Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Member Joined: 9/11/2014 Posts: 228 Location: Nairobi

|

obiero wrote:iris wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:MaichBlack wrote:obiero wrote:160,900 KQ sold out at KES 4.50; take home KES 708,845.. Viewing of the leaked actual financials late last night, triggered my thought pattern. one of my ladies in an established media house had filled me in.. was at the trading floor way beyond opening hour. I had to blind side a few investors and I apologise for ratting out but capital preservation preceeds integrity. However, I remain interested in the share and will likely reinvest on lower entry point @Obiero - On Wednesday, you stated that come what may, you cannot accept anything below 12/= on your KQ shares. Next morning you are selling at 4.50/= You really need to reevaluate your source of "inside information". Link: @Obiero not accepting anything below Kshs. 12/= on KQ shares - see post #4917 I have tried to expose this conman and his ways. If there are still some who believe him... Washindwe. But why does your mother trust me with extreme sensitive areas. I am a noble man    The ad hominem attacks. For all the insults that @Obiero can throw at me... I am glad he has been exposed as a conniving charlatan. Integrity. This remains key. For anyone who uses "winda" beware of the conman who will screw you over. Enough said. And not even the person he is at odds with but his mother. Most African vernaculars included addressing our peers' mothers as our own mothers. But @vvs, pat yourself on the back for avoiding a pissing match of such quality. While most men look at mothers of peers with some level of respect, "deadly" Obiero wants to sleep with them. And I fail to see the cause of retaliation -- Obiero announced here on the forum that he is a conman and even those of us who were inclined to think he was just misguided sometimes, now know that he may or may not be misguided, but he is definitely a conman. So, is that much talked about "spirit of Wazua" that I have come across often since I joined just an ideal like world peace? @iris lol.. I love your writing. very interesting but shallow. everyone trades for a profit, so incase I get to know that I can take a cut off your ignorance, I will do exactly that.. This is a stock exchange where profit surpasses friendship/comradeship. I took a move to sell that related to my hard earned cash. If that makes me a con, so be it.. @Obiero, shallow perhaps, but then Spinoza you are NOT  ; based on the level of imagination that still uses the same insults that you used at ten years

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

iris wrote:obiero wrote:iris wrote:VituVingiSana wrote:obiero wrote:VituVingiSana wrote:MaichBlack wrote:obiero wrote:160,900 KQ sold out at KES 4.50; take home KES 708,845.. Viewing of the leaked actual financials late last night, triggered my thought pattern. one of my ladies in an established media house had filled me in.. was at the trading floor way beyond opening hour. I had to blind side a few investors and I apologise for ratting out but capital preservation preceeds integrity. However, I remain interested in the share and will likely reinvest on lower entry point @Obiero - On Wednesday, you stated that come what may, you cannot accept anything below 12/= on your KQ shares. Next morning you are selling at 4.50/= You really need to reevaluate your source of "inside information". Link: @Obiero not accepting anything below Kshs. 12/= on KQ shares - see post #4917 I have tried to expose this conman and his ways. If there are still some who believe him... Washindwe. But why does your mother trust me with extreme sensitive areas. I am a noble man    The ad hominem attacks. For all the insults that @Obiero can throw at me... I am glad he has been exposed as a conniving charlatan. Integrity. This remains key. For anyone who uses "winda" beware of the conman who will screw you over. Enough said. And not even the person he is at odds with but his mother. Most African vernaculars included addressing our peers' mothers as our own mothers. But @vvs, pat yourself on the back for avoiding a pissing match of such quality. While most men look at mothers of peers with some level of respect, "deadly" Obiero wants to sleep with them. And I fail to see the cause of retaliation -- Obiero announced here on the forum that he is a conman and even those of us who were inclined to think he was just misguided sometimes, now know that he may or may not be misguided, but he is definitely a conman. So, is that much talked about "spirit of Wazua" that I have come across often since I joined just an ideal like world peace? @iris lol.. I love your writing. very interesting but shallow. everyone trades for a profit, so incase I get to know that I can take a cut off your ignorance, I will do exactly that.. This is a stock exchange where profit surpasses friendship/comradeship. I took a move to sell that related to my hard earned cash. If that makes me a con, so be it.. @Obiero, shallow perhaps, but then Spinoza you are NOT  ; based on the level of imagination that still uses the same insults that you used at ten years What's spinoza.. Administration need to check this :) No hard feelings @iris.. I was unfortunately rattled by a user here and in the wise words of my late uncle Hon Michuki; if you rattle..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return..

KQ ABP 4.26

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. Let him buy time as he wait for the pilots to strike. It is evident the management is to blame for the mess. How can in-flight meals be made lean yet you still expect to maintain value. Some of these things does not add up and it will end up destroying the product. The Middle East carriers have managed to attract customers through a a quality in-flight product. Quote:KQ currently sources its meals from several suppliers including Nas Servair and LSG Sky Chefs, a model it says has not been benefitial to them with volume discounts. Quote:Furthermore, the airline says there is a “wide selection of beverage and meal components that do not consider service time, flight duration and guest value” leading to wastage.

Going forward, the airline will review its meal offering across the network, consolidate global suppliers, create a negotiating strategy and match meals to the time of day.

More importantly to the 11,500 passengers who use KQ every day is that the airline plans to develop a “lean inflight (meal) product while maintaining value and stock beverages informed by consumption analysis.”

Ngunze is destroying this Co. in broad day light.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

ArrestedDev wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. Let him buy time as he wait for the pilots to strike. It is evident the management is to blame for the mess. How can in-flight meals be changed/ cut/ reduced and you expect it to attract customers to fly with you. Ngunze is destroying this Co. in broad day light.

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

ArrestedDev wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. Let him buy time as he wait for the pilots to strike. It is evident the management is to blame for the mess. How can in-flight meals be made lean yet you still expect to maintain value. Some of these things does not add up and it will end up destroying the product. The Middle East carriers have managed to attract customers through a a quality in-flight product. Quote:KQ currently sources its meals from several suppliers including Nas Servair and LSG Sky Chefs, a model it says has not been benefitial to them with volume discounts. Quote:Furthermore, the airline says there is a “wide selection of beverage and meal components that do not consider service time, flight duration and guest value” leading to wastage.

Going forward, the airline will review its meal offering across the network, consolidate global suppliers, create a negotiating strategy and match meals to the time of day.

More importantly to the 11,500 passengers who use KQ every day is that the airline plans to develop a “lean inflight (meal) product while maintaining value and stock beverages informed by consumption analysis.”

Ngunze is destroying this Co. in broad day light. The meals served on KQ are too refined and this was observed by Rick Ross in 2014 leading to a worldwide trend.. The taste of that food resembles that of an a la carte hotel. A little modesty has never hurt

KQ ABP 4.26

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote:ArrestedDev wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. Let him buy time as he wait for the pilots to strike. It is evident the management is to blame for the mess. How can in-flight meals be made lean yet you still expect to maintain value. Some of these things does not add up and it will end up destroying the product. The Middle East carriers have managed to attract customers through a a quality in-flight product. Quote:KQ currently sources its meals from several suppliers including Nas Servair and LSG Sky Chefs, a model it says has not been benefitial to them with volume discounts. Quote:Furthermore, the airline says there is a “wide selection of beverage and meal components that do not consider service time, flight duration and guest value” leading to wastage.

Going forward, the airline will review its meal offering across the network, consolidate global suppliers, create a negotiating strategy and match meals to the time of day.

More importantly to the 11,500 passengers who use KQ every day is that the airline plans to develop a “lean inflight (meal) product while maintaining value and stock beverages informed by consumption analysis.”

Ngunze is destroying this Co. in broad day light. The meals served on KQ are too refined and this was observed by Rick Ross in 2014 leading to a worldwide trend.. The taste of that food resembles that of an a la carte hotel. A little modesty has never hurt Nope, a quality in-flight product is what an airline requires to prosper. Ngunze does not know this. There are few options for him to continue cutting costs without affecting the quality of the product. What happened in 2015/2016, why did he deliver the same bottom line? Once the quality of the product is poor, there is nothing to be done even with a dreamliner to attract customers.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. We can't believe your KQ signature portfolio anymore! Just like the social media brought Chase bank to its knees within seconds, the big boys who happen to be @Obiero buddies are fearful of the good work @Spikes is doing providing informative analysis, prophetic views, incisive comments, mind boggling criticism and on top of the hour news that might influence massive selloffs. @Obiero is paid for KQ publicity on social media.Bleeding continues... How long will you play talkie talkie talkie PPT? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

Spikes wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. We can't believe your KQ signature portfolio anymore! Just like the social media brought Chase bank to its knees within seconds, the big boys who happen to be @Obiero buddies are fearful of the good work @Spikes is doing providing informative analysis, prophetic views, incisive comments, mind boggling criticism and on top of the hour news that might influence massive selloffs. @Obiero is paid for KQ publicity on social media.Bleeding continues... How long will you play talkie talkie talkie PPT? @spikes In a couple of weeks we shall see the fruits.. @ArrestedDev the bottom line held constant primarily since not all proceeds of the transformation initiatives were receipted prior to end of March 2016.. Further, the firm made a conscious decision to pay down short term debt so as to have higher cash flow.. An excellent decision

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:Spikes wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. We can't believe your KQ signature portfolio anymore! Just like the social media brought Chase bank to its knees within seconds, the big boys who happen to be @Obiero buddies are fearful of the good work @Spikes is doing providing informative analysis, prophetic views, incisive comments, mind boggling criticism and on top of the hour news that might influence massive selloffs. @Obiero is paid for KQ publicity on social media.Bleeding continues... How long will you play talkie talkie talkie PPT? @spikes In a couple of weeks we shall see the fruits.. @ArrestedDev the bottom line held constant primarily since not all proceeds of the transformation initiatives were receipted prior to end of March 2016.. Further, the firm made a conscious decision to pay down short term debt so as to have higher cash flow.. An excellent decision Painting a donkey black and white does not make it a zebra. Still a donkey. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

sparkly wrote:obiero wrote:Spikes wrote:obiero wrote:News just in to those who expect Amb Dennis Awori or Mbuvi Ngunze to exit without a just cause.. http://www.nation.co.ke/...19552-xebsmf/index.html

Signs of life are evident to me.. Gross profit up 42% +KES10.549B YoY and operating loss position up 76% +KES 12.240B YoY . KQ despite turbulent times remains a bold and treasured brand, voted as African Airline of The Year, Leading Business Class in Africa 2015, delivering 160 landing/takeoffs with uplift of over 10,000 passengers daily covering 54 global destinations. Operation Pride now at 25% of implementation, has achieved 113 improvement activities effected out of a total of 447 specific initiatives. Overall impact being 32% increase on recurrent annual income. The airline paid down KES 34.7B of its term debts in 2015-2016. Short term debt down to KES 14B from 26.4B in previous FY. The firm also managed to retain cash at hand; up 42% to KES 4.287B, implying resolution on immediate cash constraint issue. 10+ reasons to believe in operation pride atKQ: 1. End of hedging policy 2. Cut off on HOTAC and other operational expenses 3. Rightsizing of the workforce 4. Fuel efficient planes 5. Route optimization 6. Category 1 status at main hub 7. GoK guaranteed debt at reduced pay out 8. Sale of non critical assets 9. Global reduction in fuel costs 10. Revival in KE tourism 11. Budget carrier for booming middle-class 12. Cleaned-up board and management 13. Debt tenor restructure by main bankers 14. Financial revamp by transaction advisers @spikes may call this an obsession on KQ, but I smell clean cash money of high value in the near horizon. High risk high return.. We can't believe your KQ signature portfolio anymore! Just like the social media brought Chase bank to its knees within seconds, the big boys who happen to be @Obiero buddies are fearful of the good work @Spikes is doing providing informative analysis, prophetic views, incisive comments, mind boggling criticism and on top of the hour news that might influence massive selloffs. @Obiero is paid for KQ publicity on social media.Bleeding continues... How long will you play talkie talkie talkie PPT? @spikes In a couple of weeks we shall see the fruits.. @ArrestedDev the bottom line held constant primarily since not all proceeds of the transformation initiatives were receipted prior to end of March 2016.. Further, the firm made a conscious decision to pay down short term debt so as to have higher cash flow.. An excellent decision Painting a donkey black and white does not make it a zebra. Still a donkey.      John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour withthis share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

Impunity wrote:obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times

KQ ABP 4.26

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

obiero wrote:ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out    possunt quia posse videntur

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

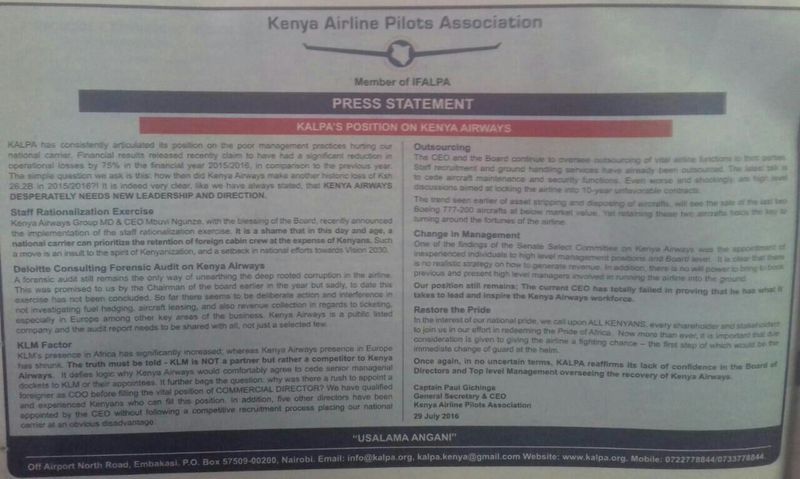

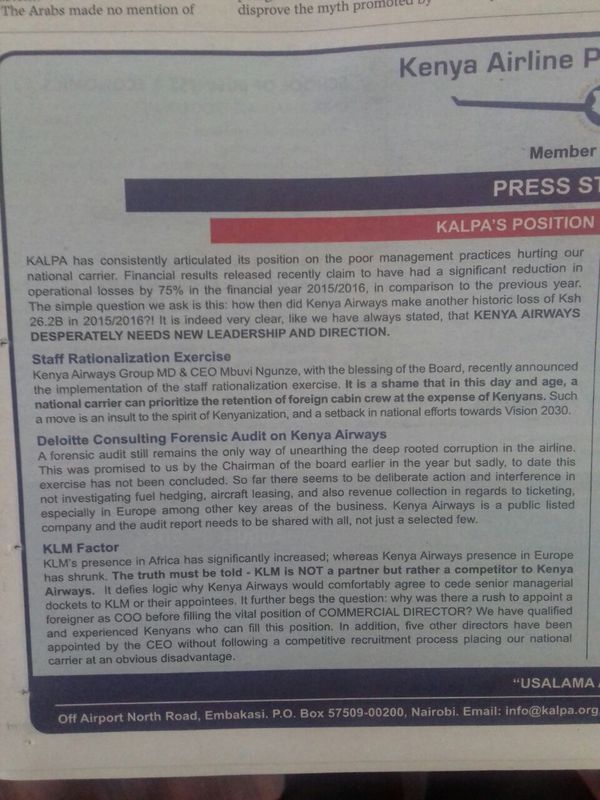

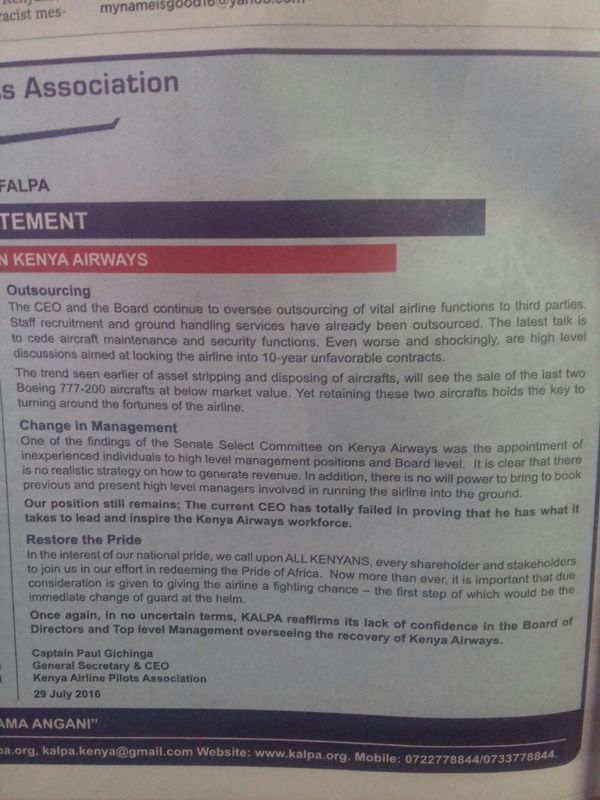

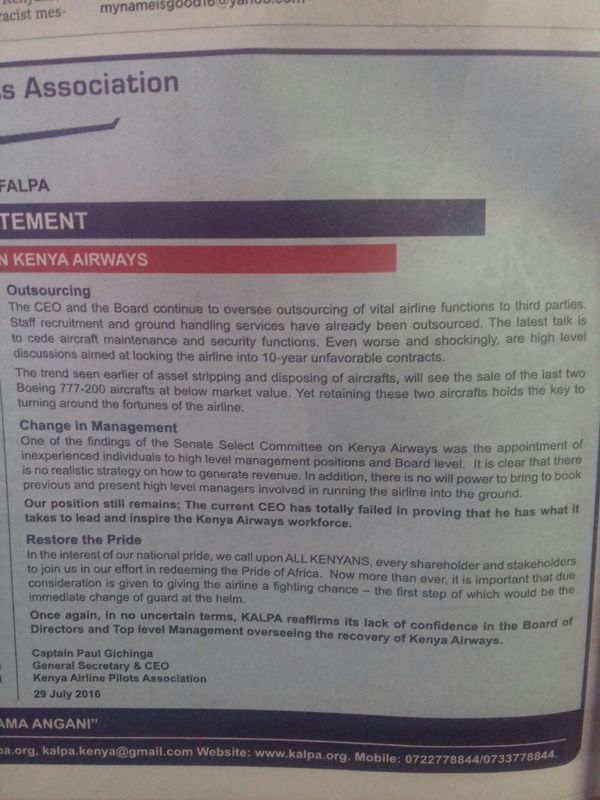

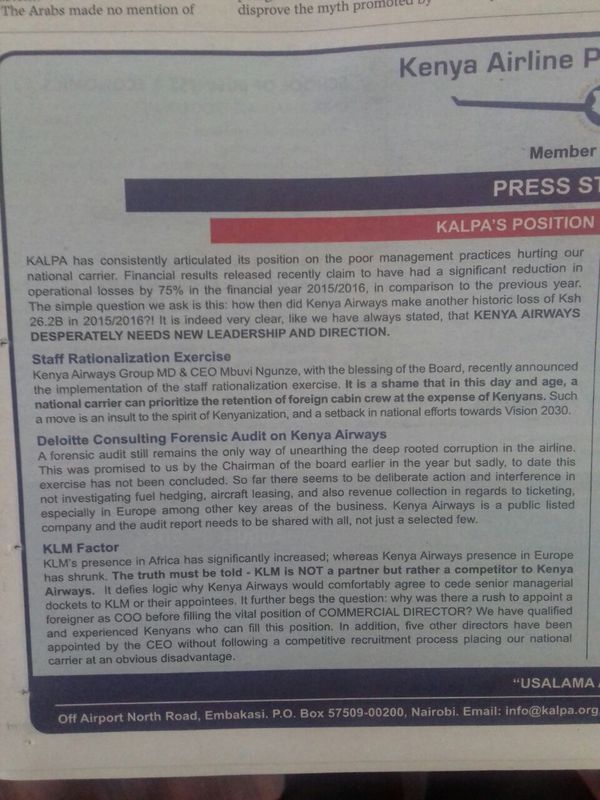

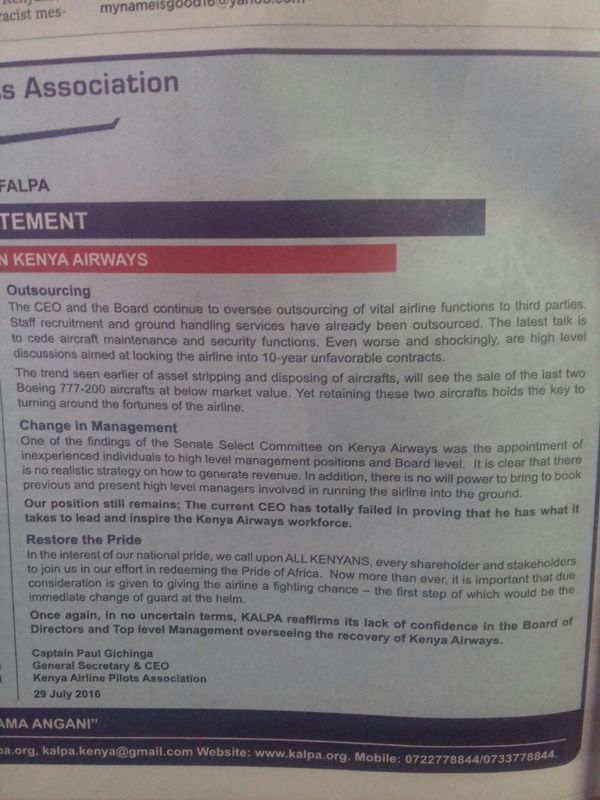

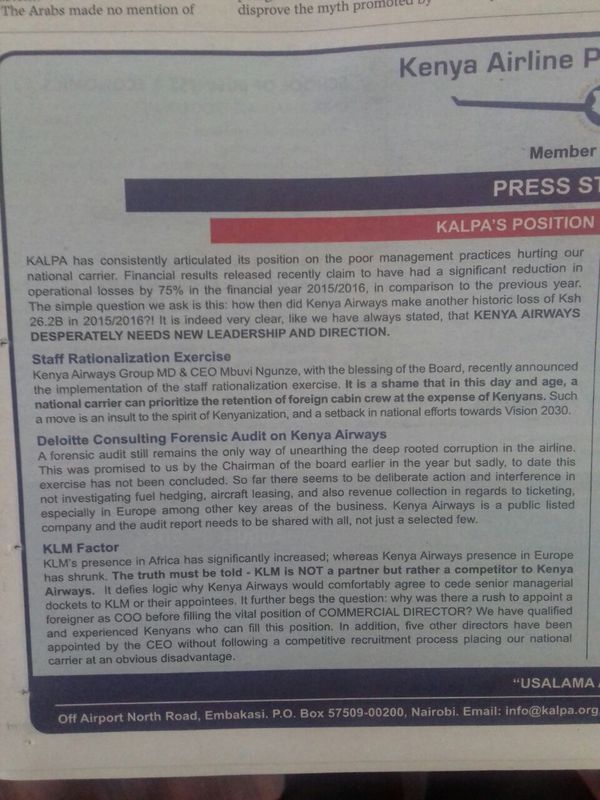

maka wrote:obiero wrote:ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:obiero wrote:Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out   Paul Gichinga.. I saw this on today's DN.. Looks like they want to cripple KQ. Hope the strike doesnt materialise especially in light of the vibrant response by the Group Chairman of Kenya Airways http://www.nation.co.ke/...319552-xebsmf/index.html

KQ ABP 4.26

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote:maka wrote:obiero wrote:ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:[quote=obiero]Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out   Paul Gichinga.. I saw this on today's DN.. Looks like they want to cripple KQ. Hope the strike doesnt materialise especially in light of the vibrant response by the Group Chairman of Kenya Airways http://www.nation.co.ke/...19552-xebsmf/index.html[/quote] These guys have a point to put across. There is something wrong with the operations of Kenya Airways. Ngunze needs to think seriously about the future of the Airline in his hands. It is evident he is not capable. All sentiments expressed so far does not lend any credibility to the management. One year is too much time for a sharp person to change things. Compare Ngunze with the guy at Uchumi, without relying on an expensive consultant, he has managed to identify and sealed loopholes, convinced suppliers to resume delivery of goods,closed all non-performing branches, etc.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,069 Location: nairobi

|

ArrestedDev wrote:obiero wrote:maka wrote:obiero wrote:ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:[quote=obiero]Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out   Paul Gichinga.. I saw this on today's DN.. Looks like they want to cripple KQ. Hope the strike doesnt materialise especially in light of the vibrant response by the Group Chairman of Kenya Airways http://www.nation.co.ke/...19552-xebsmf/index.html[/quote] These guys have a point to put across. There is something wrong with the operations of Kenya Airways. Ngunze needs to think seriously about the future of the Airline in his hands. It is evident he is not capable. All sentiments expressed so far does not lend any credibility to the management. One year is too much time for a sharp person to change things. Compare Ngunze with the guy at Uchumi, without relying on an expensive consultant, he has managed to identify and sealed loopholes, convinced suppliers to resume delivery of goods,closed all non-performing branches, etc. Uchumi is being closed soon.. Plus they let go of staff too plus left regional markets. Personally I would prefer if the KALPA guys gave solutions. They are simply sore coz of the massive cuts hitting them directly where it hurts. I would honorably leave a firm than fight with its head. Even the Bible frowns on such people

KQ ABP 4.26

|

|

|

Rank: Member Joined: 5/29/2016 Posts: 898 Location: Nairobi

|

obiero wrote:ArrestedDev wrote:obiero wrote:maka wrote:obiero wrote:ArrestedDev wrote:obiero wrote:Impunity wrote:obiero wrote:Impunity wrote:[quote=obiero]Bought back in at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own analysis and risk appetite levels What is your average buy price for this counter since time immemorial? Yaani since you fisrt enetered it. If the buy price is below 3.70, then congrats...also what has changed for you to dip in again 7 days afetr exiting? I would like to be your broker, he/she is a happy person.  Bought back in the most recent batch at all time low of KES 3.70.. Total outlay KES 731,980. I am in this for the long haul and as said here once to many times, I go solo on this journey; join me at own risk appetite level, with consideration of own analysis.. Total potentially earned investment income in 5 trading days considering fall from selling price of KES 4.50 to average buy of KES 3.95, equals KES 88,495 exclusive of applicable F&C 2.1%. In the business world, you have to spread money around at times so as to make money.. My average buy price is KES 4.05 Why do you talk about potential? Its like these are realize gains, just assumptions...come clear please. And I dont see the long-haul in your behaviour with this share...you are basically a trader. You buy and sell within a few weeks after getting the insider info from that lady journalist GF of yours. She is like a sister to me and she has never been my source. As for me being a trader, the jury is out here on wazua.. You may be right though on my pattern, I cash in when the price seats right; 20% higher and I am off any given stock unless information guides me to hold. Meanwhile, Amb Awori has come out fully clothed, defending Mbuvi Ngunze.. KALPA are baying for blood. PJT partners have found an investor ready to plough in KES 60B in equity. Stock price holds constant. Interesting times Ati 60 birrion? That's hot air. Awori was saying the Co. cannot even be valued due to the negative equity position during the results announcement. Both him and Ngunze are clueless and do not have the necessary aviation experience. KLM has rapped KQ - Which expansion at low cost has KQ undertaken through KLM. KLM tickets are for Europe and when matched with a KQ ticket, it is too expensive and no one will buy. This is the reason why KQ is loosing customers to the competition.Ngunze should leave. Ngunze will not leave soon. Viva viva Mbuvi.. About the KES 60B, please give 3 weeks for the information to appear in public domain. Up 6.5% today to trade at KES 4.15!! This share on margin trading would make one very wealthy, but you must have the inside information or you could be wiped out   Paul Gichinga.. I saw this on today's DN.. Looks like they want to cripple KQ. Hope the strike doesnt materialise especially in light of the vibrant response by the Group Chairman of Kenya Airways http://www.nation.co.ke/...19552-xebsmf/index.html[/quote] These guys have a point to put across. There is something wrong with the operations of Kenya Airways. Ngunze needs to think seriously about the future of the Airline in his hands. It is evident he is not capable. All sentiments expressed so far does not lend any credibility to the management. One year is too much time for a sharp person to change things. Compare Ngunze with the guy at Uchumi, without relying on an expensive consultant, he has managed to identify and sealed loopholes, convinced suppliers to resume delivery of goods,closed all non-performing branches, etc. Uchumi is being closed soon.. Plus they let go of staff too plus left regional markets. Personally I would prefer if the KALPA guys gave solutions. They are simply sore coz of the massive cuts hitting them directly where it hurts. I would honorably leave a firm than fight with its head. Even the Bible frowns on such people KQ is going to be closed and not Uchumi. It is the responsibility of the management to provide solutions and not KALPA. Ngunze cannot deliver. Outsourcing maintenance of aircrafts will lead to decline in the standards. Faulty aircraft is likely to be cleared for take off and accidents will occur. There a very few options to cut costs in an airline without hurting the overall service delivery which is key. Without a substantial Commercial director, how will the airline generate revenue yet the Co. is wallowing in debt???? The competitors must be laughing at what is happening in Kenya Airways. It is evident there is lack of leadership.

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|