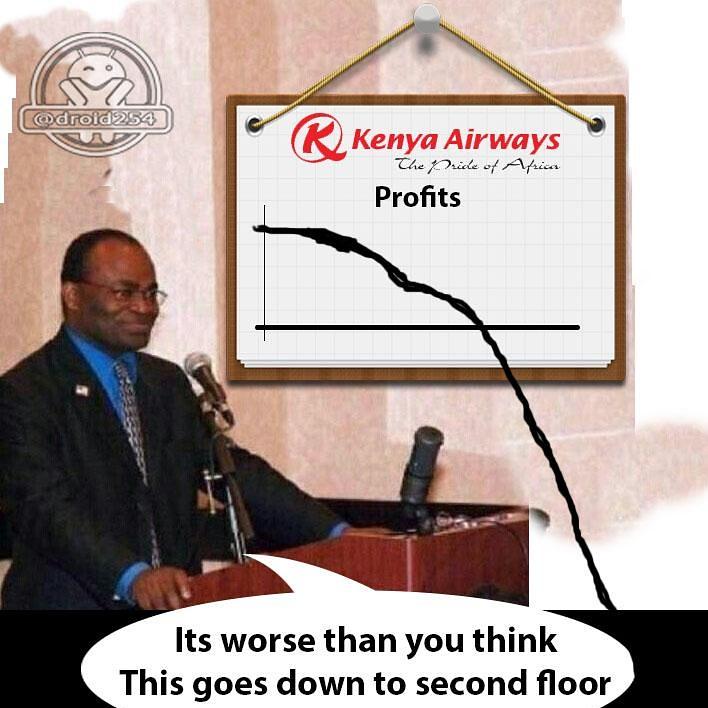

Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

How comes that DJCK who we have all crowned to be smart is also getting shafted like everyone else?.... I wonder how much he holds. Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

1. Fleet expansion without revenue growth is creating a bigger giant with a softer underbelly. 2. KQ makes money for everyone else except the shareholders. But now even KQ have outdone themselves. I have no more words on KQ. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

obiero wrote:Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing If you remove the 5B "paper loss" due hedging, we still have 20B loss...how can a company making revenue upwards of 110B and spending 130B expected to survive and recover? What areas can be done away with or tighten to loosen up some cash? Can they return say 50% of those bland (yes, bland) new planes, pay the fines and save on rent? Also may be ask pilots to accelerates the aircraft very fast for the first half of the journey high up then let the bird "free-wheel" to the final destination, this will save much fuel! But I am a layman. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 6/8/2013 Posts: 2,517

|

"😖😡KQ makes money for everyone except the shareholder 😏😏 " overheard in Wazua

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

ike wrote:maka wrote:mlennyma wrote:[quote=ike]On the bright side, Gunze seems like a bright guy.I liked the way he kept shareholders optimistic by cleverly, clearly and honestly answering the questions. true,but he needs the money to transform kq I listened to him,he is a great mind. He might be bright but the one guy who would have taken KQ places is one Yves Guibert...this fellow would blow you away with his knowledge on the airline industry. https://www.kenya-airway...mation/Management_Team/[/quote] A firm knowledge of the industry is important but there is that extra factor to leadership. Confirmed as COO possunt quia posse videntur

|

|

|

Rank: Veteran Joined: 8/10/2014 Posts: 992 Location: Kenya

|

Have you read this detailed report of what is allegedly happening inside Kenya Airways. Was done 3 months ago http://www.kahawatungu.c...ase-operation-very-soon/

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

maka wrote:ike wrote:maka wrote:mlennyma wrote:[quote=ike]On the bright side, Gunze seems like a bright guy.I liked the way he kept shareholders optimistic by cleverly, clearly and honestly answering the questions. true,but he needs the money to transform kq I listened to him,he is a great mind. He might be bright but the one guy who would have taken KQ places is one Yves Guibert...this fellow would blow you away with his knowledge on the airline industry. https://www.kenya-airway...mation/Management_Team/[/quote] A firm knowledge of the industry is important but there is that extra factor to leadership. Confirmed as COO DoR. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Veteran Joined: 3/12/2010 Posts: 1,199 Location: Eastlander

|

Still a crap stock. Pole to the investors. It is not fully dead yet.. but my condolences nevertheless. Revival crusades ongoing ..Let your light so shine before men, that they may see your good works, and glorify your Father which is in heaven...Matt5:16

- 1769 Oxford King James Bible 'Authorized Version

|

|

|

Rank: Veteran Joined: 8/16/2009 Posts: 994

|

Impunity wrote:obiero wrote:Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing If you remove the 5B "paper loss" due hedging, we still have 20B loss...how can a company making revenue upwards of 110B and spending 130B expected to survive and recover? What areas can be done away with or tighten to loosen up some cash? Can they return say 50% of those bland (yes, bland) new planes, pay the fines and save on rent? Also may be ask pilots to accelerates the aircraft very fast for the first half of the journey high up then let the bird "free-wheel" to the final destination, this will save much fuel!But I am a layman. Nice one....  Time is money, so money is time. Money saved is time gained in reverse! Money stores your life’s energy. You expend your energy, get paid money, and store that money for a future purchase made in a currency.

|

|

|

Rank: Member Joined: 1/21/2013 Posts: 427

|

Gatheuzi wrote:Impunity wrote:obiero wrote:Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing If you remove the 5B "paper loss" due hedging, we still have 20B loss...how can a company making revenue upwards of 110B and spending 130B expected to survive and recover? What areas can be done away with or tighten to loosen up some cash? Can they return say 50% of those bland (yes, bland) new planes, pay the fines and save on rent? Also may be ask pilots to accelerates the aircraft very fast for the first half of the journey high up then let the bird "free-wheel" to the final destination, this will save much fuel!But I am a layman. Nice one....

|

|

|

Rank: New-farer Joined: 10/2/2012 Posts: 21

|

And the drama continues.... http://www.standardmedia.co.ke/...managers-probed?pageNo=2  Money is like manure. You have to spread it around or it smells. ~ J. Paul Getty

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,323 Location: Nairobi

|

Here is my take if you want to buy KQ shares. If you have 100,000/- buy a 2 year T-Bond. After 2 years buy KQ shares. I doubt KQ will make significant gains that can beat 12% on bonds. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

VituVingiSana wrote:Here is my take if you want to buy KQ shares.

If you have 100,000/- buy a 2 year T-Bond. After 2 years buy KQ shares. I doubt KQ will make significant gains that can beat 12% on bonds. with panic selling you can double your fortune in a month it will depend on the extend of panic by especially wanjikus "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 3/29/2011 Posts: 2,242

|

A colleague just lost his baggage while on KQ flight and is swearing never to fly them again. This airline has just too many problems and would be be left to die naturally and a new airline picks up and starts afresh. A PR stunt with Sir Charles and Manu is a script from the past, holding nothing for the future. "Things that matter most must never be at the mercy of things that matter least." Goethe

|

|

|

Rank: Elder Joined: 7/10/2008 Posts: 9,131 Location: Kanjo

|

Gatheuzi wrote:Impunity wrote:obiero wrote:Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing If you remove the 5B "paper loss" due hedging, we still have 20B loss...how can a company making revenue upwards of 110B and spending 130B expected to survive and recover? What areas can be done away with or tighten to loosen up some cash? Can they return say 50% of those bland (yes, bland) new planes, pay the fines and save on rent? Also may be ask pilots to accelerates the aircraft very fast for the first half of the journey high up then let the bird "free-wheel" to the final destination, this will save much fuel!But I am a layman. Nice one....  Very funny coming from an engineer.  i.am.back!!!!

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,161 Location: nairobi

|

Now that all is said and done.. How much lower can the share slide?? Can it go below kobole?? God forbid ooh..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

obiero wrote:Impunity wrote:snipermnoma wrote:A loss was on the cards but surely not this huge! For those holding KQ this must be so brutally painful. May be this is some kind of "book value" loss, its not actual cheda lost..25B is too much to be a loss for the company of that size. Wacha tungoje arm chair analyst waendelee kuanlayze numbers. Numbers though may lie. No. Most of it isnt 'book value' loss. Its actual money lost on the overhead as well as fleet costs. Only the unrealised loss of 5b from hedging can be said as 'paper loss'.. Miujiza haya. No wonder DJCK called it bullshit in the media briefing https://en.m.wikipedia.o...rpetual_motion_machines

The above makes good reading for the engineer! The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Member Joined: 3/20/2009 Posts: 348

|

obiero wrote:Now that all is said and done.. How much lower can the share slide?? Can it go below kobole?? God forbid ooh.. Going by everything Mbuvi has said since he became CEO and also on all TV networks after the disastrous losses it seems a chapter 11 bankruptcy is in the making and this will wipe all shareholders value.either a reorganization type bankruptcy or the GOK lends them like 40 bill at 2-3% with a 20 plus year loan term then hire a CEO who has been able to turn around a big airline from bankruptcy.

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|