Wazua

»

SME

»

Legal

»

Import Duties - Is there a list?

Rank: Member Joined: 1/22/2011 Posts: 322 Location: Chicago, IL, USA

|

Hello fellow Wazuans,

Where can I find a simple list or spreadsheet outlining the percentages that need to be paid for import duties across various types of imports?

I'm specifically wondering about farm equipment and power tools, and the list of zero-rated items.

Thanks!

Best,

Hill

|

|

|

Rank: Elder Joined: 11/26/2008 Posts: 2,097

|

Check the KRA website, on customs download. www.kra.go.keHere is the common external tariff to EA Community. http://www.kra.go.ke/cus...0Externaltariff2007.pdf

Geneally Agricultural equipments dont attract Import duty, perhaps only 2.25% IDF fee. "Never regret, if its good, its wonderful. If its bad, its experience."

|

|

|

Rank: Member Joined: 1/22/2011 Posts: 322 Location: Chicago, IL, USA

|

Thank you Tebes. I had looked and looked and couldn't find it. Many thanks.

Best,

Hill

|

|

|

Rank: Veteran Joined: 11/9/2009 Posts: 2,003

|

@Tebes, thank you. That list is damn complex! As I try to find my way there, any comments on the following. I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs? How do they come up with these figures? The gadget is meant for programming tests purposes and no commercial use as of now!

|

|

|

Rank: Veteran Joined: 9/11/2007 Posts: 816

|

Tebes wrote:Check the KRA website, ...http://www.kra.go.ke/customs/pdf/EAC%20Externaltariff2007.pdf

.... Asante Tebes radio wrote:I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs?

.... Thats the very reason so many use other methods kama wale waria kesom/Salhiya ama Morey. No 'Surprises'!

|

|

|

Rank: Member Joined: 1/22/2011 Posts: 322 Location: Chicago, IL, USA

|

I agree. The list is quite complex.

To me, the problem with this, and with pretty much all governmental dealings such as this, in Kenya, is that they are still based on a British system of over-complexity for the sake of purposeful confusion. The Brits did this to lock-out the uneducated and the non-rich from reaping the benefits of systems of government, commerce, and justice.

Basically, if you couldn't/can't afford a full-time attorney, accountant, courier, driver, parking fees, and secretary, you couldn't possibly navigate the bureaucratic waters in a timely and efficient way- so while you are shuffling paperwork, driving from this house to that house, standing in line again, and figuring out complex documents yourself, rich Brits and Muhindis are getting the tenders, or starting the business, or enjoying freedom, etc., because they can afford the staff to do this for them in parallel, while they themselves focus on the business or idea at hand. This keeps the wanainchi as the underdog, at a disadvantage, unable to compete and set higher heights for Kenyan business. This is bad for all. It locks out competition, which causes the stagnation of advancement for ALL of Kenya! Imagine a football team that always played against a poor, malnourished, injured local opponent. They would never be able to play an able bodied team from another league. So much for a "free" market!

THIS LEADS TO CORRUPTION AS THE COMMON MAN FEELS AS THOUGH HE OR SHE MUST GO AROUND THE SYSTEM IN ORDER TO SURVIVE!

If these institutions were simplified by way of reexamination and "bureaucracy busting" wherein the amount of paperwork and complexity is reduced, and policy is geared toward a layman's understanding of common-sense policy...

SMALL BUSINESS WOULD THRIVE IN KENYA.

And small business, everywhere there are free markets, is the backbone of the economy.

Not to mention, likely half the car traffic in Nairobi could be eliminated if people could handle their dealings 1. With less paperwork and shuffling between houses, and 2. ONLINE, digitally.

So, while I don't at all condone corruption, if you want to end corruption, make it easy to do things the proper way. That's more important than clear glass office walls.

This is confusion. Remember, I have identified three things that we must eliminate in order to reach Vision 2030 and beyond:

Confusion, Self-Hate, and Doubt.

Best,

Hill

|

|

|

Rank: Member Joined: 4/13/2011 Posts: 151

|

jasonhill wrote:Hello fellow Wazuans,

Where can I find a simple list or spreadsheet outlining the percentages that need to be paid for import duties across various types of imports?

I'm specifically wondering about farm equipment and power tools, and the list of zero-rated items.

Thanks!

Best,

Hill Not to take you back to stone age but there is a "duties book" (cant remember the name) that used to be available at the government printer showing import and export duties for almost everything. It used to be printed yearly after the budget. Don't know if its still there, i used to find it much easier to understand. Common sense is the most evenly distributed quantity in the world. Everyone thinks he has enough.

|

|

|

Rank: Veteran Joined: 12/23/2010 Posts: 1,229

|

There is a harmonized system of tariff classification that is used across the globe. The idea was to simplify trade. The classification of all goods known to man must be done in order to assess taxes payable, and for statistical purposes(planning). Every good must be classified in the tariff – so I imagine it cannot be made smaller

@ Inuendo, the book you refer to was actually a schedule to the Customs & Excise Act (I think 2nd Schedule). We’ve gone regional so the current law governing customs/import/export matters is the East African Community Customs Management Act. The relevant schedule is the Common External Tarriff (for the East African States).

The responsibility of correctly classifying the imports lies with the importer – there are even offences created for wrongly classifying goods you’re importing. Its usually treated as tax evasion especially where the correct classification would yield higher taxes. Classification is highly technical since it requires you to know what you’re importing sometimes to its essential components, and also a thorough understanding of the common external tariff, and how to classify goods. For instance, a shirt is not just a shirt – e.g. what is it made from? (wool,silk,cotton, mixture – relevant percentages? Etc etc) – so you wouldnt find one classification for “shirt”. You have to find the correct one and place it there.

The earlier chapters will usually be raw / unprocessed stuff, followed by semi processed products and so on. Which is why its always a good idea to hire someone who has been trained in the stuff to help out. But again, the more you use it, the more you learn to find your way around it. If you’re a regular importer, a short course in classification of goods is indispensable since u might not want to leave everything to your agent – if he messes up you pay.

About being taxed kshs. 18k for a gadget that cost 40k....it’s possible that they doubted the value given and used a higher value as the basis for computing taxes (not legal since tax should be computed on the basis of the taxations value - but few Kenyans protest because it wld take longer to clear your consignement while referrals are being made here and there). Did you ask what you were paying (breakdown of the taxes?)

|

|

|

Rank: Member Joined: 11/18/2010 Posts: 194 Location: Kenya

|

radio wrote:@Tebes, thank you. That list is damn complex! As I try to find my way there, any comments on the following. I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs? How do they come up with these figures? The gadget is meant for programming tests purposes and no commercial use as of now! Click Ctrl+F and follow @ For sport's advice

|

|

|

Rank: Member Joined: 4/2/2011 Posts: 629 Location: Nai

|

jasonhill wrote:Hello fellow Wazuans,

Where can I find a simple list or spreadsheet outlining the percentages that need to be paid for import duties across various types of imports?

I'm specifically wondering about farm equipment and power tools, and the list of zero-rated items.

Thanks!

Best,

Hill The fifth schedule http://www.revenue.go.ke..._Schedule_Exemptions.pdf

|

|

|

Rank: Elder Joined: 11/26/2008 Posts: 2,097

|

radio wrote:@Tebes, thank you. That list is damn complex! As I try to find my way there, any comments on the following. I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs? How do they come up with these figures? The gadget is meant for programming tests purposes and no commercial use as of now! Please give a further description of what the item is. Is it a software, does it contain storage device, where is it used(Industry), does it have a transmitting device? I might be able to give u breakdown of charges/taxes due. "Never regret, if its good, its wonderful. If its bad, its experience."

|

|

|

Rank: Elder Joined: 11/26/2008 Posts: 2,097

|

jasonhill wrote:Hello fellow Wazuans,

Where can I find a simple list or spreadsheet outlining the percentages that need to be paid for import duties across various types of imports?

I'm specifically wondering about farm equipment and power tools, and the list of zero-rated items.

Thanks!

Best,

Hill 84.32 Agricultural, horticultural or forestry machinery for soil preparation or cultivation; lawn or sports-ground rollers. 8432.10.00 - Ploughs : u 0% - Harrows, scarifiers, cultivators, weeders and hoes : 8432.21.00 -- Disc harrows u 0% 8432.29.00 -- Other u 0% 8432.30.00 - Seeders, planters and transplanters u 0% 8432.40.00 - Manure spreaders and fertiliser distributors u 0% 8432.80.00 - Other machinery u 0% Import Duty rate on Agricultural equipments and machinery is 0% "Never regret, if its good, its wonderful. If its bad, its experience."

|

|

|

Rank: Elder Joined: 11/26/2008 Posts: 2,097

|

u abuve is 'unit', the measure of quantity (ie rate per kg/metre/unit/litre, etc. "Never regret, if its good, its wonderful. If its bad, its experience."

|

|

|

Rank: Member Joined: 1/22/2011 Posts: 322 Location: Chicago, IL, USA

|

|

|

|

Rank: New-farer Joined: 6/23/2011 Posts: 53

|

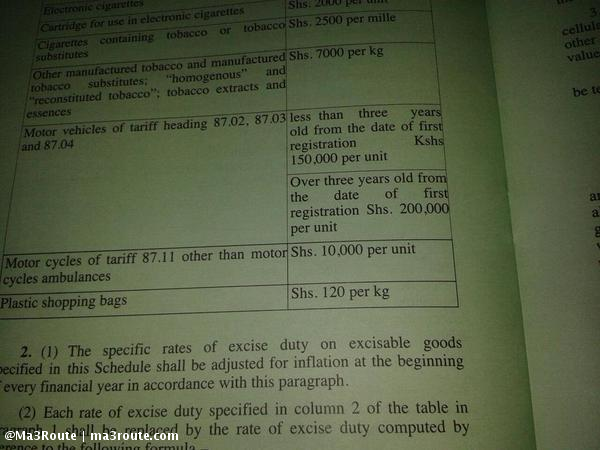

Tebes wrote:radio wrote:@Tebes, thank you. That list is damn complex! As I try to find my way there, any comments on the following. I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs? How do they come up with these figures? The gadget is meant for programming tests purposes and no commercial use as of now! Please give a further description of what the item is. Is it a software, does it contain storage device, where is it used(Industry), does it have a transmitting device? I might be able to give u breakdown of charges/taxes due. Customs usually have a list known as a CRSP (Current Retail Selling Price) so they can check on the list to verify the price u have given as selling price.in comparing both, they will take the higher value and compute tax on that higher value.these taxes are 25% import duty, 20% excise(where applicable) then 16% VAT (where applicable). on KRA website, the calculation of tax is done with illustrations too.

|

|

|

Rank: Veteran Joined: 12/23/2010 Posts: 1,229

|

mmunguti

thought using the CRSP as the basis for computing taxes is only done for used for motor vehicle imports.

The basis for computing taxes for other goods is the transaction value.

|

|

|

Rank: Veteran Joined: 3/25/2011 Posts: 946

|

radio wrote:@Tebes, thank you. That list is damn complex! As I try to find my way there, any comments on the following. I recently bought a gadget worth 40k including shipping with DHL but was slapped with 18k by customs?

How do they come up with these figures? The gadget is meant for programming tests purposes and no commercial use as of now! WOW. can it be that huge . half the price of the gadget ???? Lord have mercy...lol .

|

|

|

Rank: Member Joined: 1/30/2009 Posts: 164

|

Thank you for this info good people Hi maneno ni compplex, anyone please tell me say if I bring in kids Toys, I know the CIF value. And I read www.kra.go.ke/customs/pd...20Externaltariff2007.pdf and see toys not exempted and attracts 25% of CIF and IDF. (chapter 96) Any other applicable tax that I need to pay such as VAT/Excise etc? Thanks They keep moving the cheese  stolen from opensuse forums :)

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Seq Lu wrote:Thank you for this info good people Hi maneno ni compplex, anyone please tell me say if I bring in kids Toys, I know the CIF value. And I read www.kra.go.ke/customs/pd...20Externaltariff2007.pdf and see toys not exempted and attracts 25% of CIF and IDF. (chapter 96) Any other applicable tax that I need to pay such as VAT/Excise etc? Thanks I recently imported some stuff ( kid's toy, kid story book, headphones) whose total cost including shipping was about Sh. 21,000 (Shipping using Fedex at sh 9000 and items worth about sh 13,000) and I was slapped with taxes totalling Sh 11,300!  I asked a Fedex guy who told me it's better to use agents in case you are importing. Fedex, being a big company, does not have time to negotiate the taxes on your behalf! So apparently duty is negotiated when importing into Kenya. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Wazua

»

SME

»

Legal

»

Import Duties - Is there a list?

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|