Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

[quote=Cde Monomotapa]au revoir..

flydubai East Africa Service Changes from late-Jan 2016 http://airlineroute.net/2015/12/25/fz-jan16/

How often does RwandAir fly from Kigali to Dubai? Could they have been the reason for FlyDubai cutting back?Hello..

Kenya Airways Expands AIRFRANCE Codeshare from mid-Dec 2015 http://airlineroute.net/...5/kqaf-codeshare-dec15/[/quote] Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,163 Location: nairobi

|

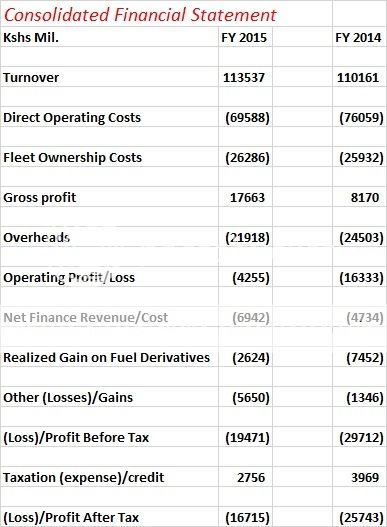

sparkly wrote:Spikes wrote:@obiero remember the company is operating with negative equity which translates to overpriced KQ at NSE bourse. If next loss announcement broadens further, it'll stir status quo of kes 4.5 by sending jitters amongst Wanjiko who would impulsively let it go on a free fall. Recall it is you to obey the law of gravity; however, if the law of gravity obeys you it is news. The price resistant at kes 4.5 is normal because some guys bought the share expensively and are expecting a reverse in performance which is not forth coming in the next 18 months. Finally the kes 4.5 floor will be broken, as some investors and a handful of speculators will grow impatient on government much awaited bailout, to unveil what is inside ground level. @Spikes let me give you a basic schooling on how to value asssets. Value of asset:ADD all foreseeable future incomes TO the expected terminal value of the asset AND discount all to the present value. The market is saying that if you buy KQ today and hold till Jesus comes back, you will have made KShs 4.50 (give or take a few cents) in today's cash equivalent. What you are telling us is that by the time Christ come back, you can only make KShs 2. Thanks @sparkly some schooling was needed right there.. :) As per post #1 adopted from ProverB, operating margin for KQ: 2015 projected -3.7% 2014 -14.8% 2013 -2.6% 2010 2.6% 2009 5.6% 2008 11.6% 2007 13.1%

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

obiero wrote:sparkly wrote:Spikes wrote:@obiero remember the company is operating with negative equity which translates to overpriced KQ at NSE bourse. If next loss announcement broadens further, it'll stir status quo of kes 4.5 by sending jitters amongst Wanjiko who would impulsively let it go on a free fall. Recall it is you to obey the law of gravity; however, if the law of gravity obeys you it is news. The price resistant at kes 4.5 is normal because some guys bought the share expensively and are expecting a reverse in performance which is not forth coming in the next 18 months. Finally the kes 4.5 floor will be broken, as some investors and a handful of speculators will grow impatient on government much awaited bailout, to unveil what is inside ground level. @Spikes let me give you a basic schooling on how to value asssets. Value of asset:ADD all foreseeable future incomes TO the expected terminal value of the asset AND discount all to the present value. The market is saying that if you buy KQ today and hold till Jesus comes back, you will have made KShs 4.50 (give or take a few cents) in today's cash equivalent. What you are telling us is that by the time Christ come back, you can only make KShs 2. Thanks @sparkly some schooling was needed right there.. :) Well, I think @Spikes is optimistic. I value KQ shares in its current form [ceteris paribus] at zero. 1) There is no future income/profit expected for 18 months even by the ever optimistic @Obiero. It will take many years after that for profits to build up to decent levels. 2) The expected terminal value [based on today's NAV] is negative for many years. If anything, the hole gets deeper every month. [And there's the real possibility of 'dilution' by a sale of shares to a strategic partner. See ARM]. 3) The current discount rate is 15% [I am using the 9-year IFB as my benchmark]. Let @Obiero provide the data as required and @Sparkly can do the maths for our benefit to find NPV. Happy Holidays! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

http://www.theeastafrica...6/-/4svnc9/-/index.html

Fastjet to fly NBO-DSM ($175 Return) and NBO-JRO with future service NBO-ZNZ and MBA-DSM ... KQ charges $350 Return. Who would you fly? Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Still early days. Let them come. Jambojet x-sells KQ on similar routes and a good reason is capacity? A trader with cargo will be ill advised to fly a LCC. Think Eastliegh. FJ can also codeshare with JJ on local and KQ on international.

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

Cde Monomotapa wrote:Still early days. Let them come. Jambojet x-sells KQ on similar routes Lies, lies, bitter lies. On which 'similar' routes does JJ x-sell KQ?and a good reason is capacity? A trader with cargo will be ill advised to fly a LCC. Think Eastliegh. What planes does KQ fly from NBO to JRO/DSM? Traders/importers in DSM are better off using direct flights into DSM from Dubai which is a major entrepot that serves China, India, etc. FJ can also codeshare with JJ on local and KQ on international. Of course FJ can codeshare with JJ & KQ. Though for now FJ will take marketshare from KQ on the KE-TZ routes.

Over time, I think FJ will also take marketshare of other routes i.e. NBO-DSM-Southern Africa (Lusaka, Harare, Lilongwe & the biggie Joburg) by providing lower fares. For those looking at flying where FastJet flies... http://www.fastjet.com/t...r-trip/fees-and-charges

http://www.fastjet.com/ke/en/ [Kenya Website] http://www.fastjet.com/tz/en/ [TZ Website] To fly beyond DSM, you may need to book a separate ticket due to Kenya CAA's restrictions. Another airline that is cheaper [but 1 stop] than KQ for many intra-Africa flights is RwandaAir. And the flight stewardesses on RwandaAir [& ET)...       #TeamMafisi Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

4%

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,163 Location: nairobi

|

Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Congrats for 300k deal but do not attempt to dive into KQ. You will aid somebody pullout leaving you there to be burnt beyond recognition. Lets do a virtual Math: you enter@5bob you obtain 60,000 units then you come to Wazua gloating beating the chest 'I have punched it' only to be screwed @2bob proceeds of 120k . Shafting continues! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea Refer to the "2 stocks for life" thread. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

sparkly wrote:obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea Refer to the "2 stocks for life" thread. SCOM, KCB The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea Brother Obiero I don't know much about stocks like you do but don't attempt kq again . Already the signs are there .there are some other competitors who have just registered with the kenya airports authority making them run for their money . There are other stocks you can purchase refer to "stocks 4 life" "thread

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea You can't go wrong with KQ. It's the next hot stock. Mbuvi is the next Jobs mixed in with Zuckerberg, wrapped in Branson & drizzled with Bezos. Don't listen to @Kausha & @VVS who know nothing about investing who have boring Unga [food is booooring], KK [fuel is going out of fashion], KenRe [who needs insurance?], Williamson [Coffee not Tea is chic] and a shady bank called I&M [M-Pesa, Bitcoin is much better]... See you in the stratosphere as you shit on these naysayers! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: New-farer Joined: 12/9/2015 Posts: 47 Location: +254

|

VituVingiSana wrote:obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea You can't go wrong with KQ. It's the next hot stock. Mbuvi is the next Jobs mixed in with Zuckerberg, wrapped in Branson & drizzled with Bezos. Don't listen to @Kausha & @VVS who know nothing about investing who have boring Unga [food is booooring], KK [fuel is going out of fashion], KenRe [who needs insurance?], Williamson [Coffee not Tea is chic] and a shady bank called I&M [M-Pesa, Bitcoin is much better]... See you in the stratosphere as you shit on these naysayers!     Be charitable

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,163 Location: nairobi

|

VituVingiSana wrote:obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea You can't go wrong with KQ. It's the next hot stock. Mbuvi is the next Jobs mixed in with Zuckerberg, wrapped in Branson & drizzled with Bezos. Don't listen to @Kausha & @VVS who know nothing about investing who have boring Unga [food is booooring], KK [fuel is going out of fashion], KenRe [who needs insurance?], Williamson [Coffee not Tea is chic] and a shady bank called I&M [M-Pesa, Bitcoin is much better]... See you in the stratosphere as you shit on these naysayers! I will follow advise of @enyands @kausha for now..

KQ ABP 4.26

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,324 Location: Nairobi

|

obiero wrote:VituVingiSana wrote:obiero wrote:Cde Monomotapa wrote: 4% Just received 300k from a deal gone good. Im terribly confused as to my next move. Hata usingizi imepotea You can't go wrong with KQ. It's the next hot stock. Mbuvi is the next Jobs mixed in with Zuckerberg, wrapped in Branson & drizzled with Bezos. Don't listen to @Kausha & @VVS who know nothing about investing who have boring Unga [food is booooring], KK [fuel is going out of fashion], KenRe [who needs insurance?], Williamson [Coffee not Tea is chic] and a shady bank called I&M [M-Pesa, Bitcoin is much better]... See you in the stratosphere as you shit on these naysayers! I will follow advise of @enyands @kausha for now.. Noooo! @Kausha & @enyands have no vision. They are naysayers. Pessimists. You need to listen to @Cde because that is the way to go. Higher, Higher, Higher. Look at KK as an example. Out with Naikuni/Segman. In with Mbuvi/Ohana. Only good things await you on KQ. You cannot go wrong. The sale of excess assets will fill the hole. The opening of new routes will boost revenue. Don't be lied to about underwater hedges. The talented and able CFO, Alex Mbugua, knows how to beat the likes of Goldman at their game. And when @VVS quotes Warren Buffett, tell him that Buffett is a loser. Tell him about IBM, Tesco, etc. @VVS or Buffett = L-O-S-E-R who doesn't know about running an airline profitably like the illustrious Board & Management of KQ. In 18 months, the likes of @VVS will regret not buying KQ at the discounted price of 5/- as it soars towards 140/-. The illustrious, progressive and fiscally responsible government is backing KQ. They know what is going on. The Kenyan government has the best economic brains in the world. They are as clean as the driven snow. You, my friend, are in very good company! Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

Eti as it soars towards 140 bob?????? hahahaha ha ha ha ha ....@VV You are a confirmed liar plying Wazuans with falsehoods! John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,163 Location: nairobi

|

Spikes wrote:Eti as it soars towards 140 bob?????? hahahaha ha ha ha ha ....@VV You are a confirmed liar plying Wazuans with falsehoods! Haha. Sarcasm my friend.. @vvs know the future!

KQ ABP 4.26

|

|

|

Rank: Elder Joined: 5/25/2012 Posts: 4,105 Location: 08c

|

Spikes wrote:Eti as it soars towards 140 bob?????? hahahaha ha ha ha ha ....@VV You are a confirmed liar plying Wazuans with falsehoods! Sppiiikkkkeeeeessssss!!!!!!!! Pesa Nane plans to be shilingi when he grows up.

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,163 Location: nairobi

|

VituVingiSana wrote:obiero wrote:VituVingiSana wrote:obiero wrote:  We are ready for the temporary losses. Soon we shall reach the desired place @maka @spikes @aguy @afroblk @muganda.. People have a new profession in bashing KQ, but they dont bother to tell you operating loss went down by KES 8.3B and that the loss before income tax actually narrowed marginally prior to consideration of the tax expense, noting last year KRA gave in a huge tax credit of backdated sums.. A trying period, but all is not lost. The writing is on the wall.. Warren Buffett's rules for investing: 1) Do not lose money. 2) Follow Rule #1 Yes, you are right. The writing is on the wall. B-A-N-K-R-U-P-T-C-Y ... 1. WALMART: Buffet USD 390M loss2. IBM: Buffet USD 500m loss3. TESCO: Buffet USD 750m lossCynthia Nyamai cannot warrant my attention. She is part of the crew that laid siege at KQ, with Naikuni.. www.kenyanbachelor.blogs...ge-her-cheating.html?m=1    I have no idea about any dalliances pale KQ lakini losses I know about! Ahem, Warren Buffett runs a firm with a POSITIVE Shareholders' Equity. And his firm makes a profit unlike KQ. And has made profits for the past 3 years unlike KQ. And Berkshire is expected to make a profit this year too unlike you-know-who.    NSE investors like myself have seen a tumultous year.. www.businessdailyafrica....6/-/eojts4z/-/index.html

KQ ABP 4.26

|

|

|

Wazua

»

Investor

»

Stocks

»

Kenya Airways...why ignore..

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|