Wazua

»

Investor

»

Economy

»

Tbill at 25% in 2016

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

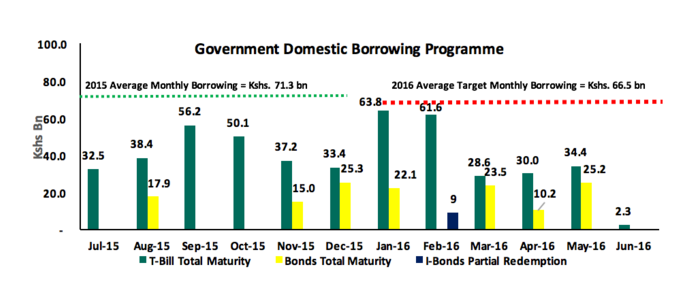

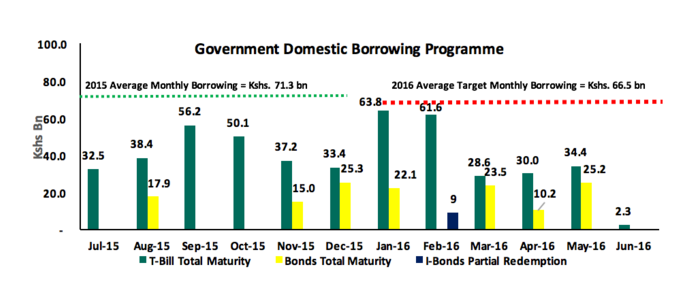

The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards. Given its an erection yr (yr before election when money and politicians are made), money will be poured. CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year. I therefore see 25% paid even for the 364 bond... Sehemu ndio nyumba

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Mainat wrote:The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards.

Given its an erection yr (yr before election when money and politicians are made), money will be poured.

CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year.

I therefore see 25% paid even for the 364 bond... @Are you a prophet of doom? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 7/26/2007 Posts: 6,514

|

Very realistic scenario. First huge repayments start in Feb/March. Its gonna be a bloodbath. Business opportunities are like buses,there's always another one coming

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Spikes wrote:Mainat wrote:The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards.

Given its an erection yr (yr before election when money and politicians are made), money will be poured.

CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year.

I therefore see 25% paid even for the 364 bond... @Are you a prophet of doom? He is just being realistic... http://www.nation.co.ke/.../-/a7iv08z/-/index.html

Rates will go up like crazy.... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

maka wrote:Spikes wrote:Mainat wrote:The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards.

Given its an erection yr (yr before election when money and politicians are made), money will be poured.

CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year.

I therefore see 25% paid even for the 364 bond... @Are you a prophet of doom? He is just being realistic... http://www.nation.co.ke/.../-/a7iv08z/-/index.html

Rates will go up like crazy.... You mean bloodbath will be uglier than what we saw last year? John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

Spikes wrote:maka wrote:Spikes wrote:Mainat wrote:The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards.

Given its an erection yr (yr before election when money and politicians are made), money will be poured.

CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year.

I therefore see 25% paid even for the 364 bond... @Are you a prophet of doom? He is just being realistic... http://www.nation.co.ke/.../-/a7iv08z/-/index.html

Rates will go up like crazy.... You mean bloodbath will be uglier than what we saw last year?  possunt quia posse videntur

|

|

|

Rank: Member Joined: 1/3/2014 Posts: 257

|

maka wrote:Spikes wrote:maka wrote:Spikes wrote:Mainat wrote:The huge stock of debt repayments haven't yet kicked in, and the slope is steadily going upwards.

Given its an erection yr (yr before election when money and politicians are made), money will be poured.

CBK will have to let interest rates or Ksh go. I think it'll choose temporary interest rate hike. Like it did last year.

I therefore see 25% paid even for the 364 bond... @Are you a prophet of doom? He is just being realistic... http://www.nation.co.ke/.../-/a7iv08z/-/index.html

Rates will go up like crazy.... You mean bloodbath will be uglier than what we saw last year?  25% seems rather high. The t-bill rates will go up but considering the cash being held in anticipation, supply is high enough to keep the rate hikes in check.

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

Cash will be king till 2018.

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

whiteowl wrote:Cash will be king till 2018. How can cash be a king when it is held without growth? Say bear run shall be a king and cash a queen. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

Spikes wrote:whiteowl wrote:Cash will be king till 2018. How can cash be a king when it is held without growth? Say bear run shall be a king and cash a queen. When RAO continues to say the "he will not accept another stolen vote" and tha Jubilee mouthpiece in cost hold that "Jubilee gaamnet will win at all cost ata kama ni kuiba ama kuuwa" then the bloodiest bath at the NSE is sure like a cock!  Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

Spikes wrote:whiteowl wrote:Cash will be king till 2018. How can cash be a king when it is held without growth? Say bear run shall be a king and cash a queen. Growth is secondary, retaining the value of your investment/s will always come first.

|

|

|

Rank: Veteran Joined: 11/2/2006 Posts: 1,206 Location: Nairobi

|

whiteowl wrote:Spikes wrote:whiteowl wrote:Cash will be king till 2018. How can cash be a king when it is held without growth? Say bear run shall be a king and cash a queen. Growth is secondary, retaining the value of your investment/s will always come first. Cash to buy TBills will be King! Formally employed people often live their employers' dream & forget about their own.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Dump equities, but low uptake in money market. This is one ugly market standoff! Definitely an ugly rate spike is coming up. GoK cash crunch is a guarantee and they can't escape it! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

whiteowl wrote:Spikes wrote:whiteowl wrote:Cash will be king till 2018. How can cash be a king when it is held without growth? Say bear run shall be a king and cash a queen. Growth is secondary, retaining the value of your investment/s will always come first. That's the true definition of an investor The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Member Joined: 1/22/2015 Posts: 682

|

Roundi this I won't be left idling around. Already prepped.

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

Mike Ock wrote:Roundi this I won't be left idling around. Already prepped. Me wwaiting a couple of months till am 100% liquid...but I wont miss to jump in with some few hundred of KES when the deal taste past 20%.   My portfolio is currently very thin on stocks. Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

hisah wrote:Dump equities, but low uptake in money market. This is one ugly market standoff! Definitely an ugly rate spike is coming up. GoK cash crunch is a guarantee and they can't escape it! banks will also enjoy the ride trading with govt which is less hectic "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Member Joined: 8/15/2015 Posts: 817

|

mimi sitaki kuona mtu aki comment this thread and you have never looked at the nse chart. hiyo ujinga ndio sisi hatutaki.look at the nse chart squarely then comment . nkt ! lol

|

|

|

Rank: User Joined: 8/15/2013 Posts: 13,237 Location: Vacuum

|

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

Cornelius Vanderbilt wrote:mimi sitaki kuona mtu aki comment this thread and you have never looked at the nse chart. hiyo ujinga ndio sisi hatutaki.look at the nse chart squarely then comment . nkt ! lol sisi  ? wewe na nani

|

|

|

Wazua

»

Investor

»

Economy

»

Tbill at 25% in 2016

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|