Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Rank: Elder Joined: 6/23/2009 Posts: 14,097 Location: nairobi

|

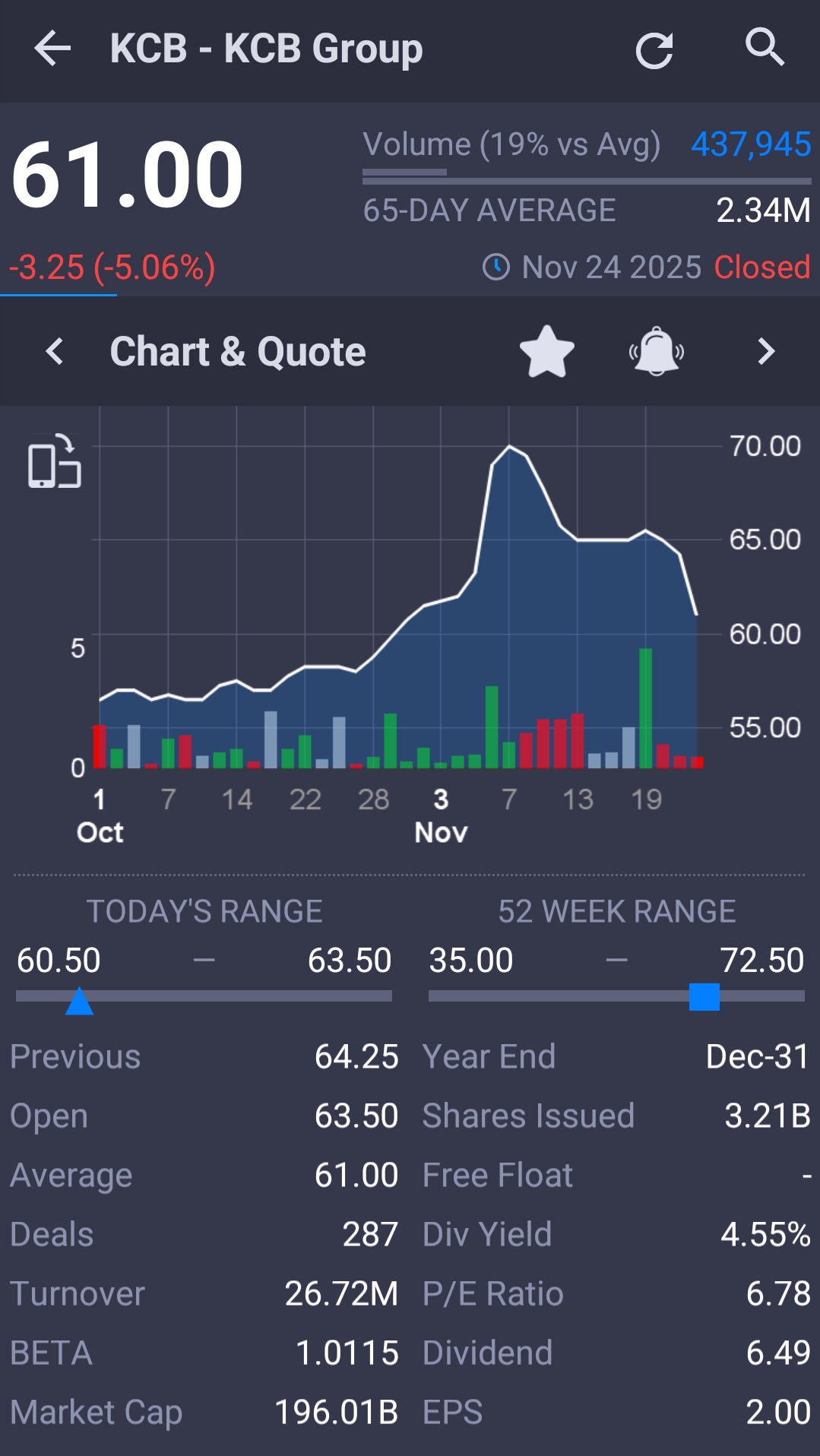

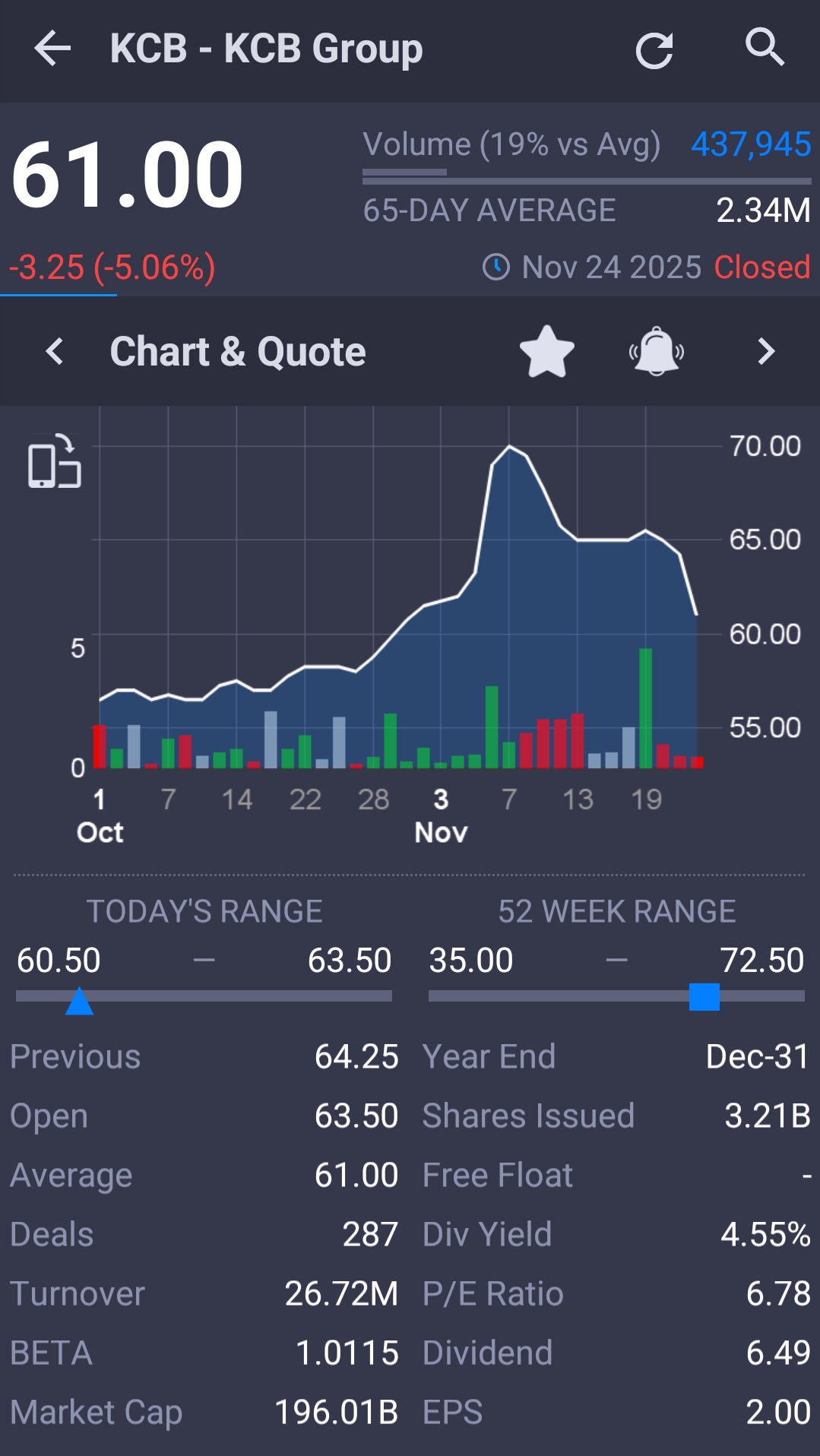

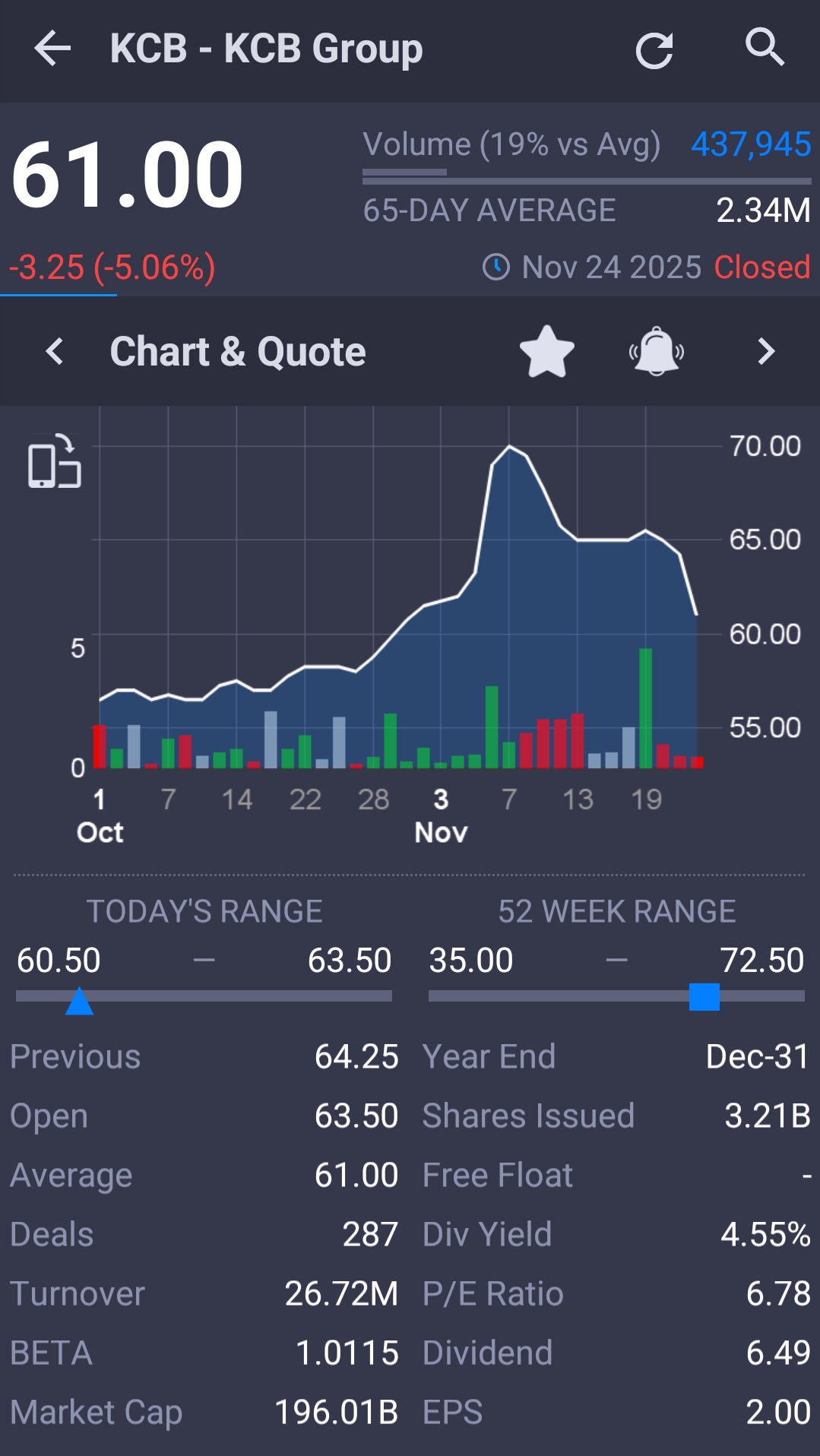

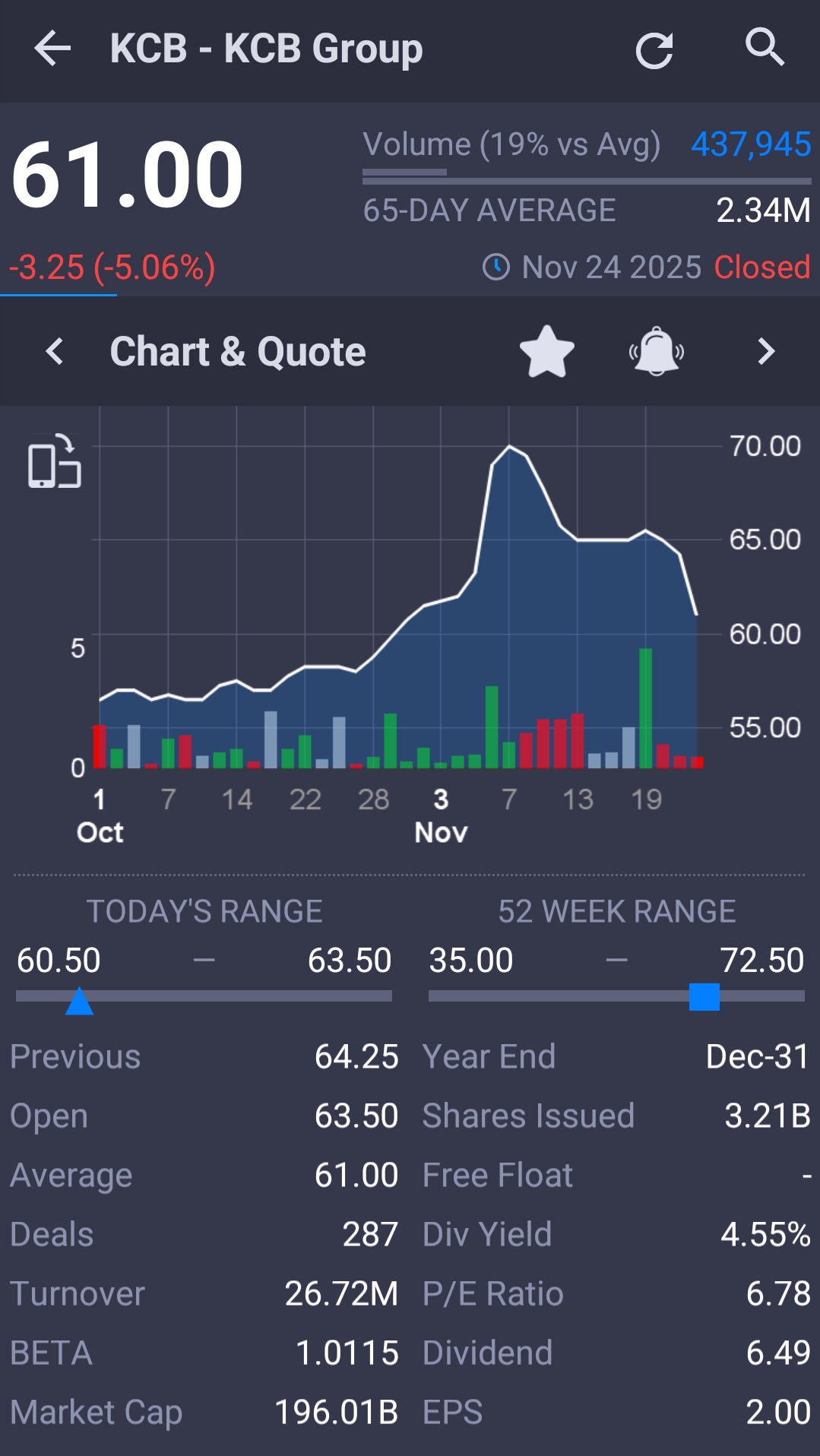

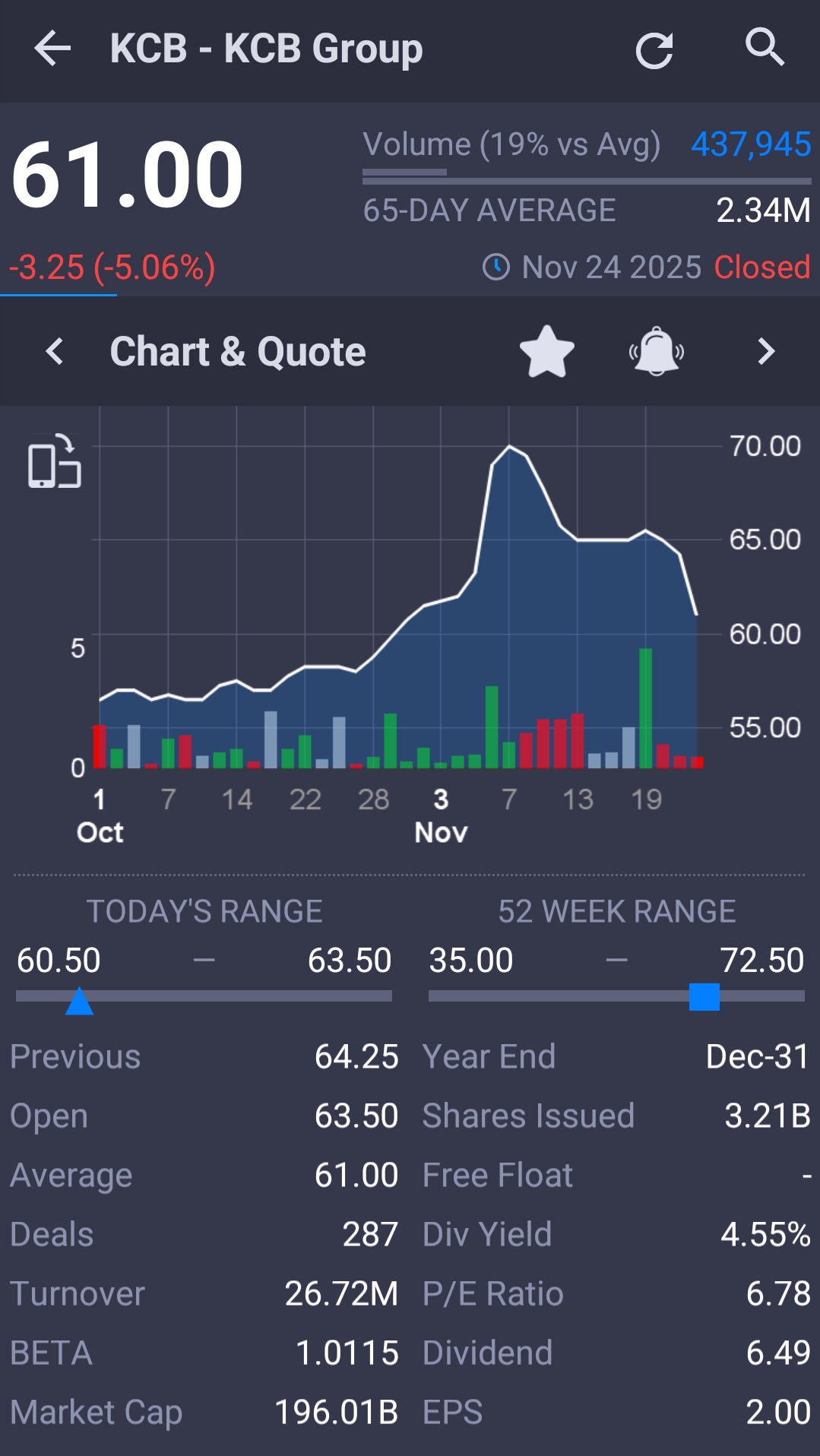

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Read post number 824, and while at it, please do tell us whether you are still holding Kurwitu shares http://m.wazua.co.ke/for...&m=914709#post914709

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,726

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Read post number 824, and while at it, please do tell us whether you are still holding Kurwitu shares http://m.wazua.co.ke/for...amp;m=914709#post914709 ^      Kurwitu??? Are you high!!?? I don't even discuss such kind of shares let alone buy them!! I'm an investor. Not a gambler!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,726

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Read post number 824, and while at it, please do tell us whether you are still holding Kurwitu shares http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ That means nothing. You were just quoting the "fair value" they way you keep quoting different fair values for KQ that have never seen the light of day. The month you sold COOP was trading between 18/= - 20/=. I remember commenting on a @vvs post about how you managed to mess up even on COOP. Then you gave long tales about target met etc. etc. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,097 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Read post number 824, and while at it, please do tell us whether you are still holding Kurwitu shares http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ That means nothing. You were just quoting the "fair value" they way you keep quoting different fair values for KQ that have never seen the light of day. The month you sold COOP was trading between 18/= - 20/=. I remember commenting on a @vvs post about how you managed to mess up even on COOP. Then you gave long tales about target met etc. etc. Now tell us why I would recommend a rally for COOP to KES 26 and sit it out? I have the financials and/or ratios, PE, EPS, DIV, NBVs etc for each listed stock on the NSE. To you it may appear like its gambling, but I do hold minimum entry and exit marks. I am not elated by a dividend yield of 7% per annum. Finally, luckily it is my money 😁

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,726

|

@Obiero you had 225,000 COOP shares (your figure not mine). You sold the entire lot for 4.3 million (your words and figures not mine) Simple maths: 4.3m ÷ 225,000 = 19.11/= per share. You sold your COOP shares at 19.11 per share.Which is okay. Your shares, your money, your decisions. Shida ni kunifanya nikae ni kama sijui kitu nasema. Hiyo ni personal!    Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,726

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Read post number 824, and while at it, please do tell us whether you are still holding Kurwitu shares http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ That means nothing. You were just quoting the "fair value" they way you keep quoting different fair values for KQ that have never seen the light of day. The month you sold COOP was trading between 18/= - 20/=. I remember commenting on a @vvs post about how you managed to mess up even on COOP. Then you gave long tales about target met etc. etc. Now tell us why I would recommend a rally for COOP to KES 26 and sit it out? I have the financials and/or ratios, PE, EPS, DIV, NBVs etc for each listed stock on the NSE. To you it may appear like its gambling, but I do hold minimum entry and exit marks. I am not elated by a dividend yield of 7% per annum. Finally, luckily it is my money 😁 That is the same thing @vvs and myself asked you more or less and you brought other stories Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,097 Location: nairobi

|

MaichBlack wrote:@Obiero you had 225,000 COOP shares (your figure not mine). You sold the entire lot for 4.3 million (your words and figures not mine) Simple maths: 4.3m ÷ 225,000 = 19.11/= per share. You sold your COOP shares at 19.11 per share.Which is okay. Your shares, your money, your decisions. Shida ni kunifanya nikae ni kama sijui kitu nasema. Hiyo ni personal!    Let me help you out boss. I sold COOP at KES 21.45 on Sep 09th 2025. Used 100% of the proceeds to buy KQ. Any further clarification needed?

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|