Wazua

»

Investor

»

Stocks

»

Stanlib Fahari I-Reit FY 2019

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

ICEA sees value in Fahari at the cheap prices. Skin in the game. I applaud that. Of course, they may have other plans eg Ndegwas selling their properties to Fahari at "full price" in exchange for discounted shares. Who remembers their attempt to sell dying Ennsvalley to Unga for shares in Unga? Then they "convinced" the compromised board to pay 700mn for lousy Ennsvalley. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

did they pay dividend for full year 2021, they declared 0.50 cts but i missed book closure and payment There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Member Joined: 9/27/2006 Posts: 505

|

littledove wrote:did they pay dividend for full year 2021, they declared 0.50 cts but i missed book closure and payment Yeah the paid it back in April I think. This is one stock I'm curious about - this 'cautionary announcement' I think involves the selling of the vacant building, but does it mean other properties will be added? Who knows. I don't know the risk/reward ratio for owning it.

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

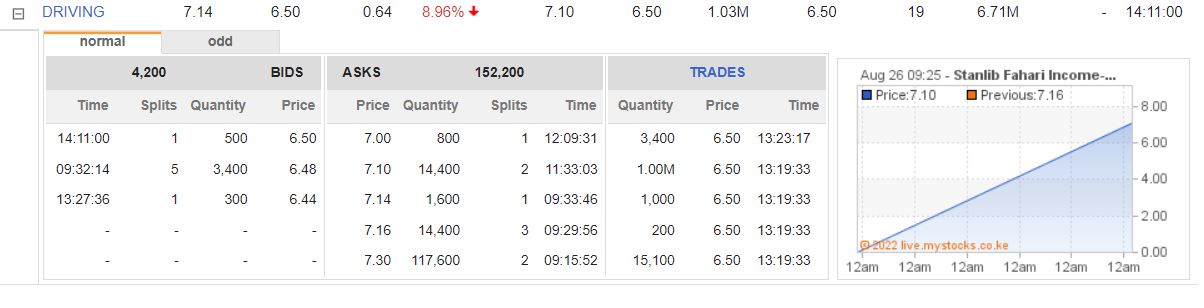

deadpoet wrote:littledove wrote:did they pay dividend for full year 2021, they declared 0.50 cts but i missed book closure and payment Yeah the paid it back in April I think. This is one stock I'm curious about - this 'cautionary announcement' I think involves the selling of the vacant building, but does it mean other properties will be added? Who knows. I don't know the risk/reward ratio for owning it. Saw this  today on https://live.mystocks.co.ke/rmw.php. Whats happening? Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

6th and 7th agm to be held on monday 24th april 2023. what kind of restructuring are they doing? that cma has delayed approving for that long. the share price has been dull for some time without any indicators that something good or bad is coming. what do we expect on monday There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Member Joined: 9/27/2006 Posts: 505

|

Probably two possibilities:

1) They announce plans to delist - this may happen before or after they sell two buildings in the REIT portfolio. They may offer to buy out current shareholders at a given price, with or without providing the proceeds from the sale.

2) They sell the two buildings and add more properties from the ICEA portfolio, keeping the listing on the NSE.

I bought this stock at around 6 bob, so I got about a 10% yield, which isn't too bad. I may keep or sell at cost depending on the restructuring.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

littledove wrote:6th and 7th agm to be held on monday 24th april 2023. what kind of restructuring are they doing?

that cma has delayed approving for that long. the share price has been dull for some time without

any indicators that something good or bad is coming. what do we expect on monday Delisting is what CMA has delayed approving. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

deadpoet wrote:Probably two possibilities:

1) They announce plans to delist - this may happen before or after they sell two buildings in the REIT portfolio. They may offer to buy out current shareholders at a given price, with or without providing the proceeds from the sale.

2) They sell the two buildings and add more properties from the ICEA portfolio, keeping the listing on the NSE.

I bought this stock at around 6 bob, so I got about a 10% yield, which isn't too bad. I may keep or sell at cost depending on the restructuring.

Possibility 1 is the most probable option. More properties from the ICEA portfolio is easier said than done. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 9/27/2006 Posts: 505

|

Ericsson wrote:deadpoet wrote:Probably two possibilities:

1) They announce plans to delist - this may happen before or after they sell two buildings in the REIT portfolio. They may offer to buy out current shareholders at a given price, with or without providing the proceeds from the sale.

2) They sell the two buildings and add more properties from the ICEA portfolio, keeping the listing on the NSE.

I bought this stock at around 6 bob, so I got about a 10% yield, which isn't too bad. I may keep or sell at cost depending on the restructuring.

Possibility 1 is the most probable option. More properties from the ICEA portfolio is easier said than done. You are correct. However, there is the possibility of ICEA making some statement just to raise the price over the short/medium term (from 6 to 8, for example). A 'pump and dump' by another name - given that they bought a stake sometime last year. Also, I think the difficulty of moving properties to be the REIT would be the same whether the company is listed or not. Given the tax advantages of REITs, it is a safe bet that such addition has been discussed in the boardroom. The question is whether it is cheaper for the powers that be to bring small shareholders along for the ride - after all, there is a cost of buying existing shareholders out (though it definitely wouldn't be at NAV).

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

deadpoet wrote:Ericsson wrote:deadpoet wrote:Probably two possibilities:

1) They announce plans to delist - this may happen before or after they sell two buildings in the REIT portfolio. They may offer to buy out current shareholders at a given price, with or without providing the proceeds from the sale.

2) They sell the two buildings and add more properties from the ICEA portfolio, keeping the listing on the NSE.

I bought this stock at around 6 bob, so I got about a 10% yield, which isn't too bad. I may keep or sell at cost depending on the restructuring.

Possibility 1 is the most probable option. More properties from the ICEA portfolio is easier said than done. You are correct. However, there is the possibility of ICEA making some statement just to raise the price over the short/medium term (from 6 to 8, for example). A 'pump and dump' by another name - given that they bought a stake sometime last year. Also, I think the difficulty of moving properties to be the REIT would be the same whether the company is listed or not. Given the tax advantages of REITs, it is a safe bet that such addition has been discussed in the boardroom. The question is whether it is cheaper for the powers that be to bring small shareholders along for the ride - after all, there is a cost of buying existing shareholders out (though it definitely wouldn't be at NAV). ICEA/Ndegwas are no fools to pay the fake NAV as a buyout price  A delisting makes sense to allow for a restructuring that including adding more properties and then re-listing Fahari. The current portfolio is very small and very few would take shares, as currently priced, in exchange for a property. Kamau thinks his building is worth 200mn even if the Net Income is just 8mn. That's the reality in Nairobi. The true value on an income basis may be 80mn (10x NI). He will not accept 10mn shares of Fahari (NAV 20) since they trade at 6/-. So how does Fahari get new properties unless it pays cash? How does it raise cash? Who will subscribe to a Rights Issue? What will the price of the Rights be? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

VituVingiSana wrote:deadpoet wrote:Ericsson wrote:deadpoet wrote:Probably two possibilities:

1) They announce plans to delist - this may happen before or after they sell two buildings in the REIT portfolio. They may offer to buy out current shareholders at a given price, with or without providing the proceeds from the sale.

2) They sell the two buildings and add more properties from the ICEA portfolio, keeping the listing on the NSE.

I bought this stock at around 6 bob, so I got about a 10% yield, which isn't too bad. I may keep or sell at cost depending on the restructuring.

Possibility 1 is the most probable option. More properties from the ICEA portfolio is easier said than done. You are correct. However, there is the possibility of ICEA making some statement just to raise the price over the short/medium term (from 6 to 8, for example). A 'pump and dump' by another name - given that they bought a stake sometime last year. Also, I think the difficulty of moving properties to be the REIT would be the same whether the company is listed or not. Given the tax advantages of REITs, it is a safe bet that such addition has been discussed in the boardroom. The question is whether it is cheaper for the powers that be to bring small shareholders along for the ride - after all, there is a cost of buying existing shareholders out (though it definitely wouldn't be at NAV). ICEA/Ndegwas are no fools to pay the fake NAV as a buyout price  A delisting makes sense to allow for a restructuring that including adding more properties and then re-listing Fahari. The current portfolio is very small and very few would take shares, as currently priced, in exchange for a property. Kamau thinks his building is worth 200mn even if the Net Income is just 8mn. That's the reality in Nairobi. The true value on an income basis may be 80mn (10x NI). He will not accept 10mn shares of Fahari (NAV 20) since they trade at 6/-. So how does Fahari get new properties unless it pays cash? How does it raise cash? Who will subscribe to a Rights Issue? What will the price of the Rights be? The Ndegwa family stated from Fahari I-REIT properties they want to keep Greenspan Mall and the Lavington property. The others have been marked for disposal Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

anybody who has an idea what was discussed at the agm yesterday? the link they had given for participation was down throughout the period There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Member Joined: 9/27/2006 Posts: 505

|

littledove wrote:anybody who has an idea what was discussed at the agm yesterday? the link they had

given for participation was down throughout the period Yep, same for me. And the helpline they provided was busy. Grrr, so now how am I supposed to know if staying in or getting more shares is a value trap?

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

deadpoet wrote:littledove wrote:anybody who has an idea what was discussed at the agm yesterday? the link they had

given for participation was down throughout the period Yep, same for me. And the helpline they provided was busy. Grrr, so now how am I supposed to know if staying in or getting more shares is a value trap?   its like they didnt want shareholders to participate in that agm or even the agm never happenned. There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Member Joined: 9/27/2006 Posts: 505

|

There should be a fine for botched online AGMs, but we all know how competent the CMA is...

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,646

|

The link worked. The AGM was poorly attended but all the items on the agenda were dealt with.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

deadpoet wrote:There should be a fine for botched online AGMs, but we all know how competent the CMA is... The directors will have the firm (aka shareholders) pay the fine. The directors should be surcharged if you want to see an improvement. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,646

|

Quote:An asset management firm owned by the Philip Ndegwa family has made an offer to buy out retail investors in property fund ILAM Fahari I-Reit at Sh402.4 million or Sh11 per unit, representing a major premium to the trading price on the Nairobi Securities Exchange.

ICEA Lion Asset Management Limited, which manages Fahari, has offered to buy a total of 36.58 million units (shares) as part of a plan to delist the property fund. Business Daily   Payday is here

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,331 Location: Nairobi

|

wukan wrote:Quote:An asset management firm owned by the Philip Ndegwa family has made an offer to buy out retail investors in property fund ILAM Fahari I-Reit at Sh402.4 million or Sh11 per unit, representing a major premium to the trading price on the Nairobi Securities Exchange.

ICEA Lion Asset Management Limited, which manages Fahari, has offered to buy a total of 36.58 million units (shares) as part of a plan to delist the property fund. Business Daily   Payday is here On one hand they say the NAV is 20/share and in the same breath offer 55% of that     Fake NAVs. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,646

|

The NAV is actually 18.75

REIT has Cash and near cash assets of kshs 630 million

We are walking away with 402 million. NSE is a fish market.

Observing how Unga group shareholders were treated its best to take and leave.

CMA should really reconsider if REITs below 5B require fund managers and big trustees. Small reits can administered by property managers earning a salary.

|

|

|

Wazua

»

Investor

»

Stocks

»

Stanlib Fahari I-Reit FY 2019

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|