Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Member Joined: 7/1/2009 Posts: 270

|

[quote=cyruskulei]For those of us who dont have live nse stream can us this link: https://www.nse.co.ke/nse-25-index.html[/quote] Thank you. For a while now, was only left with ft.com

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

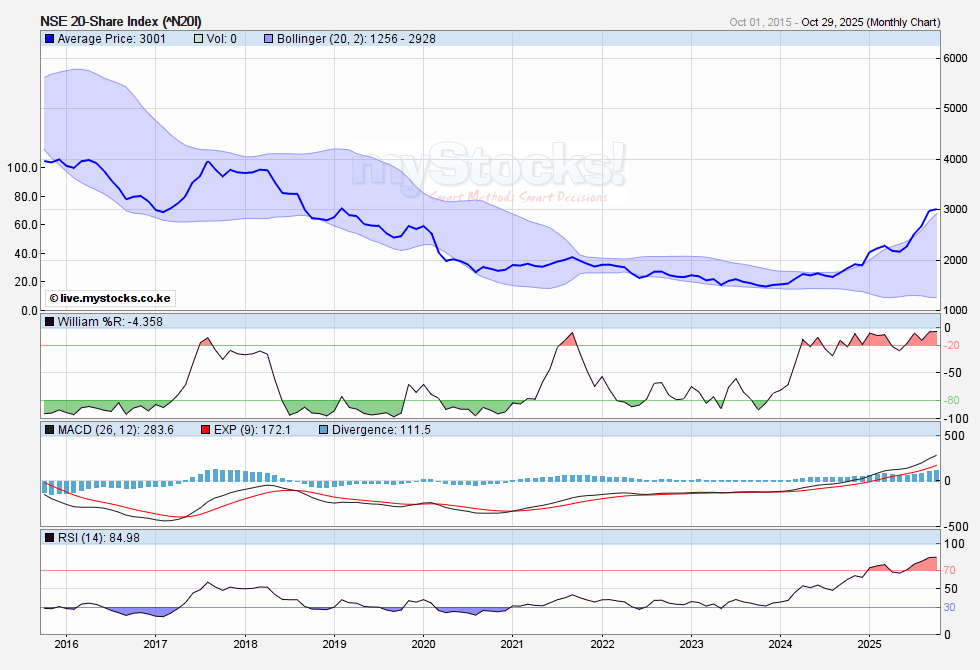

DJIA. The bearish rally is now complete at 24,500. The next wave DOWN should take DOW below 18,000. Targets 17,400, 13,000 and 6,000. An epic slide.. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Member Joined: 3/9/2010 Posts: 320 Location: kenya

|

It appears New lows are being broken by this covid.  Work hard at your job and you can make a living. Work hard on yourself and you can make a fortune.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

The DJIA Elliott Wave analysis. Minor waves 1 and 2 complete. The next move is a drop towards 21,500 in wave 3. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

GOLD is completing wave (Y) of [2] below the all time high of 1919. The next move in Gold will be a drop to levels below 1000. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,327 Location: Nairobi

|

mnandii wrote: GOLD is completing wave (Y) of [2] below the all time high of 1919. The next move in Gold will be a drop to levels below 1000. Gold USD 1,000/oz? When? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 6/1/2017 Posts: 288

|

VituVingiSana wrote:mnandii wrote: GOLD is completing wave (Y) of [2] below the all time high of 1919. The next move in Gold will be a drop to levels below 1000. Gold USD 1,000/oz? When? The futures price of gold may retrace back to 1450 USD/oz or at the very worst its prior 6 year resistance of 1350 USD but 1000 is highly unlikely especially considering the trillions of currency the developed world central banks are printing up.Notice I said the futures price of gold as commodity prices are determined in the futures markets and as we clearly saw last Monday with WTI oil price when it collapsed to MINUS 40 USD,futures prices do not reflect the reality of physical commodity prices.Would a producer sell in the real world oil at -40 USD?Of course not but then again Monday saw a ridiculous situation where traders and those who store oil were willing to pay buyers 40 USD to take their futures contracts and physical oil away from them.The futures markets is simply a gambling casino of Wall Street and Chicago Commodity Exchange (COMEX) traders who can manipulate prices to ludicrous levels like the -40 WTI price. Right now as the futures price of gold trades at around 1720 USD,its almost impossible to buy physical gold at this price and physical is selling at premiums of 1900 USD and above ie if you can even get it.Smart investors,fearing the consequences of central banks money printing,have gobbled up the above ground stockpiles in a buying frenzy over the last few weeks resulting in shortage of physical especially in the retail space.Bullion dealers and mints have been cleaned out by the buying avalanche.To make things worse,most gold mines and mints have been closed down in fear of having Covid-19 break out in the areas further constraining supply.Also,the physical gold supply chains are affected by Covid-19 movement restrictions thus the Comex price of gold is just a paper price with no bearing on reality of the physical market. Well who knows the futures gold price may hit 1000 or possibly even negative like we saw on oil but the physical market wont drop to those depressed prices. Contrarian Investor and Trader.Advocate of free markets,limited government interference in the economy and sound money

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

The DJIA could rise to 25,000 but the bigger picture is tilted to the Downside. A dive below 20,000 should come soon. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

slick wrote:VituVingiSana wrote:mnandii wrote: GOLD is completing wave (Y) of [2] below the all time high of 1919. The next move in Gold will be a drop to levels below 1000. Gold USD 1,000/oz? When? The futures price of gold may retrace back to 1450 USD/oz or at the very worst its prior 6 year resistance of 1350 USD but 1000 is highly unlikely especially considering the trillions of currency the developed world central banks are printing up.Notice I said the futures price of gold as commodity prices are determined in the futures markets and as we clearly saw last Monday with WTI oil price when it collapsed to MINUS 40 USD,futures prices do not reflect the reality of physical commodity prices.Would a producer sell in the real world oil at -40 USD?Of course not but then again Monday saw a ridiculous situation where traders and those who store oil were willing to pay buyers 40 USD to take their futures contracts and physical oil away from them.The futures markets is simply a gambling casino of Wall Street and Chicago Commodity Exchange (COMEX) traders who can manipulate prices to ludicrous levels like the -40 WTI price. ... Well who knows the futures gold price may hit 1000 or possibly even negative like we saw on oil but the physical market wont drop to those depressed prices. The contracts are priced with respect to delivery dates. There are different contracts in oil based on where they are sold. The price of the commodity is not separate from what you call futures. the particular oil contract that went into negative territory was expiring on March 21st(I think). The price reflected reality. As always people like to project trends linearly into the future which is what is happening with Gold right now. Everybody assumes that because it has been rising then it will continue to rise ad infinitum. People are now even quoting what central bankers are ready to do with respect to stimulus packages. Well, just know that the central bank does not control the market. It reacts to the market. For a little bit of perspective read this report for what happened in 2012 when a similar extreme sentiment in Gold resulted in Gold plummeting: linkConventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

mnandii wrote: The DJIA could rise to 25,000 but the bigger picture is tilted to the Downside. A dive below 20,000 should come soon. Very toppish. Liquidated some positions two weeks ago and looking to go short. Corporate earnings estimates are projected to be lower by 30-50% by year end...the bear isn't done with this one. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 6/1/2017 Posts: 288

|

mnandii wrote:slick wrote:VituVingiSana wrote:mnandii wrote: GOLD is completing wave (Y) of [2] below the all time high of 1919. The next move in Gold will be a drop to levels below 1000. Gold USD 1,000/oz? When? The futures price of gold may retrace back to 1450 USD/oz or at the very worst its prior 6 year resistance of 1350 USD but 1000 is highly unlikely especially considering the trillions of currency the developed world central banks are printing up.Notice I said the futures price of gold as commodity prices are determined in the futures markets and as we clearly saw last Monday with WTI oil price when it collapsed to MINUS 40 USD,futures prices do not reflect the reality of physical commodity prices.Would a producer sell in the real world oil at -40 USD?Of course not but then again Monday saw a ridiculous situation where traders and those who store oil were willing to pay buyers 40 USD to take their futures contracts and physical oil away from them.The futures markets is simply a gambling casino of Wall Street and Chicago Commodity Exchange (COMEX) traders who can manipulate prices to ludicrous levels like the -40 WTI price. ... Well who knows the futures gold price may hit 1000 or possibly even negative like we saw on oil but the physical market wont drop to those depressed prices. The contracts are priced with respect to delivery dates. There are different contracts in oil based on where they are sold. The price of the commodity is not separate from what you call futures. the particular oil contract that went into negative territory was expiring on March 21st(I think). The price reflected reality. As always people like to project trends linearly into the future which is what is happening with Gold right now. Everybody assumes that because it has been rising then it will continue to rise ad infinitum. People are now even quoting what central bankers are ready to do with respect to stimulus packages. Well, just know that the central bank does not control the market. It reacts to the market. For a little bit of perspective read this report for what happened in 2012 when a similar extreme sentiment in Gold resulted in Gold plummeting: link Futures prices at times do not reflect real price of the underlying asset and present the means by which big wall street money can manipulate prices of underlying assets to their desire.When WTI May futures contract collapsed to -40 USD,of course no oil producer was paying refiners to take away their oil.The negative prices were only in the paper futures contracts and for oil stored in depots where traders and oil storage parties were willing to pay buyers 40 USD to take a contract or a barrel away from them respectively and did not reflect selling price of oil producers. With respect to gold futures contracts,there are far more paper contracts at the Chicago Commodity Exchange (COMEX) than underlying gold bullion for delivery.The ratio of paper contracts to physical gold at times is as high at 100:1 meaning 100 paper contracts to every 1 unit of physical gold.Thus there is fractional reserves of gold (just like fractional reserve banking) or what is known as rehypothecation of gold.Most of the time paper traders just settle in cash once the futures contract hits its maturity date and few rarely take physical delivery of gold thus the Comex scheme (like banks) can continue as long as most traders dont ask for physical delivery.In the current environment,more and more traders are requesting for delivery of physical gold putting pressure on the Comex to avail gold.Comex usually delivers physical gold in 100 oz bars but they run out and now souring for 400 oz bars which are also in limited supply.Its gotten so insane that Comex is trying to get bars from Australia and London in the gold rush and if this persists Comex may default on its obligation to settle in physical gold.In fact in their contract agreement with traders,Comex can elect to refuse physical delivery if a trader requests so and settle in cash at maturity. For gold and silver,the Comex futures market was designed to manage and suppress the price of the metals.Gold and silver represent a competitor to the fiat currency system that central banks can print almost ad infinitum.A rising gold price is evidence in peoples losing confidence in the fiat currency system thus central banks,governments and bullion banks cannot allow gold prices to rise and use the Comex to suppress gold price rise.By issuing multiples of contracts over the physical stock of gold and pegging the price of physical gold to the price of futures contracts the central banks and bullion banks can dilute the market with enormous number of paper contracts keeping prices low.Also,the bullion banks like JP Morgan and Deutsche Bank tend to be massively short the gold and silver markets and dump their contracts in mass to periodically force gold and silver futures prices lower.In fact JP Morgan and Deutsche Bank have been caught rigging the metals prices downwards,fined a small fee then they continue the rigging game nonetheless    Contrarian Investor and Trader.Advocate of free markets,limited government interference in the economy and sound money

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

@slick, no one has the capacity to manipulate any liquid market in the world. NO ONE (not even the Central Bank!). Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

mnandii wrote:@slick, no one has the capacity to manipulate any liquid market in the world. NO ONE (not even the Central Bank!). Guys, it is important to note that before I started learning Elliott, I was like many other speculators. I wandered between technical analysis (other than Elliott) and fundamental analysis. And yes, there was a time I believed this useless myth that there are people who manipulate the markets - that there is smart money! Nothing is further from the truth. If a market is manipulated then it isn't liquid. Mass psychology determines the direction that markets go, not some super resourced people who take advantage of the less endowed. And if markets are indeed manipulated then there wouldn't be any need to try to forecast them, would there?! Indeed why would anyone even invest in such a market if you are not among or know the strategies of smart money managers. The earlier one comes to agreement with the fact that no one manipulates markets the better their view of the markets become. There is more flesh to what I have stated above and I would advice people who are interested in facts to get the book Prechter's Perspective and also check 'Market Myths' from www.elliottwave.com Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: New-farer Joined: 7/16/2018 Posts: 23

|

Any company in Kenya installing 100% solar roofs

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

mnandii wrote:mnandii wrote:@slick, no one has the capacity to manipulate any liquid market in the world. NO ONE (not even the Central Bank!). Guys, it is important to note that before I started learning Elliott, I was like many other speculators. I wandered between technical analysis (other than Elliott) and fundamental analysis. And yes, there was a time I believed this useless myth that there are people who manipulate the markets - that there is smart money! Nothing is further from the truth. If a market is manipulated then it isn't liquid. Mass psychology determines the direction that markets go, not some super resourced people who take advantage of the less endowed. And if markets are indeed manipulated then there wouldn't be any need to try to forecast them, would there?! Indeed why would anyone even invest in such a market if you are not among or know the strategies of smart money managers. The earlier one comes to agreement with the fact that no one manipulates markets the better their view of the markets become. There is more flesh to what I have stated above and I would advice people who are interested in facts to get the book Prechter's Perspective and also check 'Market Myths' from www.elliottwave.com Psychologically investors create fall guys/boogeymen for their losses...be it central banks or smart money. These boogeymen especially central banks are happy to take the credit when things work out their way as it creates a veil of invincibility (like don't fight the Fed). Manipulation even in an illiquid market is short term as sooner rather than later corrections take place. Markets run on their own fuel/energy. Wouldn't it for example be in all investors interest if we had perpetual bull markets? Shouldn't the combined firepower of GoK, KLM, several KE banks and smart money push a stock like KQ to trade above their respective breakeven points? The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 6/1/2017 Posts: 288

|

mnandii wrote:mnandii wrote:@slick, no one has the capacity to manipulate any liquid market in the world. NO ONE (not even the Central Bank!). Guys, it is important to note that before I started learning Elliott, I was like many other speculators. I wandered between technical analysis (other than Elliott) and fundamental analysis. And yes, there was a time I believed this useless myth that there are people who manipulate the markets - that there is smart money! Nothing is further from the truth. If a market is manipulated then it isn't liquid. Mass psychology determines the direction that markets go, not some super resourced people who take advantage of the less endowed. And if markets are indeed manipulated then there wouldn't be any need to try to forecast them, would there?! Indeed why would anyone even invest in such a market if you are not among or know the strategies of smart money managers. The earlier one comes to agreement with the fact that no one manipulates markets the better their view of the markets become. There is more flesh to what I have stated above and I would advice people who are interested in facts to get the book Prechter's Perspective and also check 'Market Myths' from www.elliottwave.com Developed world central banks manipulate liquid markets all the time.Yes its harder to manipulate a liquid market than an illiquid one but central banks have the firepower to push markets in the direction they desire since they can print fiat currency almost to infinity to pump up markets.Even the well respected Forbes magazine image below agrees with me  The US government bond market is the most liquid asset market in the world and the Fed massively manipulates this market and has been doing so especially after the 2008 GFC by buying several trillions of treasuries to keep yields suppressed below 1% currently for most bonds to lower borrowing costs thus enabling every Tom,Janet,Tesla,General Electric,US shale oil producer borrow at utlra low costs and build bubbles that have recently come under stress.Its gets worse in the Eurozone where the European Central Bank (ECB)-ECB owns over 1/3 of Eurozone bonds and Bank of Japan (BOJ) owns over 1/2 of Japanese bonds.The BOJ and ECB owns so many bonds that many bond yields flipped into negative territory.The BOJ has taken this a step further through measures like yield curve control ie e.g the BOJ has pegged the 10 year bond to 0% such that if the bond sells off and yields rise above 0% the BOJ will buy back as many bonds as possible to return yields back to 0%.A blatant manipulation by all accounts.The BOJ also buys stocks and is the biggest single player in the Nikkei   The April rally in the US stock market after the March crash is purely attributed to Fed money printing.There are no fundamentals backing that bear market rally other than Fed unleashing trillions of fiat currency to buy all asset markets and prevent a complete collapse.How can US stocks possibly been rising in the last few weeks yet the US has the highest Covid-19 infection and death rates,non essential businesses are under lockdown and over 30 million jobs have been lost so far?Its all about the Fed thus the US central bank is manipulating all asset markets buy buying government and corporate bonds,commercial paper,bailing out money market and hedge funds and indirectly buying stocks.Thats obvious central bank manipulation.   As I said,central banks dont have 100% control of markets but are by far the largest factor contributing to market moves.Technical (TA) and Fundamental (FA) Analysis isnt totally obsolete but central bank action reduces its efficacy.TA and FA are far more prominent in free markets.I have to admit that the Kenyan bourse is far more free market than Western markets because Opus Dei doesnt pull the shenanigans of mass money printing like first world central banks to prop up markets.Inevitably free market forces will reassert themselves in advanced nations and the current deflation is a free market natural mechanism to purge malinvestments and asset/debt bubbles but central banks are fighting the deflation by trillions of new fiat currency creation.Its this titanic struggle between the natural deflationary corrective mechanism vs central bank money printing inflationary response thats creating these volatile swings in markets Contrarian Investor and Trader.Advocate of free markets,limited government interference in the economy and sound money

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 868 Location: nairobi

|

https://www.businessdail...F5S2gaLTAioHLy3ltl8GqnQ

CBK says loans worth Sh81.7 billion had been restructured since mid-March, a signalling that Absa and StanChart accounted for a fifth of credit whose terms have been reviewed. Looks like banks will really be hit since we are still in the early days of getting to the full economic impact

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

heri wrote:https://www.businessdailyafrica.com/corporate/companies/StanChart-restructures-6-4pc-loans/4003102-5543594-2rdnqv/index.html?utm_source=traqli&utm_medium=email&utm_campaign=bdafrica_newsletter&tqid=0fKiYnV.AxQBBiglHD9F5S2gaLTAioHLy3ltl8GqnQ

CBK says loans worth Sh81.7 billion had been restructured since mid-March, a signalling that Absa and StanChart accounted for a fifth of credit whose terms have been reviewed.

Looks like banks will really be hit since we are still in the early days of getting to the full economic impact It has passed sh.100bn Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 9/14/2011 Posts: 868 Location: nairobi

|

Just wondering , with all the debts that GOK has , is it not a matter of time before it is forced to sell stakes in some of the companies ad parastatals like Safcom, KCB , Kenya pipeline , National Oil etc . How else will GOK get out of the deep financial hole? May not happen now though

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

DJIA. Ready for a wave 3 DROP down. Targets around 21,000. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|