Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Monk wrote:obiero wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:obiero wrote:mlennyma wrote:VituVingiSana wrote:Ericsson wrote:Ericsson wrote:Blood on the streets https://www.businessdail...40774-bfnrg6/index.html

The share prices of 17 Nairobi Securities Exchange (NSE) listed firms have fallen below Sh5 per unit in a stock market bear run attributed to a mix of corporate governance weaknesses, a tough economy and over-indebtedness. Kenya Airways has accounted for the biggest fall in capitalisation, losing Sh34.1 billion to be valued at Sh16.4 billion after its share price dropped from Sh8.90 to Sh2.89. Are you speaking in code?  it's worth -ve According to your analysis, but KQLC value it at KES 8.52 Past tense. They might have done so under duress but not any more. All banks with shares in KQ via KQLC should sensibly take the write-down to zero given the performance of KQ and very small group of buyers. I don’t know why most people are not plugged into the Open Offer missing link. The current KQ shares trading are fake! Then you should be BUYING all you can. Borrow and buy KQ shares. Sell your house and buy KQ shares. After all, how long will it take for your house to 3x in value vs KQ? You know I have houses and not a house   You've made my day. Without you, I think Wazua would be a very dull place. I agree!

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

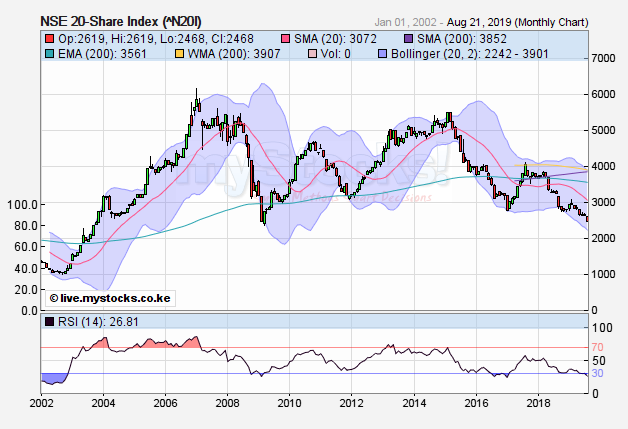

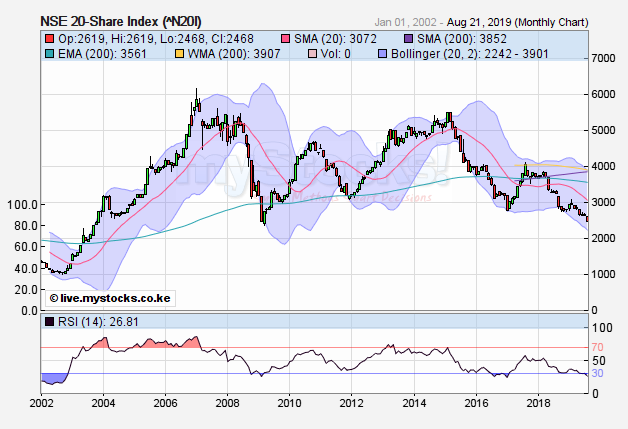

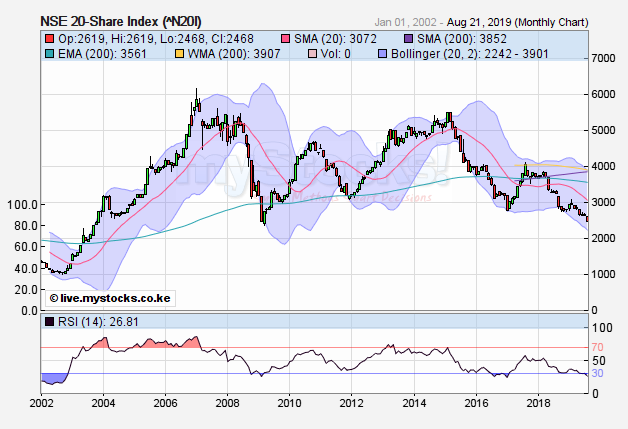

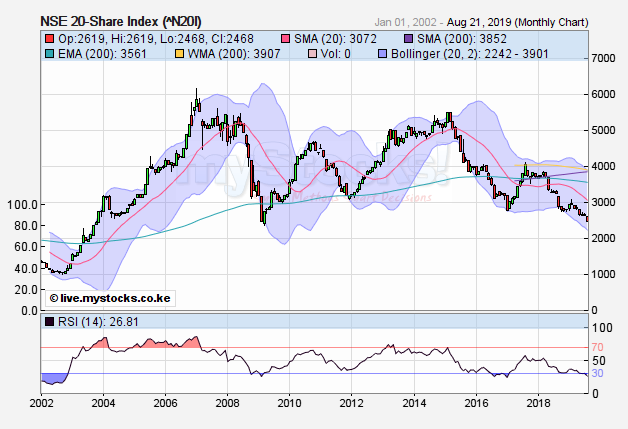

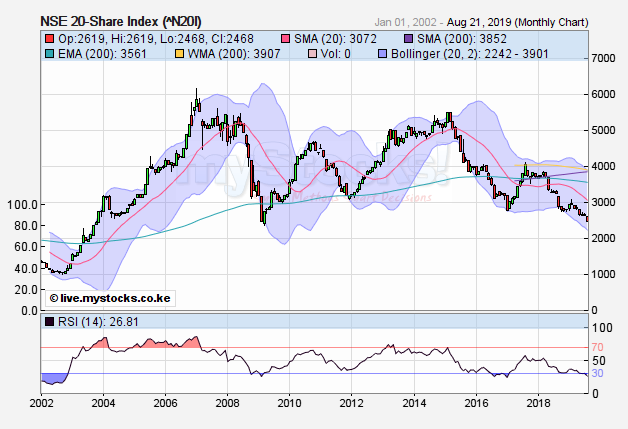

Could September be the month that we smash the GFC March 2009 low of 2360? Remember Saf goes ex on 3rd, and KCB on 6th(both 1st week of Sept  Saving grace going forward would be if the rate cap is done away with....but i don't see this happening with our populist leader. Oh how i miss Kibaki.  @SufficientlyP

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Sufficiently Philanga....thropic wrote:Could September be the month that we smash the GFC March 2009 low of 2360? Remember Saf goes ex on 3rd, and KCB on 6th(both 1st week of Sept  Saving grace going forward would be if the rate cap is done away with....but i don't see this happening with our populist leader. Oh how i miss Kibaki.  No one misses Kibaki more than me

KQ ABP 4.26

|

|

|

Rank: Member Joined: 11/17/2018 Posts: 173 Location: Mars

|

Sufficiently Philanga....thropic wrote:Could September be the month that we smash the GFC March 2009 low of 2360? Remember Saf goes ex on 3rd, and KCB on 6th(both 1st week of Sept  Saving grace going forward would be if the rate cap is done away with....but i don't see this happening with our populist leader. Oh how i miss Kibaki.  Beyond that comes 16 year low.

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,638

|

Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets

|

|

|

Rank: Member Joined: 11/17/2018 Posts: 173 Location: Mars

|

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

[quote=Extraterrestrial]Meanwhile, here is a bullish view: https://twitter.com/mose...164137733247373312?s=19[/quote] he says "16 year low is like predicting crisis for Kenya....." The truth is we cant rule out crisis if the government continue with the borrowing spree! we will reach a point where we are unable to service the debts, government will have no money to send to counties, strikes due to unpaid salaries will be the order of the day ( already happening in small scale), lenders will not be willing to lend us, already kra is harassing everybody even those paying taxes honestly and loading unnecessary fees and fines to their tax account, just try to get a tax clearance and you will be shocked and very lucky if your account is clean , in short a crisis is coming There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

littledove wrote:[quote=Extraterrestrial]Meanwhile, here is a bullish view: https://twitter.com/mose...164137733247373312?s=19[/quote] he says "16 year low is like predicting crisis for Kenya....." The truth is we cant rule out crisis if the government continue with the borrowing spree! we will reach a point where we are unable to service the debts, government will have no money to send to counties, strikes due to unpaid salaries will be the order of the day ( already happening in small scale), lenders will not be willing to lend us, already kra is harassing everybody even those paying taxes honestly and loading unnecessary fees and fines to their tax account, just try to get a tax clearance and you will be shocked and very lucky if your account is clean , in short a crisis is coming The two men are finishing us, but our good Lord will get us to 2022

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

https://www.businessdailyafrica.com/markets/capital/Dusty-storm-sweeps-through-Sh2trn/4259442-5242654-ng5vud/index.htmlThere is a dusty wind blowing up a storm through the dessert that is the floor of the Nairobi Securities Exchange. The market that is supposed to hold Sh2.278 trillion, which is 30 per cent of the country’s Gross Domestic Product has no takers sending down stock prices and wiping out billions of shillings in paper wealth. Walking through its vacant isles, you see a ghost town with rickety store fronts, discoloured dead stock and owners sapped dry with only one distant corner of refuge where all the market players are huddled for safety of their last pieces of silver as they watch advance of the great drought on returns. A review last week showed that when the market opened on Tuesday, after Eid ul Adha celebrations, 17 counters had zero transactions and 11 counters had transactions that were less than 1,000. On Wednesday, the situation worsened as 21 counters went without trading while seven had less than 1,000 stocks exchanged. There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Could September be the month that we smash the GFC March 2009 low of 2360? Remember Saf goes ex on 3rd, and KCB on 6th(both 1st week of Sept  Saving grace going forward would be if the rate cap is done away with....but i don't see this happening with our populist leader. Oh how i miss Kibaki.  Indeed. Doing away with the rate cap seems to be the only silver bullet anywhere on the horizon. However, if GoK delays to abolish it, the markets will force them to before end of next year...we know how chaotic that tends to be. Breaking below the GFC low is ominous for very many reasons and the market being a leading economic indicator is suggesting that something big is about to pop. Below 2360 will open for a challenge on the 2002 low (I don't think it will get there) but a sub 2000 is looking like a dead on certainty at this point in time. A bounce at the current 2400 zone is critical for the sanity of this market however short-lived it will be. The NASI chart looks scarier than the NSE20. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

littledove wrote:[quote=Extraterrestrial]Meanwhile, here is a bullish view: https://twitter.com/mose...164137733247373312?s=19[/quote] he says "16 year low is like predicting crisis for Kenya....." The truth is we cant rule out crisis if the government continue with the borrowing spree! we will reach a point where we are unable to service the debts, government will have no money to send to counties, strikes due to unpaid salaries will be the order of the day ( already happening in small scale), lenders will not be willing to lend us, already kra is harassing everybody even those paying taxes honestly and loading unnecessary fees and fines to their tax account, just try to get a tax clearance and you will be shocked and very lucky if your account is clean , in short a crisis is coming The self sabotage on display from the fiscal side of GoK is downright idiotic. The state is rolling out what looks, smells and walks like a war on enterprise. Even the sturdiest of the blue chips aka safcom is unable to weather such an affront on businesses. To that end I expect the government to keep hiking excise and transactional tax on mpesa until something gives...ditto for real estate. As if the laffer curve wasn't self evident GoK is steaming ahead in extracting - forcefully I might add - the last drop of tax from everything to the detriment of everyone including the state itself. Social unrest will soon follow in short order...political rapprochement be damned. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Could September be the month that we smash the GFC March 2009 low of 2360? Remember Saf goes ex on 3rd, and KCB on 6th(both 1st week of Sept  Saving grace going forward would be if the rate cap is done away with....but i don't see this happening with our populist leader. Oh how i miss Kibaki.  Indeed. Doing away with the rate cap seems to be the only silver bullet anywhere on the horizon. However, if GoK delays to abolish it, the markets will force them to before end of next year...we know how chaotic that tends to be. Breaking below the GFC low is ominous for very many reasons and the market being a leading economic indicator is suggesting that something big is about to pop. Below 2360 will open for a challenge on the 2002 low (I don't think it will get there) but a sub 2000 is looking like a dead on certainty at this point in time. A bounce at the current 2400 zone is critical for the sanity of this market however short-lived it will be. The NASI chart looks scarier than the NSE20. #Punchline @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. True that. Technical analysis does not exist in isolation. You cannot ignore fundies. In 2009, during the GFC, NSE20 printed a low of 2360 points while Dow fell to 6469 points. 10 years later, we are back to these levels while Dow is up 400% to 26200 points. Ours has to a large extent been as a result of fiscal indiscipline by the Treasury, a hostile business environment, crowding out of the private sector etc. @SufficientlyP

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,638

|

lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin.

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. The retrenchments and job losses being witnessed were they there during GFC Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Ericsson wrote:wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. The retrenchments and job losses being witnessed were they there during GFC This is a local problem with little to do with global economics, the Rwandese for instance are winning!

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,317 Location: Nairobi

|

wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. The moment Kibaki decided he wanted a second term come hell or high water... his legacy and "good works" from 2003-2007 went to the dogs. Flushed down the toilet. Any semblance of fiscal discipline was removed as the order of the day was to buy political support and favor his people. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

VituVingiSana wrote:wukan wrote:lochaz-index wrote:wukan wrote:Would it have mattered if Kibaki was still president. The impulse wave started in in 2002 had to be corrected. You can't rig markets Partly disagree. It is enough that the global economy is in turmoil to roil the markets. With strong local fundies, Nse20 despite taking a beating would have withstood the storm a lot better than what is unraveling or about to unravel. That KE has by and large self inflicted this nagging wound cannot be highlighted enough. Me thinks we have a deep structural problem with our economy which Kibaki did not attempt to solve neither has Uhuru nor any other of the other leading lights. That's why we need a deep correction. Structurally the economy has moved on the same rails from 1900. It is still a dual economy-the formal and informal and they often don't move in tandem. Policy makers act clueless until it's too late. See this example on investments by RufusQuote:Their investment in financial assets is lagging; there are less than 1.5 million self-directed investors at the NSE, assets under management by collective investments schemes account for less than one percent of GDP and pension assets account for about 10 percent of GDP. We speak of the GFC low of 2360 to mean Kibaki escapes the blame yet fundamentally the lack of trickle down of the 2002-2007 impulse wave and resulting 2008 PEV hit the NSE harder necessitating a stimulus. From 2009-2011 NSE was really running on a sugar high therefore needing a more complex correction. To keep the sugar high we run another stimulus in form of debt financed infrastructural development. The market still continues to correct which you see in the collapse of private sector credit demand. What structural adjustment of the economy do you think kibaki,uhuru, raila, ruto et.all would have delivered differently? None they all think the same-two sides of the same coin. The moment Kibaki decided he wanted a second term come hell or high water... his legacy and "good works" from 2003-2007 went to the dogs. Flushed down the toilet. Any semblance of fiscal discipline was removed as the order of the day was to buy political support and favor his people.   Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Number of shares traded so far today; Safaricom traded 7.01mn Co-op 2.2mn EABL 150,000 KCB 2.46mn Kengen 7.04mn And the madness continues Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|