Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:July inflation hits 6% - http://www.nation.co.ke/...0/-/cihs02/-/index.html Bottomed out, now heading north. CBK is 9%. Above that level stocks begin to slid. VAT bill on the way, volatile oil, current account deficit... Sovereign bond saving grace for now... Month on Month inflation is looking good at 0.2%. At the MoM rate, we will remain below 7% YoY inflation rate for a long while. If we get a respite from oil, inflation will remain low even with the VAT bill ... closing the current account gap is much needed ... #Economy Outlook is Upbeat #Challenges Abound

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Interesting this mpesa example on how to improve efficiency and money velocity. Money velocity in an instant. No wonder CBK roped in mpesa. They must be amazed - http://www.businessdaily.../-/t614ftz/-/index.html I saw an article stating that cheques will now clear in 24 hrs in KE... Competing for realtime settlement like mobile money. I can only imagine if 50% of the daily biz turnover for the entire econ could be settled in a day, the money velocity would be a global case study. Definitely KE is heading towards a cashless society maybe in a decade's time... Mobile money revolution will forcefully change the archaic banking system. Many financial firms resisting this disruption will fall on the way side... Financial revolution is happening in KE and the whole world is taking notes  *** At some point it'll be a big 'sin' for mobile money platforms to fail considering the effect they'll be having on the money chain as well as the influence that will have on the GDP... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Equity Bank has criticised Safaricom over its continued refusal to open up the M-Pesa platform to enable its users transact business with other mobile money networks. The commercial bank said this has kept the cost of mobile money transaction high and may hinder further growth in the mobile commerce in Kenya. Equity Bank joins the other mobile operators, Airtel and Essar Telecom, who have been pushing for cross network operations in mobile money business. "Financial services by nature should be inter-operable,” said John Staley, chief officer for finance, innovation and technology at Equity. "Kenya has not seen much of this as one of the operators has tried as much as possible to be on a closed loop,"Stanley said. http://www.the-star.co.ke/news/...esa-lines-should-be-open

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:Equity Bank has criticised Safaricom over its continued refusal to open up the M-Pesa platform to enable its users transact business with other mobile money networks. The commercial bank said this has kept the cost of mobile money transaction high and may hinder further growth in the mobile commerce in Kenya. Equity Bank joins the other mobile operators, Airtel and Essar Telecom, who have been pushing for cross network operations in mobile money business. "Financial services by nature should be inter-operable,” said John Staley, chief officer for finance, innovation and technology at Equity. "Kenya has not seen much of this as one of the operators has tried as much as possible to be on a closed loop,"Stanley said. http://www.the-star.co.ke/news/...esa-lines-should-be-open Daft regulator (CCK) = disordered industry. Mpesa bank will squeeze that lemon until the regulator styles up. If it were CBK, things would be different.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

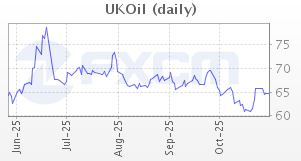

I don't like how oil price is coiling up... Global fundies don't support lofty oil prices, but geopolitics is quite tense where oil matters. MPs faceoff on the VAT bill means things are getting tense in the house. Interesting fight. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

^ that's a major contributor to this

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:mwekez@ji wrote:Equity Bank has criticised Safaricom over its continued refusal to open up the M-Pesa platform to enable its users transact business with other mobile money networks. The commercial bank said this has kept the cost of mobile money transaction high and may hinder further growth in the mobile commerce in Kenya. Equity Bank joins the other mobile operators, Airtel and Essar Telecom, who have been pushing for cross network operations in mobile money business. "Financial services by nature should be inter-operable,” said John Staley, chief officer for finance, innovation and technology at Equity. "Kenya has not seen much of this as one of the operators has tried as much as possible to be on a closed loop,"Stanley said. http://www.the-star.co.ke/news/...esa-lines-should-be-open Daft regulator (CCK) = disordered industry. Mpesa bank will squeeze that lemon until the regulator styles up. If it were CBK, things would be different. Time is ripe for this to become an MPesa Bank under CBK. We need it to move to the next level. I read that it has improved access to financial services in Kenya from as low as 20 per cent to more than 50 per cent.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Luxury brands flock to Kenya as middle class tastes growThe number of Kenyans classified as middle class has doubled in the last decade to almost a fifth of the population or 6.5 million Kenyans, data from the African Development Bank (AfDB) shows. It means that one out of every five Kenyans is considered middle class — a status mostly defined by tertiary educated persons holding salaried jobs or owning small businesses, urban residency and ownership of household goods such as refrigerators, phones, flat screen TVs and automobiles. The African Development Bank defines persons with an annual income exceeding Sh340,000 per year and spending between Sh500 and Sh900 ($6 and $10) daily as being in the middle class but experiential analysis suggests this is too low.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Kilifi mining firm ventures into cement production Duma Group which is a mining operator based in Kilifi County has entered into the commercial production of cement to tap on the emerging opportunities in the real estate industry. "Our pricing will be lower than other cement prices in the market. As a new company, we will try to be price conscious lower than what other companies are offering as we strive to create a market niche in the country,’’ said Naja Dahmani who is an investor from Italy. The firm will now be competing with renowned cement manufactures in the country among them Bamburi Cement, East African Portland Cement and the Athi River Mining Company (ARM). The firm said it will be targeting real estate developers as well as the road contractors who intend to use their products.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

"The shilling has been on a slow decline, trading at Sh87.50 on Tuesday, down from Sh84 to the dollar three months ago."

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:"The shilling has been on a slow decline, trading at Sh87.50 on Tuesday, down from Sh84 to the dollar three months ago." 88/- level has been getting CBK defensive, but 90 is likely to print with the sustained oil price upward pressure.

If tbills vault up, the KES slide will be stemmed, but that affects the slashing of lending rates.

#Dilemma...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Recovery not. Just hopium of a recovery - http://www.bloomberg.com...fine-look-at-italy.html

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Kenyan firms increase appetite for India, China goods• KRA customs data for the first five months of the year shows that India and China have widened their lead over other exporters to Kenya. • The import bill from India’s suppliers leapt 13.4 per cent to Sh87 billion in the period from Sh74.5 billion recorded last year. • Over the same period, imports from China grew four per cent from Sh63.8 billion to Sh66.3 billion. • While imports from the UK increased to Sh21.9 billion from Sh17.8 billion by May last year and those from US dropped to Sh25 billion from Sh28.7 billion last year, the figures pale in comparison to import trade with Asia. • When export destinations are taken on individual basis, the UK is usually the second-largest export destination for Kenya’s goods after Uganda.

|

|

|

Wazua

»

Investor

»

Economy

»

Kenya Economy Watch

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|