Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

obiero wrote:Sober wrote:slykat wrote:I will sit it out and see how things pan out in the economy .... will resume stocks when the floor is very messy. Gainers Price Change EVRD 1.10 10.00% ▲ MSC 0.60 9.09% ▲ HAFR 0.70 7.69% ▲ WTK 175.00 6.71% ▲ KCB 40.00 3.23% ▲ When the highest gainers are the penny stocks, you know things are thick..  Do not be left out, just managed a few more COOP and KCB. These opportunities do not happen everday We aren't done with the blood on the streets Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 11/27/2007 Posts: 3,604

|

obiero wrote:Sober wrote:slykat wrote:I will sit it out and see how things pan out in the economy .... will resume stocks when the floor is very messy. Gainers Price Change EVRD 1.10 10.00% ▲ MSC 0.60 9.09% ▲ HAFR 0.70 7.69% ▲ WTK 175.00 6.71% ▲ KCB 40.00 3.23% ▲ When the highest gainers are the penny stocks, you know things are thick..  Do not be left out, just managed a few more COOP and KCB. These opportunities do not happen everday Those 2 are likely to sink deeper next week, may be 13.00 and 35.20 respectively. i am waiting for next week to come up with my 4th quarter strategy. African parents don't know how to say sorry.. the closest you will get to a sorry is a 'have you eaten'

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Nic bank sh.20 per share coming Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Sober wrote:obiero wrote:Sober wrote:slykat wrote:I will sit it out and see how things pan out in the economy .... will resume stocks when the floor is very messy. Gainers Price Change EVRD 1.10 10.00% ▲ MSC 0.60 9.09% ▲ HAFR 0.70 7.69% ▲ WTK 175.00 6.71% ▲ KCB 40.00 3.23% ▲ When the highest gainers are the penny stocks, you know things are thick..  Do not be left out, just managed a few more COOP and KCB. These opportunities do not happen everday Those 2 are likely to sink deeper next week, may be 13.00 and 35.20 respectively. i am waiting for next week to come up with my 4th quarter strategy. You could be right or wrong, only next week will tell us who is the greater strategist

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 4/4/2016 Posts: 2,007 Location: Kitale

|

obiero wrote:Sober wrote:obiero wrote:Sober wrote:slykat wrote:I will sit it out and see how things pan out in the economy .... will resume stocks when the floor is very messy. Gainers Price Change EVRD 1.10 10.00% ▲ MSC 0.60 9.09% ▲ HAFR 0.70 7.69% ▲ WTK 175.00 6.71% ▲ KCB 40.00 3.23% ▲ When the highest gainers are the penny stocks, you know things are thick..  Do not be left out, just managed a few more COOP and KCB. These opportunities do not happen everday Those 2 are likely to sink deeper next week, may be 13.00 and 35.20 respectively. i am waiting for next week to come up with my 4th quarter strategy. You could be right or wrong, only next week will tell us who is the greater strategist We will judge next week! Towards the goal of financial freedom

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

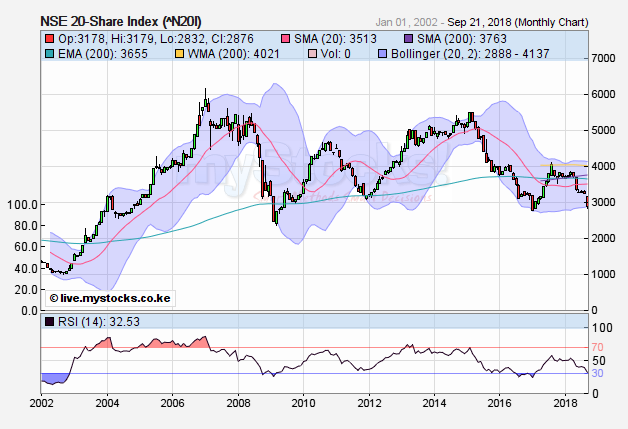

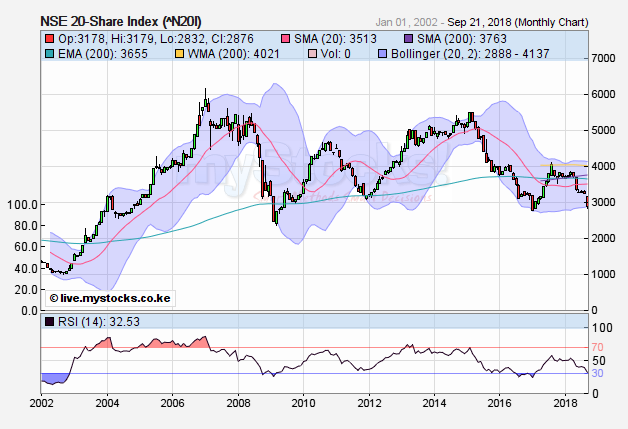

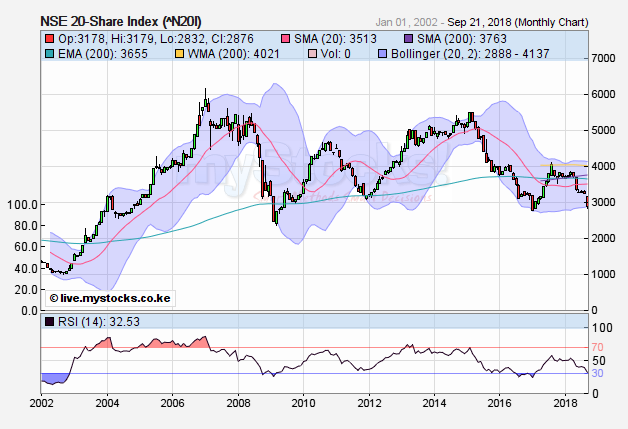

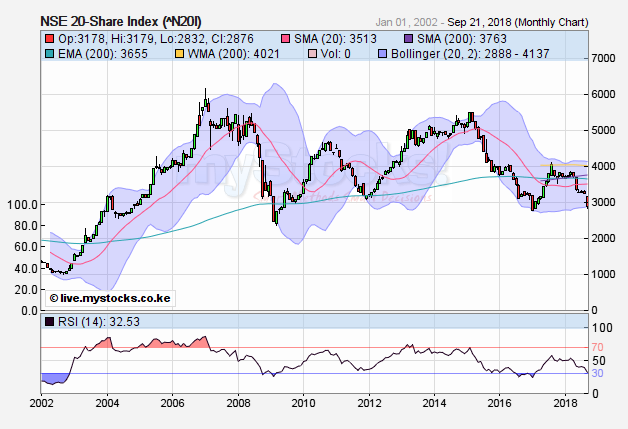

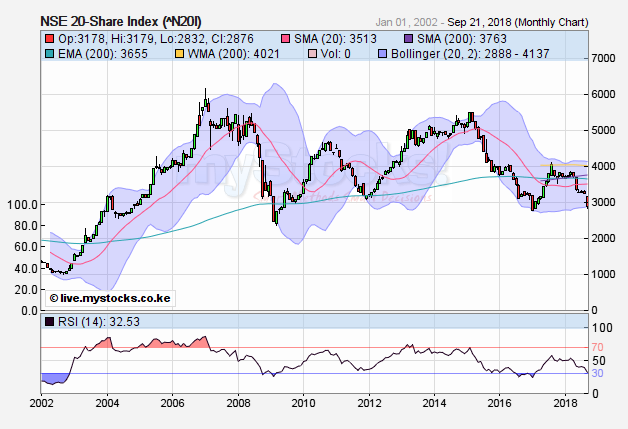

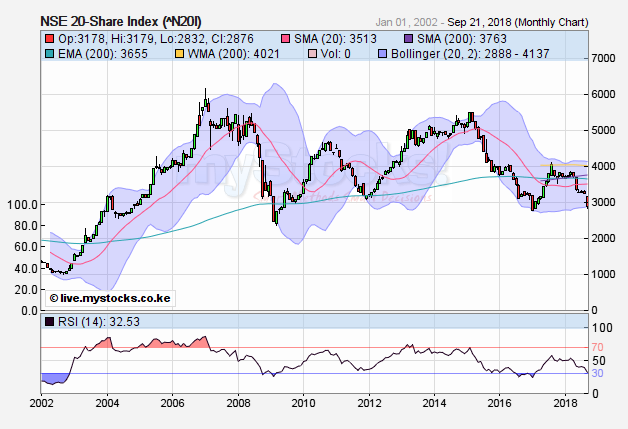

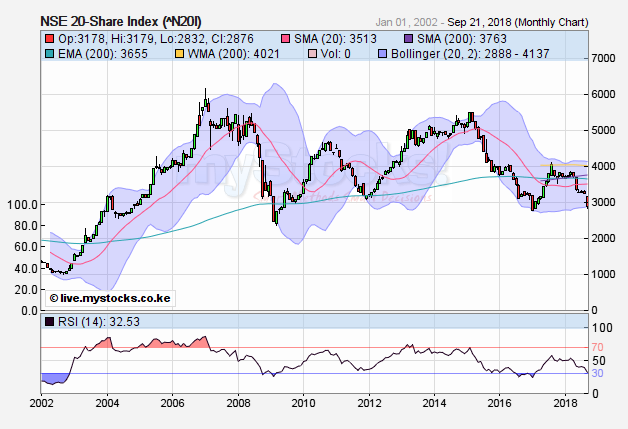

NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   @SufficientlyP

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Slight recovery "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

today counters traded at reduced volumes with the exception of Equity bank which traded 8.5mn shares to top the list Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. @SufficientlyP

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Ebenyo wrote:obiero wrote:Sober wrote:obiero wrote:Sober wrote:slykat wrote:I will sit it out and see how things pan out in the economy .... will resume stocks when the floor is very messy. Gainers Price Change EVRD 1.10 10.00% ▲ MSC 0.60 9.09% ▲ HAFR 0.70 7.69% ▲ WTK 175.00 6.71% ▲ KCB 40.00 3.23% ▲ When the highest gainers are the penny stocks, you know things are thick..  Do not be left out, just managed a few more COOP and KCB. These opportunities do not happen everday Those 2 are likely to sink deeper next week, may be 13.00 and 35.20 respectively. i am waiting for next week to come up with my 4th quarter strategy. You could be right or wrong, only next week will tell us who is the greater strategist We will judge next week! Next week is here.. COOP KES 15.85; KCB 40.5; KQ 8.50

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. The 2017 rally is about to be wiped out in its entirety - 100% retracement. FFR projection is one more hike in December and four more hikes in 2019. Not to take their word for it knowing how unreliable some of these forecasts turn out to be but the fundies ( 10yr UST is > than 3% and steadily climbing anchoring inflation expectations) point to a faster rate hike cycle. If we discount two hikes and only factor one at year end, two more next year plus this week's hike that makes it 100bps jump by end of 2019...this never portends well for EM/FM. Holding everything else constant (no crises/contagion in relation to debt and China is still chugging along fine) my operative scenario is that those markets will broadly tank by about 15-20%. That would place NSE20 at around the GFC levels. If inflation in the US picks up faster than anticipated then all hell will break loose. As the Fed and PBoC continue tightening, ECB risks being left in no man's land with its QE programme in the Eurozone. The markets will end up armtwisting the ECB in to a knee-jerk policy in an effort to fend off capital outflows. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. The 2017 rally is about to be wiped out in its entirety - 100% retracement. FFR projection is one more hike in December and four more hikes in 2019. Not to take their word for it knowing how unreliable some of these forecasts turn out to be but the fundies ( 10yr UST is > than 3% and steadily climbing anchoring inflation expectations) point to a faster rate hike cycle. If we discount two hikes and only factor one at year end, two more next year plus this week's hike that makes it 100bps jump by end of 2019...this never portends well for EM/FM. Holding everything else constant (no crises/contagion in relation to debt and China is still chugging along fine) my operative scenario is that those markets will broadly tank by about 15-20%. That would place NSE20 at around the GFC levels. If inflation in the US picks up faster than anticipated then all hell will break loose. As the Fed and PBoC continue tightening, ECB risks being left in no man's land with its QE programme in the Eurozone. The markets will end up armtwisting the ECB in to a knee-jerk policy in an effort to fend off capital outflows. Some shares aren't doing too bad.. Its not all doom and gloom

KQ ABP 4.26

|

|

|

Rank: Veteran Joined: 11/13/2015 Posts: 1,638

|

lochaz-index wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. The 2017 rally is about to be wiped out in its entirety - 100% retracement. FFR projection is one more hike in December and four more hikes in 2019. Not to take their word for it knowing how unreliable some of these forecasts turn out to be but the fundies ( 10yr UST is > than 3% and steadily climbing anchoring inflation expectations) point to a faster rate hike cycle. If we discount two hikes and only factor one at year end, two more next year plus this week's hike that makes it 100bps jump by end of 2019...this never portends well for EM/FM. Holding everything else constant (no crises/contagion in relation to debt and China is still chugging along fine) my operative scenario is that those markets will broadly tank by about 15-20%. That would place NSE20 at around the GFC levels. If inflation in the US picks up faster than anticipated then all hell will break loose. As the Fed and PBoC continue tightening, ECB risks being left in no man's land with its QE programme in the Eurozone. The markets will end up armtwisting the ECB in to a knee-jerk policy in an effort to fend off capital outflows. Plus the Fed balance sheet reduction peak in October at US 50B. ECB will most likely tighten around July 2019. 2019 will be a nightmare for EMs

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

wukan wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. The 2017 rally is about to be wiped out in its entirety - 100% retracement. FFR projection is one more hike in December and four more hikes in 2019. Not to take their word for it knowing how unreliable some of these forecasts turn out to be but the fundies ( 10yr UST is > than 3% and steadily climbing anchoring inflation expectations) point to a faster rate hike cycle. If we discount two hikes and only factor one at year end, two more next year plus this week's hike that makes it 100bps jump by end of 2019...this never portends well for EM/FM. Holding everything else constant (no crises/contagion in relation to debt and China is still chugging along fine) my operative scenario is that those markets will broadly tank by about 15-20%. That would place NSE20 at around the GFC levels. If inflation in the US picks up faster than anticipated then all hell will break loose. As the Fed and PBoC continue tightening, ECB risks being left in no man's land with its QE programme in the Eurozone. The markets will end up armtwisting the ECB in to a knee-jerk policy in an effort to fend off capital outflows. Plus the Fed balance sheet reduction peak in October at US 50B. ECB will most likely tighten around July 2019. 2019 will be a nightmare for EMs The temporary run is coming to an end,from tomorrow/Monday expect some price declines on counters that have had a good run Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,150 Location: nairobi

|

Ericsson wrote:wukan wrote:lochaz-index wrote:Sufficiently Philanga....thropic wrote:Sufficiently Philanga....thropic wrote:NSE 20 closes the week at 2832, 42 points shy of the Jan 2017 low of 2790.Let's see whether this will be defended. Below this and the new support will be the March 2009 low of 2360   Holding steady ATM but FED's decision to keep increasing its FED rate will keep emboldening the bears especially in Frontier and Emerging Economies. The 2017 rally is about to be wiped out in its entirety - 100% retracement. FFR projection is one more hike in December and four more hikes in 2019. Not to take their word for it knowing how unreliable some of these forecasts turn out to be but the fundies ( 10yr UST is > than 3% and steadily climbing anchoring inflation expectations) point to a faster rate hike cycle. If we discount two hikes and only factor one at year end, two more next year plus this week's hike that makes it 100bps jump by end of 2019...this never portends well for EM/FM. Holding everything else constant (no crises/contagion in relation to debt and China is still chugging along fine) my operative scenario is that those markets will broadly tank by about 15-20%. That would place NSE20 at around the GFC levels. If inflation in the US picks up faster than anticipated then all hell will break loose. As the Fed and PBoC continue tightening, ECB risks being left in no man's land with its QE programme in the Eurozone. The markets will end up armtwisting the ECB in to a knee-jerk policy in an effort to fend off capital outflows. Plus the Fed balance sheet reduction peak in October at US 50B. ECB will most likely tighten around July 2019. 2019 will be a nightmare for EMs The temporary run is coming to an end,from tomorrow/Monday expect some price declines on counters that have had a good run On Q3 book closure for financials.. You honestly expect a decline?? Anyways.. Selling COOP at KES 16.50, cool 21% gain over 9 days

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,801 Location: NAIROBI

|

Deacons becomes the first counter to go below 0.50 per share. A loss of the maximum 5 cents is more than the 10% rule. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,317 Location: Nairobi

|

If it closes at 0.45 (VWAP), what happens the next day on the way down? Can someone bid at 0.40 given that's 11%? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 5/6/2008 Posts: 199

|

If it closes below 0.45 it's technically fixed at that price unless a material event occurs; in which case I'm curious how low it could go Ericsson wrote:Deacons becomes the first counter to go below 0.50 per share.

A loss of the maximum 5 cents is more than the 10% rule.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,317 Location: Nairobi

|

tandich wrote:If it closes below 0.45 it's technically suspended from trading unless a material event occurs; in which case I'm curious how low it could go Ericsson wrote:Deacons becomes the first counter to go below 0.50 per share.

A loss of the maximum 5 cents is more than the 10% rule. It's likely to close at 0.45 today given the level of trades. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Member Joined: 3/8/2018 Posts: 507 Location: Nairobi

|

Looks like the downtrend will continue next week.

|

|

|

Wazua

»

Investor

»

Stocks

»

Madness at the NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|