Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Heli. Ben on Fed hike.

Bernanke says he never expected rates to be at zero for so long

Quote:Former Federal Reserve Chairman Ben Bernanke is optimistic the U.S. economy can power through renewed global economic weakness and inflation will pick up, but said Congress has to be the first line of defense just in case the downward pressure is too much.

On the eve of the likely first interest rate hike in nine years, Bernanke told MarketWatch the domestic economy is “pretty strong,” resilient enough to withstand the headwinds from the weak global economy... http://www.marketwatch.c...o-for-so-long-2015-12-15

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

What a week! Rare moments when Govt. private sector & CSOs are speaking in one voice! A constructive sideshow.

Lobbyists stage protest at Nairobi WTO talksQuote:NAIROBI, Kenya, Dec 15 – The ongoing Tenth World Trade Organisation (WTO) talks were not without protest, as civil societies voiced dissatisfaction on trade issues.

The protestors drawn from various WTO member countries staged a protest as delegates existed the opening plenary session at KICC with placards to express their disappointment at delay in solving issues that could help developing countries. http://www.capitalfm.co....business/2015/12/34438/

Quote:Over 80 civil society experts including trade unionists, farmers, development advocates, and consumer activists from at least 25 countries have traveled to Nairobi for the 10th Ministerial meeting.

Represented countries include Bangladesh, Belgium, Brazil, France, Canada, Germany, Ghana, Greece, India, Indonesia, Kenya, Nepal, the Netherlands and Nigeria.

Others are Norway, Pakistan, Philippines, Sierra Leone, Sweden, Switzerland, Tanzania, Togo, Uganda, the UK, and the US. Yeah... SkyTeam.

|

|

|

Rank: Elder Joined: 12/7/2012 Posts: 11,929

|

FED rate raised by 0.25%. What is the expected impact of this globally? In the business world, everyone is paid in two coins - cash and experience. Take the experience first; the cash will come later - H Geneen

|

|

|

Rank: Elder Joined: 9/20/2015 Posts: 2,811 Location: Mombasa

|

The impact will not be catastrophic as the subsequent rate hikes will be executed gradually. No financial turmoil expected as Dow Jones rose 100 points immediately after the announcement. John 5:17 But Jesus replied, “My Father is always working, and so am I.”

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Angelica _ann wrote:FED rate raised by 0.25%. What is the expected impact of this globally? Positively received "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

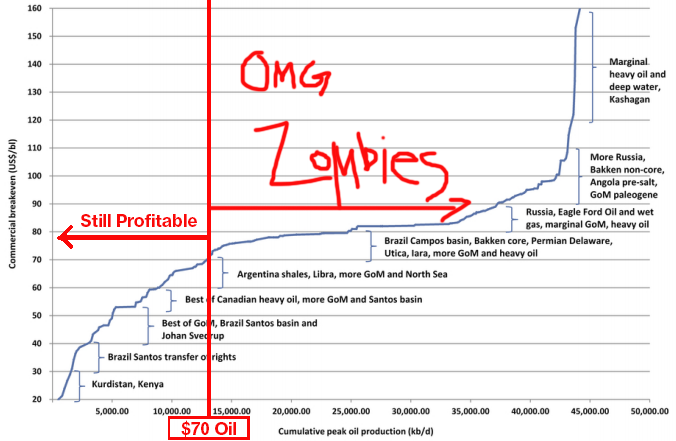

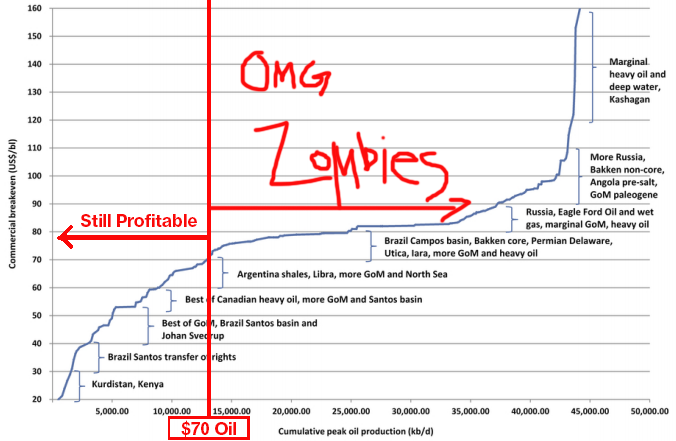

Unusual Options Activity In HYG ETFQuote:He added that on Tuesday, the options trading volume in the ETF was 2.5 times higher than the average daily options trading volume. By the time the bond market gets what just happened it'll be winter...! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Crude going down down....causing panic Throwback Dec 17 2014 Bloomberg  Article Article : Crude was $60 then. A year later $36 "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@cde watch the pound devaluation. On course since July 2014. Capital is fleeing UK. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

hisah wrote:@cde watch the pound devaluation. On course since July 2014. Capital is fleeing UK. K. A lot of usd pegs have been offed lately. What's up? Brent, WTI premium narrowed. ??

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Cde Monomotapa wrote:hisah wrote:@cde watch the pound devaluation. On course since July 2014. Capital is fleeing UK. K. A lot of usd pegs have been offed lately. What's up? Brent, WTI premium narrowed. ?? The Fed rate hike and others to come ensures that any govt enforcing USD pegs will struggle to control the peg going forward since capital is now flowing into USD assets thus strengthening USD. The reason that capital is flowing into US assets in droves is due to the negative interest rate (NIR) regime recently enforced by the ECB. QE combined with NIR is going to weaken the euro badly. Also since 2012 the QE program and other funny monetary experiments in Japan has weakened the Yen. The UK is also not willing to attract investors. US is the only place to turn to for big money and it's the only currency that is commanding confidence for now. A very strong USD is coming up due to this shift, which will ensure commodities priced in USD will continue to crash.

The problem with a very muscular USD is it leads to deflation. USD credit becomes expensive to source and since there more importers than exporters, the importers slash their spending budgets which in turn slumps the global trade momentum. Of course this will lead to other problems for the global economy and a reset will have to be done. A new reserve currency will be sourced in order to deflate the enormous global debt with the least chaotic outcome...

My wish is each continent should have its currency to represent its unique trade. This way continents will be exchanging efficiently rather than competing.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:Crude going down down....causing panic Throwback Dec 17 2014 Bloomberg  Article Article : Crude was $60 then. A year later $36 If crude closes below 35 this year that will signal a shift from high prices to lower prices for a long time! The strong USD will continue frying the commodity market.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

I see @hisah that we have a major ccy becoming an asset in its absolute sense and less of a input of production i.e as a medium of exchange.

My experience with hyper monetary finance should see the Fed make compromises real soon.

Monetary works don't create jobs the fiscus does. As you might notice my plays are mostly CFO works. Recaps, refis & restructurings. Abroad the CFO works are over done i.e buybacks, M&As etc.

Big question is what's going to be the new drivers of Real growth? What will drive fiscus? The current global Real is indeed out of whack. Producer/Consumer balances are imbalanced.

True, might prompt new bloc ccys and that will require ccys going bust as a result of inward looking CBs.

Time to cast lots wide and airlines make the cut most now. Fuel being the trick though too low for too long will be counteractive. Drawing down of global usd reserves has a limit.

Knowledge based sector will grow and smart popn.will do well with ICT.

Interesting times. Eyes wide open. 2016.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Cde Monomotapa wrote:I see @hisah that we have a major ccy becoming an asset in its absolute sense and less of a input of production i.e as a medium of exchange.

My experience with hyper monetary finance should see the Fed make compromises real soon.

Monetary works don't create jobs the fiscus does. As you might notice my plays are mostly CFO works. Recaps, refis & restructurings. Abroad the CFO works are over done i.e buybacks, M&As etc.

Big question is what's going to be the new drivers of Real growth? What will drive fiscus? The current global Real is indeed out of whack. Producer/Consumer balances are imbalanced.

True, might prompt new bloc ccys and that will require ccys going bust as a result of inward looking CBs.

Time to cast lots wide and airlines make the cut most now. Fuel being the trick though too low for too long will be counteractive. Drawing down of global usd reserves has a limit.

Knowledge based sector will grow and smart popn.will do well with ICT.

Interesting times. Eyes wide open. 2016. Technology will drive growth. The most efficient producer will take the day.

I'm not a fan of airline investments. It's a very thin margin game which ensures bankruptcy follows on the slightest mistake! Elon Musk will disrupt this industry very soon - magnetic tubes.

As for the UK tip I gave you, research on how foreign investors in UK are being heavily taxed especially in the real estate sector. Chasing away capital. UK real estate will have a spectacular nosedive soon.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Eh! At 1st glance of your post I thought of Japan, bullet trains and thought where is the differential? Of speed & time. Then..

Elon Musk's Hyperloop might actually get built Quote: The current fastest train is the Japan's maglev, which also operates using magnetic levitation technology but runs at a maximum speed of 602 kmh. The Hyperloop would double this speed by using the same magnet technology (which propels the train along as it floats above a magnetic rail) inside a vacuum, so friction would be reduced to a minimum.] http://www.citymetric.co...-actually-get-built-663

At those speeds one can traverse KE in a bat of an eyelid! Interesting. Thanks.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

200 more air routes on the way in 2016

Quote:BEIJING, Dec. 25 (Xinhuanet) -- China will add at least 200 international air routes next year, a senior aviation official said on Thursday.

The additions will be made as the government focuses on increasing flights with nations involved in China's Belt and Road Initiative, the official said. http://news.xinhuanet.co...5-12/25/c_134950249.htm

One Belt, One RoadQuote:East Africa

This region of Africa (In particular Kenya) will form part of the MSR after improvement of local ports and construction of a modern standard-gauge rail link between Nairobi and Mombasa.[6] https://en.wikipedia.org...lt,_One_Road#East_Africa

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:Cde Monomotapa wrote:I see @hisah that we have a major ccy becoming an asset in its absolute sense and less of a input of production i.e as a medium of exchange.

My experience with hyper monetary finance should see the Fed make compromises real soon.

Monetary works don't create jobs the fiscus does. As you might notice my plays are mostly CFO works. Recaps, refis & restructurings. Abroad the CFO works are over done i.e buybacks, M&As etc.

Big question is what's going to be the new drivers of Real growth? What will drive fiscus? The current global Real is indeed out of whack. Producer/Consumer balances are imbalanced.

True, might prompt new bloc ccys and that will require ccys going bust as a result of inward looking CBs.

Time to cast lots wide and airlines make the cut most now. Fuel being the trick though too low for too long will be counteractive. Drawing down of global usd reserves has a limit.

Knowledge based sector will grow and smart popn.will do well with ICT.

Interesting times. Eyes wide open. 2016. Technology will drive growth. The most efficient producer will take the day.

I'm not a fan of airline investments. It's a very thin margin game which ensures bankruptcy follows on the slightest mistake! Elon Musk will disrupt this industry very soon - magnetic tubes.

As for the UK tip I gave you, research on how foreign investors in UK are being heavily taxed especially in the real estate sector. Chasing away capital. UK real estate will have a spectacular nosedive soon.

Very ill conceived idea by the UK...with massive capital outflow and real estate sector tanking the move will be counterproductive and they will end up having to reverse the policy to breathe new life into it. Meanwhile, landlords have taken to court to oppose the tax hike http://www.telegraph.co....-tax-hike-in-court.html The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

hisah wrote:Cde Monomotapa wrote:hisah wrote:@cde watch the pound devaluation. On course since July 2014. Capital is fleeing UK. K. A lot of usd pegs have been offed lately. What's up? Brent, WTI premium narrowed. ?? The Fed rate hike and others to come ensures that any govt enforcing USD pegs will struggle to control the peg going forward since capital is now flowing into USD assets thus strengthening USD. The reason that capital is flowing into US assets in droves is due to the negative interest rate (NIR) regime recently enforced by the ECB. QE combined with NIR is going to weaken the euro badly. Also since 2012 the QE program and other funny monetary experiments in Japan has weakened the Yen. The UK is also not willing to attract investors. US is the only place to turn to for big money and it's the only currency that is commanding confidence for now. A very strong USD is coming up due to this shift, which will ensure commodities priced in USD will continue to crash.

The problem with a very muscular USD is it leads to deflation. USD credit becomes expensive to source and since there more importers than exporters, the importers slash their spending budgets which in turn slumps the global trade momentum. Of course this will lead to other problems for the global economy and a reset will have to be done. A new reserve currency will be sourced in order to deflate the enormous global debt with the least chaotic outcome...

My wish is each continent should have its currency to represent its unique trade. This way continents will be exchanging efficiently rather than competing.

I would really like to see how they pull that off. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

For those still trying to figure out the outlook for 2016...here is a nice curtain raiser http://www.bloomberg.com...42-yields-provide-a-clueThe main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|