Wazua

»

Investor

»

Offshore

»

Chinese stocks have surged over 100%

Rank: New-farer Joined: 3/3/2010 Posts: 79

|

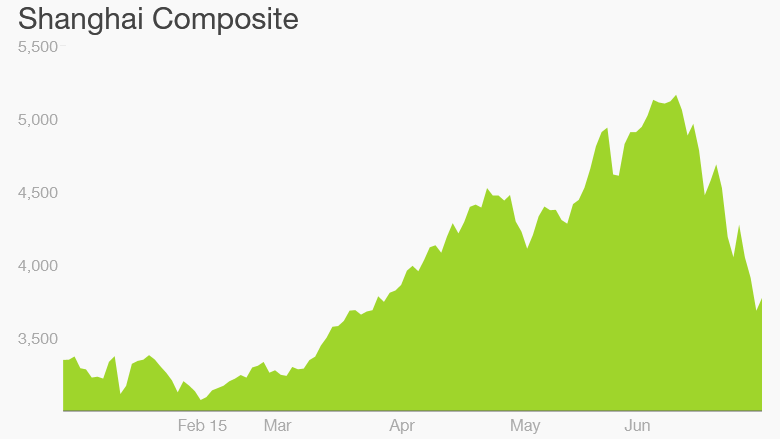

Those with some extra cash to spare in risky offshore markets, China might be an option to consider. The Shanghai stock exchange has surged to become the number three exchange with a market cap of $10T surpassing Tokyo. http://money.cnn.com/201...arket/index.html?iid=EL

http://money.cnn.com/201...on/index.html?iid=SF_LN

1.New York Stock Exchange - $19.7 trillion 2.NASDAQ OMX - $7.4 trillion 3.Shanghai Stock Exchange - $5.9 trillion 4.Japan Stock Exchange - Tokyo - $5 trillion Knowledge is contagious...Infect truth!

|

|

|

Rank: Elder Joined: 9/15/2006 Posts: 3,907

|

Late to the party, it seems...

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

muganda wrote:Late to the party, it seems...

I don't agree with the author of that article. The rotation is ongoing and the rally still has legs to go! Until that time when mainstream headlines hype why to buy chinaland stocks that's when I'll agree that the party has run overboard.

The market always does the opposite of the mainstream/herd/wanjikus etc believe.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

@afro you are seriously misadvising guys. The Shangai exchange and the chinext are overcooked beyond what is reasonably plausible-talk of p/e's of 300. The fallout however is the one guys should be looking out for as it is bound to be apocalyptic. The fallout should also help gauge the impact of the Chinese stock markets in the global economy. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: New-farer Joined: 3/3/2010 Posts: 79

|

lochaz-index wrote:@afro you are seriously misadvising guys. The Shangai exchange and the chinext are overcooked beyond what is reasonably plausible-talk of p/e's of 300. The fallout however is the one guys should be looking out for as it is bound to be apocalyptic. The fallout should also help gauge the impact of the Chinese stock markets in the global economy. I wouldn't call it "misadvising", rather a call to consider other markets. Notice on my post I said those with "extra cash" and are willing to take on the risk that comes with offshore investments especially China. I agree, its a damn risky market. For example one Chinese billionaire lost $15B in one hour, see story below.. http://money.cnn.com/201...gy-stock-plunge/?iid=EL This is for those who can afford such risks, so please don't put your entire pension in the Chinese stock exchange    Knowledge is contagious...Infect truth!

|

|

|

Rank: Veteran Joined: 9/18/2014 Posts: 1,127

|

Afroblk wrote:lochaz-index wrote:@afro you are seriously misadvising guys. The Shangai exchange and the chinext are overcooked beyond what is reasonably plausible-talk of p/e's of 300. The fallout however is the one guys should be looking out for as it is bound to be apocalyptic. The fallout should also help gauge the impact of the Chinese stock markets in the global economy. I wouldn't call it "misadvising", rather a call to consider other markets. Notice on my post I said those with "extra cash" and are willing to take on the risk that comes with offshore investments especially China. I agree, its a damn risky market. For example one Chinese billionaire lost $15B in one hour, see story below.. http://money.cnn.com/201...gy-stock-plunge/?iid=EL This is for those who can afford such risks, so please don't put your entire pension in the Chinese stock exchange    In two short weeks since this thread was put up chinese stock marts have all sunk into bear territory losing 20% or the equivalent worth of the Spanish stock exchange. This is even after interest rate cuts to prop the markets. However, the real stampede is yet to commence and when it does the bloodbath will be massive. The main purpose of the stock market is to make fools of as many people as possible.

|

|

|

Rank: Member Joined: 5/14/2014 Posts: 289 Location: nairobi

|

what is the process of investing in the chinese. stock market I find satisfaction in owning great business,not trading them

|

|

|

Rank: Veteran Joined: 7/1/2014 Posts: 927 Location: sky

|

BREAKING: Another 173 firms announced to suspend trading tonight - in total 942, or 1/3 of all listed firms in China stock market are halted things are thick in china stocks, any wazuan trading their to give us the real experience? There are only two emotions in the stock market, fear and hope. The problem is, you hope when you should fear and fear when you should hope

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

This is what happens when Wanjiku and her neighbors join the party "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

The Chinese market will not crash. China is simply going through a fourth wave correction. People who got in at the top of wave three (the strongest and broadest portion of the Elliott Wave) are the ones crying foul because they didn't anticipate a fourth wave drop. If you want to invest in China you are better off following Elliott Wave International's 'The Asian Pacific Financial Forecast' by Mark Galasiewski. linkChina's Stock Market Roller Coster Ride ContinuesAll the best. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Its called pricking a bubble. Soon you'll see police patrolling shanghai stock exchange Sehemu ndio nyumba

|

|

|

Rank: Veteran Joined: 2/10/2010 Posts: 1,001 Location: River Road

|

Hii ni kionjo tu. The real bubble is in the bonds market. It is slowly starting to unravel. Today blue chip corporate bonds are getting dumped. Hong kong is down 8%

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

Today, NYSE has been down for hours due to a "technical hitch".Is this the beginning of the collapse of global equities?

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

China’s stock exchange regulator has imposed severe limits on stock market selling, having earlier warned of panic in the market as a range of recent government measures failed to prevent stocks plummeting a further 6%. After 10 minutes of morning trading a wave of listed companies’ shares had been suspended across China’s two stock markets after they dropped by the daily limit of 10%. The China Securities Regulatory Commission ruled that controlling shareholders and managers holding more than 5% of a company’s shares could not reduce their holdings for six months, in an attempt to maintain stability in the markets. Earlier, the regulator’s statement saying there had been a surge in “irrational selling” and “panic sentiment” had done little to calm investor nerves. http://www.theguardian.c...regulator-warns-of-panic"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: New-farer Joined: 3/3/2010 Posts: 79

|

The Chinese government orchestrated the whole thing when they urged people to get loans and invest in the stock market. They even lowered interest rates to a record low so people would be lured in getting loans. This as we all know is pure risk, and Chinese banks are susceptible to a crash if the market continues the trend. Major American banks are also exposed but not by much. Good thing is few foreign investors have direct exposure to these stock markets coz China still limits the amount of overseas investment. Majority of the people affected are the Chinese themselves, who own stocks of small companies. Since most of them did margin trading (buying stocks with borrowed money) there's an accelerated sell off to recover capital and we all know how that goes. In a country on 1.5B people, there are only 90 million trading accounts, it will take more bleeding for the downfall to affect other markets. If it does, countries like Australia and Hong Kong will be the first to bleed. Be sure to enter at the bottom of the wave. Knowledge is contagious...Infect truth!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

China banks lend $209 billion to margin lender to lift stock pricesQuote:China's biggest banks have lent 1.3 trillion yuan ($209.4 billion) to the country's state-backed margin lender to halt a meltdown in Chinese shares, local media said on Friday, underlining the government's determination to support stock prices. Chinaland gubberment stepping in with massive PPT injection to kill the bears. Short sellers will be crimped badly here. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,330 Location: Nairobi

|

hisah wrote:China banks lend $209 billion to margin lender to lift stock pricesQuote:China's biggest banks have lent 1.3 trillion yuan ($209.4 billion) to the country's state-backed margin lender to halt a meltdown in Chinese shares, local media said on Friday, underlining the government's determination to support stock prices. Chinaland gubberment stepping in with massive PPT injection to kill the bears. Short sellers will be crimped badly here. Though the market will start a slow decline after that unless the firms being supported have real earnings. Slow punctures make investors complacent and they start trying to average down based on PAST purchase prices vs fundamentals. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

VituVingiSana wrote:hisah wrote:China banks lend $209 billion to margin lender to lift stock pricesQuote:China's biggest banks have lent 1.3 trillion yuan ($209.4 billion) to the country's state-backed margin lender to halt a meltdown in Chinese shares, local media said on Friday, underlining the government's determination to support stock prices. Chinaland gubberment stepping in with massive PPT injection to kill the bears. Short sellers will be crimped badly here. Though the market will start a slow decline after that unless the firms being supported have real earnings. Slow punctures make investors complacent and they start trying to average down based on PAST purchase prices vs fundamentals. Of course the market will be inflated by targeting the index heavy weights. If it were KE it would be so simple by just pressing the PPT turbo button to buy bucket loads of mpesa bank, KCB and member to force the indices up. And yes, it's a warped strategy since the market disconnects from fundies. But to force back confidence in the playground crazy strategies are unleashed! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/3/2007 Posts: 18,330 Location: Nairobi

|

hisah wrote:VituVingiSana wrote:hisah wrote:China banks lend $209 billion to margin lender to lift stock pricesQuote:China's biggest banks have lent 1.3 trillion yuan ($209.4 billion) to the country's state-backed margin lender to halt a meltdown in Chinese shares, local media said on Friday, underlining the government's determination to support stock prices. Chinaland gubberment stepping in with massive PPT injection to kill the bears. Short sellers will be crimped badly here. Though the market will start a slow decline after that unless the firms being supported have real earnings. Slow punctures make investors complacent and they start trying to average down based on PAST purchase prices vs fundamentals. Of course the market will be inflated by targeting the index heavy weights. If it were KE it would be so simple by just pressing the PPT turbo button to buy bucket loads of mpesa bank, KCB and member to force the indices up. And yes, it's a warped strategy since the market disconnects from fundies. But to force back confidence in the playground crazy strategies are unleashed! It is a losing strategy though HK and Singapore did well but they stepped in to prevent massive fallout [from the Global Financial Crisis] rather than just support high prices. Or they were lucky. In Kenya, the government should be divesting not adding to their portfolios. It's tough love but necessary. Look at KQ. Or Mumias. Or Panpaper. Or NBK. KCB started recovering after GoK reduced its stake & private investors [Mbaru, Kirubi, Sunil Shah] started acquiring large stakes and making changes. KenGen will be the next test for GoK. I feel they should go for PPPs and convert loans to equity (non-cash) but NOT give more cash to KenGen. Greedy when others are fearful. Very fearful when others are greedy - to paraphrase Warren Buffett

|

|

|

Wazua

»

Investor

»

Offshore

»

Chinese stocks have surged over 100%

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|