Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Veteran Joined: 6/8/2010 Posts: 1,733

|

Who wants to touch kenyan market when DPP, DCI are harrassing local investors at beheast of international investors whom in turn are taking their operations out of country (Diageo operations mainly Finance and HR have been moved to India) Life is an endless adventure

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. KE has structural problems that is not in doubt...it has had them all along even in pre-colonial times and it will take an almighty effort to change course perhaps through the ticking demographic time bomb. That still doesn't excuse the fiscal indiscipline of the current regime, white elephant projects strewn all over the place, debt spree/treadmill and the general emasculation of the private sector. It is laughable to suggest that the current leadership can tackle structural issues if the basics are Greek to them. 2002-2007 was superb economically on a trickle down basis - all the succesful IPOs during that time is testament to this fact from an NSE perspective, deepening of financial inclusion, absorption levels of skilled and semi-skilled labour in to the formal wrokforce etc - but the regime changed tune after 2008 to go the Hollywood way of shiny/grandiose projects and hollow/vanity undertakings like project 2030 and the likes. The big 4 projects are a tragic comedy. 2008 PEV was as a result of political gamesmanship than economics. The current downslide is economic in nature and even an ambient political environment won't change it...the die is already cast as it were. That said, the faster the reset happens the better. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

lochaz-index wrote:wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. KE has structural problems that is not in doubt...it has had them all along even in pre-colonial times and it will take an almighty effort to change course perhaps through the ticking demographic time bomb. That still doesn't excuse the fiscal indiscipline of the current regime, white elephant projects strewn all over the place, debt spree/treadmill and the general emasculation of the private sector. It is laughable to suggest that the current leadership can tackle structural issues if the basics are Greek to them. 2002-2007 was superb economically on a trickle down basis - all the succesful IPOs during that time is testament to this fact from an NSE perspective, deepening of financial inclusion, absorption levels of skilled and semi-skilled labour in to the formal wrokforce etc - but the regime changed tune after 2008 to go the Hollywood way of shiny/grandiose projects and hollow/vanity undertakings like project 2030 and the likes. The big 4 projects are a tragic comedy. 2008 PEV was as a result of political gamesmanship than economics. The current downslide is economic in nature and even an ambient political environment won't change it...the die is already cast as it were. That said, the faster the reset happens the better. True! We are at the point of no return. Only a change in top leadership will resuscitate the exchange and the economy at large. Until 2022 itabidi tukubali hali

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

September will be an interesting month. Safaricom and kcb will be ex dividend. Their current prices are being held up by them being cum dividend Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Ericsson wrote:September will be an interesting month.

Safaricom and kcb will be ex dividend.

Their current prices are being held up by them being cum dividend Those two stocks rarely go with the vagaries of dividend chasers

KQ ABP 4.26

|

|

|

Rank: Hello Joined: 8/24/2019 Posts: 1 Location: London

|

Why is it so hard to change one's physical address?

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

https://www.businessdail...8634-7cje52z/index.html

Some of the insolvent or financially distressed companies at the Nairobi Securities Exchange (NSE)risk being delisted if far-reaching changes to the rules are adopted. The Capital Markets Authority (CMA) and the NSE Wednesday released the proposed listing rules that will see the struggling firms put under a recovery board and given three years to complete a turnaround or be expelled from the Nairobi bourse altogether. The recovery board will accommodate firms struggling with negative working capital — where short-term assets fall short of short-term liabilities — a position that has made it difficult for them to pay their short-term debt and meet routine financial obligations. The recovery board is also expected to alert investors at the NSE of companies in which they should trade with caution when buying shares. The proposal is aimed at helping especially retail investors make informed decisions before buying stocks. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

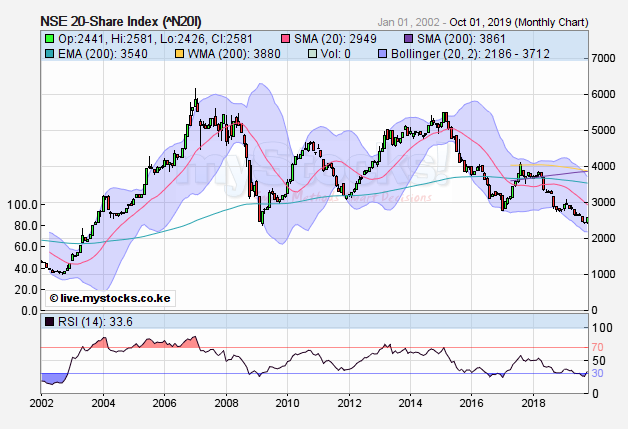

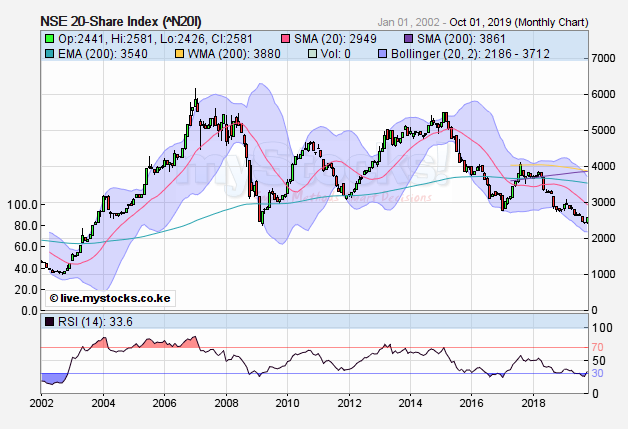

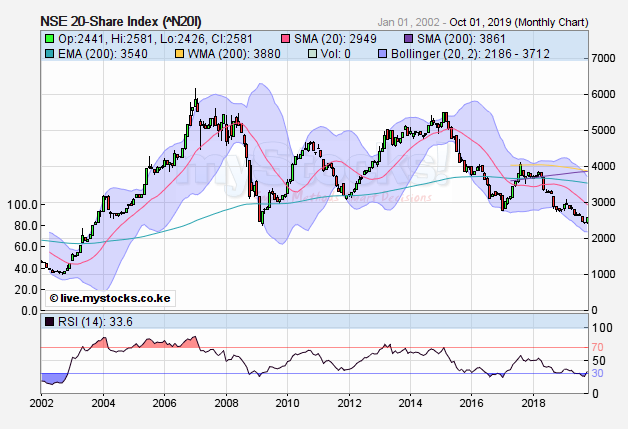

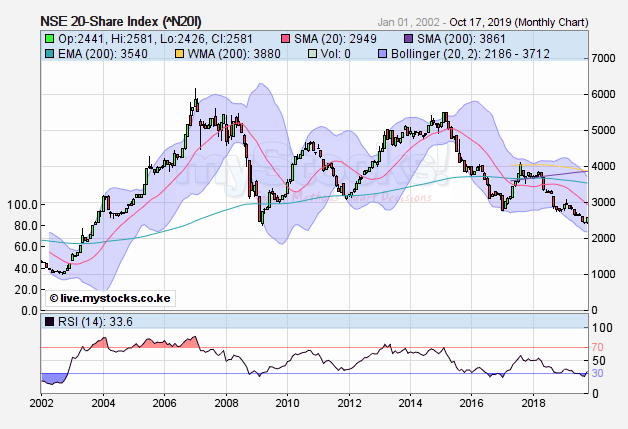

2nd month in a row at sub 2500 for the NSE20. And we are still 3 years away from an election. Like i said before, repealing the interest rate caps holds the key to anything above 2500. For now, it's still buying season, well.... with no end in sight.....  @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Latest figures from KNBS show that inflation has come down from 5% in August to 3.83%!!! Why on earth is CBR still at 9%???? This should be brought down to 5.5% and then do away with that thing called interest rate cap. Efficient banks will definitely pass on the benefit to borrowers even to levels below the current allowed 13%. Let market forces reign! @SufficientlyP

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,638

|

Sufficiently Philanga....thropic wrote:Latest figures from KNBS show that inflation has come down from 5% in August to 3.83%!!!

Why on earth is CBR still at 9%????

This should be brought down to 5.5% and then do away with that thing called interest rate cap. Efficient banks will definitely pass on the benefit to borrowers even to levels below the current allowed 13%.

Let market forces reign! Low inflation could signal diminished purchasing power. If banks are not willing to lend at 13% they won't lend at 8%. Low inflation and low interest rates will have an overall negative effect on consumption. Low inflation is good for countries with an ageing population Kenya's avg age is 19 years. As for market forces for interest rate it's a bit too late to change gears. There is the law of unintended consequences. The irony of it all is that letter from Mediamax on the intended redundancy   You simply can't make this stuff up. Quote:In a notice to the Ministry of Labour and Social Services, Acting CEO Ken Ngaruiya said the company has been forced by the recent economic downturn and loss of its major revenue streams to reorganise its staff structure and abolish some positions as part of its cost-cutting measures.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

wukan wrote:As for market forces for interest rate it's a bit too late to change gears. There is the law of unintended consequences. The irony of it all is that letter from Mediamax on the intended redundancy  You simply can't make this stuff up. You simply can't make this stuff up. Quote:In a notice to the Ministry of Labour and Social Services, Acting CEO Ken Ngaruiya said the company has been forced by the recent economic downturn and loss of its major revenue streams to reorganise its staff structure and abolish some positions as part of its cost-cutting measures. They have used wanjiku through propaganda and achieved what they wanted now they don't need them anymore. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Great points @Wukan. Well no one is forcing the banks to lend just like no one will force GoK to scrap its populist measures like Rate Caps. THE MARKETS WILL! In 2003, when Kibaki took over the reigns of power, the banks were not lending to wanjiku and Kibaki, via then Finance CS Mwiraria(may his soul rest in peace) didn't bother forcing them to. All they did was lower cbr (easing) and the rest is history. The current folks at treasury are afraid of easing as this will awaken the USD bulls and there is that little issue of mounting USDloans, including the Eurobonds....and the resultant hike in the figure in KES terms.. Well the thing is, at some point, they will have to bow down to THE MARKETS!! @SufficientlyP

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,638

|

I agree that at some point they will bow down to the markets especially if USD bulls rage. But it is viable politically, socially and economically to hold things constant for a decade to allow for the debt binge to balance off. Treasury's kick-the-can strategy on debt shows this as more likely.

The biggest casualty will be the poor and the emerging middle class who will stagnate for a decade because of low employment and stagnant wages. However, given the docile nature of kenya's middle class it will have little consequence for the power elite. They can pull it off. Wanjiku is easily taken in by propaganda as @Angel puts it.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Sufficiently Philanga....thropic wrote:2nd month in a row at sub 2500 for the NSE20. And we are still 3 years away from an election. Like i said before, repealing the interest rate caps holds the key to anything above 2500. For now, it's still buying season, well.... with no end in sight.....  Let's see how prices of various counters will behave this month. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:2nd month in a row at sub 2500 for the NSE20. And we are still 3 years away from an election. Like i said before, repealing the interest rate caps holds the key to anything above 2500. For now, it's still buying season, well.... with no end in sight.....  The NASI has already crossed the proverbial Rubicon. A small bounce then the NSE20 will crack the GFC low. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Great points @Wukan.

Well no one is forcing the banks to lend just like no one will force GoK to scrap its populist measures like Rate Caps. THE MARKETS WILL!

In 2003, when Kibaki took over the reigns of power, the banks were not lending to wanjiku and Kibaki, via then Finance CS Mwiraria(may his soul rest in peace) didn't bother forcing them to.

All they did was lower cbr (easing) and the rest is history.

The current folks at treasury are afraid of easing as this will awaken the USD bulls and there is that little issue of mounting USDloans, including the Eurobonds....and the resultant hike in the figure in KES terms.. Well the thing is, at some point, they will have to bow down to THE MARKETS!! The CRR was also regularly used by cbk as a lever to spur or curtail lending as situation demanded. That is all but dead too in the cap regime. My fear as well is that the longer the caps remain the more potent the pressure will build and the resultant snap back will blow off the lid in a furious manner. MTM bondholdings will be an ugly sight. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

wukan wrote:I agree that at some point they will bow down to the markets especially if USD bulls rage. But it is viable politically, socially and economically to hold things constant for a decade to allow for the debt binge to balance off. Treasury's kick-the-can strategy on debt shows this as more likely.

The biggest casualty will be the poor and the emerging middle class who will stagnate for a decade because of low employment and stagnant wages. However, given the docile nature of kenya's middle class it will have little consequence for the power elite. They can pull it off. Wanjiku is easily taken in by propaganda as @Angel puts it. A decade? My guesstimate is one year tops before the market shows the way. Bond yields may have already bottomed if what is happening in the Japanese bond and US REPO markets is any kind of indicator. Overall, after retesting and exceeding the 2016 lows, negative yielding bonds are now retreating and it could be a short ride up if this is a liquidity shortage. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Great points @Wukan.

Well no one is forcing the banks to lend just like no one will force GoK to scrap its populist measures like Rate Caps. THE MARKETS WILL!

In 2003, when Kibaki took over the reigns of power, the banks were not lending to wanjiku and Kibaki, via then Finance CS Mwiraria(may his soul rest in peace) didn't bother forcing them to.

All they did was lower cbr (easing) and the rest is history.

The current folks at treasury are afraid of easing as this will awaken the USD bulls and there is that little issue of mounting USDloans, including the Eurobonds....and the resultant hike in the figure in KES terms.. Well the thing is, at some point, they will have to bow down to THE MARKETS!! The CRR was also regularly used by cbk as a lever to spur or curtail lending as situation demanded. That is all but dead too in the cap regime. My fear as well is that the longer the caps remain the more potent the pressure will build and the resultant snap back will blow off the lid in a furious manner. MTM bondholdings will be an ugly sight. Kenya has no monetary policy when it comes to interest and lending rates. Jude Njomo is the policy maker not CBK nor the market Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Member Joined: 11/17/2018 Posts: 173 Location: Mars

|

Ericsson wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Great points @Wukan.

Well no one is forcing the banks to lend just like no one will force GoK to scrap its populist measures like Rate Caps. THE MARKETS WILL!

In 2003, when Kibaki took over the reigns of power, the banks were not lending to wanjiku and Kibaki, via then Finance CS Mwiraria(may his soul rest in peace) didn't bother forcing them to.

All they did was lower cbr (easing) and the rest is history.

The current folks at treasury are afraid of easing as this will awaken the USD bulls and there is that little issue of mounting USDloans, including the Eurobonds....and the resultant hike in the figure in KES terms.. Well the thing is, at some point, they will have to bow down to THE MARKETS!! The CRR was also regularly used by cbk as a lever to spur or curtail lending as situation demanded. That is all but dead too in the cap regime. My fear as well is that the longer the caps remain the more potent the pressure will build and the resultant snap back will blow off the lid in a furious manner. MTM bondholdings will be an ugly sight. Kenya has no monetary policy when it comes to interest and lending rates. Jude Njomo is the policy maker not CBK nor the market No word from Uhuru yet...

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Following the Prseident's refusal to sign the Finance bill until the rate cap is done away with, September 2019's 10 year low of 2420 will be the floor.....  @SufficientlyP

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|