Wazua

»

Groups

»

Triumph

»

Cytonn Investments

Rank: Veteran Joined: 7/5/2010 Posts: 2,061 Location: Nairobi

|

wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,641

|

Angelica _ann wrote:quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption. Really!! You wish. There is really no disruption here. Most fund managers have the mpesa feature to deposit funds. Quote:Clients of asset manager Stanlib Kenya have withdrawn Sh75 billion ahead of the buyout by rival ICEA Lion Asset Management. The outflows, representing over half Stanlib assets under management (AUM), have been disclosed by the company’s parent company Liberty Holdings of South Africa. The multinational says in a trading update that Stanlib’s “discontinued mandates” stood at R11.1 billion (Sh75 billion) as of December 31, 2019. https://www.businessdail...0026-p9380iz/index.html

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

wukan wrote:Angelica _ann wrote:quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption. Really!! You wish. There is really no disruption here. Most fund managers have the mpesa feature to deposit funds. Quote:Clients of asset manager Stanlib Kenya have withdrawn Sh75 billion ahead of the buyout by rival ICEA Lion Asset Management. The outflows, representing over half Stanlib assets under management (AUM), have been disclosed by the company’s parent company Liberty Holdings of South Africa. The multinational says in a trading update that Stanlib’s “discontinued mandates” stood at R11.1 billion (Sh75 billion) as of December 31, 2019. https://www.businessdail...0026-p9380iz/index.html

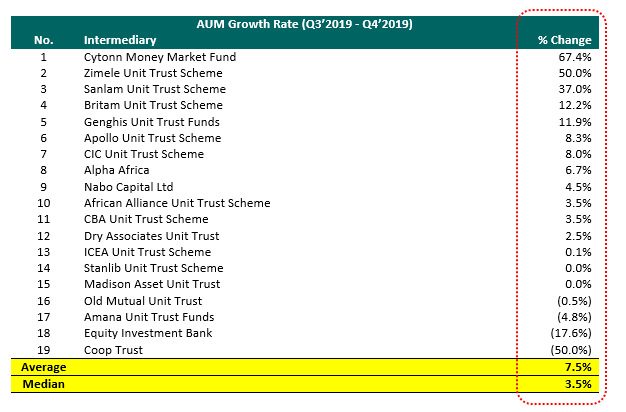

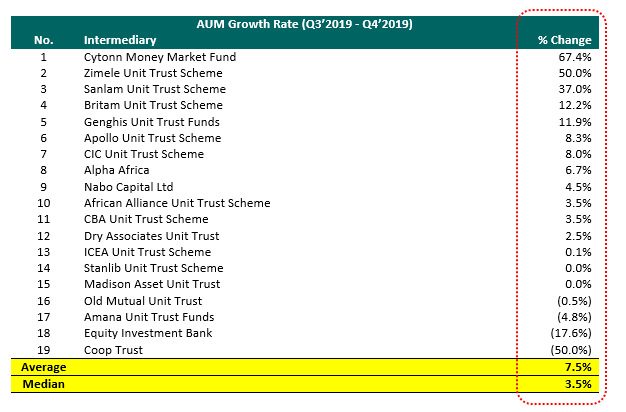

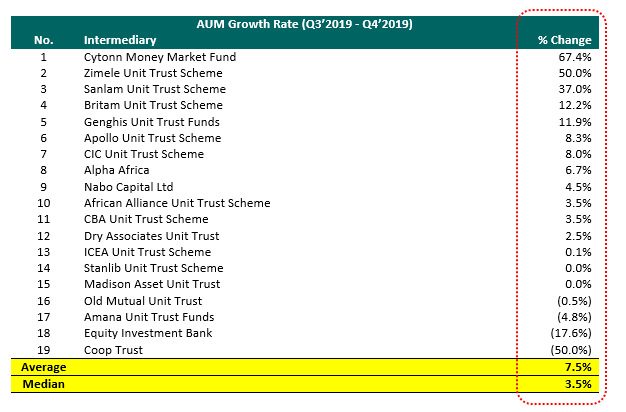

Quarterly Statistical Bulletin market analysis for the period covering the third and fourth quarters of 2019, done by CMA:  Top 5 are pulling double digit growths. Cytonn and Zimele offering high rates and ease of access, Sanlam and Britam making heavy investments in digital products to target young market. Meanwhile the old timers ICEA, Stanlib, Madison are barely making change. Old Mutual, Equity and Coop saw reductions. Tide is changing. While the heavyweights still control a huge portion of the market, if they keep getting comfortable they will continue losing marketshare. Full Report: The CMA Quarterly Capital Markets Statistical Bulletin

|

|

|

Rank: Veteran Joined: 7/8/2008 Posts: 947

|

tony stark wrote:Angelica _ann wrote:Rollout wrote:Even educated investor will struggle to remember which product is regulated and which product is not regulated.

-- Cytonn High Yield Solution (CHYS)

-- Cytonn High Yield Fund (CHYF)

At best, Cytonn did a terrible job making sure their investors understand what they were investing in. At worst, Cytonn intentionally wanted to confuse their investors.

It was obviously this one, prey on the massess' innocence and limited investment knowledge/exposure. I have invested in the cyton high yield solution and have gotten my money out with no problem or hustle. I then reinvested again and I am still expecting to get my money with no hustle. Will know by September if I get my money. But the experience clear. They informed me several times through the agent that this is an unregulated product and they try to sell you to the regulated product. You even sign that you know he risk. Wouldn't say they tried to hide anything. Do i know their investment strategy that will yield 18% in these ridiculous times. NO! Do I expect to get 18% interest ..... YES! These are the kind of messages I need from my fund manager "Dear Esteemed Client, Following the assent of the Tax Amendment Bill 2020, CHYS & CPN investors will now enjoy a final tax rate of 15% on their returns, instead of the previous 30%. This is more reason to further your investment in CHYS & CPN. CMMF & CHYF will continue as before with a 15% final tax on the interest" Let me collect my 18% +covid tax relief yangu. Aluta continua!

|

|

|

Rank: Veteran Joined: 7/8/2008 Posts: 947

|

rwitre wrote:wukan wrote:Angelica _ann wrote:quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption. Really!! You wish. There is really no disruption here. Most fund managers have the mpesa feature to deposit funds. Quote:Clients of asset manager Stanlib Kenya have withdrawn Sh75 billion ahead of the buyout by rival ICEA Lion Asset Management. The outflows, representing over half Stanlib assets under management (AUM), have been disclosed by the company’s parent company Liberty Holdings of South Africa. The multinational says in a trading update that Stanlib’s “discontinued mandates” stood at R11.1 billion (Sh75 billion) as of December 31, 2019. https://www.businessdail...0026-p9380iz/index.html

Quarterly Statistical Bulletin market analysis for the period covering the third and fourth quarters of 2019, done by CMA:  Top 5 are pulling double digit growths. Cytonn and Zimele offering high rates and ease of access, Sanlam and Britam making heavy investments in digital products to target young market. Meanwhile the old timers ICEA, Stanlib, Madison are barely making change. Old Mutual, Equity and Coop saw reductions. Tide is changing. While the heavyweights still control a huge portion of the market, if they keep getting comfortable they will continue losing marketshare. Full Report: The CMA Quarterly Capital Markets Statistical Bulletin I totally agree, I don't think old money will change. MPESA platform doesn't make it an obvious winner. Investment is a hard sell to the current investors and unless safaricom grows a totally new market they will struggle penetrating into the current investment culture by simply offering mpesa platform.

|

|

|

Rank: Veteran Joined: 7/5/2010 Posts: 2,061 Location: Nairobi

|

wukan wrote:Angelica _ann wrote:quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption.

Really!! You wish. There is really no disruption here. Most fund managers have the mpesa feature to deposit funds. Quote:Clients of asset manager Stanlib Kenya have withdrawn Sh75 billion ahead of the buyout by rival ICEA Lion Asset Management. The outflows, representing over half Stanlib assets under management (AUM), have been disclosed by the company’s parent company Liberty Holdings of South Africa. The multinational says in a trading update that Stanlib’s “discontinued mandates” stood at R11.1 billion (Sh75 billion) as of December 31, 2019. https://www.businessdail...0026-p9380iz/index.html

You are only seeing Mpesa as a funnel in and out for money. You are not seeing the strategic, marketing and operations jaggernaut that is Safaricom. Saf will launch a blitz that will say, We are Safaricom, we just made 60 billion. Invest with us . Nothing more really needs to be said...they will be up against a guy in a suit from Fancyname Asset Managers with a brochure with colourful graphs and tables full of figures. No contest. They will hoover up sizeable chunks of money....and some of that money will leave existing funds to join this new one. People have eyes but they don't see. Kaa hapo tu ukifikiria this industry will be the same as it was.

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

quicksand wrote:You are only seeing Mpesa as a funnel in and out for money.

You are not seeing the strategic, marketing, and operations juggernaut that is Safaricom.

Saf will launch a blitz that will say, We are Safaricom, we just made 60 billion. Invest with us .

Nothing more really needs to be said...they will be up against a guy in a suit from Fancyname Asset Managers with a brochure with colourful graphs and tables full of figures.

No contest.

They (Safaricom) will hoover up sizeable chunks of money....and some of that money will leave existing funds to join this new one.

People have eyes but they don't see.

Kaa hapo tu ukifikiria this industry will be the same as it was. My sentiments, precisely. Which brings us back to the question most pertinent to THIS thread: Should Cytonn (whichever arm) be worried?

|

|

|

Rank: Member Joined: 4/26/2011 Posts: 759

|

quicksand wrote:wukan wrote:Angelica _ann wrote:quicksand wrote:wukan wrote:

Rarely does old money move from one fund manager to another. It's very conservative sticking to the old and tested ways. Safcom will have to build their own clientele base among the millennials. It takes time to build credibility in the investment world.

Welcome to disruption. These sentiments were rampant in banking circles at the infancy of Mpesa..when it started heating up, bankster CEOs ran to the CBK governor to whine,....Equity tried a fast one during its first partnership with Safcom where they would attempt to pull customers over to its agency business side. It all backfired and banks were steamrolled. It is time fund managers put on their thinking hats and quick, because the reason whole fund and money management business is stodgy and stagnant is this same, tired reasoning. These guys think people who don't wear suits and can't talk indexes while sticking their noses in the air in snobbishness are not worth chasing as customers. The jackboot is coming and the kick will be so hard they will think the ass has moved into the lungs. Agree, being backed by assets and full faith of a company like Safaricom is no joke. Consumers will choose Safaricom entity any day, all day. Even Edwin will choose Safaricom over Cytonn. Old money is also changing hand from one generation to another in Kenya who hold different investment views. Plus enhanced globalization and innovation disruption.

Really!! You wish. There is really no disruption here. Most fund managers have the mpesa feature to deposit funds. Quote:Clients of asset manager Stanlib Kenya have withdrawn Sh75 billion ahead of the buyout by rival ICEA Lion Asset Management. The outflows, representing over half Stanlib assets under management (AUM), have been disclosed by the company’s parent company Liberty Holdings of South Africa. The multinational says in a trading update that Stanlib’s “discontinued mandates” stood at R11.1 billion (Sh75 billion) as of December 31, 2019. https://www.businessdail...0026-p9380iz/index.html

You are only seeing Mpesa as a funnel in and out for money. You are not seeing the strategic, marketing and operations jaggernaut that is Safaricom. Saf will launch a blitz that will say, We are Safaricom, we just made 60 billion. Invest with us . Nothing more really needs to be said...they will be up against a guy in a suit from Fancyname Asset Managers with a brochure with colourful graphs and tables full of figures. No contest. They will hoover up sizeable chunks of money....and some of that money will leave existing funds to join this new one. People have eyes but they don't see. Kaa hapo tu ukifikiria this industry will be the same as it was.

|

|

|

Rank: Veteran Joined: 7/8/2008 Posts: 947

|

aemathenge wrote:quicksand wrote:You are only seeing Mpesa as a funnel in and out for money.

You are not seeing the strategic, marketing, and operations juggernaut that is Safaricom.

Saf will launch a blitz that will say, We are Safaricom, we just made 60 billion. Invest with us .

Nothing more really needs to be said...they will be up against a guy in a suit from Fancyname Asset Managers with a brochure with colourful graphs and tables full of figures.

No contest.

They (Safaricom) will hoover up sizeable chunks of money....and some of that money will leave existing funds to join this new one.

People have eyes but they don't see.

Kaa hapo tu ukifikiria this industry will be the same as it was. My sentiments, precisely. Which brings us back to the question most pertinent to THIS thread: Should Cytonn (whichever arm) be worried? I don't think so. Other than marketing to people who don't invest safaricom has so many disadvantages. 1. Paying brokerage fees 2. Lack of financial investment strategies 3. Add their marketing blitz and that's an added cost reducing their margins and I am not sure this will yield high quality clients. 4. There is no clear value add in using safaricom over using another investment firm unless you are buying a communication solution. This idea of Safaricom being infallible is totally false. Here is a short list of failed projects Safaricom call a doc- fail Safaricoms little cabs - another failure Safaricoms blaze another stupid and failing idea Do you remember Vuma online for mathrees. Waaah. Safaricom has so many jokers they can lose so much money and still make a profit. This will probably be another failed project.

|

|

|

Rank: Member Joined: 2/20/2007 Posts: 767

|

tony stark wrote:aemathenge wrote:quicksand wrote:You are only seeing Mpesa as a funnel in and out for money.

You are not seeing the strategic, marketing, and operations juggernaut that is Safaricom.

Saf will launch a blitz that will say, We are Safaricom, we just made 60 billion. Invest with us .

Nothing more really needs to be said...they will be up against a guy in a suit from Fancyname Asset Managers with a brochure with colourful graphs and tables full of figures.

No contest.

They (Safaricom) will hoover up sizeable chunks of money....and some of that money will leave existing funds to join this new one.

People have eyes but they don't see.

Kaa hapo tu ukifikiria this industry will be the same as it was. My sentiments, precisely. Which brings us back to the question most pertinent to THIS thread: Should Cytonn (whichever arm) be worried? I don't think so. Other than marketing to people who don't invest safaricom has so many disadvantages. 1. Paying brokerage fees 2. Lack of financial investment strategies 3. Add their marketing blitz and that's an added cost reducing their margins and I am not sure this will yield high quality clients. 4. There is no clear value add in using safaricom over using another investment firm unless you are buying a communication solution. This idea of Safaricom being infallible is totally false. Here is a short list of failed projects Safaricom call a doc- fail Safaricoms little cabs - another failure Safaricoms blaze another stupid and failing idea Do you remember Vuma online for mathrees. Waaah. Safaricom has so many jokers they can lose so much money and still make a profit. This will probably be another failed project. The way I see it, a real game changer for Safaricom would be if they get a banking license. That way they get to keep and recirculate all deposits at a handsome profit. However, I doubt NCBA and kamwana would allow it.... They must find it difficult....... those who have taken authority as the truth, rather than truth as the authority. -G. Massey.

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,641

|

rwitre wrote:Quarterly Statistical Bulletin market analysis for the period covering the third and fourth quarters of 2019, done by CMA:  Top 5 are pulling double digit growths. Cytonn and Zimele offering high rates and ease of access, Sanlam and Britam making heavy investments in digital products to target young market. Meanwhile the old timers ICEA, Stanlib, Madison are barely making change. Old Mutual, Equity and Coop saw reductions. Tide is changing. While the heavyweights still control a huge portion of the market, if they keep getting comfortable they will continue losing marketshare. Full Report: The CMA Quarterly Capital Markets Statistical Bulletin Cytonn has done analysis for the full year 2019. It is still an old boys network. 82% of the market https://cytonnreport.com.../fy2019-utf-performance

Equity tried their hand and it's been a dismal performance.

|

|

|

Rank: Member Joined: 1/19/2016 Posts: 204

|

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

paulkimani wrote:https://twitter.com/pkwazua/status/1268061618056966145?s=21

Why drag wazua into this your fight with Cytonn? In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Angelica _ann wrote:paulkimani wrote:https://twitter.com/pkwazua/status/1268061618056966145?s=21

Why drag wazua into this your fight with Cytonn? Clicked on the link out of curiosity. Comments on the thread are from two accounts with less than 5 followers. (One has zero) No problem with new accounts. But these are new accounts whose content is majorly on bashing Cytonn. Unsurprisingly, PK's account doesn't talk about anything else. Forgive us if we conclude that yours is a personal vendetta against the company, not an objective take on their activities.

|

|

|

Rank: Elder Joined: 10/3/2008 Posts: 4,058 Location: Gwitu

|

rwitre wrote:Angelica _ann wrote:paulkimani wrote:https://twitter.com/pkwazua/status/1268061618056966145?s=21

Why drag wazua into this your fight with Cytonn? Clicked on the link out of curiosity. Comments on the thread are from two accounts with less than 5 followers. (One has zero) No problem with new accounts. But these are new accounts whose content is majorly on bashing Cytonn. Unsurprisingly, PK's account doesn't talk about anything else. Forgive us if we conclude that yours is a personal vendetta against the company, not an objective take on their activities. This reminds of a movie called Obsessed featuring Idris Elba and Beyonce. Truth forever on the scaffold

Wrong forever on the throne

(James Russell Rowell)

|

|

|

Rank: Member Joined: 1/19/2016 Posts: 204

|

Good morning and welcome to another episode of “peter kimani only comments on Cytonn”! Welcome! Hope you all are keeping safe #cytonnairesturnedcytonnbeggars https://twitter.com/deev...272260117623377921?s=21

https://twitter.com/morr...275287053450784768?s=21

https://twitter.com/morr...275270947151450112?s=21

https://twitter.com/ekon...275272136064667653?s=21

Have a blessed day to friends and foe alike!

|

|

|

Rank: Member Joined: 1/19/2016 Posts: 204

|

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

Lots of whispers in the market about a high level shake up of personnel in Cytonn.....are the fellows planning on running with the money? Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

There's a deeva who really seems to have an axe to grind with Cytonn.

|

|

|

Wazua

»

Groups

»

Triumph

»

Cytonn Investments

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|