Wazua

»

Groups

»

Triumph

»

Cytonn Investments

Rank: Member Joined: 11/21/2018 Posts: 564 Location: Britain

|

My 2 cents wrote:For those that think MM funds equate to zero risk, please google Amana Capital. True. Amana drank clients money, just like Cytonn has done.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Queen wrote:My 2 cents wrote:For those that think MM funds equate to zero risk, please google Amana Capital. True. Amana drank clients money, just like Cytonn has done. Is there any such thing as zero risk? Life is short. Live passionately.

|

|

|

Rank: Member Joined: 10/14/2011 Posts: 661

|

sparkly wrote:Queen wrote:My 2 cents wrote:For those that think MM funds equate to zero risk, please google Amana Capital. True. Amana drank clients money, just like Cytonn has done. Is there any such thing as zero risk? If you invest directly with CBK in Treasury Bills and/or Bonds what will be the risk?

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Thiong'o wrote:sparkly wrote:Queen wrote:My 2 cents wrote:For those that think MM funds equate to zero risk, please google Amana Capital. True. Amana drank clients money, just like Cytonn has done. Is there any such thing as zero risk? If you invest directly with CBK in Treasury Bills and/or Bonds what will be the risk? Risk is mismanaging the economy. Argentina, Belize, Ecuador, Lebanon and Suriname all defaulted on their debt in 2020 Zambia defaulted on its Eurobond payment (first African country to do so) Remember Greece in 2015? Defaulted on $1.7 billion IMF payment GoK T-Bills and Bonds come with the same risk. "But they can just print more money to pay it off" Who wants to be paid the same interest in a devalued currency? Zero risk is a myth

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Thiong'o wrote:sparkly wrote:Queen wrote:My 2 cents wrote:For those that think MM funds equate to zero risk, please google Amana Capital. True. Amana drank clients money, just like Cytonn has done. Is there any such thing as zero risk? If you invest directly with CBK in Treasury Bills and/or Bonds what will be the risk? Sovereign risk. The risk that Government will default on its covenants, resulting in unpaid obligations, runaway interest rates and inflation Re Argentina, Greece, Zimbabwe. You get paid your money but need wheel barrows to carry it from the bank, and the next day your money is worth half of whatever you collected. Life is short. Live passionately.

|

|

|

Rank: Veteran Joined: 7/8/2008 Posts: 947

|

Spot on. Thanks for the overview. Point taken!!!      rwitre wrote:The back and forth on this thread   Cytonn HYS clients: You invested in a high risk fund that pumped capital into real estate, and the market is now largely illiquid (Talk to every other real estate developer and property auctioneer and see how "well" they are fairing) Cytonn bashers: Cherry picking on one firm and saying the sky is falling since one of its products is faltering? Must be nice running your lucrative business. Legal: CMA and Cytonn court debacles. CMA hands are largely tied because technically Cytonn is following its contract terms. PR: Cytonn aggressively pushed HYS, and overlaying terms with the regulated Cytonn HYF (High Yield Fund) could easily mislead investors. Investors: Every investment has its risks. Do your research before jumping in. There's a reason why riskier funds come with higher rates. Even countries can default on sovereign debt. My advice: If you have money in HYS, either write it off, or wait it out. I hear there is an option to top up and buy one of the properties for the anxious and moneyed.

|

|

|

Rank: Veteran Joined: 7/8/2008 Posts: 947

|

VituVingiSana wrote:tony stark wrote:muganda wrote:Pain caused needs to be shared. Can't believe the Cytonnaires have not yet replaced Cytonn as the fund manager. Unless Cytonn revenue is directly affected, pain is not aligned. But how many Cytonnaires are there in the CHYS?? Probably less than 5000. But the largest capital is mainly held by a few so less than 100 people probably held by 60-80% of the fund. The Cytonn contract is actually very solid and this risk is in the contract. The few cytonnaires who went to court just wasted money .... all this is in the contract. There is noise and signal. Noise is PK and wazua noisemakers. The signal is that underlying assest actually exist and the people who want to convert funds to property can actually do that. The challenge is that the noisemakers don't have enough to change their funds to property. If you have the funds, do you really want an apartment in Alma? I would rather roll the dice on compounding of my investment and see where it lands me when the economy recovers than convert it to an apartment that I have to manage. Waste of time. Separate the noise from the signal and you will see why the cytonnaires are not making noise. Some Wazuans say even though the Alma development does look good the price for the Alma units is quite high vs comparable units in the area. I agree that for some it may make more sense to take the units regardless of the pricing but for others who have to top-up a large enough sum, it doesn't make sense. The real test is whether non-Cytonnaires are buying units. They have no money stuck in Cytonn so they would be unbiased and looking for value. BTW, how does it work with such developments where there are multiple parties on the selling side? Will the banks give up title to an apartment they have a charge on if they don't get the cash? E.g. If I have 10mn in CHYS and Cytonn agrees to sell me a unit for 10mn, how does the bank/lender benefit? Partial release of mortgage is what will be done. and you get your title from the overall title. or if it is already divided and the bank has several titles then they just release your title. But most likely it is a partial release of the mortgage. On the whether you are getting value in Alma is different strokes for different folks. It depends on whether you plan to live there, where you plan to work, etc. Is it good value for me ..... No! Not at that rental return. But I wouldn't mind living there.

|

|

|

Rank: Member Joined: 8/29/2008 Posts: 573

|

tony stark wrote:VituVingiSana wrote:tony stark wrote:muganda wrote:Pain caused needs to be shared. Can't believe the Cytonnaires have not yet replaced Cytonn as the fund manager. Unless Cytonn revenue is directly affected, pain is not aligned. But how many Cytonnaires are there in the CHYS?? Probably less than 5000. But the largest capital is mainly held by a few so less than 100 people probably held by 60-80% of the fund. The Cytonn contract is actually very solid and this risk is in the contract. The few cytonnaires who went to court just wasted money .... all this is in the contract. There is noise and signal. Noise is PK and wazua noisemakers. The signal is that underlying assest actually exist and the people who want to convert funds to property can actually do that. The challenge is that the noisemakers don't have enough to change their funds to property. If you have the funds, do you really want an apartment in Alma? I would rather roll the dice on compounding of my investment and see where it lands me when the economy recovers than convert it to an apartment that I have to manage. Waste of time. Separate the noise from the signal and you will see why the cytonnaires are not making noise. Some Wazuans say even though the Alma development does look good the price for the Alma units is quite high vs comparable units in the area. I agree that for some it may make more sense to take the units regardless of the pricing but for others who have to top-up a large enough sum, it doesn't make sense. The real test is whether non-Cytonnaires are buying units. They have no money stuck in Cytonn so they would be unbiased and looking for value. BTW, how does it work with such developments where there are multiple parties on the selling side? Will the banks give up title to an apartment they have a charge on if they don't get the cash? E.g. If I have 10mn in CHYS and Cytonn agrees to sell me a unit for 10mn, how does the bank/lender benefit? Partial release of mortgage is what will be done. and you get your title from the overall title. or if it is already divided and the bank has several titles then they just release your title. But most likely it is a partial release of the mortgage. On the whether you are getting value in Alma is different strokes for different folks. It depends on whether you plan to live there, where you plan to work, etc. Is it good value for me ..... No! Not at that rental return. But I wouldn't mind living there. As a Wazua noisemaker, mine is just to whistle.

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

Meanwhile, similar modus operandi in China: https://www.theguardian....as-protesters-besiege-hqBusiness opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

Would China's new 'three-red lines' cut Cytonn to shreds?  Meanwhile, there's been some press (from Cytonn of course) praising a few stranded folk switching debt to property https://citizentv.co.ke/...e-homes-offer-13099089/

Similar firesale in Evergrande amounted to nought.

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,083

|

Evergrande is Cytonn on steroids.

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,083

|

Debt-ridden China Evergrande Group offered three options Monday to repay retail investors in its high-yield wealth management products after hundreds of them protested overdue payments Sunday.

Investors can accept cash installments, property or investors’ payables on residential units they have purchased, according to the plan announced by Du Liang, head of Evergrande’s wealth management unit.

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,083

|

Evergrandes problems causing jitters in global stock markets and cryptos. Some are speculationg that this is 2021's Lehman momemt. Evergrande attempting to make debt repayments in unfinished flats, parking spaces, debt rescheduling etc.

We have heard this story locally. Cytonn. So much for 'there are underlying assets blah blah blah

|

|

|

Rank: Elder Joined: 12/2/2009 Posts: 2,458 Location: Nairobi

|

My 2 cents wrote:Evergrandes problems causing jitters in global stock markets and cryptos. Some are speculationg that this is 2021's Lehman momemt. Evergrande attempting to make debt repayments in unfinished flats, parking spaces, debt rescheduling etc.

We have heard this story locally. Cytonn. So much for 'there are underlying assets blah blah blah Mr. Paul Kimani the blogger.. Have you looked at the companies portfolio.. or you just read headlines...?

|

|

|

Rank: Veteran Joined: 6/2/2010 Posts: 1,083

|

You mean the financials that they hardly publish anymore?

|

|

|

Rank: New-farer Joined: 3/12/2014 Posts: 96

|

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

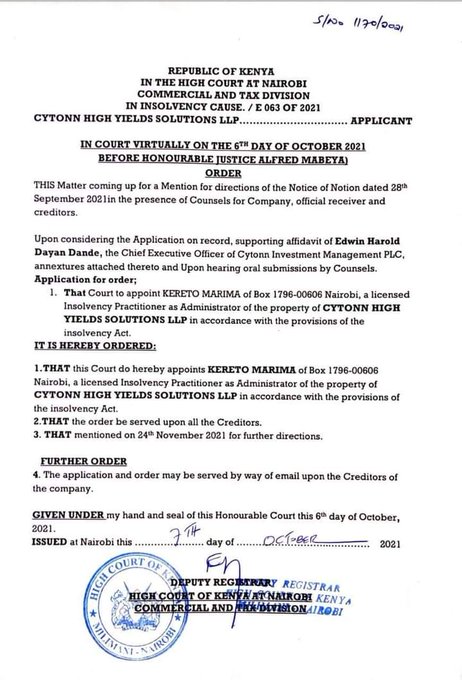

CHYS Insolvent

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

sparkly wrote:sqft wrote:sparkly wrote:They have apologized, they have pulled down the story. There is still the matter of damages (cash payment) upon proof of damages by Cytonn. Keep us posted and try to avoid digging yourself in the same hole. The money you receive to smear Cytonn name will not be enough to pay them damages. will they also sue all the other media houses who have written all those articles listed above? I predicted that people would sue. Now @PK is running around reporting how people have sued! Sparkly wrote:Whistle blowing on what? You went to Cytonn, you signed an investment CONTRACT with them. If they don't fulfill their end of the bargain, you sue for BREACH of contract. In legal jargon this kind of a suit is called a "personam suit" i.e. you sue a particular person for the breach. This is to say there is nothing like whistle blowing on personal contracts. The most you can do is alert fellow netizens if something dodgy is going on and let everyone carry their burden. My next predictions:- 1. Cytonn Funds will not survive the run on assets. Pole for the investors.2. The regulated funds, structured as Collective Investment schemes will face massive loss of capital. People will be lucky to get out 50% of what they invested. 3. The unregulated funds are worse of without ring-fencing and any security. Total write-off is likely.4. There will be no fraud prosecutions on Cytonn directors. 5. Fund Investors will have no recourse on the real estate projects. There are priority interests on the real estate. My predictions 7 months ago. Now the high yield fund is under insolvency protection, nobody can sue or get paid without the High Court's approval. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

sparkly wrote:sparkly wrote:sqft wrote:sparkly wrote:They have apologized, they have pulled down the story. There is still the matter of damages (cash payment) upon proof of damages by Cytonn. Keep us posted and try to avoid digging yourself in the same hole. The money you receive to smear Cytonn name will not be enough to pay them damages. will they also sue all the other media houses who have written all those articles listed above? I predicted that people would sue. Now @PK is running around reporting how people have sued! Sparkly wrote:Whistle blowing on what? You went to Cytonn, you signed an investment CONTRACT with them. If they don't fulfill their end of the bargain, you sue for BREACH of contract. In legal jargon this kind of a suit is called a "personam suit" i.e. you sue a particular person for the breach. This is to say there is nothing like whistle blowing on personal contracts. The most you can do is alert fellow netizens if something dodgy is going on and let everyone carry their burden. My next predictions:- 1. Cytonn Funds will not survive the run on assets. Pole for the investors.2. The regulated funds, structured as Collective Investment schemes will face massive loss of capital. People will be lucky to get out 50% of what they invested. 3. The unregulated funds are worse of without ring-fencing and any security. Total write-off is likely.4. There will be no fraud prosecutions on Cytonn directors. 5. Fund Investors will have no recourse on the real estate projects. There are priority interests on the real estate. My predictions 7 months ago. Now the high yield fund is under insolvency protection, nobody can sue or get paid without the High Court's approval. You are dancing on your grave!  Anyway this was bound to happen, where is the loudmouth CEO now. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Angelica _ann wrote:sparkly wrote:sparkly wrote:sqft wrote:sparkly wrote:They have apologized, they have pulled down the story. There is still the matter of damages (cash payment) upon proof of damages by Cytonn. Keep us posted and try to avoid digging yourself in the same hole. The money you receive to smear Cytonn name will not be enough to pay them damages. will they also sue all the other media houses who have written all those articles listed above? I predicted that people would sue. Now @PK is running around reporting how people have sued! Sparkly wrote:Whistle blowing on what? You went to Cytonn, you signed an investment CONTRACT with them. If they don't fulfill their end of the bargain, you sue for BREACH of contract. In legal jargon this kind of a suit is called a "personam suit" i.e. you sue a particular person for the breach. This is to say there is nothing like whistle blowing on personal contracts. The most you can do is alert fellow netizens if something dodgy is going on and let everyone carry their burden. My next predictions:- 1. Cytonn Funds will not survive the run on assets. Pole for the investors.2. The regulated funds, structured as Collective Investment schemes will face massive loss of capital. People will be lucky to get out 50% of what they invested. 3. The unregulated funds are worse of without ring-fencing and any security. Total write-off is likely.4. There will be no fraud prosecutions on Cytonn directors. 5. Fund Investors will have no recourse on the real estate projects. There are priority interests on the real estate. My predictions 7 months ago. Now the high yield fund is under insolvency protection, nobody can sue or get paid without the High Court's approval. You are dancing on your grave!  Anyway this was bound to happen, where is the loudmouth CEO now. I am not an investor or any other way connected to Cytonn. I am just pointing out how capitalism works. Insolvency by the way protects the loudmouth CEO not the hapless investors that Paul Kimani fought so hard for. Life is short. Live passionately.

|

|

|

Wazua

»

Groups

»

Triumph

»

Cytonn Investments

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|