Wazua

»

Investor

»

Offshore

»

Cytonn Listing at NSE

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks?

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks.

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. Business opportunities are like buses,there's always another one coming

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

KulaRaha wrote:mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. say's who? They have stated before that their spread of CoC and RoI is around +6% If Obiero did it, Who Am I?

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

Swenani wrote:KulaRaha wrote:mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. say's who? They have stated before that their spread of CoC and RoI is around +6% That’s as a minimum.

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

KulaRaha wrote:mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. + at 21% +(perhaps what IPO hopes to partly resolve) Downturn in construction sector (evidenced by bank loans, cement companies results) Depth of ownership (perhaps what IPO hopes to partly resolve)

|

|

|

Rank: Veteran Joined: 8/30/2007 Posts: 1,558 Location: Nairobi

|

muganda wrote:KulaRaha wrote:mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. + at 21% +(perhaps what IPO hopes to partly resolve) Downturn in construction sector (evidenced by bank loans, cement companies results) Depth of ownership (perhaps what IPO hopes to partly resolve)  Some more speculations. I guess it’s what we in Wazua do best....speculate

|

|

|

Rank: Elder Joined: 10/18/2008 Posts: 3,434 Location: Kerugoya

|

Horton wrote:muganda wrote:KulaRaha wrote:mwekez@ji wrote:aemathenge wrote:mwekez@ji wrote:The biggest risk I see here is assets verses liability maturity mismatch. The assets (properties) do take time to develop and sell, while the financial liabilities (funding of the properties) mainly have a maturity of less than 1 year. What or which are the rest of the risks? My second biggest risk is the company not being able to find additional funds to complete the many massive property developments that it is undertaking simultaneously. Over to others wazuans to add on the risks. Cost of funding far exceeds profit on property. + at 21% +(perhaps what IPO hopes to partly resolve) Downturn in construction sector (evidenced by bank loans, cement companies results) Depth of ownership (perhaps what IPO hopes to partly resolve)  Some more speculations. I guess it’s what we in Wazua do best....speculate No, some of us are oxy-whatevers, others are speculators but you, you are what? investment genius, Guru? So, how about we play a game. For everyone who gives the "wrong" information about Cytonn, how about you give us the real picture or a proven fact we do not know? Do we have an accord?

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

Horton wrote:

Some more speculations. I guess it’s what we in Wazua do best....speculate

Quite unfair, everything in life has a risk. The risks listed are not opinions. An opinion states whether Cytonn is a good investment or not

|

|

|

Rank: Elder Joined: 12/9/2009 Posts: 6,592 Location: Nairobi

|

I would never touch. Cytonn has never made sense to me. In my personal opinion, this has always been the end game.

BBI will solve it :)

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Angelica _ann wrote:A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. Listing threshhold for GEMS are really low i.e. 1. 10 million paid up capital - The price of a two bedroom apartment in middle class Nairobi Estates; 2. Operation for 1 year or more - It's almost an year since Sonko became Governor and he still has no deputy. With such low threshhold we should be expecting over 1,000 SMEs firms to have listed by now. What Cytonn want to do is neither remarkable nor wonder inspiring. They just want to list an SME firm which many businesses should have done by now. Now to my personal opinion. Dande and Co. are young sharp minds. They plans and ambitions are bigger than the Cytonn container. In other words there is alot of potential in Cytonn. It is easier to sell potential to VCs than to Wanjiku. This is obvious from the number of companies that list with lofty valuations but are brought back to reality by Mr Market. A good example is Home Afrika. Valued at 12 on listing but 5 years later, despite growing their balance sheet, the market values them at sub 1 bob. They only raised 1/3 of a 900m bond issue. Other examples abound like Transcentury and EA Cables. Consequently IMO listing too soon will kill the company. They better grow the company with Smart Money and exit later because Wanjiku does not believe in dreams. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

If this market allowed shorting shares, I'd sell Cytonn until the ponzi collapses (as all ponzis do). The profits would be like a NYS tender!! LOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOL Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

KulaRaha wrote:If this market allowed shorting shares, I'd sell Cytonn until the ponzi collapses (as all ponzis do). The profits would be like a NYS tender!!

LOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOL You need some positivity in your life... Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,173 Location: nairobi

|

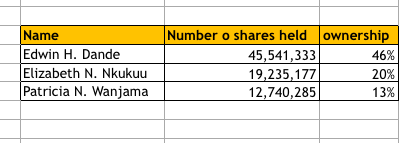

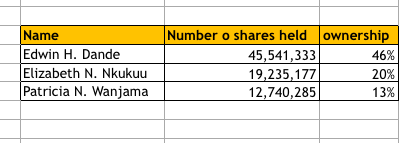

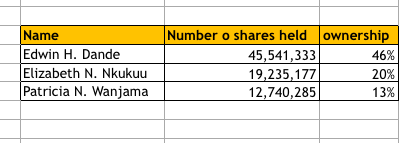

sparkly wrote:Angelica _ann wrote:A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. Listing threshhold for GEMS are really low i.e. 1. 10 million paid up capital - The price of a two bedroom apartment in middle class Nairobi Estates; 2. Operation for 1 year or more - It's almost an year since Sonko became Governor and he still has no deputy. With such low threshhold we should be expecting over 1,000 SMEs firms to have listed by now. What Cytonn want to do is neither remarkable nor wonder inspiring. They just want to list an SME firm which many businesses should have done by now. Now to my personal opinion. Dande and Co. are young sharp minds. They plans and ambitions are bigger than the Cytonn container. In other words there is alot of potential in Cytonn. It is easier to sell potential to VCs than to Wanjiku. This is obvious from the number of companies that list with lofty valuations but are brought back to reality by Mr Market. A good example is Home Afrika. Valued at 12 on listing but 5 years later, despite growing their balance sheet, the market values them at sub 1 bob. They only raised 1/3 of a 900m bond issue. Other examples abound like Transcentury and EA Cables. Consequently IMO listing too soon will kill the company. They better grow the company with Smart Money and exit later because Wanjiku does not believe in dreams. In the current shareholding set up. Did Dande, Nkukuu and Wanjama each fully pay up for their shares or do they want to sell what they never did buy? A crypto kind of ICO in the name of GEMS

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:sparkly wrote:Angelica _ann wrote:A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. Listing threshhold for GEMS are really low i.e. 1. 10 million paid up capital - The price of a two bedroom apartment in middle class Nairobi Estates; 2. Operation for 1 year or more - It's almost an year since Sonko became Governor and he still has no deputy. With such low threshhold we should be expecting over 1,000 SMEs firms to have listed by now. What Cytonn want to do is neither remarkable nor wonder inspiring. They just want to list an SME firm which many businesses should have done by now. Now to my personal opinion. Dande and Co. are young sharp minds. They plans and ambitions are bigger than the Cytonn container. In other words there is alot of potential in Cytonn. It is easier to sell potential to VCs than to Wanjiku. This is obvious from the number of companies that list with lofty valuations but are brought back to reality by Mr Market. A good example is Home Afrika. Valued at 12 on listing but 5 years later, despite growing their balance sheet, the market values them at sub 1 bob. They only raised 1/3 of a 900m bond issue. Other examples abound like Transcentury and EA Cables. Consequently IMO listing too soon will kill the company. They better grow the company with Smart Money and exit later because Wanjiku does not believe in dreams. In the current shareholding set up. Did Dande, Nkukuu and Wanjama each fully pay up for their shares or do they want to sell what they never did buy? A crypto kind of ICO in the name of GEMS Paying up does not mean writing a cheque to the bank only. Life is short. Live passionately.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

sparkly wrote:obiero wrote:sparkly wrote:Angelica _ann wrote:A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. Listing threshhold for GEMS are really low i.e. 1. 10 million paid up capital - The price of a two bedroom apartment in middle class Nairobi Estates; 2. Operation for 1 year or more - It's almost an year since Sonko became Governor and he still has no deputy. With such low threshhold we should be expecting over 1,000 SMEs firms to have listed by now. What Cytonn want to do is neither remarkable nor wonder inspiring. They just want to list an SME firm which many businesses should have done by now. Now to my personal opinion. Dande and Co. are young sharp minds. They plans and ambitions are bigger than the Cytonn container. In other words there is alot of potential in Cytonn. It is easier to sell potential to VCs than to Wanjiku. This is obvious from the number of companies that list with lofty valuations but are brought back to reality by Mr Market. A good example is Home Afrika. Valued at 12 on listing but 5 years later, despite growing their balance sheet, the market values them at sub 1 bob. They only raised 1/3 of a 900m bond issue. Other examples abound like Transcentury and EA Cables. Consequently IMO listing too soon will kill the company. They better grow the company with Smart Money and exit later because Wanjiku does not believe in dreams. In the current shareholding set up. Did Dande, Nkukuu and Wanjama each fully pay up for their shares or do they want to sell what they never did buy? A crypto kind of ICO in the name of GEMS Paying up does not mean writing a cheque to the bank only. Besides, they could have contributed Kes. 7.75M only. The par value of their shares

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,173 Location: nairobi

|

mwekez@ji wrote:sparkly wrote:obiero wrote:sparkly wrote:Angelica _ann wrote:A general observation is that this Cytonn listing, if done in the next year or so, would be one of the fastest listing of a company, since its incorporation. Listing threshhold for GEMS are really low i.e. 1. 10 million paid up capital - The price of a two bedroom apartment in middle class Nairobi Estates; 2. Operation for 1 year or more - It's almost an year since Sonko became Governor and he still has no deputy. With such low threshhold we should be expecting over 1,000 SMEs firms to have listed by now. What Cytonn want to do is neither remarkable nor wonder inspiring. They just want to list an SME firm which many businesses should have done by now. Now to my personal opinion. Dande and Co. are young sharp minds. They plans and ambitions are bigger than the Cytonn container. In other words there is alot of potential in Cytonn. It is easier to sell potential to VCs than to Wanjiku. This is obvious from the number of companies that list with lofty valuations but are brought back to reality by Mr Market. A good example is Home Afrika. Valued at 12 on listing but 5 years later, despite growing their balance sheet, the market values them at sub 1 bob. They only raised 1/3 of a 900m bond issue. Other examples abound like Transcentury and EA Cables. Consequently IMO listing too soon will kill the company. They better grow the company with Smart Money and exit later because Wanjiku does not believe in dreams. In the current shareholding set up. Did Dande, Nkukuu and Wanjama each fully pay up for their shares or do they want to sell what they never did buy? A crypto kind of ICO in the name of GEMS Paying up does not mean writing a cheque to the bank only. Besides, they could have contributed Kes. 7.75M only. The par value of their shares Aha! And now sell it to wanjiku at obscene profit levels.. ni sawa

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

That tweet from Dande CC@Loooooooooooooooooooooooooooooool If Obiero did it, Who Am I?

|

|

|

Wazua

»

Investor

»

Offshore

»

Cytonn Listing at NSE

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|