Wazua

»

Investor

»

Economy

»

Law Capping interest rates

Rank: Veteran Joined: 11/15/2013 Posts: 1,977 Location: Here

|

It's another view in the Sacco's vs Banks loans targeting any interested party. Everybody STEALS, a THIEF is one who's CAUGHT stealing something of LITTLE VALUE. !!!

|

|

|

Rank: Member Joined: 9/11/2014 Posts: 228 Location: Nairobi

|

MaichBlack wrote:enyands wrote:MaichBlack wrote:enyands wrote:Now this was the missing part of puzzle iv been looking for and found it

1 If I make a member deposit of 1m in 2015 Jan ,I'll expect a dividend of 110,000 in Dec 2015.

2 If I take a loan of 1m in 2016 IL be expected to pay an interest of 120,000 by Dec 2016

3 if I choose to tell them to use my dividend of last year 2015 (110,000) to pay my interest this year (120,000) ,all I'll do is make additional 10,000(roughly 900 sh every month) to take care of interest.

....

....

....

6 if I know I have a project coming in 2017 I'd rather deposit money in sacco of 1m 2016 and take a loan with sacco than deal with banks rate of 20-30% currently

This is just my thoughts Wonders never seize!!! Explain to me like a 3 year old, why would you want to take a loan of 1 million and pay ANY AMOUNT OF INTEREST while you have 1 million in the same entity. Why not simply withdraw your 1 million - FOR FREE!!?? Well I want my 1m to remain there as a base if Incase I want 3m .you know you can get 3 times your deposit . The one million is just a hypethical example sir But as per the example you are talking about getting 1 million while having a deposit of 1 million!! And in any case, you can get your 1 million, 110,000/= dividend and the monthly payments you would be making deposit them as savings. You would still be back at 1 million (savings) without paying any interest and having pocketed the dividends! That sounds like the typical hand-to-mouth approach that we excel at as a nation. So you would get the 1m and dividends today "cheaply", but what happens to your plans for tomorrow? If the one million cannot complete your project, then what is your next source of funds? Would it not be better to borrow the 1m cheaply from the sacco, stretch to pay while knowing that you can go back immediately when your project requires more funding?

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

iris wrote:MaichBlack wrote:enyands wrote:MaichBlack wrote:enyands wrote:Now this was the missing part of puzzle iv been looking for and found it

1 If I make a member deposit of 1m in 2015 Jan ,I'll expect a dividend of 110,000 in Dec 2015.

2 If I take a loan of 1m in 2016 IL be expected to pay an interest of 120,000 by Dec 2016

3 if I choose to tell them to use my dividend of last year 2015 (110,000) to pay my interest this year (120,000) ,all I'll do is make additional 10,000(roughly 900 sh every month) to take care of interest.

....

....

....

6 if I know I have a project coming in 2017 I'd rather deposit money in sacco of 1m 2016 and take a loan with sacco than deal with banks rate of 20-30% currently

This is just my thoughts Wonders never seize!!! Explain to me like a 3 year old, why would you want to take a loan of 1 million and pay ANY AMOUNT OF INTEREST while you have 1 million in the same entity. Why not simply withdraw your 1 million - FOR FREE!!?? Well I want my 1m to remain there as a base if Incase I want 3m .you know you can get 3 times your deposit . The one million is just a hypethical example sir But as per the example you are talking about getting 1 million while having a deposit of 1 million!! And in any case, you can get your 1 million, 110,000/= dividend and the monthly payments you would be making deposit them as savings. You would still be back at 1 million (savings) without paying any interest and having pocketed the dividends! That sounds like the typical hand-to-mouth approach that we excel at as a nation. So you would get the 1m and dividends today "cheaply", but what happens to your plans for tomorrow? If the one million cannot complete your project, then what is your next source of funds? Would it not be better to borrow the 1m cheaply from the sacco, stretch to pay while knowing that you can go back immediately when your project requires more funding? Read my post# 199 and read it slowly and carefully - especially the 2nd paragraph. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Boris Boyka wrote:@Maichblack there is this idea tha says you need at least 6 Months of your net income as back up somewhere(whether payslip or business or both), Do you believe in it? If so where have you or do you advice that cash to be put? For average Kenyans do you think the money in sacco is meant to be a cash cushion for 6 months savings or it is their ONLY savings and a means to obtain "cheap" loans? No one is saying putting your money in a sacco is bad but we are arguing that getting a sacco loan is expensive as compared to a bank loan If Obiero did it, Who Am I?

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

iris wrote:MaichBlack wrote:enyands wrote:MaichBlack wrote:enyands wrote:Now this was the missing part of puzzle iv been looking for and found it

1 If I make a member deposit of 1m in 2015 Jan ,I'll expect a dividend of 110,000 in Dec 2015.

2 If I take a loan of 1m in 2016 IL be expected to pay an interest of 120,000 by Dec 2016

3 if I choose to tell them to use my dividend of last year 2015 (110,000) to pay my interest this year (120,000) ,all I'll do is make additional 10,000(roughly 900 sh every month) to take care of interest.

....

....

....

6 if I know I have a project coming in 2017 I'd rather deposit money in sacco of 1m 2016 and take a loan with sacco than deal with banks rate of 20-30% currently

This is just my thoughts Wonders never seize!!! Explain to me like a 3 year old, why would you want to take a loan of 1 million and pay ANY AMOUNT OF INTEREST while you have 1 million in the same entity. Why not simply withdraw your 1 million - FOR FREE!!?? Well I want my 1m to remain there as a base if Incase I want 3m .you know you can get 3 times your deposit . The one million is just a hypethical example sir But as per the example you are talking about getting 1 million while having a deposit of 1 million!! And in any case, you can get your 1 million, 110,000/= dividend and the monthly payments you would be making deposit them as savings. You would still be back at 1 million (savings) without paying any interest and having pocketed the dividends! That sounds like the typical hand-to-mouth approach that we excel at as a nation. So you would get the 1m and dividends today "cheaply", but what happens to your plans for tomorrow? If the one million cannot complete your project, then what is your next source of funds? Would it not be better to borrow the 1m cheaply from the sacco, stretch to pay while knowing that you can go back immediately when your project requires more funding? this is a skewed argument If Obiero did it, Who Am I?

|

|

|

Rank: Member Joined: 9/9/2015 Posts: 233

|

If you can make money, you can borrow with the expectation of paying back with money you make in the future. I see @Maichblack's arguement but Im lost on @iris and @enyand's views. I thought saccos are for people with terrible credit ratings and no security. "Buy when there's blood in the streets, even if the blood is your own."

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,931

|

The Great wrote:I thought saccos are for people with terrible credit ratings and no security. Isorite    In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

The Great wrote:If you can make money, you can borrow with the expectation of paying back with money you make in the future. I see @Maichblack's arguement but Im lost on @iris and @enyand's views. I thought saccos are for people with terrible credit ratings and no security.   . Credit ratings was introduced to kenya just the other day . I don't think before we had this credit ratings like the west do and our people used to get loans from saccos then. Now about security you are right .sacco security is your fellow member who have to be 2 . Iv done both sacco and bank and I prefer sacco more . This is just me...

|

|

|

Rank: Elder Joined: 9/19/2015 Posts: 2,871 Location: hapo

|

I don't know how much economics a common voter knows in Kenya. But I'll say this...A gov't capping interest rates is not a capitalist gov't. Now with that out of the way The question becomes, why are interest rates high? In Kenya, its because the gov't is borrowing even to pay for t shirts. If you're gov't is borrowing, your interest rates go up... I don't know how simple that is yet, the voters are just about sijui uhuru, sijui raila stuff. Listen The gov't right now is borrowing at unprecendeted levels. So you interest rates are higher than normal. If Uhuru signs such a silly bill, everyone will be broke within a year. Coz gov't borrows at 10 points, banks has to work on 14 and someone has to paid a salary. So yes, Uhuru is right not signing the bill But the interest rates are the fault of Uhuru... Go figure. Hardwood by the way that is what conservatism means. Uhuru would never be an MP in the Us simply because he's not a conservative...Every year gov't spending goes up in his administration. Means every year, interest rates go up for small businesses and corporates. 2000 jobs lost in banks in the past few years. Gov't is not about emotions its about reality. The reality is the current gov't is confused about the economy and social issues. They don't know why schools are being burnt...They don't understand why borrowing from China means that my taxes go up. We are living in very dangerous times... Your interest payment at more than the world aveage of 5 is a shylock loan. We all know about shylocks. Anyway....Sorry, I don't supprt this gov't simpy because their economics doesn't make sense to me..You can't talk about capping interest rates yet we we have that thing called helb. Help is legally approved to charge shylock rates..Ati you don't pay for a month you pay 5k.. Let's talk about mshwari, I can't even calculate the illegal interest rates this mshwari thing is about Njunges sports pesa. They take money, make profits kill charities then sponsor hull city. All legal... Ati capping interst rates. That's not the issue. The issue is gov't borrowing willy nilly. And then gov't accepting shylocking as a business model. Thieves are not good people. Tumeelewana?

|

|

|

Rank: Elder Joined: 3/18/2011 Posts: 12,069 Location: Kianjokoma

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

alma1 wrote:I don't know how much economics a common voter knows in Kenya.

But I'll say this...A gov't capping interest rates is not a capitalist gov't.

Now with that out of the way

The question becomes, why are interest rates high? In Kenya, its because the gov't is borrowing even to pay for t shirts.

If you're gov't is borrowing, your interest rates go up...

I don't know how simple that is yet, the voters are just about sijui uhuru, sijui raila stuff.

Listen

The gov't right now is borrowing at unprecendeted levels. So you interest rates are higher than normal.

If Uhuru signs such a silly bill, everyone will be broke within a year. Coz gov't borrows at 10 points, banks has to work on 14 and someone has to paid a salary.

So yes, Uhuru is right not signing the bill

But the interest rates are the fault of Uhuru...

Go figure.

Hardwood by the way that is what conservatism means. Uhuru would never be an MP in the Us simply because he's not a conservative...Every year gov't spending goes up in his administration. Means every year, interest rates go up for small businesses and corporates. 2000 jobs lost in banks in the past few years.

Gov't is not about emotions its about reality. The reality is the current gov't is confused about the economy and social issues.

They don't know why schools are being burnt...They don't understand why borrowing from China means that my taxes go up.

We are living in very dangerous times...

Your interest payment at more than the world aveage of 5 is a shylock loan. We all know about shylocks.

Anyway....Sorry, I don't supprt this gov't simpy because their economics doesn't make sense to me..You can't talk about capping interest rates yet we we have that thing called helb.

Help is legally approved to charge shylock rates..Ati you don't pay for a month you pay 5k..

Let's talk about mshwari, I can't even calculate the illegal interest rates this mshwari thing is about

Njunges sports pesa. They take money, make profits kill charities then sponsor hull city.

All legal...

Ati capping interst rates. That's not the issue. The issue is gov't borrowing willy nilly. And then gov't accepting shylocking as a business model.  GOK is mirroring the global trend where all govts will end up defaulting on their bonds! People world over should be buying - actually hoarding quality bluechips hand over fist as a hedge against this spectacular sovereign bond crisis about to trigger any time. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 11/5/2010 Posts: 2,459

|

Am reading Jaindi Kisero's article in the businessdaily and he claims the governor has held three meetings with bank CEOs pleading with them to show goodwill by reducing lending rates. A down payment as he called it to avoid a head-on collision between a seemingly unstoppable populist bill and simple economic logic.

Well, the banksters have stuck to their positions. In his op-ed last week, the governor pointed out that between July 2015 and July 2016, the key indicators had reduced by a margin of 2%. During the same period, bank's lending rates had increased by 3%. Clearly, there is a strong case for the down payment.

Am curious to know how high level political lobbying works in kenya. Will the president join the governor in demanding a demonstration of goodwill by the banks ? Or are the bank's too powerful ? @murchr, where are you ?

|

|

|

Rank: Elder Joined: 7/23/2008 Posts: 3,017

|

FRM2011 wrote:Am reading Jaindi Kisero's article in the businessdaily and he claims the governor has held three meetings with bank CEOs pleading with them to show goodwill by reducing lending rates. A down payment as he called it to avoid a head-on collision between a seemingly unstoppable populist bill and simple economic logic.

Well, the banksters have stuck to their positions. In his op-ed last week, the governor pointed out that between July 2015 and July 2016, the key indicators had reduced by a margin of 2%. During the same period, bank's lending rates had increased by 3%. Clearly, there is a strong case for the down payment.

Am curious to know how high level political lobbying works in kenya. Will the president join the governor in demanding a demonstration of goodwill by the banks ? Or are the bank's too powerful ? @murchr, where are you ? I think the governor being an honest man is just realising that the much taunted free markets economics is not working in Kenya. Lets cap that sh*t real tight. "The purpose of bureaucracy is to compensate for incompetence and lack of discipline." James Collins

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

|

|

|

Rank: Elder Joined: 7/22/2009 Posts: 7,810

|

Obi 1 Kanobi wrote:

I think the governor being an honest man is just realising that the much taunted free markets economics is not working in Kenya.

Lets cap that sh*t real tight.

Go ahead!!! May be some fellows who have never had a bank account and cannot qualify for a loan even from their siblings can be paid a few shillings to "protest", loot and rob innocent. That ought to quicken the process. Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good returns.

|

|

|

Rank: Member Joined: 9/29/2010 Posts: 679 Location: nairobi

|

FRM2011 wrote:Am reading Jaindi Kisero's article in the businessdaily and he claims the governor has held three meetings with bank CEOs pleading with them to show goodwill by reducing lending rates. A down payment as he called it to avoid a head-on collision between a seemingly unstoppable populist bill and simple economic logic.

Well, the banksters have stuck to their positions. In his op-ed last week, the governor pointed out that between July 2015 and July 2016, the key indicators had reduced by a margin of 2%. During the same period, bank's lending rates had increased by 3%. Clearly, there is a strong case for the down payment.

Am curious to know how high level political lobbying works in kenya. Will the president join the governor in demanding a demonstration of goodwill by the banks ? Or are the bank's too powerful ? @murchr, where are you ? the CB has enough tools to force interest rates whatever direction they want, this guy is merely passing the buck..don't we all remember what happened immediately NARC came into power?

|

|

|

Rank: Elder Joined: 11/5/2010 Posts: 2,459

|

kizee1 wrote:FRM2011 wrote:Am reading Jaindi Kisero's article in the businessdaily and he claims the governor has held three meetings with bank CEOs pleading with them to show goodwill by reducing lending rates. A down payment as he called it to avoid a head-on collision between a seemingly unstoppable populist bill and simple economic logic.

Well, the banksters have stuck to their positions. In his op-ed last week, the governor pointed out that between July 2015 and July 2016, the key indicators had reduced by a margin of 2%. During the same period, bank's lending rates had increased by 3%. Clearly, there is a strong case for the down payment.

Am curious to know how high level political lobbying works in kenya. Will the president join the governor in demanding a demonstration of goodwill by the banks ? Or are the bank's too powerful ? @murchr, where are you ? the CB has enough tools to force interest rates whatever direction they want, this guy is merely passing the buck..don't we all remember what happened immediately NARC came into power? Good point there @kizee. Still remember day when stanbic reduced their base rate to 8%. Kibaki was the man. What I am enjoying is the fact that everyone knows what the problem is. Mpigs have prescribed the wrong medicine. The patient is willing to ignore warnings on the side effects and take the medicine. At the end of the day, it will be a political solution to an economic problem.

|

|

|

Rank: Member Joined: 6/6/2016 Posts: 167 Location: Nairobi

|

I am waiting to see the entry of price comparison / aggregator websites to add transparency in these loans and credit products, intermediaries have typically increased transparency in such services albeit adding their cost/commission into the process.

|

|

|

Rank: New-farer Joined: 3/12/2014 Posts: 96

|

enyands wrote:MaichBlack wrote:maka wrote:MaichBlack wrote:mlennyma wrote:MaichBlack wrote:mlennyma wrote:mlennyma wrote:This can be a raila policy, i will be shocked if it can still be uhuru's policy as well. tinga pushing hard for the signing as i had predicted @mlennyma - Hii ni socialism ama ni Communism? People DEMANDING to benefit from other people (not government's) resources!!! Some people might kill free enterprise/businesses if given a chance. communism and laziness,you must sell your mangoes the way you want even if they rot for lack of buyers they are yours,I even suggest raila would tame the green elephant given the presidency Exactly @mlennyma! Very soon some "intelligent" fellow will suggest controlling the prices of fruits, milk, vegetables etc. because they are basic needs. And soon after that there will be no Fruits, milk, vegetables etc. in any shop, kiosk etc. Thought its Duale who said he will not rest till this thing is passed? I am not aware but Duale is not someone I would exactly trust with the Kenyan economy!!! And politicians will say anything to please the electorate. And that is one of the problems with Kenyan politics. You can't even tell what most politicians stand for. In the US for example they know who will increase taxes for which group and reduce for which group. Who will enhance social welfare programmes and who will cut down etc. Kenya ni pang'ang'a tu! It depends with what your so called principal says for whatever reason or who is paying top dollar or what resonates with your electorate etc. And your stand can change conveniently any time - a number of times!!! Ha ha now that baba is pushing for signing ,there is no way UK will sign it just because baba is pushing .he is suspecting witch hunt hapo .instead it will be sent back for ammendment to buy more time ... from my loan repayment schedule i see the bank is recovering its interest first and my principle repayment is half of the interest  ?

|

|

|

Rank: Member Joined: 9/11/2014 Posts: 228 Location: Nairobi

|

MaichBlack wrote:iris wrote:MaichBlack wrote:enyands wrote:MaichBlack wrote:enyands wrote:Now this was the missing part of puzzle iv been looking for and found it

1 If I make a member deposit of 1m in 2015 Jan ,I'll expect a dividend of 110,000 in Dec 2015.

2 If I take a loan of 1m in 2016 IL be expected to pay an interest of 120,000 by Dec 2016

3 if I choose to tell them to use my dividend of last year 2015 (110,000) to pay my interest this year (120,000) ,all I'll do is make additional 10,000(roughly 900 sh every month) to take care of interest.

....

....

....

6 if I know I have a project coming in 2017 I'd rather deposit money in sacco of 1m 2016 and take a loan with sacco than deal with banks rate of 20-30% currently

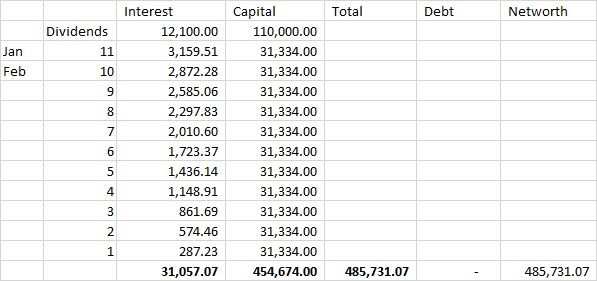

This is just my thoughts Wonders never seize!!! Explain to me like a 3 year old, why would you want to take a loan of 1 million and pay ANY AMOUNT OF INTEREST while you have 1 million in the same entity. Why not simply withdraw your 1 million - FOR FREE!!?? Well I want my 1m to remain there as a base if Incase I want 3m .you know you can get 3 times your deposit . The one million is just a hypethical example sir But as per the example you are talking about getting 1 million while having a deposit of 1 million!! And in any case, you can get your 1 million, 110,000/= dividend and the monthly payments you would be making deposit them as savings. You would still be back at 1 million (savings) without paying any interest and having pocketed the dividends! That sounds like the typical hand-to-mouth approach that we excel at as a nation. So you would get the 1m and dividends today "cheaply", but what happens to your plans for tomorrow? If the one million cannot complete your project, then what is your next source of funds? Would it not be better to borrow the 1m cheaply from the sacco, stretch to pay while knowing that you can go back immediately when your project requires more funding? Read my post# 199 and read it slowly and carefully - especially the 2nd paragraph. @MB, I have re-read post# 199 slowly and carefully and it does nothing to convince me, unless you prove to me my inability to understand your post. Let's talk some numbers: @MB:  @Iris:  In the pictures, please read "dividend" instead of "interest" Assuming that we consider the first year after I take a loan of 1m from my sacco where I also have a deposit of 1m, my networth will be KES 497,279 at the end of the year, after subtracting what is owed on my loan. This is higher than your networth of 485,731 notwithstanding the fact that I can borrow way more than you. The calculation is based on interest of 12%/year, reducing balance over a period of 4 years. Note that Sacco's prorate dividends according to your deposits over the year. So you get more dividend on your contribution in January than in November. The monthly loan repayment works out to 26,334/=, but to remain a member, Saccos require that you still contribute some amount towards the deposits. I have assumed a figure of 5.000/=, which is why you are depositing 31,334/=. Using the same formula, the difference between my networth and yours increases in my favour over the next 4 years because my higher dividend is being compounded even if my contributions are small. So at end of year 2, we will both be closing in to a million net worth with you at 902,792 and me at 930,604. Now if we leave the numbers alone and consider other aspects; at end of year 2, you will have total deposits of 902792 and since you do not take loans from saccos, that is the only funding available for your next project. While I on OTOH will have 1,490,063 and can take a loan of (4,470,189-559,419) or 3,910,770. Now who is more likely to put on hold an uncompleted project? Finally, if you step away from this theoretical comparison, how many of us Kenyans can remain disciplined enough to put aside that money that would have gone towards loan repayment religiously through the 4 years? No doubt you @MB would do it, but 80% or more won't. However, a good percentage of the 80% would reduce on their drinking/sponsoring/shoes enough to keep up with loan repayment. Some of the arguments here make me wonder if banks have spokesmen in the same way KQ has Obiero. Of course SACCOs are not able to fund multi-million shilling projects that banks can fund, but 80% of Kenyans are looking for <20M which can be obtained from SACCOs more easily and competitively.

|

|

|

Wazua

»

Investor

»

Economy

»

Law Capping interest rates

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|