Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

@spikes i shouldnt be your measurung stick.. js have a strategy devoid of competing with anyone. you dont know how deep my pockets are.. i could stand losses that could cripple hearts of mere mortals

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

@spikes play in the sand pit please. Here is some homework for you. 6 in 10 graduates have no employability skills – Report http://www.capitalfm.co....oyability-skills-report/

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

[quote=Cde Monomotapa]@spikes play in the sand pit please. Here is some homework for you. 6 in 10 graduates have no employability skills – Report http://www.capitalfm.co....yability-skills-report/[/quote] @cde be easy on the young chap.. He obviously doesnt know who Gulamali Ismail or Vijay Ratilal Shah are to KQ, or even doesnt know 83% of KQ is held by a mere 47 shareholders.. Let the guy learn NSE slowly, since even the 1million shares intended to be bought shall be 0.0..% of total issued shares incapable of swaying price. In the NSE as with any other exchange access to info in a timely manner is everything. There is a reason I sold my KQ when I did, last year.. Hii soko iko na wenyewe..

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

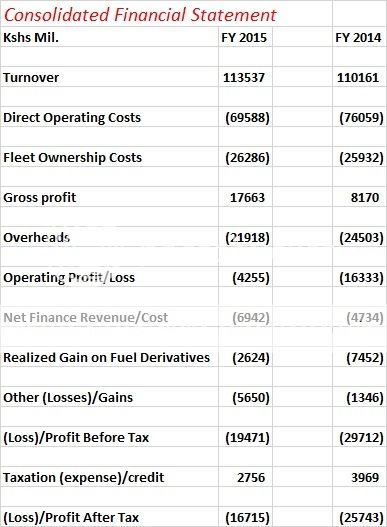

enyands wrote:obiero wrote:sparkly wrote:obiero wrote:sparkly wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. The figures tell a story. The story that KQ will be in trouble for a long long time. Let us review in exactly five months, I have reason to believe the worst is behind us. Todays top gainer?? Problem with KQ is a very weak topline. The company needs to double the topline just to break even. I doubt if they are covering their fixed costs. The topline was impacted by some of the reasons offered by management in previous announcements. However, I see an active management ready to steady the sinking ship/plunging plane which was abused by Naikuni's impropriety.. Based on the macro environment and steps taken to right the operating measures at KQ, its unlikely neigh improbable that the firm shall remain in losses upto their next H1 Obiero why did u sell your KQ. U r campaigning so hard for its like you still have your 90k shares still yet last time I checked it was 500  ama uliongeza? I'm starting to believe the guy you once refered to as a new clown in town (@spikes )  Throwback :)

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL You think it's free money? wait for the finance costs. Life is short. Live passionately.

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

More long term loans and more negative NAV. KQ will take more than 3 years to return to operating profit.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan??

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,331 Location: Masada

|

obiero wrote:Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan?? I overheard in a pub,6%. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

Kausha wrote:More long term loans and more negative NAV. KQ will take more than 3 years to return to operating profit. Ngunze said in 2018, they will be making profit; even 1 shilling is a profit If Obiero did it, Who Am I?

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

[quote=Cde Monomotapa]@spikes play in the sand pit please. Here is some homework for you. 6 in 10 graduates have no employability skills – Report http://www.capitalfm.co....yability-skills-report/[/quote] That is how you end up being brainwashed by researches done by ungodly people who have no basis of biblical teachings. You don't haffi to be employed by anybody to be successful! People prosper through talent and uniqueness shunned by the very employers you blindly glorify. Change your way of thinking. Don't take everything authored by researchers as the gospel truth. No wonder we have billionaires in Kenya with little education but abundance of investment skills which they borrow from you academicians toiling under them. And work on tight schedules on peanuts. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

Impunity wrote:obiero wrote:Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan?? I overheard in a pub,6%. Seems like a good rate

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

obiero wrote:Impunity wrote:obiero wrote:Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan?? I overheard in a pub,6%. Seems like a good rate Under this tough interest rate regime 6% is favourable. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,329 Location: Nairobi

|

GoK borrows long-term money at 14% and then on-lends it at 6%? That's how countries default. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Veteran Joined: 8/28/2015 Posts: 1,247

|

Spikes wrote:obiero wrote:Impunity wrote:obiero wrote:Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan?? I overheard in a pub,6%. Seems like a good rate Under this tough interest rate regime 6% is favourable. Real interest rate reflects inflation forex losses, exchange undercuts and all lots of things there. Hii sio member inakopesha kq bana. My fair bet is over 12% in the longrun. Let's call a spade a spade n not big spoon. Another Arm, etc in the making n the cycle continues. Anyway just added 3yrs to my 13yrs to get 16yrs plus. R we through with restructuring yet? N then reconsulting.    @ spikes its good to dare n dream. 2bob was a fair guess by any metrics. Where is mumias after 1bsh injection,.. ,Behold, a sower went forth to sow;....

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

muandiwambeu wrote:Spikes wrote:obiero wrote:Impunity wrote:obiero wrote:Spikes wrote:obiero wrote:in accounting as per IFRS, how will the afriexim and government bailout be treated in the financials.. will it only affect the balance sheet and cashflow or even PL As for the money KQ got from government as bailout is a misnomer. This is a loan. @obiero don't hide behind political gimmicks. Huge finance costs will smoke you out. It is a matter of time value of money! Whats the rate on the loan?? I overheard in a pub,6%. Seems like a good rate Under this tough interest rate regime 6% is favourable. Real interest rate reflects inflation forex losses, exchange undercuts and all lots of things there. Hii sio member inakopesha kq bana. My fair bet is over 12% in the longrun. Let's call a spade a spade n not big spoon. Another Arm, etc in the making n the cycle continues. Anyway just added 3yrs to my 13yrs to get 16yrs plus. R we through with restructuring yet? N then reconsulting.    @ spikes its good to dare n dream. 2bob was a fair guess by any metrics. Where is mumias after 1bsh injection,.. o And imagine Mumias got a real bailout of 500m+500m+1B=2B KES . It sinks deeper into losses year after year! It is a wake up call!!! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Cde Monomotapa wrote:The video, here a written summary of Transformation initiatives thus far. KQ eyeing narrow loss via low fuel costs and savings http://www.standardmedia...-fuel-costs-and-savings

(Debt) Finance in any other name is finance. Bailout, shareholder loan, bridge loan whatever. Water is water and from Afreximbank (since we'd have liquidate NSSF to fund KQ - save, invest more) comes at better rate & tenor than commercial banks. That's sufficient funding to see KQ through financial capital restructuring culminating in a most probable buy-in. Stay tuned. Another well written piece. Consistency* KQ banks on flight changes to fly into profitability http://www.nation.co.ke/...8/-/bbg2rgz/-/index.html

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Cde Monomotapa wrote:[quote=Cde Monomotapa] The video, here a written summary of Transformation initiatives thus far. KQ eyeing narrow loss via low fuel costs and savings http://www.standardmedia...-fuel-costs-and-savings

(Debt) Finance in any other name is finance. Bailout, shareholder loan, bridge loan whatever. Water is water and from Afreximbank (since we'd have liquidate NSSF to fund KQ - save, invest more) comes at better rate & tenor than commercial banks. That's sufficient funding to see KQ through financial capital restructuring culminating in a most probable buy-in. Stay tuned. Another well written piece. Consistency* KQ banks on flight changes to fly into profitability http://www.nation.co.ke/.../-/bbg2rgz/-/index.html[/quote] You talk of low fuel cost as Nguze emphasises on hedges in place widening expenses instead of cutting them. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,166 Location: nairobi

|

Spikes wrote:Cde Monomotapa wrote:[quote=Cde Monomotapa] The video, here a written summary of Transformation initiatives thus far. KQ eyeing narrow loss via low fuel costs and savings http://www.standardmedia...-fuel-costs-and-savings

(Debt) Finance in any other name is finance. Bailout, shareholder loan, bridge loan whatever. Water is water and from Afreximbank (since we'd have liquidate NSSF to fund KQ - save, invest more) comes at better rate & tenor than commercial banks. That's sufficient funding to see KQ through financial capital restructuring culminating in a most probable buy-in. Stay tuned. Another well written piece. Consistency* KQ banks on flight changes to fly into profitability http://www.nation.co.ke/.../-/bbg2rgz/-/index.html[/quote] You talk of low fuel cost as Nguze emphasises on hedges in place widening expenses instead of cutting them. Current fleet is more fuel efficient hence utilises less litres per trip even at same hedged prices.. Hii inahitaji explanation kweli??

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|