Wazua

»

Investor

»

Economy

»

Greece is broke

Rank: Veteran Joined: 2/10/2010 Posts: 1,001 Location: River Road

|

[quote=hisah]My advice to Greece is to follow the Iceland route. Default, get out of the euro straitjacket and handcuff the banksters and their political aides. And while at it close the IMF office like Hungary. Reset everything, turn east (NDB/AIIB/EXIM) and in 5yrs the econ will be back to normal. For the banksters chopping they should start here (Le Squid aka GS) to get to know how deep the rabbit hole is - http://www.spiegel.de/in...rue-debt-a-676634.htmlm[/quote] You expect that from the Greeks who until a while back were paying government workers a bonus for coming to work early and unmarried daughters their father's pension. What do they export apart from olives and tourism? Argentina survived because of commodities the Greeks can't.

|

|

|

Rank: Veteran Joined: 7/5/2010 Posts: 2,061 Location: Nairobi

|

mkonomtupu wrote:hisah wrote:My advice to Greece is to follow the Iceland route. Default, get out of the euro straitjacket and handcuff the banksters and their political aides. And while at it close the IMF office like Hungary. Reset everything, turn east (NDB/AIIB/EXIM) and in 5yrs the econ will be back to normal. For the banksters chopping they should start here (Le Squid aka GS) to get to know how deep the rabbit hole is - http://www.spiegel.de/in...rue-debt-a-676634.htmlm

You expect that from the Greeks who until a while back were paying government workers a bonus for coming to work early and unmarried daughters their father's pension. What do they export apart from olives and tourism? Argentina survived because of commodities the Greeks can't. They will have to. There is no other choice. Iceland's economic mainstay is fishing (not commodities) and they managed to rise from the ashes. Greek's debt burden is borne by taxpayers from healthy European countries (Germany, France), the political establishments there have to cut the ECB money train or they get massacred at the polls. The Greeks need a painful attitude re-adjustment and they will get it. As for Goldman Sachs,..waah these are thieves kabisa. They did the same with Italy. I wonder if the US treasury can be put on the hook for this ...

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

The Economist wrote:The bloc knows that it needs to change. It has moved towards banking union; five of its leaders have issued a paper on how to strengthen the euro, including, among other ideas, a deposit-insurance scheme. But their proposals are modest because governments are harried by anti-EU populists and their citizens did not sign up to the euro expecting to give up a lot more sovereignty. The moral of Greece’s disaster is that Europeans must face up to the euro’s contradictions now—or suffer the consequences in more ruinous circumstances. http://www.economist.com...-europes-future-greeces

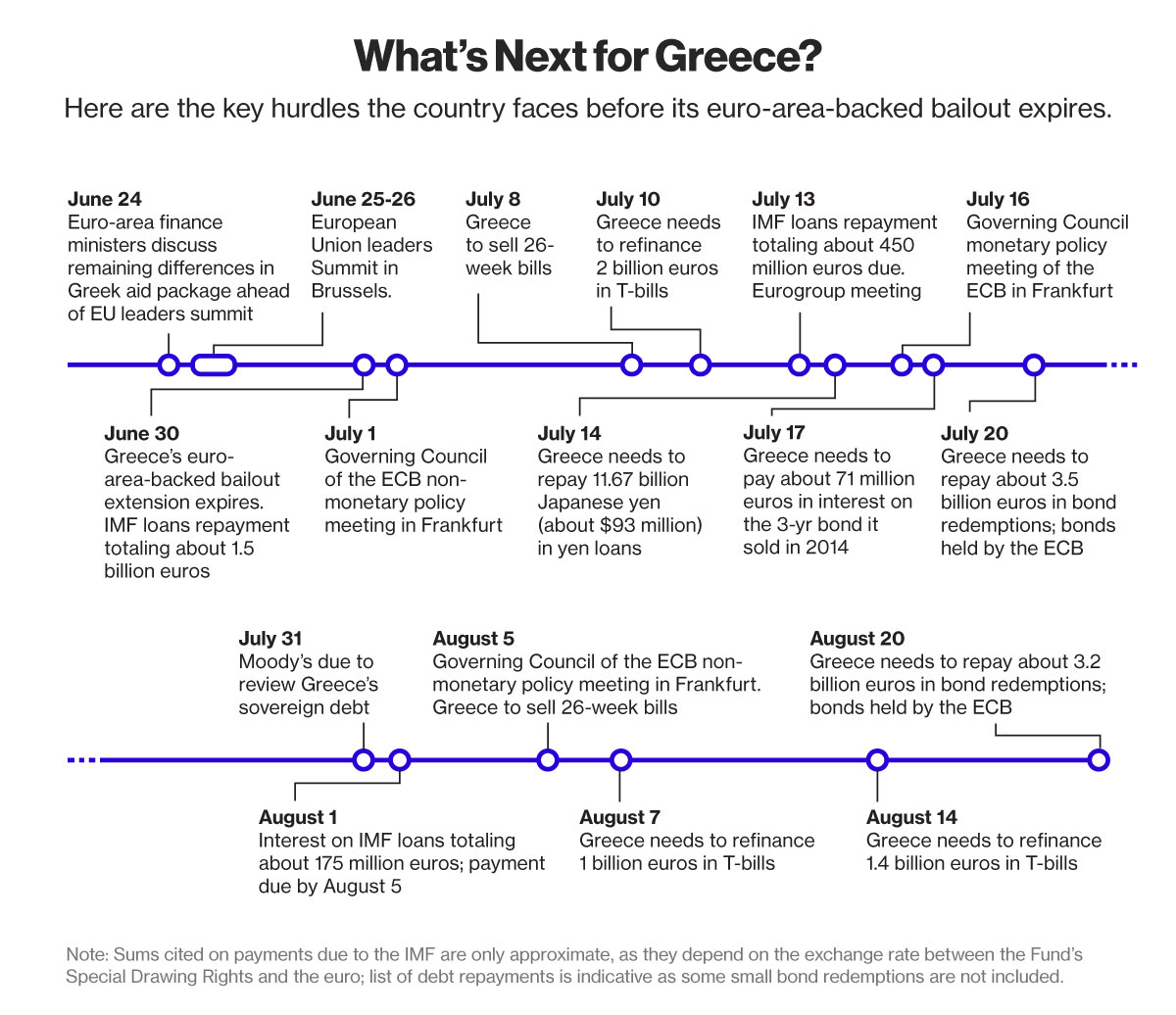

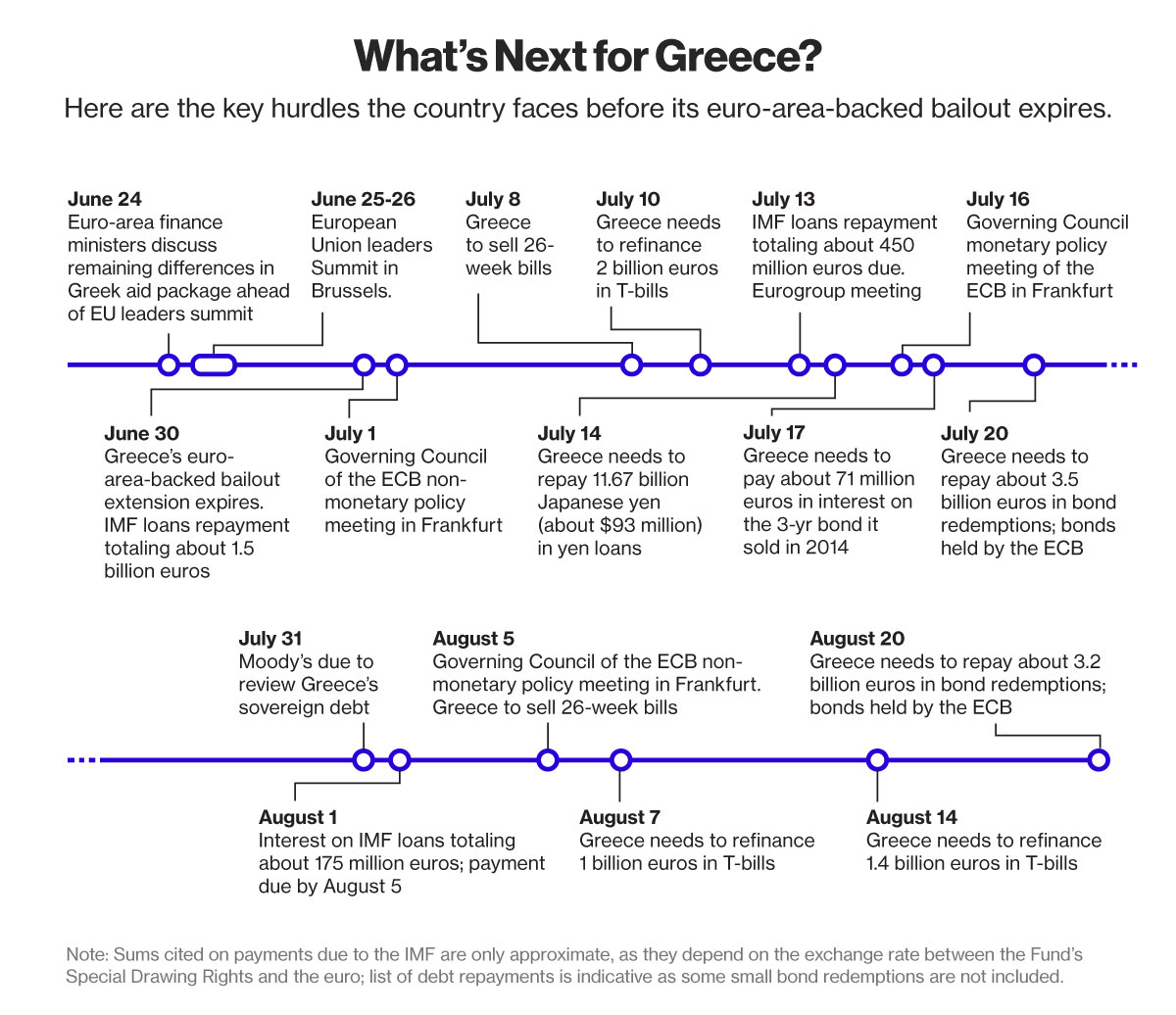

There's talk that they go will go for the local's savings Time line July 14 Greece needs to pay 11.63B Japanese Yen July 17 Greece needs to pay 71 Million Euros interest accrued on the 3 year bond July 20 Greece needs to repay 3.5B Euros in bond redemption  "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 10/29/2008 Posts: 1,566

|

Assuming in tomorrows referendum they vote No. what next? Wont they still have to meet their financial obligations to their creditors! Do they hope to dictate terms of repayment. Going forward from where will they be borrowing. Isuni yilu yi maa me muyo - ni Mbisuu

|

|

|

Rank: Elder Joined: 3/2/2009 Posts: 26,330 Location: Masada

|

murchr wrote:The Economist wrote:The bloc knows that it needs to change. It has moved towards banking union; five of its leaders have issued a paper on how to strengthen the euro, including, among other ideas, a deposit-insurance scheme. But their proposals are modest because governments are harried by anti-EU populists and their citizens did not sign up to the euro expecting to give up a lot more sovereignty. The moral of Greece’s disaster is that Europeans must face up to the euro’s contradictions now—or suffer the consequences in more ruinous circumstances. http://www.economist.com...-europes-future-greeces

There's talk that they go will go for the local's savings Time line July 14 Greece needs to pay 11.63B Japanese Yen July 17 Greece needs to pay 71 Million Euros interest accrued on the 3 year bond July 20 Greece needs to repay 3.5B Euros in bond redemption  IMPOSSIBLITY!!!   Portfolio: Sold

You know you've made it when you get a parking space for your yatcht.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Ngalaka wrote:Assuming in tomorrows referendum they vote No. what next?

Wont they still have to meet their financial obligations to their creditors!

Do they hope to dictate terms of repayment.

Going forward from where will they be borrowing.

Best option is the Iceland route. Read about it. How come the lame stream media stopped covering Iceland  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Europeans tried to block IMF debt report on GreeceI wonder why US forced this report to be published just when the referendum is about to be held. Is someone happy to see the euro experiment get clobbered?  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 5/13/2008 Posts: 558

|

Kenya if not careful within 10-15 Years will be where Greece is today. The JAPanse are borrowing uncontrollably to spend on MCA's Yet the drivers of the economy are stagnating if not shrinking.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Quote:The document released in Washington on Thursday said Greece's public finances will not be sustainable without substantial debt relief, possibly including write-offs by European partners of loans guaranteed by taxpayers.

It also said Greece will need at least 50 billion euros in additional aid over the next three years to keep itself afloat. I guess they are enjoying the circus "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Exit polls show that No vote is ahead... This will be good drama! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 11/7/2007 Posts: 2,182

|

Jaina wrote:Kenya if not careful within 10-15 Years will be where Greece is today. The JAPanse are borrowing uncontrollably to spend on MCA's Yet the drivers of the economy are stagnating if not shrinking.

This may come to pass one day. LOVE WHAT YOU DO, DO WHAT YOU LOVE.

|

|

|

Rank: Veteran Joined: 4/16/2014 Posts: 1,420 Location: Bohemian Grove

|

The NO vote has won it.60%+ can be called a landslide

|

|

|

Rank: Elder Joined: 12/25/2014 Posts: 2,301 Location: kenya

|

Jaina wrote:Kenya if not careful within 10-15 Years will be where Greece is today. The JAPanse are borrowing uncontrollably to spend on MCA's Yet the drivers of the economy are stagnating if not shrinking.

I mentioned such habits in an earlier thread as "kicking the can down the road " and a wazuan mentioned that the cabinet secretary for finance has no options apart from ........ no one cares and the same attitude that Greeks have is the same attitude we have . Majani Chai halted , coffee uprooted , manufacturing dead long time ago . The only drive of economy is taxes harvested from salaries.infact 10yrs is the ideal time not more than that till we become like Greece

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Japan in close contact with other govts on Greece, ready to respond -official

TOKYO, JULY 6What next??"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

While the drama pans out the billion dollar question is, who stands to benefit if the Greek CDS trigger? That is where the real story can be found. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/23/2008 Posts: 3,017

|

@Hisah, It will be extremely difficult for Greece to take the Iceland/Argentina option without some backlash to its tourism industry which is its bread winner. This guys are in sh*t and have absolutely no solution. They need to be left alone to sought out this mess internally otherwise they will never learn. Its over 5 years since they started having this financial problems and through out the period, the ECB has been giving them more debt (feeding the monster). "The purpose of bureaucracy is to compensate for incompetence and lack of discipline." James Collins

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Quote:German media are reporting that Alexis Tsipras and Angela Merkel have telephoned (as we flagged earlier), with both leaders agreeing that Greece will bring new proposals with him to the Euro group meeting which may help to overcome the crisis.

Further details of what they discussed have yet to emerge.

Also, a Spiegel correspondent in Greece, Giorgis Christides, is reporting that paper supplies are running out in Greece, with newspaper publishers saying they had enough paper left to print only up until next Sunday.

One publishing manager has even proposed halting the printing of books, until the shortage eases. This country imports almost everything, who will agree to sell anything to them esp if they ditch the Euro Meanwhile Quote:Greek banks to stay shut

Newsflash: Greece’s banks will not reopen on Tuesday, or indeed on Wednesday, according to the head of the Greek bank association.

The daily withdrawal limit remains at €60. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Veteran Joined: 9/21/2011 Posts: 2,032

|

Jaina wrote:Kenya if not careful within 10-15 Years will be where Greece is today. The JAPanse are borrowing uncontrollably to spend on MCA's Yet the drivers of the economy are stagnating if not shrinking.

In Kenya we borrow to pay salaries and allowances, build rails and roads that will impress the voter, without necesarily asking if there is something else we could have done to benefit the voter and lift them out of poverty. Chida iko hapo

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:Quote:German media are reporting that Alexis Tsipras and Angela Merkel have telephoned (as we flagged earlier), with both leaders agreeing that Greece will bring new proposals with him to the Euro group meeting which may help to overcome the crisis.

Further details of what they discussed have yet to emerge.

Also, a Spiegel correspondent in Greece, Giorgis Christides, is reporting that paper supplies are running out in Greece, with newspaper publishers saying they had enough paper left to print only up until next Sunday.

One publishing manager has even proposed halting the printing of books, until the shortage eases. This country imports almost everything, who will agree to sell anything to them esp if they ditch the Euro Meanwhile Quote:Greek banks to stay shut

Newsflash: Greece’s banks will not reopen on Tuesday, or indeed on Wednesday, according to the head of the Greek bank association.

The daily withdrawal limit remains at €60. The greek PM should also queue at the ATM if he really is with the people.

Can he beat this - http://www.irishmirror.i...chael-d-higgins-3287795

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Greece is broke

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|