Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? At the exchange bar, we only drink and share projections. We hold no data, nor justifications. Watch and learn

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? At the exchange bar, we only drink and share projections. We hold no data, nor justifications. Watch and learn      I doubt anyone would watch and learn anything if it is just drinking and projections with no data and no justification. I can't even imagine being part of such a conversation. "You know what? I project KQ shares will go to Kshs. 20/= by next week!" "Oh. Nice. Don't worry about sharing your reasoning. On my side, I project KCB will go to Kshs. 48/=! Good thing you are not allowed to ask for my reasoning, data or all those boring things. Coz I have none!" "Guys, anyone else wants to make a projection not based on any data or fundamentals??" Wuuueeeh!! I cannot can!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 Okay my brother. Patience is a virtue. I will wait till February. Let's revisit in February. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

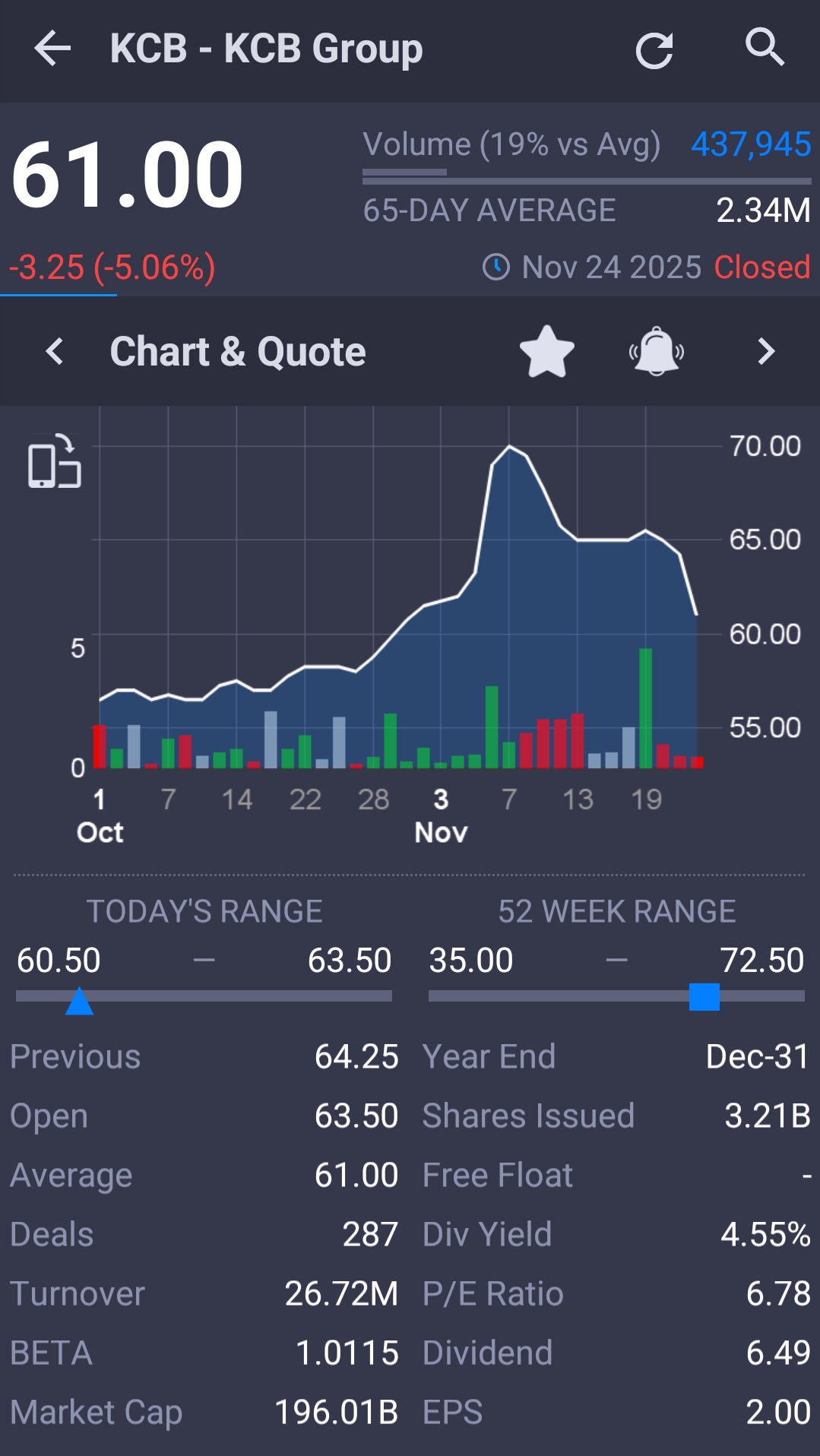

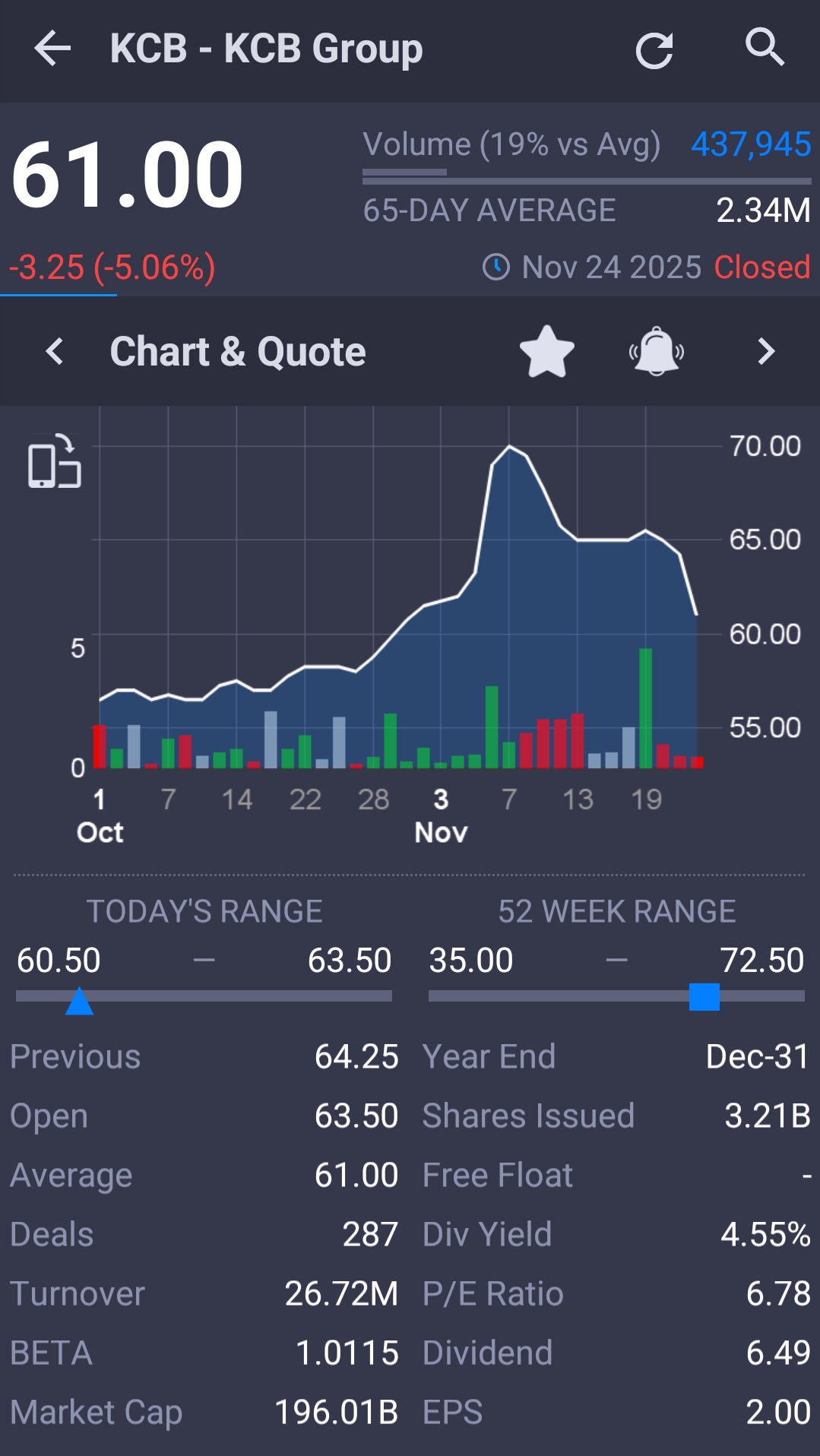

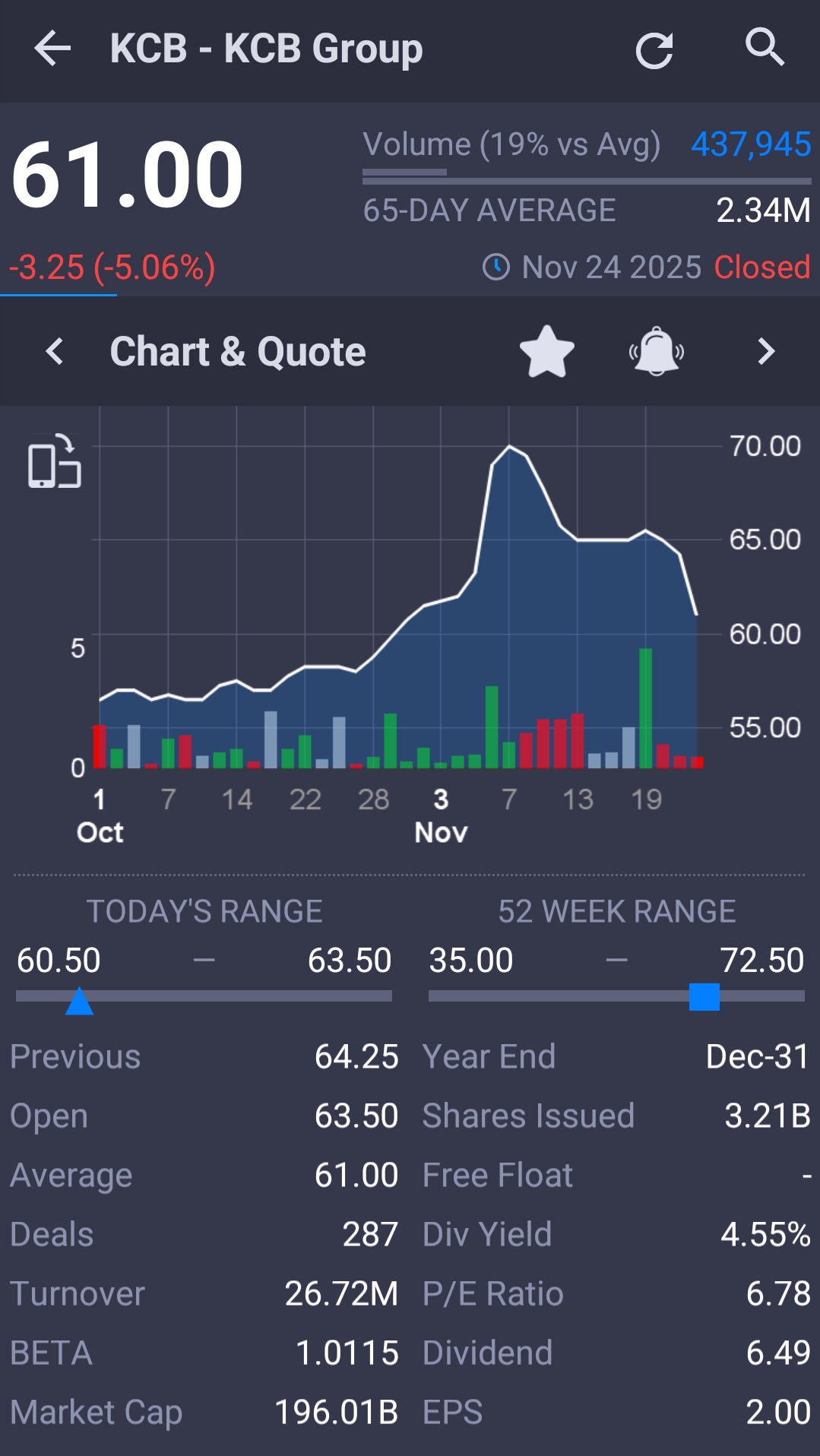

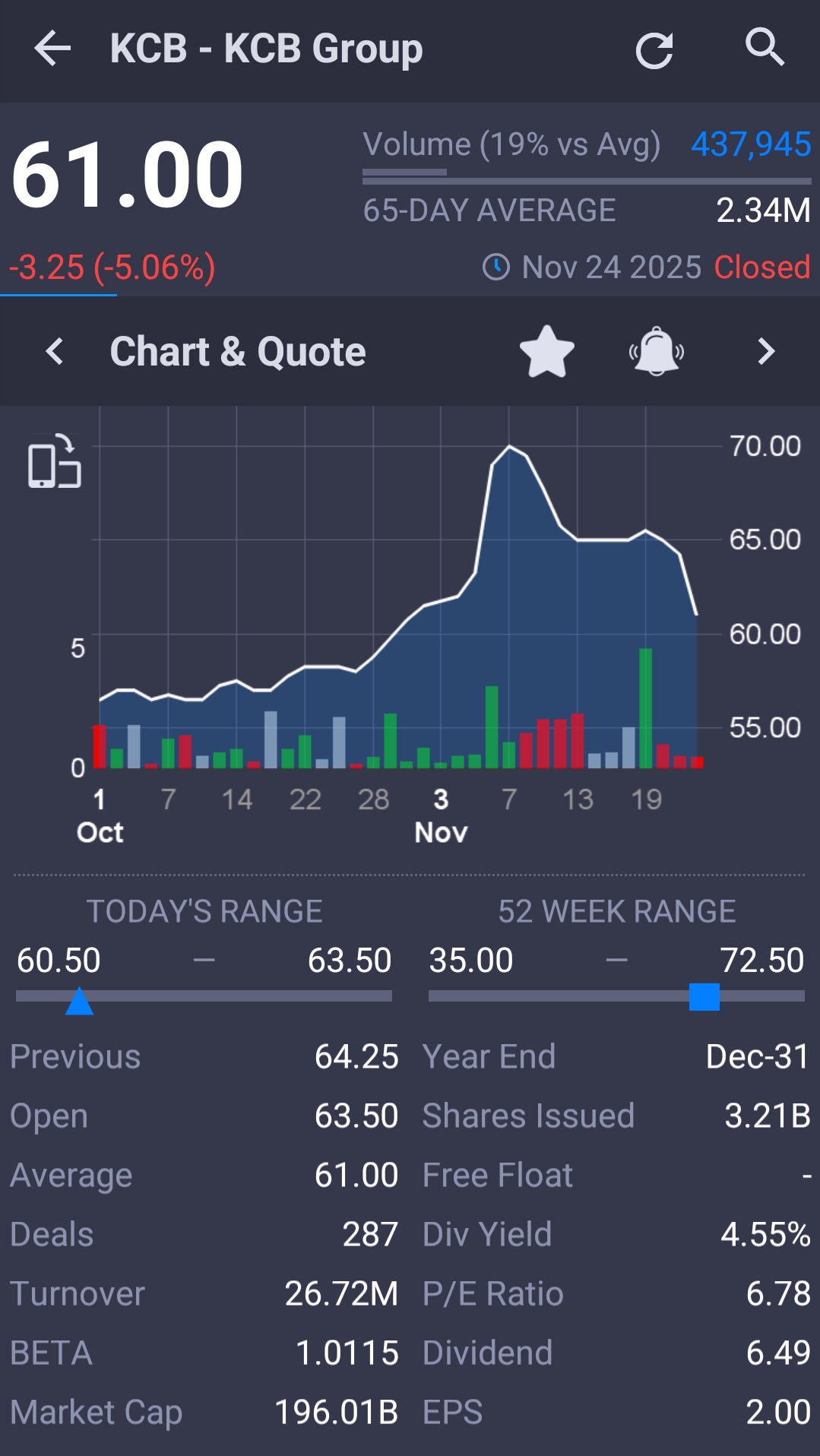

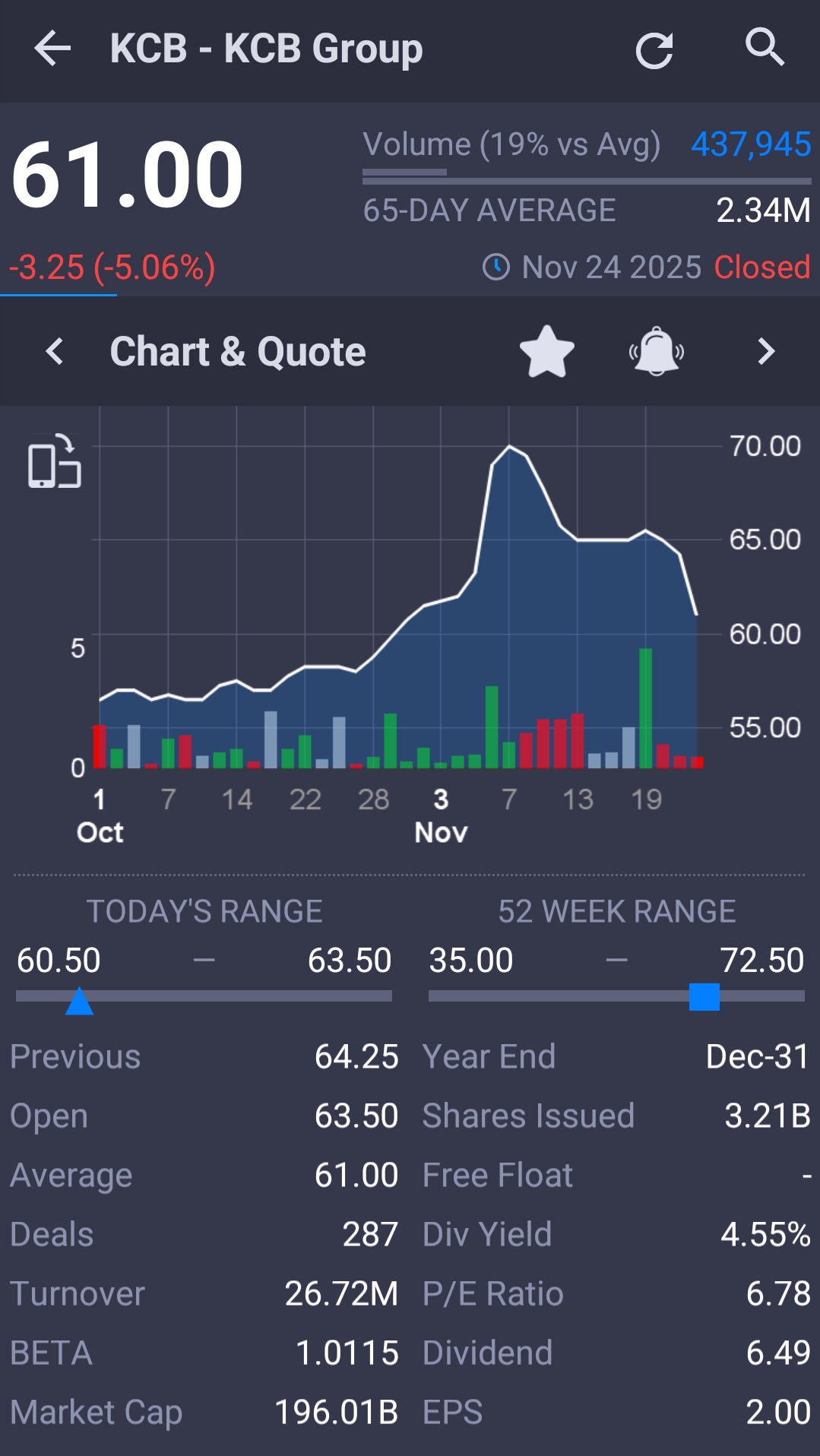

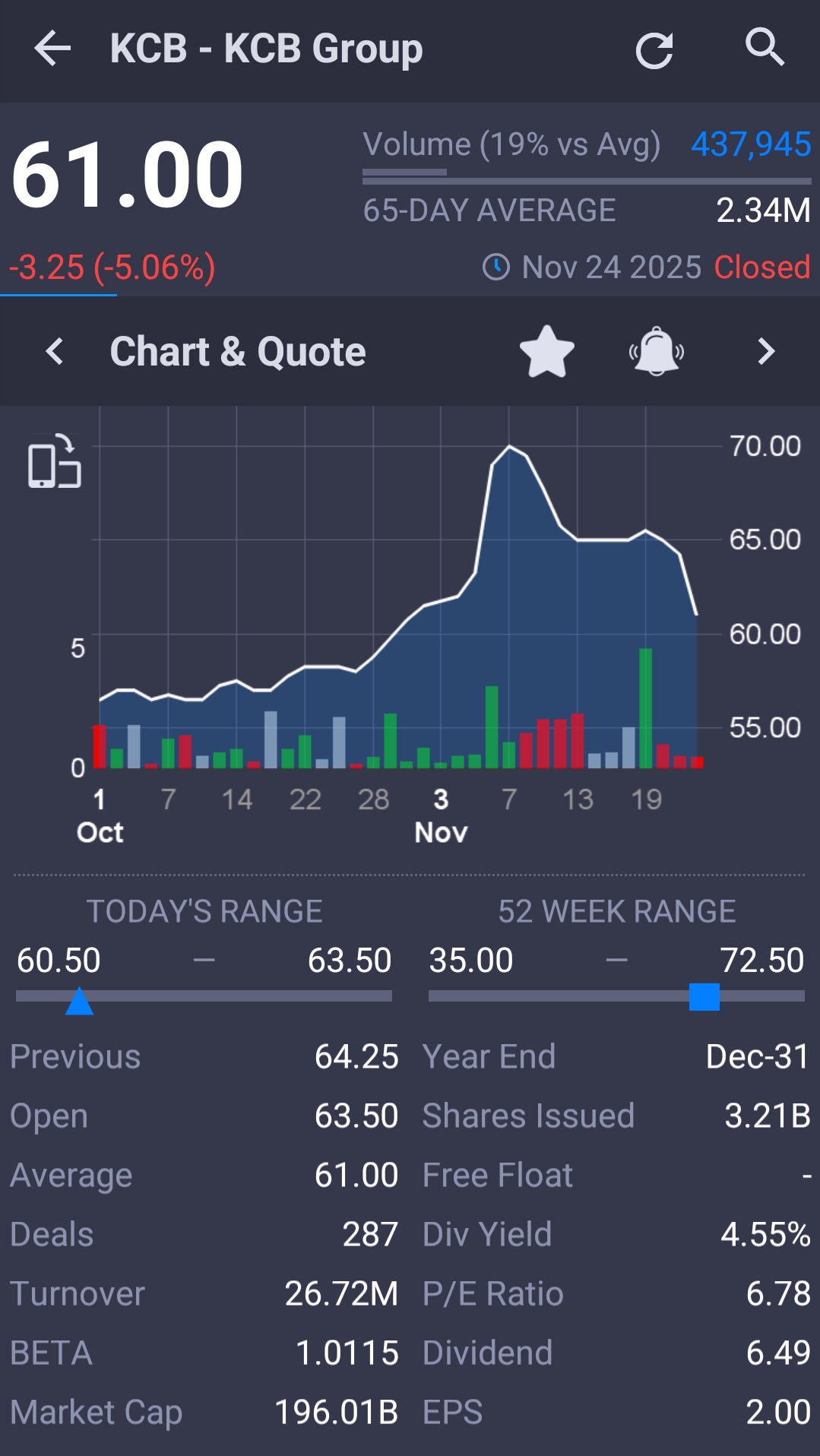

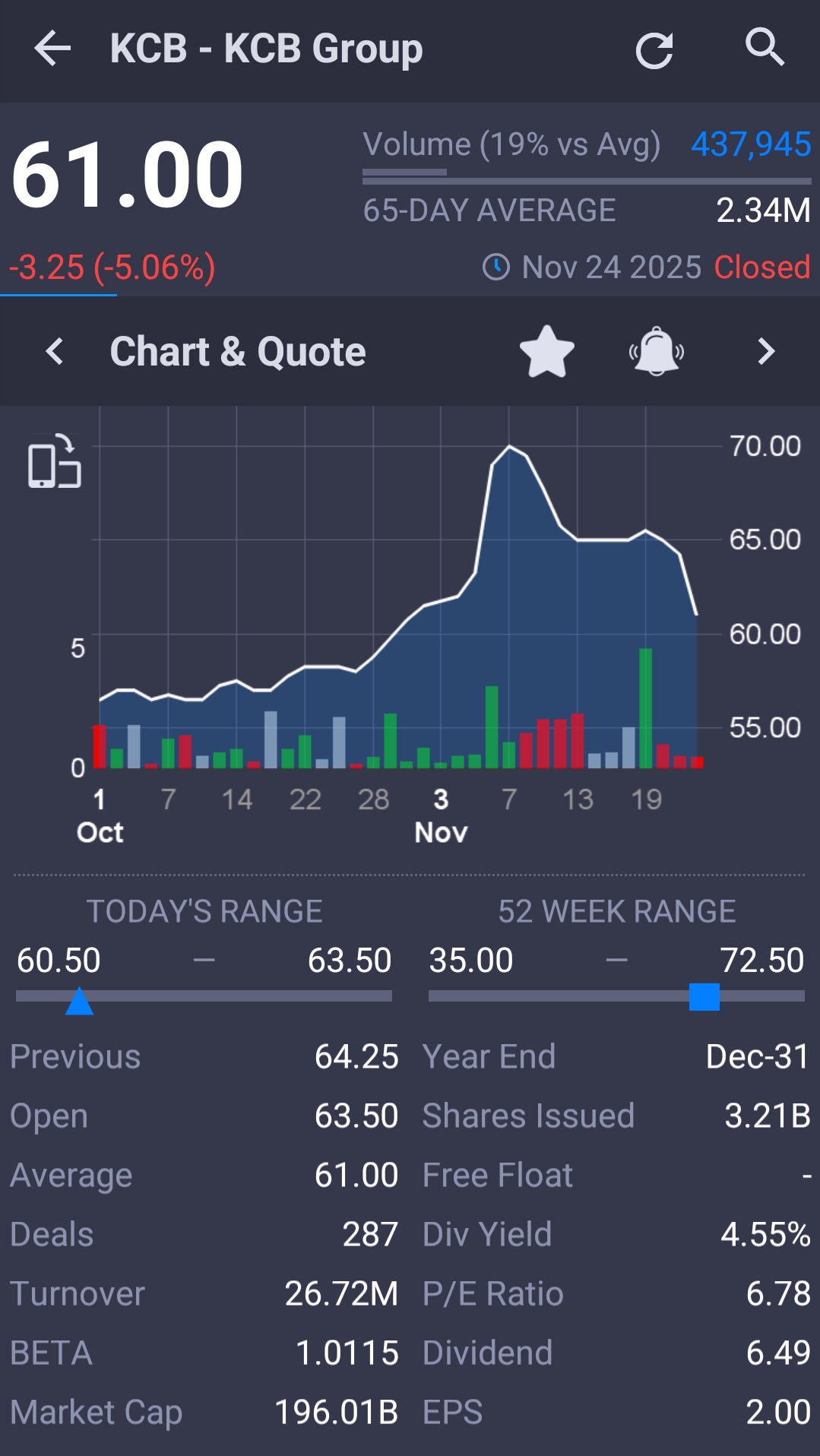

obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 What??? Where??? KCB has not traded below 60/= the entire of January (and even last two weeks of December)!!! I know this because I have had my finger on the trigger throughout. I still need to buy my final 6%! If at any point the price went to 54/= I would throw everything at the share, over and beyond my original target! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 What??? Where??? KCB has not traded below 60/= the entire of January (and even last two weeks of December)!!! I know this because I have had my finger on the trigger throughout. I still need to buy my final 6%! If at any point the price went to 54/= I would throw everything at the share, over and beyond my original target! Surely! Acha uvivu kaka. These trading apps are not expensive, some features are even free

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 What??? Where??? KCB has not traded below 60/= the entire of January (and even last two weeks of December)!!! I know this because I have had my finger on the trigger throughout. I still need to buy my final 6%! If at any point the price went to 54/= I would throw everything at the share, over and beyond my original target! Surely! Acha uvivu kaka. These trading apps are not expensive, some features are even free  This is covers up to December bro. I am talking about whole of this January and the last two weeks of December. Show me anything clearly showing the price going below 60/= this January and last two weeks of December. Hasn't happened even for a single day!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 What??? Where??? KCB has not traded below 60/= the entire of January (and even last two weeks of December)!!! I know this because I have had my finger on the trigger throughout. I still need to buy my final 6%! If at any point the price went to 54/= I would throw everything at the share, over and beyond my original target! Surely! Acha uvivu kaka. These trading apps are not expensive, some features are even free  This is covers up to December bro. I am talking about whole of this January and the last two weeks of December. Show me anything clearly showing the price going below 60/= this January and last two weeks of December. Hasn't happened even for a single day!!! Dec 09th 2025 was the day. This year it has not traded below KES 60

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:obiero wrote:I didn't want to say I warned you, but I did warn you About what exactly @Obiero? What just happened?? The exchange bar has peeked into Feb 2026 and it has sighted KES 48 per share from recent highs of >70. I speak in code Is there a reasoned justification you can repeat here or it is just "trust me bro!"?? I hope @Obiero you now get why there was NO reasoned justification. There couldn't have been one! 67.25/= today. 1. Retrace to KES 54 happended just days ago 2. We are not in Feb 2026 What??? Where??? KCB has not traded below 60/= the entire of January (and even last two weeks of December)!!! I know this because I have had my finger on the trigger throughout. I still need to buy my final 6%! If at any point the price went to 54/= I would throw everything at the share, over and beyond my original target! Surely! Acha uvivu kaka. These trading apps are not expensive, some features are even free  This is covers up to December bro. I am talking about whole of this January and the last two weeks of December. Show me anything clearly showing the price going below 60/= this January and last two weeks of December. Hasn't happened even for a single day!!! Dec 09th 2025 was the day. This year it has not traded below KES 60 That is exactly what I was saying. First week of December and initial days of second week of December I was still buying. I took a small breather and it went to 60+ from the third week and it never retraced. I was hoping the festivities and back to school would cause a retrace but it never happened. That is how I know it hasn't traded sub 60 from mid December because my finger has been on the trigger throughout!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,189 Location: nairobi

|

MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...&m=914709#post914709

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

obiero wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:VituVingiSana wrote:MaichBlack wrote:MaichBlack wrote:obiero wrote:MaichBlack wrote:I have been a very worried man because as I have said in multiple post here, I am a buyer of KCB till early next year. I have been loading up the the entire year. I have quite a number of shares but I want to have a ridiculously high number and hold "forever". As I was waiting for the next batch of money the prices went haywire. It went all the way 72. Given my abp in the 40s level I was finding it difficult to buy at those prices (emotions NOT fundamentals    ). I sat it out. Now my finger is on the trigger. I am happy buying at 50s for my next batch even though 60s is still a bargain for a share whose eps for fy 2025 will be around Kshs. 25/=!!! All the best  @Obiero - This P/E ratio is based on what? KCB's EPS fy 2024 was 18.70/=. EPS for Q3 2025 is 19.12/=. Which EPS is bringing a P/E of 6.67??? Yet another time to be glad I didn't listen to @Obiero. Bought boatloads at 56/= - 57/=. Only issue is that the price increased again before I bought my last small batch - Remaining 6% - 8% to get to my long term target number of shares. Total bought over time around 94% of long term target. We need an Anti-Obiero Index like the Anti-Cramer Index.  Exactly!!! I have always said if anyone has been following @Obiero and doing EXACTLY THE OPPOSITE of what he says they would be stinking rich!!!    Like not buy HFCK? COOP? MTNU? IMH? You are such a funny human 😆 Remember, @Obiero's total individual wealth is represented by a mere 5% at the NSE. I am a real estate investor who participates in stock trading. Dont get confused Like selling COOP (At the worst possible time) to load up on KQ!!! You sold at what? 20/= just a few months ago? 4 months ago?? 27/= today! 35% gains down the drain. And you said your shares were worth 4.3m. That is 1.5m you left on the table. And if I am not wrong, you missed the maiden interim dividend. An extra 220k missed??? Aim to reduce embarrassment on yourself. My trades are documented. KES 26 na KES 27 ni hapa na wapi? http://m.wazua.co.ke/for...amp;m=914709#post914709 ^ Wapi!!?? What post #??? I can see anything. The time you sold prices were nowhere near there!!! Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Wazua

»

Investor

»

Stocks

»

Portfolio Balancing: Avoid Over Exposure To Financial Sector

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|